Once Upon a Time: Fed Guidance and Fairytale Markets.

Ever since the ABS humpty-dumpty market fell off the wall in 08, only to be put back together again by historical “accommodation” from the US Federal Reserve (i.e. QE 1-3 and 100+ months of ZIRP), the markets seem to hang on every word of the magical Uncle Bernanke and Aunt Yellen.

In essence, investors wanted to know one thing: does the central bank have their back? Which means: Will they keep rates low and/or print money when needed? Or to a borrow a sentiment from a European Central banker who borrowed it from us (after we borrowed QE from the Bank of Japan), will the US Federal Reserve do “whatever it takes” to make sure humpty dumpty never breaks again?

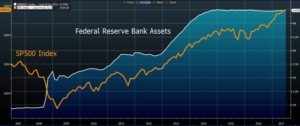

Well, for more than eight years running, the answer from DC seemed like a resounding “yes.” Just look at what a central bank can do for a stock market:

Good times. Good times indeed.

And having now enjoyed almost a decade of prosperity (and “forward guidance”) in the wake of an unprecedented Fed stimulus, many of today’s investors, traders, pundits and scholars seem to think we’ve entered a kind of “true” fairytale—a “new normal” where academics and bankers within a “reserve” that is “federal” on the surface but private and unregulated at its core, can keep us safe from traditional market forces.

The Magical Thermostat and White Horse.

But has any central bank ever succeeded in defeating market forces? Stated otherwise: Has any apple ever defeated gravity forces?

Common sense: It guides us through the noise. Yet despite it (and the lessons of supply and demand), investors have been lulled into a modern bedtime story. In this fairytale, a committee of central bankers with peer-reviewed white papers and PhD’s have been magically endowed to dial market pricing, inflation and employment up or down with the ease and accuracy of a thermostat.

You know: “a little QE here, a little interest rate bump there,” and all is fine in the Never-Never Land of a market that never seems to go down…

And frankly, there are times I almost believe the fairytale too.

Markets dip a bit? Bombs fly? Volatility spikes? Alas, “have no fear! A central banker is here!” Fed governors and their chairpersons have somehow morphed into superheroes on white horses who can solve almost any threat to equity pricing with their power to control the supply and price of money.

Those are super powers indeed… Almost nothing seems to get in their way. Should politics get too messy, debt ceilings too high, or bubbles too fat, no worries–that galloping white horse is just around the corner with its magical money printer and interest rate sword.

These are comforting stories. And so the markets are buying into them. Investors (here and abroad) are collectively sucking their thumbs and listening to press conferences from Aunt Yellen (or Uncle Draghi et al) with one hand holding a teddy bear and the other hand pushing the “buy” button, even as sovereign bond rates go negative, yields curves go flat and PE multiples go to the moon.

After all, who doesn’t like to be comforted? The markets, which have gone up and to the right ever since chapter 1 (or QE 1) of this fairytale began, certainly do.

Fed Avoidance as the Fairytale Turns Scary.

Like sleepy children, markets and investors don’t like bedtime stories that end badly.

The scary stuff is no fun.

Instead, those accustomed to long-dated bull markets prefer the comfort of consensus, rising share prices and tales of heroic white horses leaping from the steps of the Federal Reserve and promising happy endings.

Today’s “animal spirits” remind me of an expression popular in Japan just before the Nikkei’s infamous bubble crashed in 89. In the euphoric height of their now familiar bubble, investors comforted each other with crazy logic: “How can we get hit by a car if we are all crossing the street at the same time?”

Such delusions really are comforting. Herds of bulls adore fairytales and positive feedback loops from each other, the markets and the Fed. And since these same bulls are allergic to scary stuff, it should come as no surprise that they (and the markets) are no longer hanging on every word of the Fed these days.

Why?

Because the Fed is sounding a bit more hawkish.

And hawkish is no fun for bulls because the markets (unlike the mainstream media) thrive off good stories, not bad ones. As the evidence and tone points more toward scary stuff (i.e. rate hikes, debt ceilings, and record high PE multiples), investors tend to put hands over their ears and hide under the sheets.

Hawks Circling. No One Looking.

This week, for example, Bill Dudley (perhaps the most influential FOMC voice after Yellen and Fischer) basically admitted that the Fed will keep raising rates so long as financial conditions continue to improve (or “ease”).

Market reaction? Crickets…

Normally, talk of more rate hikes in the backdrop of peak debt and bloated credit markets should feel kind of scary, right? Markets should react, right?

Not in this fairytale…

And Dudley wasn’t the only hawk squawking. While he was upsetting teddy-bear holders in the US, his colleague John Williams, President of the San Francisco Fed, was making equally hawkish sounds during his Australia tour.

Using the metaphor of a boat coming to harbor, Williams told the Aussie press that an overly aggressive vessel (like a fast economy/market) must occasionally slow down and come to port. In other words: The Fed won’t let growth (i.e. stock and bond bubbles) run wild.

Even the house of doves, it seems, is turning hawkish (i.e. nervous) over at the Federal Reserve.

Why?

Because this market is getting too bullish for the very gang who made the bull.

Today, data dependence is no longer (nor, in my opinion, ever really was) the driver behind the Fed’s policies. Their long-touted inflation and employment targets (however questionable their measurements and methodology) had been reached long ago, so the Fed could have hawkishly tightened by now if “full employment” and 2% inflation was the real objective.

Confusing Wall Street’s Markets with Main Street’s Economics.

But the Fed, I’ll argue (along with a few others) had bigger plans than the CPI or U6 numbers. Since the rubble of 08, its primary target has been the stock and bond market, not data targets from the BLS. In other words, its Dow-Dependent priorities were obvious: Wall Street first, then Main Street.

Is that so bad? In all fairness to Yellen & Co, they saw a rising stock market as the best way to ensure a post-08 recovery. Without the support (stimulus) of their magical money printer and rate suppressor, the Keynesian Fed feared that another “08 moment” would be catastrophic.

Unfortunately, history confirms that the trickle-down effect of artificially bloated stock and bond markets has as much to do with rebuilding Main Street economies as Teslas have to do with West Virginia coal miners: almost nothing.

The Fed is Getting Nervous.

And the PhD’s at the FMOC are starting to see this. Their experiment is backfiring. After 9 years of uber-accommodation, money printing and sky-rocketing debt, America is still broke and with a stalled GDP, yet its stock market is way past the nose bleed section and heading toward a potential nose dive.

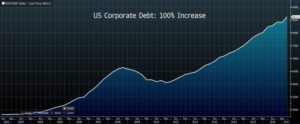

But this is what happens when superheroes use low rates to make market “magic.” Companies borrow their way into a mountain of prosperity on top of an even greater mountain of debt.

And those same companies aren’t using debt to finance more productivity. Instead, they are buying back their own shares (at peak prices) and paying off their executives (at stock-based compensation models). As C-Suite prosperity rises, GDP stalls.

Such images are more the stuff of bad dreams than fairytales, no? New debt is never a cure for old debt, and current levels of reckless enthusiasm and low rates always end in a downward slide.

The Fed, of course, hopes to prevent nose dives. They are ready to ride in once again on their white horses and contain the very monster bull (aka “everything bubble”) which their own policies created.

The ironies abound. The once “zero-rate” Fed is tightening its stance—trying to reign the biggest bull it has ever seen with a few more 25 bip rate hikes… After all, rate hikes and the magical thermostat are supposed to turn down this market heat.

But the Fed’s Magic is Wearing Off.

Unfortunately, the heat isn’t going down… investors aren’t listening/reacting to rate hikes or even rumors of hikes.

It seems the Fed is slowly losing its hitherto fairytale control over the markets. As bubbles (created by central banks) get bigger, it’s as if investors buy on good news and the bad news, mostly because the bad news is simply pushed aside.

Sympathy for the Devils?

But if Yellen, Dudley, Fischer or even Williams are wondering why their thermostat is not behaving as intended and are therefore beginning to panic behind the walls of the Eccles Building, it’s hard to feel sorry for them…

Over-heated markets caused by the over-heated monetary policies of an over-heated Fed, create over-heated (or “irrational”) exuberance which leads to over-heated risks that always end in an over-heated correction whose magnitude of pain inversely correlates to the magnitude of enthusiasm which preceded it.

Von Mises put it quite simply:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

The Fed Made Its Own Bed.

If today’s investors are ignoring Fed signals, it’s because the Fed created the very distortive conditions which make traders punch bowl crazy. In short: The Fed has created a market addicted to fairytales.

Taking the storybook from Bernanke (who took it from Greenspan), Yellen became the temporary heroine of the post-08 “recovery.” But all her heroic stimulus acted more like heroin than the deeds of a heroine.

In the midst of this record breaking Fed “accommodation” (i.e. low rates and the promise of more money printing, if needed), investors got themselves hooked on it. What was supposed to be a “temporary measure” has morphed into a fulltime addiction.

In this addictive vicious circle, markets have lost sight once again of normal price discovery and risk, which might explain our record high markets and record low VIX readings.

Today, vol sellers are making the same kind of fortunes MBS buyers were in 07; the herd mentality of the NASDAQ is similar to the pre-Nikkei markets of 88, and multiples of earnings on names like Apple, Tesla, and Amazon are eerily reminiscent of the multiples we saw of Microsoft, Juniper and Cisco in the bubble which popped illusions and prices back in 2000.

It feels a bit crazy to me.

You?

The Good ol’ Days.

Remember when we used to trade or invest based on what the markets where doing rather than off Fed “guidance”? Remember when income statements, cash flow, earnings consistency and GAAP accounting mattered more than the fairytale nouns, adjectives or verbs of a central banker?

Remember when good companies went up in value and bad companies went down in value? Remember when you could short a stock based on fundamentals, rather than get squeezed out by Fed tailwinds, ETF distortions or robo buys? Remember when earnings were based on revenue streams rather than ex-items accounting? Remember when an occasionally prudent Fed Chairperson looked more at history than book tours, and cared less about popularity (think Greenspan) and more about reigning in (rather than cowing too) Wall Street (think Martin or Volker).

Remember when the financial press was guided by economics and objective debate rather than sell-side marketing teams, product peddlers or bank executives bailed out by the very tax payers they ruined in 08?

Remember common sense? Remember our dads who told us to buy low and sell high? And remember when we used to invest for the long term, because markets had cyclical characteristics rather than structural (central-bank-created) deformations?

Look at this market today.

Would you buy and hold at these fairytale levels?

Pivotally informative, helpful!