Signals Matters News Letter: The Signals THAT Matter

Alternative investing, discussed below, is making more and more sense as ongoing Fed signals make less and less sense.

Broadly, the core and timeless principles behind the infrastructure of Signals Matter Portfolio Construction are carefully discussed here and here.

As for WHAT’S HAPPENING NOW…

More Fed “Guidance”?

Jerome Powell looked a bit agitated and nervous at his most recent press conference, once again speaking about when and if the Fed will cut rates. He’s not ruling out a September “cut” (despite the markets already pricing in an 80% or greater chance of precisely that). For now, Powell is waiting on the “totality of the data” to decide what the Fed will do in September. This is his way of buying time and fighting inflation by increasing recessionary forces under his higher-for-longer trap.

For now, the markets, driven by the Fed, and a narrow margin of tech leaders, seem more and more dependent on Jerome Powell than they do on earnings, profits and healthy PE ratios. This, of course, is scary at many levels.

Needless to say, a potential rate cut in September will likely send already dangerously-high and narrowly-driven equities a tad (and temporarily) higher, despite the weaknesses underlying the vast majority of the S&P names. US stocks have become a “tech ETF” on the hopes that AI will save the world, a meme we’ve seen before about dot.com leaders in 2000 or real estate indices in 2007; and we all know how that ended.

Bonds, meanwhile, will tend to go up if Powell sends rates down. From sovereign to junk, however, this just means that real returns will be technically weaker, if one assumes the CPI inflation rate is accurate. For most investors, however, the jig is already up in the credit markets when yields are measured against actual rather than “official” inflation data. In short, and as all the leading bond experts agree, this market is heading toward pain.

Given the foregoing, what can investors do in a world where traditional assets are distorted and market direction can and will change from north to south?

Traditional vs. Alternative Investing

It has always struck us as odd that traditional stock and bond allocators (60% stocks/40% bonds) believe that bonds are a reliable hedge against stocks or that stocks are a reliable hedge against bonds. They are sometimes, and sometimes not. Investors holding long stocks and bonds expect both values to rise over time. Why else would they hold them?

There is an alternatives to traditional stock and bond investing, called alternative investing, whereby investors go beyond the usual allocations to stocks, bonds, and cash in favor of investing differently, by asset class or by methodology.

By example, investing in commodities like gold, silver, oil, and real estate are tangible goods that trade on their own beat of supply and demand and don’t always zig when stocks zag.

Then there’s the concept of short selling, where all these things are borrowed, sold, and bought back at a lower price. If a company or commodity plummets, investors buy back the shares at a lower price, returning the borrowed shares or commodities to the original owner.

Or stated more simply, “going short” means money is made when the selected security or asset class goes down rather than up.

This matters because not everything goes up. The idea is not just to hedge the long side to cover a loss, but to deliberately sell and buy back at a lower price, especially when everyone else is panicking.

Why not have your cake and eat it, too?

Hedging vs. Alternative Investing

So, what’s the difference between hedging and alternative investing?

The former intends to protect, while the latter intends to profit. In fact, you can have it both ways, as do we.

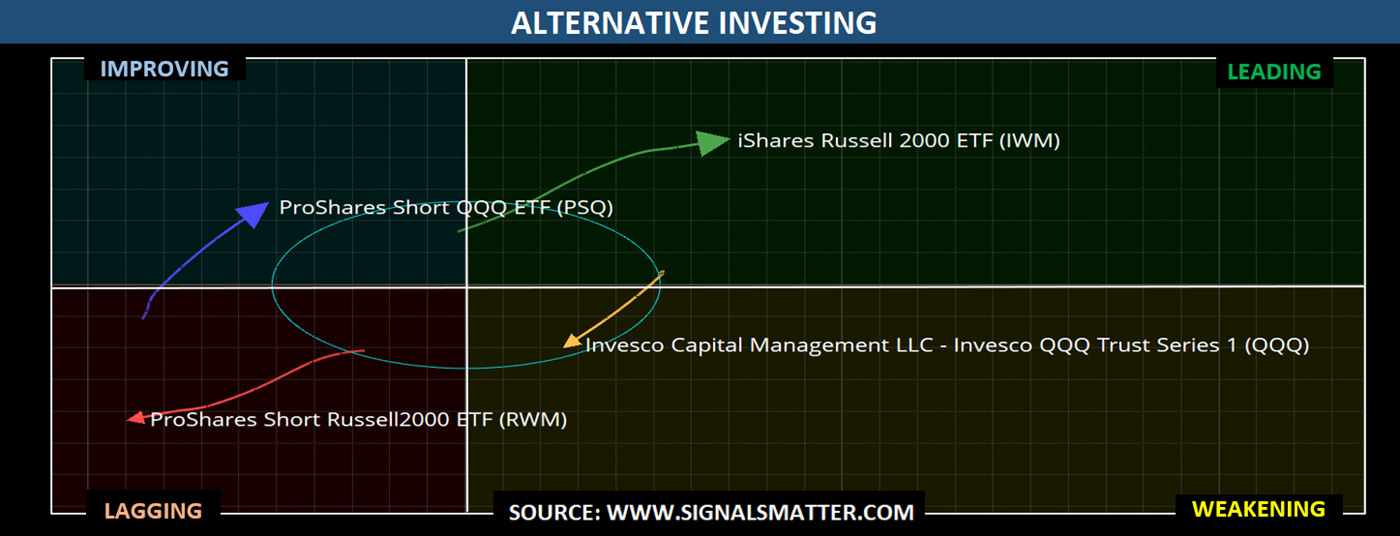

With Small-Cap stocks rising (IWM), we are long in the Leading Quadrant. With high-tech falling, we are short (PSQ), making money in the Improving Quadrant.

Call these hedges or investments; that’s up to you. The fact of the matter is that it’s the same ticker.

Correlations Matter When Hedging or Investing

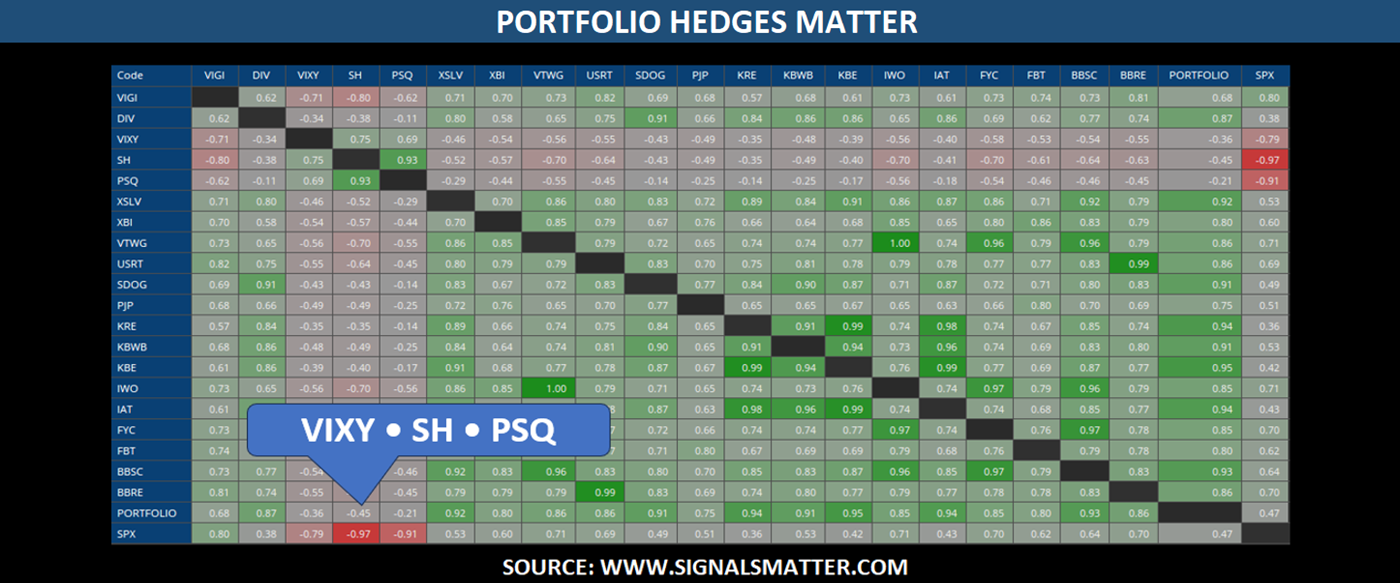

The key to smart investing is to invest, diversify, and hedge. Take our current Aggressive Portfolio at Signals Matter.

We’re invested in VIXY—ProShares VIX Short-Term Futures ETF (a play on rising volatility), hedged in SH—ProShares Short S&P500 ETF (to hedge our stock exposure), and short the Nasdaq via PSQ—Proshares Short QQQ ETF (an investment in tumbling technology stocks).

All in, note the reddish, negative correlations – key to keeping overall portfolio volatility in check.

Bottom Line

Markets remain toppy. Stock mania has led almost all major domestic and overseas sectors to be highly overweight equities.

Making things worse, hedge funds are almost unanimously crowded into long equity exposure, for that’s where the action is.

Remember, we have something most traditional investors lack: a plan and a process. If you’d like to learn more about how we build portfolios or invest in our hedge fund, Signals Matter Partners, LP, come join us at Signals Matter or Book a Meeting with us, and we’ll discuss it.

Even More

Signals Matter Market Reports reflect the company’s long-term macro views and are posted free of charge at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Portfolio Solutions are geared to shorter timeframes and may differ from our longer-term perspectives. Our actively managed Portfolios are available to Subscribers who Join Here and to Accredited Investors who directly invest in Signals Matter Partners, LP. For further information, click Direct Invest or Book a Meeting with us.