Stock Market Advice? Trust but Verify.

Below, we verify our stock market advice with facts rather than fancy.

Skepticism is Contagious Too

There’s no shortage of skepticism these days. Faith in everything from governments, media pundits and markets is falling faster than last quarter’s oil price.

Does anyone really know anything?

For those who’ve already been burned by traditional portfolio advice from traditional advisors, is there anything safe, especially online, that doesn’t smack of either a get-rich-quick fantasy or some “sky-is-falling” YouTube interview?

We’ve seen those same guru’s too, all trying to sell a new instant-solution or mega-fear, be they penny stock peddlers, option-wizards or gold-plated bomb-shelter developers.

Time to Verify…

So rather than just tell you to trust our stock market advice, Tom and I thought we’d let our 3 years at SignalsMatter.com just speak for themselves.

Since we began our mission in 2017 to give the best of Wall Street intel and stock market advice to an otherwise ignored Main Street audience, we can all agree that markets have seen plenty of bull and bearish swings.

And guess what?

We used signals rather than tarot cards to foresee them all—the high points and the low ones, and made money all the way by simply, well, …NOT losing it.

Hard to believe?

We get it.

So, let’s just show rather then tell.

The 2017 Rise and 2018 Fall: We Were Right.

We posted our first stock market advice report in May of 2017.

By September of that year, we reminded our readers here and elsewhere that the Fed would start “tightening” its balance sheet and dumping Treasuries in the market.

How did we know? Because the Fed told us so. What was our stock market advice?

We warned this QT would push bond prices down and lift bond yields (and thus rates) up.

We said rising rates would shock the debt-soaked stock markets and lead to a massive market sell-off and “bond storm” beginning in October of 2018, when the pre-announced Fed bond dumping would kick-in at high-speed at a rate of $600B/month.

In short: That “bond wave” of balance sheet tightening and Fed rate hikes was certain to be a disaster. That was our clear stock market advice.

Thus, all through the summer of 2018, we then warned viewers to prepare for the October surprise, and I went live with those warnings and stock market advice (on my iPhone) again HERE from Los Angeles in June.

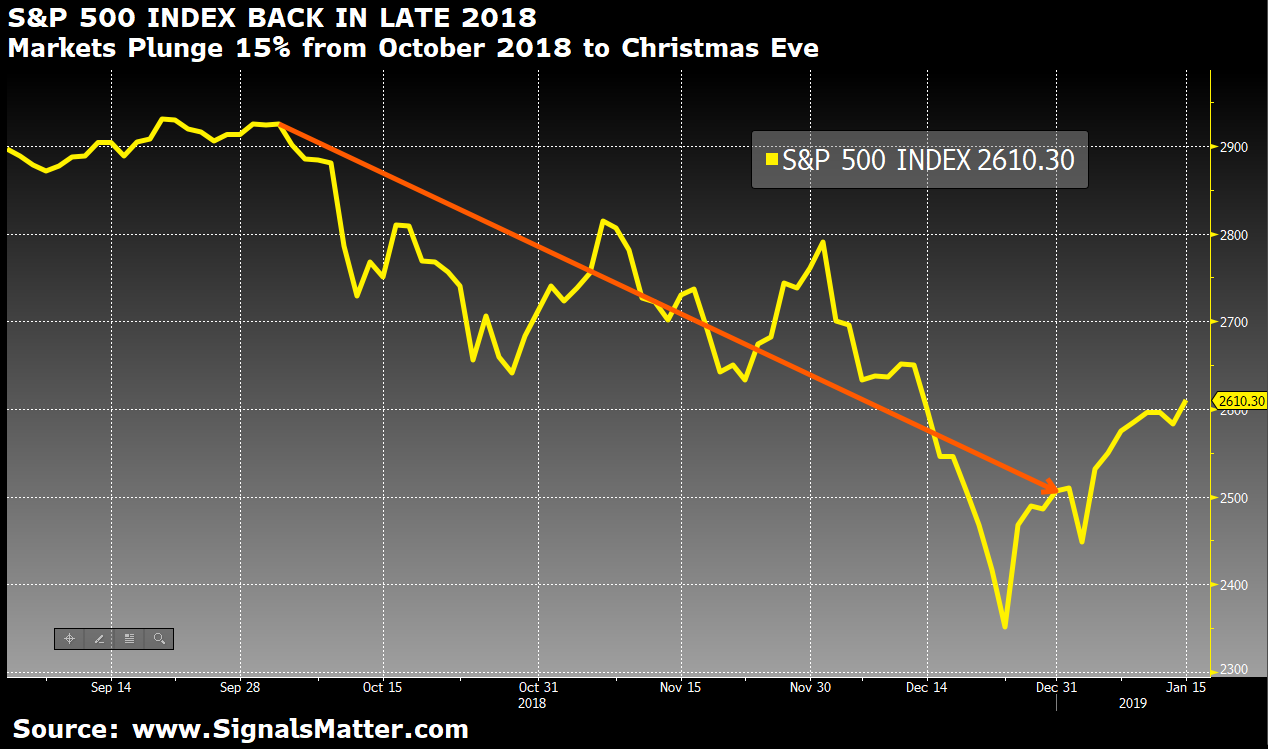

Then came October 2018, and right on que, markets began to tank.

From a beach in Malibu, I dropped my surfboard, picked up an iPhone and warned everyone that the next three months would be brutal. Again: clear stock market advice before rather than after the slide.

Don’t believe I warned you? Then See For Yourself.

By Christmas of 2018, the markets had fallen by 15% from their October highs to their Christmas Eve lows.

The 2019 Melt-Up: We Were Right Again

And by New Years Eve of 2019, I walked out of a hotel in Cannes, France and went back to my trusty iPhone and said the Fed would soon quit its suicidal tightening and rate hike policies.

Why? Because they literally had no choice. That was my stock market advice.

Don’t believe me? Then See For Yourself.

By February of 2019, and right on que, Powell pivoted, rate-hikes were “paused” (and then lowered, as we said they would), and once again we told our readers to get bullish again by April.

Don’t believe me? Then See For Yourself.

Immediately markets began to climb by a whopping 18%.

We even posted a report that same month about the Seven Tailwinds of a Melt-Up to let this sink in.

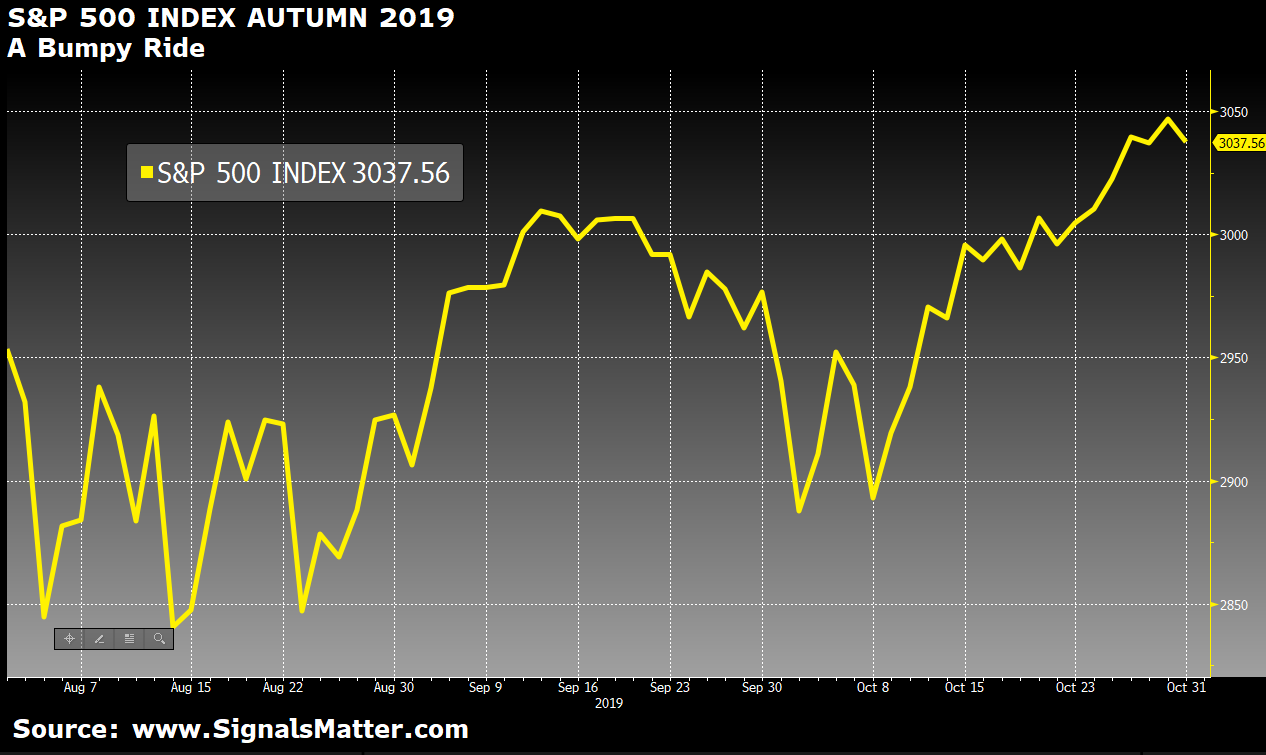

However, by the summer of 2019, we were tracking negative (!) yielding bonds and risky yield compression signals, and warned our readers of a bumpy autumn ahead, and once again, our stock market advice was right.

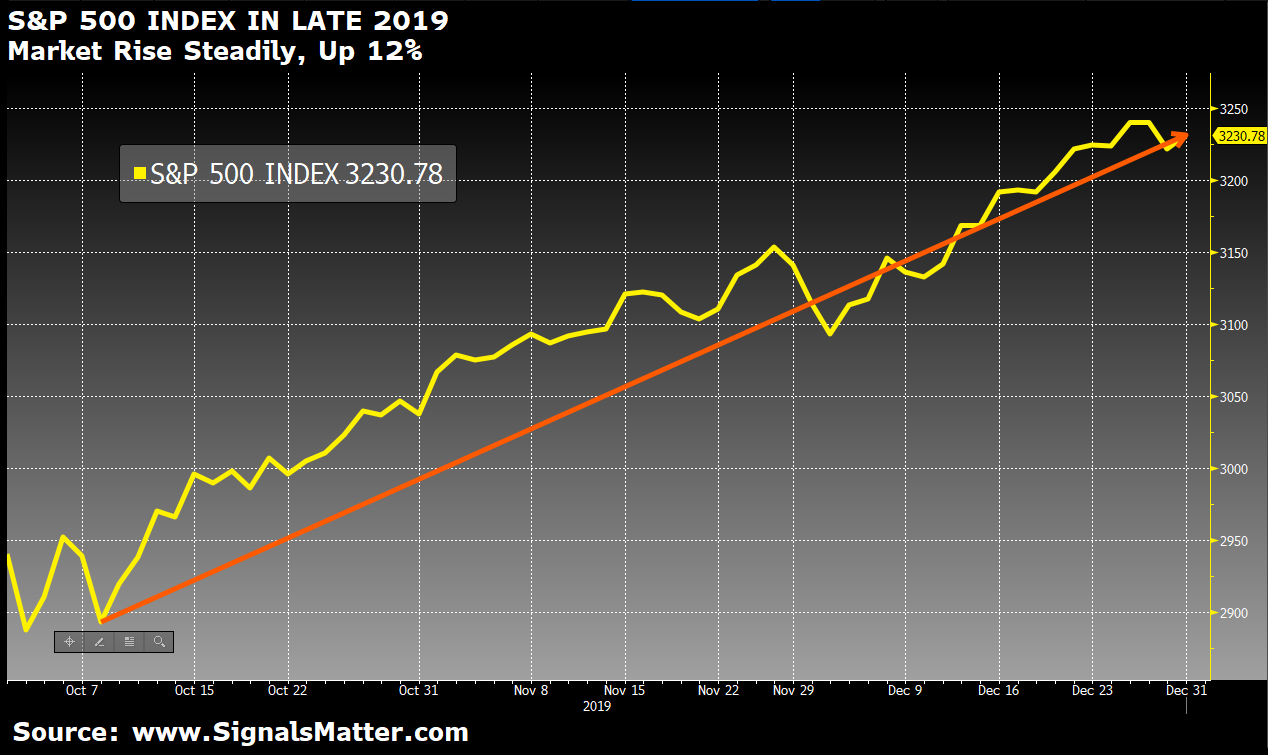

By late October of 2019, however, we then suddenly turned bullish, as the Fed was back to desperately printing money again.

So, I dropped my fly rod in Utah and picked up my iPhone yet again and basically screamed “risk on!” That was my clear stock market advice.

Don’t believe me? Then See For Yourself.

And once again, we were right. Markets continued to ride the Fed gravy train.

The 2020 Melt-down: Right Again…

Then came the 2020 disaster in which we now find ourselves.

Did Tom and I predict the COVID grey swan?

Of course not.

But we did predict that our debt-soaked markets were so fragile that any number of things would bring the house of cards crumbling down.

Again: Very clear stock market advice.

In fact, and almost unbelievably (?), we even listed a global virus as one among many possible melt-down triggers as early as April of 2019.

Don’t believe me? Then Click Here.

But perhaps nothing evidences our informed 2020 foresight and stock market advice better than the publication of our Amazon No#1 Release book, Rigged to Fail…

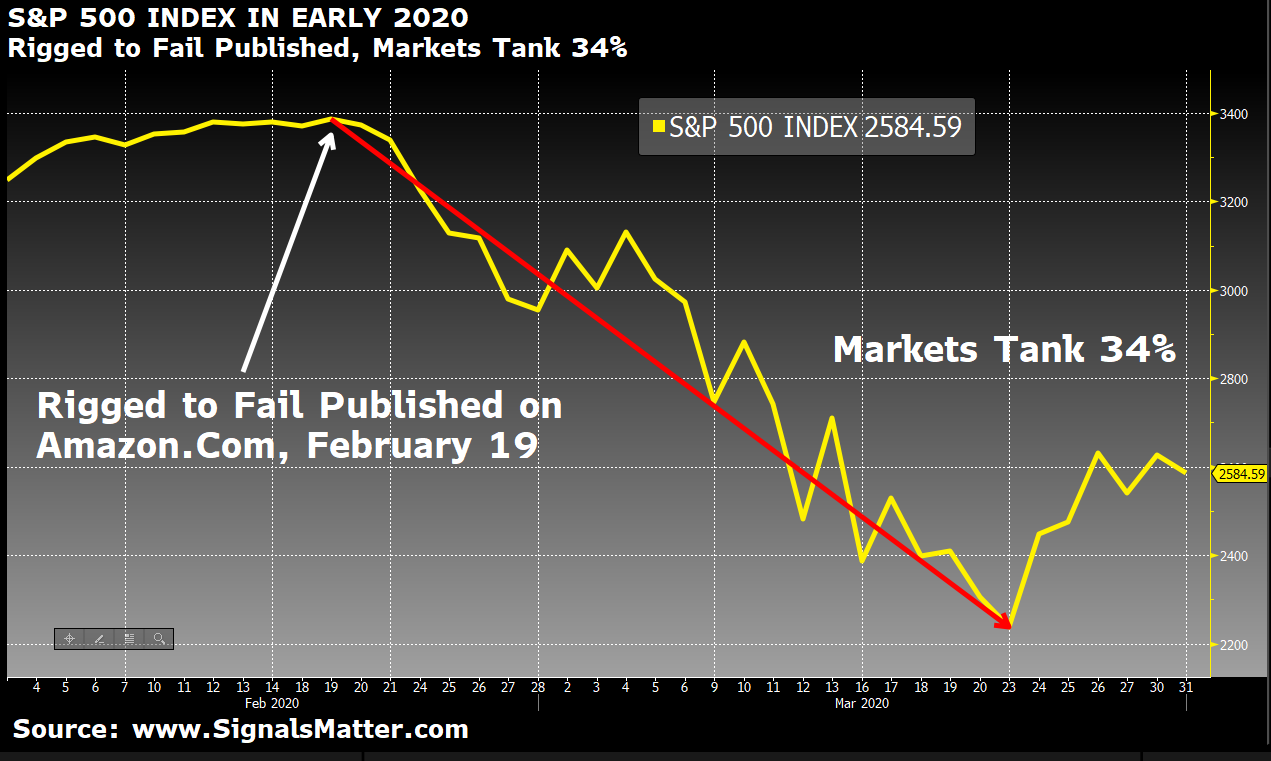

Rigged to Fail on Amazon.com was released on February 19,, 2020, the exact date of the market’s all-time, record high.

See the date at the bottom…

Many laughed at our title as well as our clear warning that our “magical markets” were about to fail.

Well, within a month of publishing Rigged to Fail, the markets promptly…FAILED.

Neither Psychic nor Gold-Bugs, Just Right Again…

We posted our first gold recommendation in April of 2018 here, and made subsequent reports on the need for this precious currency hedge here and here.

From the time of our first report, the price of gold has climbed 47%, From $1,175 an ounce to $1,733.

Junk Bond Warnings, Right Again…

In November of 2018, we looked into the grossly over-valued junk bond markets and saw a ticking time bomb.

Once again, I paused my Montauk vacation, grabbed a coffee and an iPone, and said look out below for junk bonds.

Don’t believe me? Then See for Yourself.

Since the date of the November warning, look what the junk bond ETF/Sector has done…

Unlimited QE Ahead? Right Again…

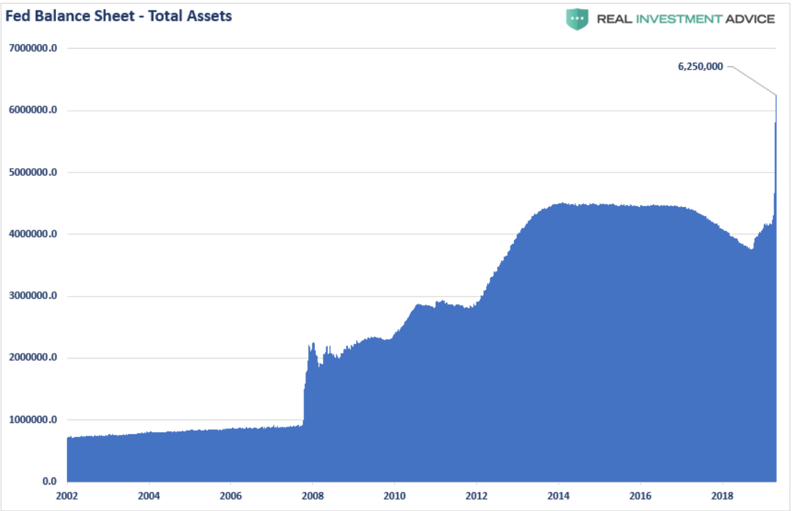

In April of 2019, when everyone was convinced the Fed would stop printing money, I literally laughed out loud, jumped off a horse in Bordeaux, and picked up my iPhone again with some more clear stock market advice…

I said the money printing will come, with a little help from French history.

Don’t believe me? Then See For Yourself.

And if you want to see what the pre-warned money-printing mania looks like just a year later, well, see for yourself…

Are We Always Right? Of Course Not.

But we are right a lot more than we are wrong, and we never suffer major drawdowns because our portfolios are not measured against the S&P, they are measured against risk and turn on signals rather than hunches.

Can your advisors truly say the same of their stock market advice, and prove it? How did their standard “buy & hold” pie-chart portfolio’s do for you when the COVID crisis hit?

Well, we were up when almost everyone else was down, way down.

Why?

Because we make money by not losing it, and slowly and steadily, we just crush the S&P over the long game.

Always have, always will.

Join Our Circle

I recite the above “I told you so’s” not to brag about my travel destinations or iPhone skills (highly debatable), but simply to show you, rather than tell you, that Tom and I back our statements with facts not fantasy.

We know it’s hard for many of you to simply trust an online face (or faces).

We don’t do webinars from South Beach with Ferrari’s and scantily clad models to show you our success, nor promise instant wealth with some market “trick de jour.”

If you’re looking for instant miracles, look elsewhere.

Instead, we promise blunt advice, consistent returns in all conditions, and no BS, just a heck-of-a-lot of experience that we once handed to America’s wealthiest and now deliver to America’s best—YOU.

We hope you’ll join hundreds of others who’ve trusted and confirmed our advice.

If you like our approach, join us here and we’ll see you on the other side of the subscriber bar.

Sincerely,

Matt and Tom