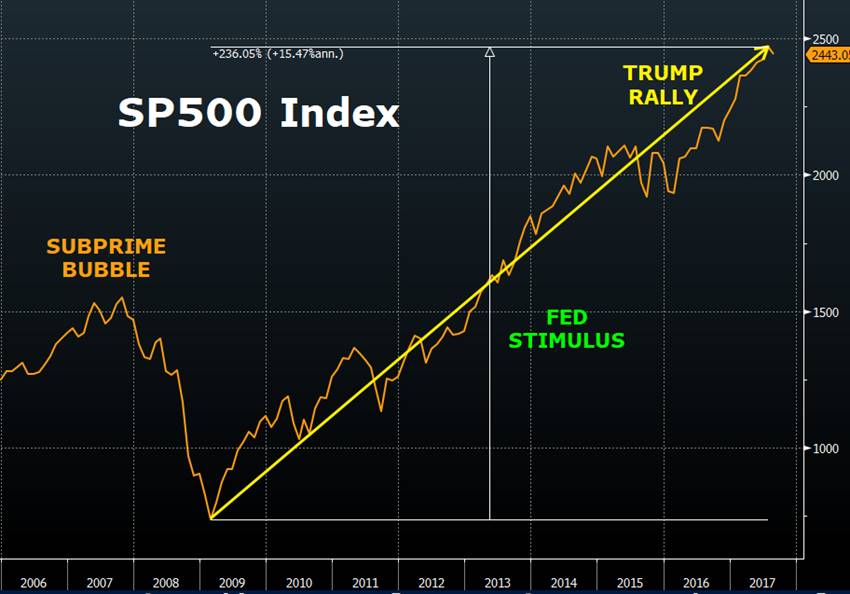

So we live in a post-08 market that only goes up and in which every dip in the 100+ months since the Fed began printing money is bought with fearless alacrity. The bulls back then (I’m thinking of Appaloosa’s David Tepper) saw a free lunch in the rubble of 08 (compliments of the Fed “stimulus”) and took it. Hell, they even levered it.

Hats off to them. After all, one look at the S&P since 2008 is confirmation enough: this market is more doped by QE (money printing) and ZIRP (zero-bound rates) than Lance Armstrong at the height of his fame…

As I’ve written elsewhere, I never thought the steroids handed down from Bernanke and Yellen would last this long, so I confess, my bearish skepticism was premature. Tepper (the bull) was right, I (the bear) was wrong.

{Then again, our market signals still have us beating the S&P…Even bears have to keep signals ahead of opinions…}

The Fed, in either case, is crazy…

The question now, is how long can this steroid-distorted bacchanalia continue?

As hard as it is, I’ve been wracking my brains to come up with a bull case for the next cycle or two that makes any sense. Law school (oh so many years ago) helped me to think and argue as “objectively” as possible for both sides of a given case, so I’ve been trying to think like a bull, if nothing else, out of nostalgia…

So let’s consider two popular arguments the bulls are making—from the perspective of both the prosecution (bull) and the defense (bear).

Back in 2016, Blackrock came out with an estimate that there was at least $50T in cash “sitting on the sidelines” and thus ready to rush back into the markets and send them ripping to further nose-bleed levels. Since then, others have suggested that figure could even be as high at $70T.

Needless to say, those are some big numbers… the kind of free market steroids that would even make Mark McGwire blush.

I mean, just imagine what another $50T in-flow would do to these already record-high credit and equity markets! Whwwww…

But I guess the first thing any good prosecutor (bull) should do is verify the numbers. That is, just where is this $50T coming from? Apparently, the figure includes a wide range of metrics, from central bank assets and financial reserves to Joe-Public’s savings accounts.

The figure is also based on private equity firms which are sitting on huge piles of cash, including Blackstone, of which 1/3 of their assets is cash. Even hedge funds are reporting record high reserves—the highest since 2001.

But do these figures actually amount to $50T or more? Frankly, that’s hard to quantify or confirm, but even assuming such figures were close to accurate, the next, and more important question, is this: would this side-lined cash support another massive wave of asset value support?

The prosecutors (bulls) scream “Yes!” but we ought to consider those clever defense attorneys dressed like bears. What’s their take?

Let me make the bear case then…

First: just because there may be gobbs of cash in the financial system, that by no means suggests the money is actually available to buy more securities. Nor does it mean that all that money confirms less rather than more risk ahead.

Hedge fund managers, for example, are most likely holding gobbs of cash to offset massively risky and highly levered derivative gambles, which may not be enough to cover their risky bets.

The notional value of this derivatives trade in global markets is in fact a sum that exceeds 9X global GDP—a figure so astronomically high, it defies all measures of risk analysis or complexity theory and is the hidden cancer rotting through the marrow of today’s global markets… In short, those cash reserves may be a sign of hell to come, not heaven.

Equally worth noting is the simple reminder that for every buyer of equities, there must also be a seller. Money—i.e. $50T or more— cannot just flow into stocks and bonds with impunity. That is: if $50T came into the markets, there would still be another new $50T in sideline cash…

The only (and minor) exception to this rule would be the secondary market, which is miniscule compared to the $50-70T figure under consideration.

I would thus close my bear case for the defense by stating that all this sideline cash is merely a function of debt expansion and central bank money printing around the world, of which not a penny will make it into the primary markets.

Why? Because every Dollar, Yen and Euro et al printed into being has to be held by someone until reverse repos (money borrowed by central banks from commercial banks) drain that cash.

In short: this bear rests his case.

As for your own verdict on this sidelined cash, you can be the judge.

The bulls today are equally enthusiastic about what they believe will be the biggest tax cut in US history, compliments of the Trump white house. This revolutionary tax cut/reform is expected shortly, and it is to be financed (i.e. made “revenue neutral”) by four key “payfors,” namely: 1) taxing 401K’s, 2) capping the mortgage deduction at $500k rather than $1M, 3) ending local and state tax deductability and 4) eliminating business interest deductions.

Tax cuts are awesome tailwinds for markets, and the bulls are trusting “the great disrupter” to keep his campaign pledge to usher in another tax reform era to stimulate market (and economic) growth. Indeed, current hope heralds back to thoughts of the beloved Reagan era and the Tax Reform Act of 1986—the last revenue neutral tax reform bill in 50 years.

The prosecution (bulls) makes a strong case for such a bill, and rely heavily upon the leadership and guidance of the ex-Goldman money men, Steven Mnuchin and Gary Cohn.

Indeed, if such a tax bill sees the light of day, the bulls will have a strong case for further tailwinds ahead.

But let’s also hear from the bearish side of the market courtroom…

First, and as much as the Reagan years warm our memories, there is almost nothing about today’s politics or markets that resemble Reaganomics. As I’ve written elsewhere, the political climates of Reagan and Trump could not be more different.

Even die-hard Republicans—including Gary Cohn himself—are losing faith in the current administration’s ability to gain anything resembling consensus, across the aisle or within the highly fractured GOP. Most of us, red or blue, would agree that never has DC been more divided, ineffective and downright antagonistic.

The total opposite was true during the Reagan tax reform era of 1986, which saw the rarest and most fluid bi-partisan cooperation in legislative history. Remember Tip O’Neill? Remember Republicans like Bob Dole and Howard Baker working with Democrats like Pat Moynihan and Bill Bradley?

Compare that with today’s era of sit-ins, screaming rants, tweet mania and flat-out animosity within the House and Senate and one wonders how the legislature could agree on a dinner bill let alone a tax bill…

In such a swampy backdrop, let’s therefore revisit the realistic odds that any of the hoped-for “payfors” listed above will ever garner consensus…Taxing 401K contributions, for example, is gonna hit a major Democratic sweet spot.

And eliminating the deductability of interest on business debt is a great idea, but it would only fly if it applied to the carry cost of all that $13T worth of debt that corporate America has incurred in the Fed’s drunken low-rate scheme since 2008.

This was the very same debt publicly traded companies have used to buy-back stocks, pay for dividends and artificially fatten their EPS numbers. But there is no chance at all that US businesses will allow for the elimination of this deduction—it would effectively send them over the cliff.

And lowering the mortgage deduction cap from $1M to $500K is gonna hit the rich hard—and they are the very same who contribute to the campaigns of most Republican lawmakers. In short: good luck passing that…

So once again, you can be the judge of whether this bullish tax cut has any merit.

As we wait to see this bull and bear showdown playout, we can continue to watch these crazy markets binge on the easy money steroids of the central banks. Today, every dip is bought, regardless of whether the news is good or bad—for even bad news just causes investors to assume more Fed “accommodation” and thus more drunken investing.

In this backdrop, natural supply and demand has died, short-sellers (once a natural market “cop’) are terrified, downside hedging is thin, market-makers and counterparties are buying less puts and markets are increasingly becoming more of a one-way trade, suppressing volatility and leading eventually to a mother of a correction…

What do you think?