What the U.S. in particular, and the West in general, are failing to confess is that today’s so-called Developed Economies are more like yesterday’s debt-straddled Emerging Market economies, and like any banana republic, the only option ahead for our clueless elites IS inflationary.

Titanic Ignorance

I’ve often cryptically joked that listening to investors, mainstream financial pundits or downstream politicians debating about near-term asset class direction, inflation or central bank miracle solutions is like listening to First Class passengers on the Titanic debating about desert choices on the menu in their hands rather than the iceberg off their bow.

In short: The real issues are right in front of us, yet ignored until the economic ship is already dipping beneath the waves.

Rising Debt + Declining Income = Uh-Oh.

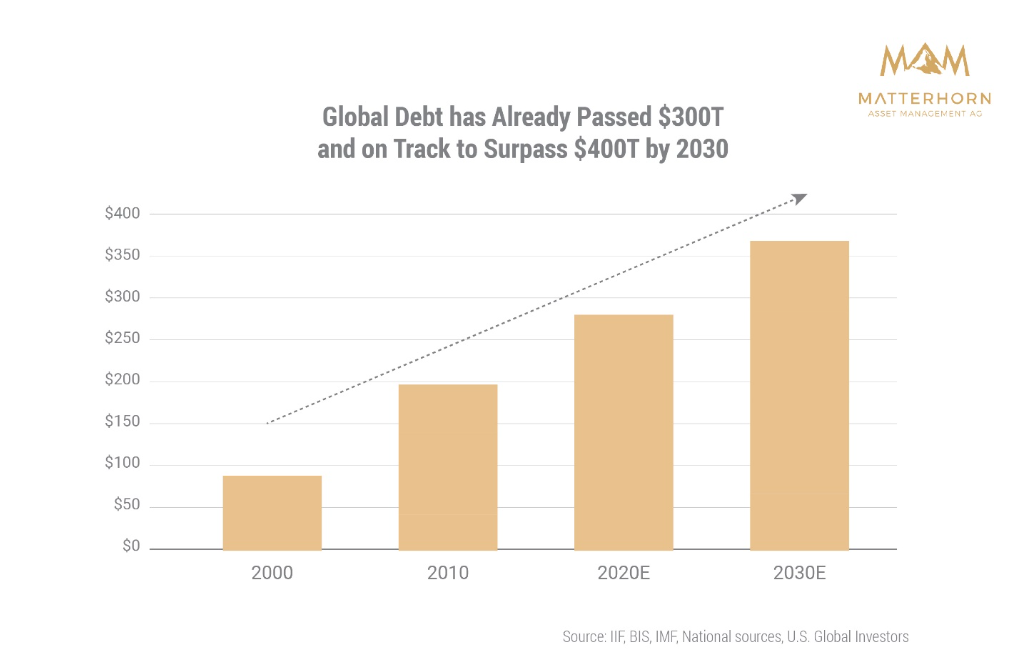

As for such hard facts (i.e., icebergs), the most obvious are fatal global and national debt levels rising at levels which can never be repaid….

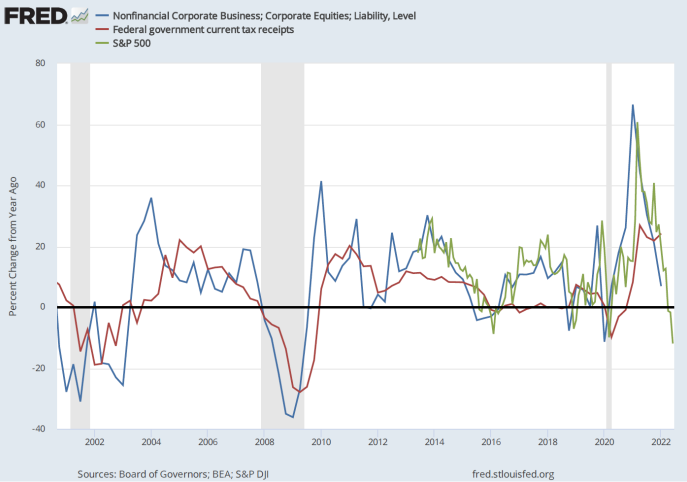

Meanwhile, income from GDP and tax receipts are falling, which means debts are grossly outpacing revenues, which any kitchen-table, boardroom or even cabinet meeting conversation should know is a bad thing…

Toward this end, it’s worth lifting our eyes above the A-deck menu and taking a hard look at the following iceberg scrapping the bow, namely: Tanking US tax receipts:

What Biden and Powell might wish to remind themselves is that U.S. tax receipts have fallen YoY by 16%, and are likely to fall even further if markets continue their trend South at the same time the US steers toward a recessionary block of ice.

No Love for Uncle Sam’s IOUs

What’s even more alarming is that as U.S. Federal deficits are rising, foreign interest in Uncle Sam’s IOU’s (i.e., U.S. Treasuries) are tanking.

China’s interest in U.S. Treasuries, for example, has hit a 12-year low and Japan, as I’ve warned elsewhere, is too broke (and too busy buying its own JGB’s with mouse-klick Yen) to afford bailing out Uncle Sam.

Given the artificial and relative strength of the USD and the fact that FX-hedged UST yields are negative in EUR, it’s fairly safe to conclude that there will be more sellers than buyers of UST’s.

That’s a bad sign for Uncle Sam’s bloated and unloved bar tab.

Filling the Deficit Gap: Print or Default?

In the past, the spread between rising debts and declining faith in U.S. IOUs was filled by a magical money printer at the not-so-federal Federal Reserve.

But with a cornered Fed tilting toward QT rather than QE, where will this magical money come from, as it sure as heck aint coming from tax receipts?

As I see it, the Fed has only two pathetic options left if it wants to fill the widening gap between its growing deficits and declining faith from foreign bond buyers.

Namely: It can 1) default on its embarrassing IOU’s or 2) pivot and create more magical (i.e., inflationary and toxic) money.

When it comes between embarrassment or toxicity, my bet is on option #2, which means expect more rather than less inflationary currency debasement ahead.

Why?

Saving the Politico’s, Drowning the Citizen

Because neutering one’s currency is the classic/desperate policy taken by all debt-soaked regimes to create a lifeboat for themselves while leaving the average Joe Citizen shivering in an inflationary ocean of pain.

But one must hedge even one’s own highest convictions, and I suppose the Fed could try to increase demand for UST’s (as a so-called “Safe-Haven”?) by crashing the stock market rather than re-heating its money printer.

Anything is possible is a world bereft of good options.

But such an equally pathetic option just means less tax receipts from the stock-rich and hence places the Fed right back where it started: Starring down the barrel of even less incoming cash, even less consumer spending and hence even less GDP.

In short: I just don’t see anyway around the pathetic end-game ahead, which the Fed pretends to ignore and the media can’t even fathom.

Seeking Rather than Fighting Inflation

And so, I’ll say it again and again: The Fed is not fighting inflation, it wants inflation.

Or in plainer English, and as no surprise to Fed-watchers like me: The Fed is, once again, simply lying to the public.

The West: Just Another Banana Republic

Today, whether we wish to admit it or not, the so-called “Developed Economies” in the U.S., Europe and Japan are really nothing more than debt-broke economies, veritable banana republics.

This means their economic profiles, and hence economic policies, more resemble those of “Emerging Markets” rather than “Developed Markets.”

And what have we learned of the EM policies from Argentina to Yugoslavia and every other debt-strapped nation in history?

It’s simple: INFLATION MUST BE KEPT ABOVE INTEREST RATES TO REDUCE DEBT BY “INFLATING IT AWAY.”

The Volcker Option is Dead

This means inflation levels in the West can eventually reach a base-case similar to that of the 1970’s, but unlike that pre-Volcker era, today’s drunk central bankers can’t induce a recession (i.e., raise rates above the inflation rate) when the public debt is above $30T rather than $900B level of the Volcker era.

Folks, US debt to GDP is 122% today, under Volcker it was 30%. There is no going back to a Volcker option. Period.

Stated simply: Short of outright default, the US is in too much debt to conduct anything but an inflationary policy.

The Endless Larry Summers

Meanwhile, an increasingly tired President Biden stands on a Delaware beach and pretends he is good hands, telling reporters he has been on the phone with none other than Larry Summers to create a plan to fight inflation.

Oh, how the ironies do abound.

Larry Summers, the de-regulating patient-zero of the 2008 derivatives debacle and co-signer to the two most destructive pieces of financial madness since World War II (i.e., the repeal of Glass-Steagall and the 2000 Commodities Modernization Act—aka: Enron “loop hole”), is gonna save us?

From what most know of Larry, he’s always looking for an angle to appear like an expert and be at the center of power, while forgetting to remind anyone, including Ray Dalio, that he has been the very eye of more than one financial hurricane.

In fact, there’s no one I’d trust less to “solve” any financial problem, including the Harvard endowment, which former University President Summers helped crush in 2008 by filling it with the very same toxic derivatives which he had “de-regulated” a decade prior.

For now, the endless Larry Summers somehow feels a stronger USD and rising bond yields will give foreigners positive real returns and hence attract badly needed foreign interest in U.S. credit markets, when such a plan is likely to have the opposite effect (as per usual with all of Larry’s “plans”).

Big names like China, and broke names like Japan, as noted above, are selling, not buying our debt.

Instead, by raising rates/yields and tightening rather than easing, the “Summers Solution,” like the Powell policy, will merely hasten the demise of the U.S. economy while simultaneously increasing the risk of a U.S. default.

Why?

Because Larry seems to have forgotten that current US debt levels can’t endure rising yields/rates.

Simple History Lesson: Gold Rises as Currencies Debase

Again, the only option left for a debt-soaked banana republic like the U.S. is to look in the mirror and act like the banana republic it truly is—which just means more inflation and more currency debasement lies ahead.

See why gold’s golden era has yet to even begin?

Now is also the time to have smart portfolios in the backdrop of dumb markets. We’re here to help.

Signals Matter’s Blogs & Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly by Signing Up Here. Signals Matter’s Portfolio Solutions Made Simple are geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here.