With a $2 TRILLION dollar stimulus package on tap, it’s clearly time for a market reality check.

The Best Market That Money (Printing) & Debt Can Buy

Many investors were breathing sighs of relief as Tuesday’s historic rally saw the DOW’s greatest one-day percentage gain (11%) since 1933.

But as usual, many investors are getting it wrong, and are in deep need of a market reality check.

By the way, celebrating any market record circa 1933 (i.e. the Great Depression) seems a tad ironic, no?

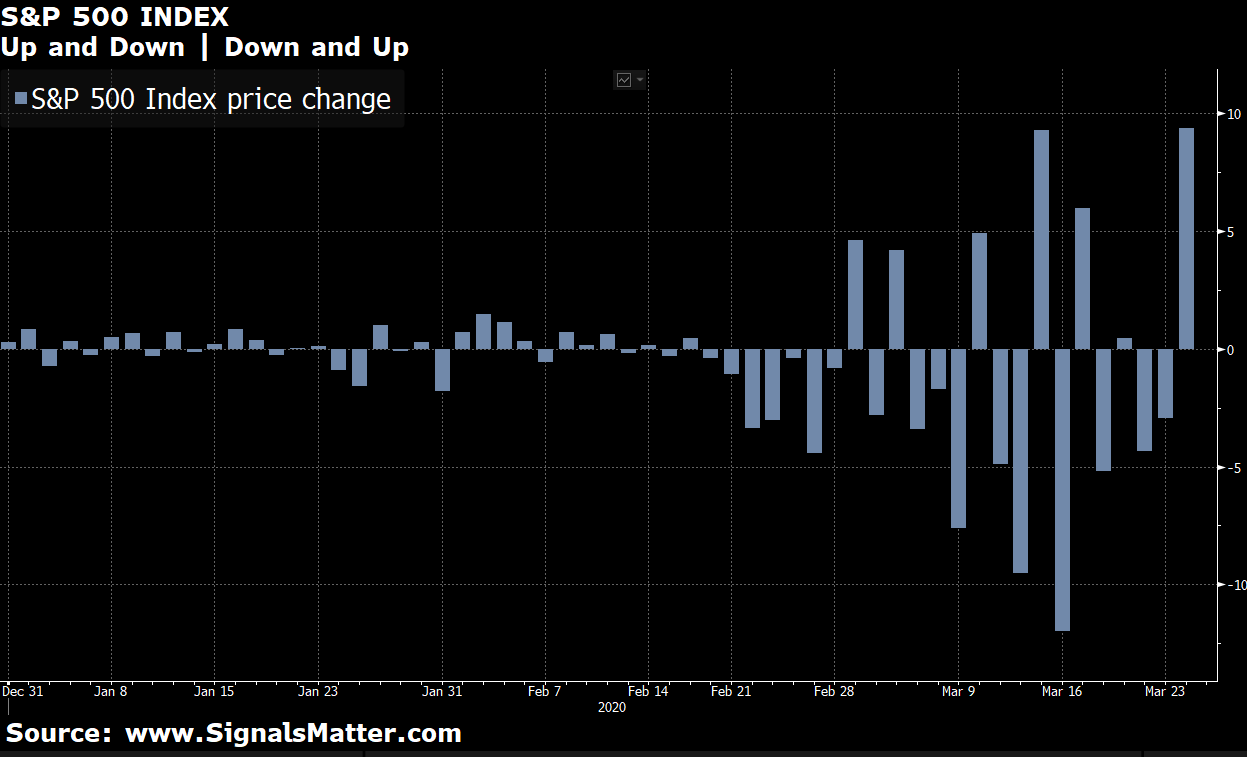

For now, however, we can accept that the S&P jumped 9.4% on Tuesday, despite falling to its lowest levels since 2016 just the day before on Monday.

In today’s pre-markets (i.e. futures markets), the Dow Jones surged 500 points at 5:26 AM, after the White House and Senate reached agreement on the stimulus bill, but then headed promptly south into negative territory. As of 10:30 AM, as we post this report, nervous markets are flat. In short, markets are currently whipsawing rather than applauding, as they were just one day ago.

As we’ve said many times, such dramatic swings up and down (and goodness knows we’ve seen similar percentage swings down recently, including a handful of market-halting circuit breakers which kept markets from tanking much further) are in and of themselves a BAD thing rather than the sign of “all clear ahead.”

By now, of course, our readers know better. They’re comfortable with a market reality check.

As investors who understand risk as much as performance, they know that such “surges” in the backdrop of a triple whammy of 1) a pandemic health crisis,2) a repo-on-respirator and 3) a stock market without earnings is hardly any indicator that the rest of the year bodes well.

Then again… a 2 TRILLION stimulus from the Senate ought to buy us something, right?

Tag onto that the recent $1.5 TRILLION repo market stimulus and another $700 Billion in Quantitative Easing plus a bazooka-like 100 basis point slashing of interest rates and voila: You get a market surge.

But here’s the rub: Who’s gonna pay for all this?

For now, many of you may be saying that desperate times call for desperate measures, and that we should thank the Fed and DC for helping us through these admittedly trying times. We get this.

But if you’ve been following along, you’ll also see the irony in such logic, for these trying times were in fact created by the very bodies of DC absurdity that put us in this fragile market setting in the first place—long before COVID-19 added insult to egregious injury. In short, thanking the Fed or DC for their support today would be like thanking a thief for tossing you a twenty after he just stole your wallet full of Benjamins…

In short, and I’ll say it again: I’m not thanking, nor feeling sorry for the Fed.

But as I’ve also warned, it’s never wise to fight the Fed or the deficit-spending hysteria of DC. If the geniuses there want to deficit spend, print more money and add more debt to the funeral pyre of natural capitalism, then markets can and will rise.

So hey, let’s jack the deficit up to $25, $30 or even $40 Trillion in the coming months and years and let our kids worry about the painful bill, as it seems we are now of a generation who somehow feels markets aren’t supposed to ever re-price and fall to natural levels.

Have we as a nation of investors really become that soft?

Not really, because it’s the Fed and Wall Street who benefits the most in this Rigged-to-Fail system wherein Main Street takes it in the gut while Wall Street brushes the dust off its Armani jacket (for a day or two, that is…)

But just in case you worry that I’m ranting “elitist-liberal” rhetoric your way (I’m actually pretty conservative), let’s do what we (and Dr. Fauci over at NIH) do best and stick to the math rather than the adjectives to make this clear rather than opinion. And yes, this virus is real, and emergency measures are needed. Sadly, however, we’ve been in emergency mode for years bailing out the markets, so we’re running out of economic medicine as well immunity from more debt poison.

Buckle up, as it’s time for yet another…

Market Reality Check

As for the S&P 500 Index, since peaking on Feb. 19, the Index fell 34% in the 23 trading days through Monday, reaching its lowest level since December 2016. Bloomberg did the math. Each day wiped out an average of 1.7 months of gains. Not so good.

That’s market reality check #1.

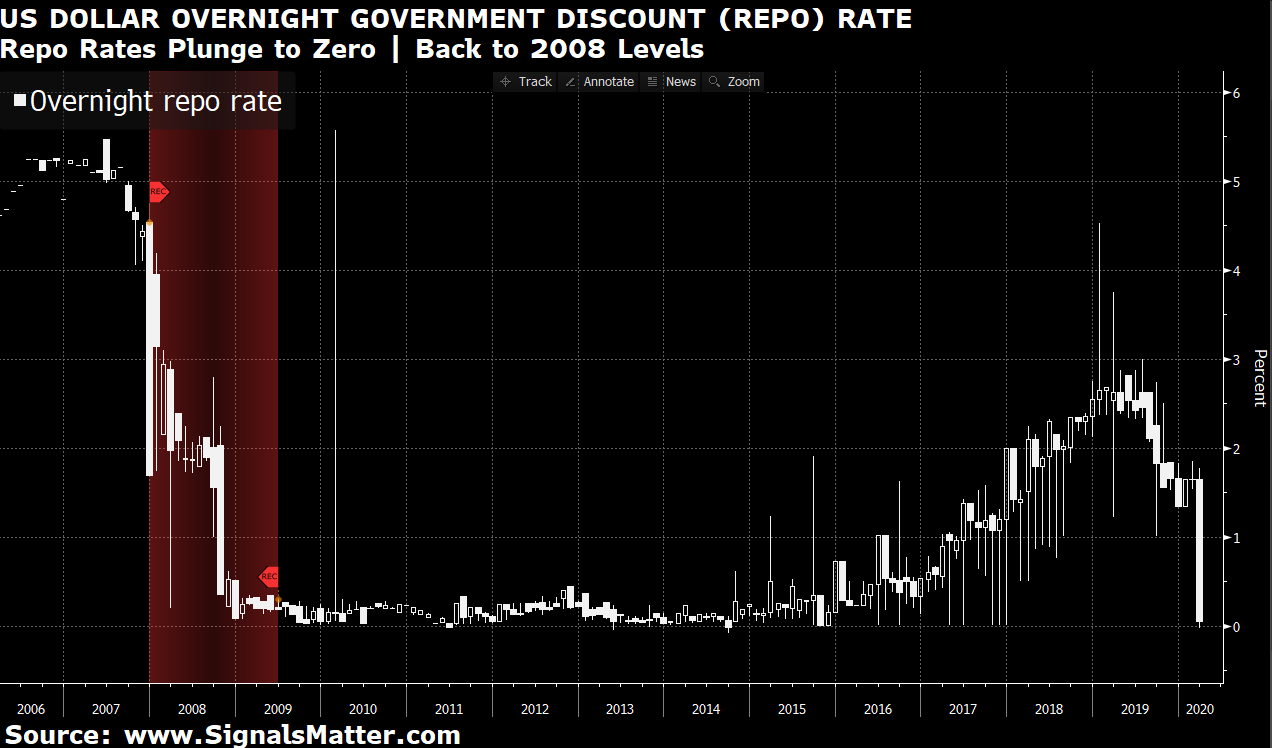

And in a single week, the repo-market (which essentially allows broken banks and other government-like entities to roll-over debt to each other in an over-night game of musical chairs) was forced to the 2008 floor, which if memory serves, was not a good vintage year…

That’s market reality Check #2.

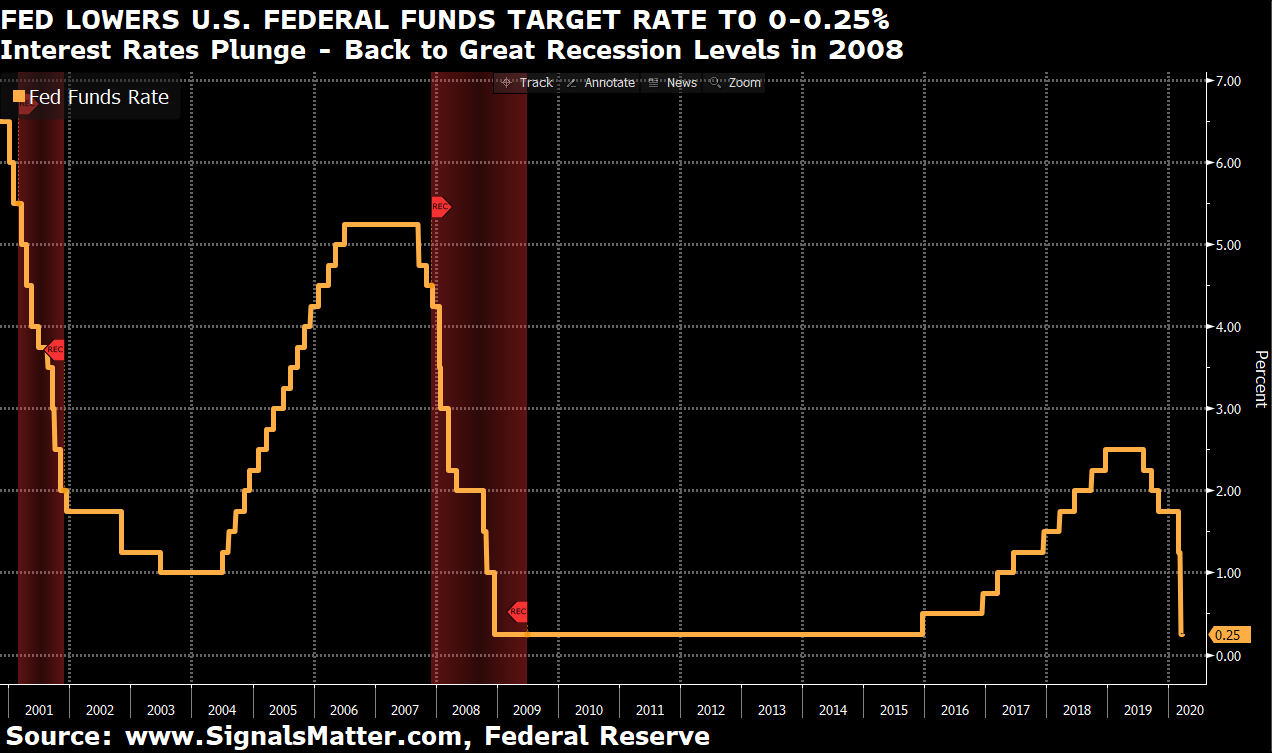

In a scene reminiscent of a barnyard full of headless chickens, the Fed then rushed to drop rates to the zero level as well, hoping this might help encourage markets toward confidence despite a policy that is running out of further rates to cut.

That’s market reality check #3.

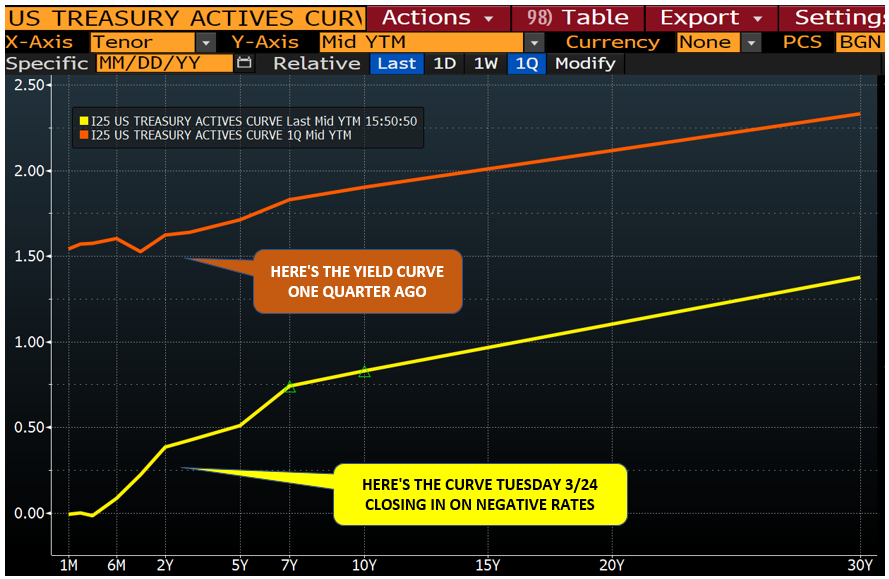

As a result, the Fed, like Custer, is running out of “rate ammo,” as our yield curve plunges toward negative territory on the short-end, and well into negative territory when adjusted for even mis-reported inflation.

That’s market reality check #4.

The only “magic bullet” we now have left is money printing and deficit spending, which just means adding more debt and decreasing even further the purchasing-power dilution of our “relatively” strong currency, which gives an entire new meaning to the phrase “best horse in the glue factory.”

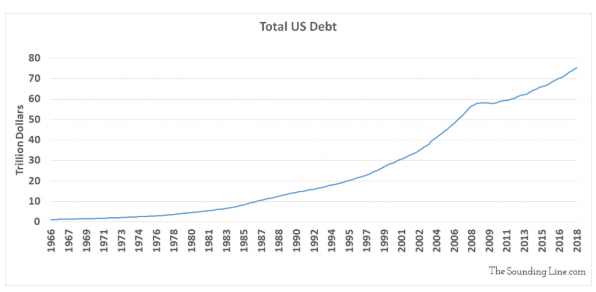

With combined public and private debt now well over $75 trillion (!!!) and a debt to GDP ratio of 365%, we are in full on crazy-land now. This chart alone tells you all you need to know about the historical risk we now face, which risk was already in play before COVID-19 topped the scales even further against this broken, yet hidden market cancer of debt.

Folks, debt levels like that are market reality check #5…

So, there you have it. We have no rates left to cut and nothing but a powder keg of record-high debt before us which is sustained by a money-printer punch bowl in DC and a room full of binge-drinking Fed officials to use it.

How Did We Get to This Little Bighorn Moment?

Of course, literally every headline is blaming the current scenario on the Coronavirus (market reality check #6) and thus looking to DC to throw more money at an invisible virus to make markets feel safe again.

Tuesday’s surge on the back of a promised Senate Stimulus is proof of such desperate hope. But when markets rise on headlines rather than balance sheets, that’s never an assuring sign and thus serves as market reality check #7.

Furthermore, we’ve shown over a year ago that this market was a can of flammable gasoline long before the Corona-match arrived, warning here of trouble to come and illustrating here that these markets were fatally ill well before COVID-19.

Adding more debt, fiat money deficit spending and balance sheet pain at the Fed is not a solution, it’s a drug-addict’s “quick fix” at best, and a can-kicking policy of delusion rather than realistic, honest and blunt economic truth. Sorry to be so candid, but we have passed a point of no return when it comes to debt and stimulus. There will be more pain ahead, or as General Longstreet said before Pickett’s doomed charge at Gettysburg: “Defeat is now a mathematical equation.”

For now, however, the headlines will cheer (thanks to a cadre of 20-something financial journalists reliant upon google-searches rather than market experience) as the Fed’s balance sheet quietly continues to rise above previous highs not seen since the Great Financial Crisis of 2008.

In the week ending March 18, Bloomberg reported assets at Federal Reserve banks totaled $4.7 trillion, compared with $4.3 trillion the prior week.

And that was before the central bank unveiled more measures Monday that will quickly add to that tally.

This embarrassingly fat and bloated Fed balance sheet is market reality check #8.

More Reality Ahead

In case such stubborn facts haven’t ruined your buzz for Tuesday’s “surge,” let’s look a bit further ahead at more data rather than more market cheer-leading.

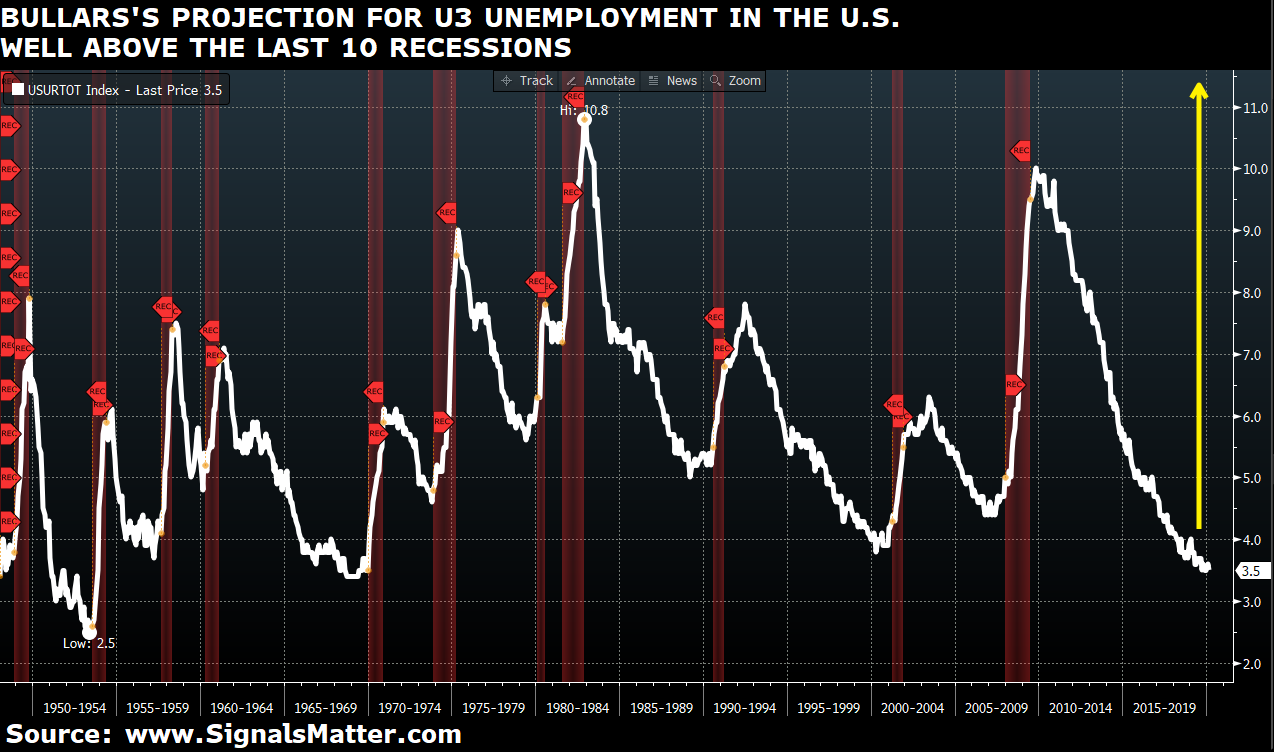

According to Federal Reserve Bank of St. Louis President James Bullard, the U.S. unemployment rate may hit 30% in Q2 2020 because of shutdowns to combat the coronavirus, with an unprecedented 50% drop in gross domestic product.

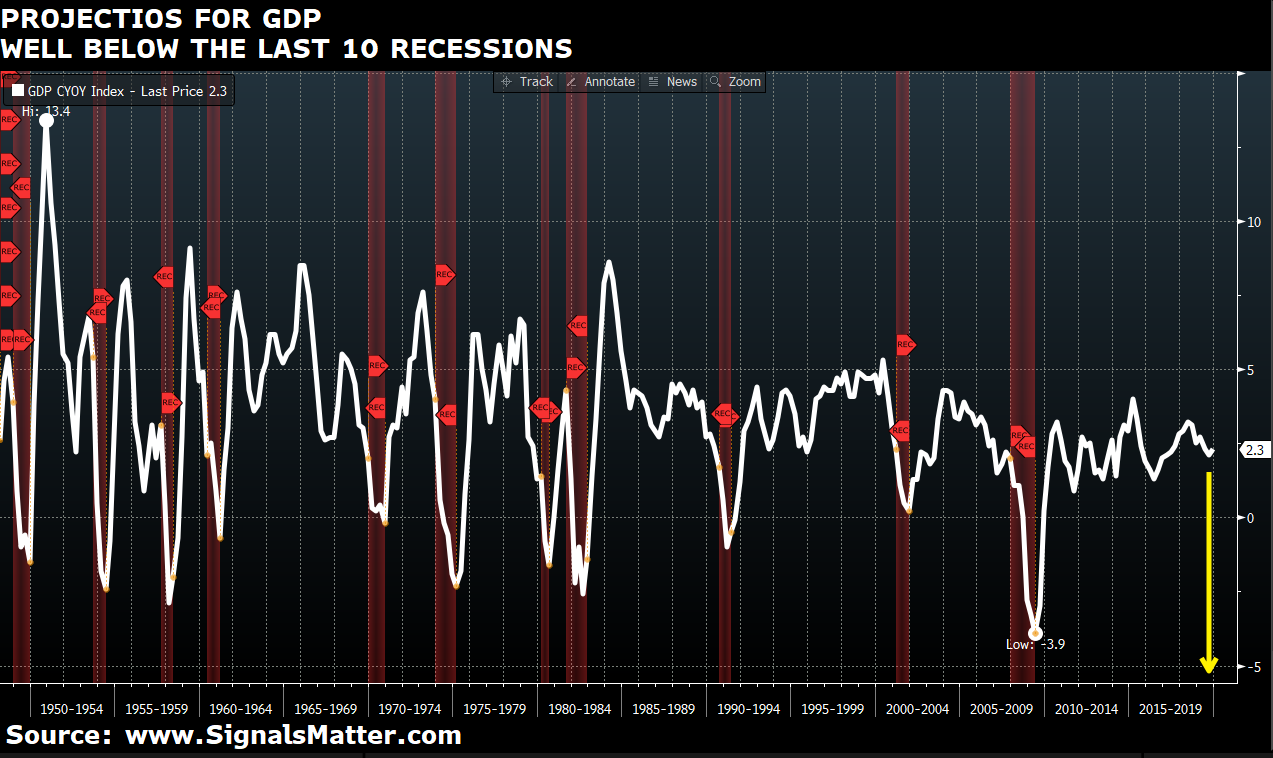

Others call for GDP well-into negative territory for Q3/Q3 2020.

Here’s what that would look like…for unemployment:

And for GDP…

The foregoing employment and GDP forecasts are market reality check #9 and market reality check #10…

Let’s Keep It Real

If, like subscribers to Signals Matter, you aren’t afraid to face facts nor worry about being caught in meaningless bear vs bull debates, then you are likely an individual realist rather than a herd-follower.

Furthermore, you are likely someone who recognizes that the surest and safest way to market wealth is risk management, not performance and top-chasing desperation or checking your portfolio every hour or day.

Instead you wisely prepare for market risk ahead of, rather than after, the fat lady sings.

In short, if you recognize that wealth is made slowly and steadily, rather than fast and furiously…If you recognize that avoiding big losses (which take forever to get back) is the first step to successful investing…

…and if you know that the smart money sells at tops and waits patiently to buy at bottoms, then you are the perfect candidate for Signals Matter and will feel right at home with our realistic rather than fantasy-pitching approach to portfolio management.

And as for buying at bottoms rather than tops, we aren’t even close to the bottom, despite what the headlines and Fed might want you to believe.

But then again, the headlines and the Fed have never been good at warning of recessions. In fact, their record for warning investors before the storm is 0 in 9.

One look at our website and its time-stamped reports, however, and you’ll see we’ve been bulls and bears at all the right times, and now is no time for bull or bull$#!?…

In short, if you are looking for blunt-speak rather than sales-speak, and data backed direction rather than hope-backed projections, we are just one click away.

Let’s get real, together. In the interim, stay informed and stay safe.

Your Guides, Matt & Tom