Understanding market risk is essential for portfolio construction here at Signals Matter. Over decades of investing, we have developed tools to track the probability of potential significant losses due to external factors that could disrupt the financial markets.

In our Q4 2024 Market Report, we shared our Recession Indicators, highlighting concerns at that time while discussing strategies for recession hedging. As we have repeatedly emphasized, understanding market risk requires effective measurement. To achieve this, we compile a broad range of indicators, which we analyze weekly for our Subscribers.

In this 3.0 Edition of “Party-On or Hunker Down,” we aim to provide an in-depth analysis of these indicators.

In the latter part of Q4|2024, some respondents to our Market Reports, both on LinkedIn and through direct communication, found it amusing that we were discussing the possibility of a recession while the markets were at all-time highs and our Recession Indicator stood at 36%.

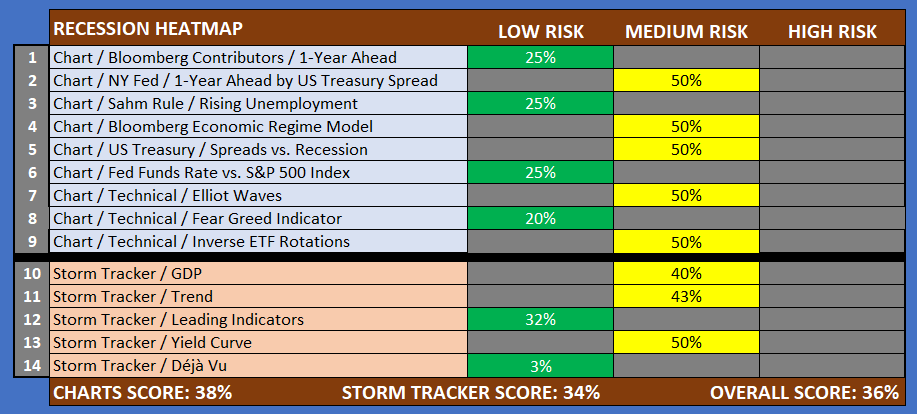

We published this heatmap on December 17, 2024.

Fast Forward

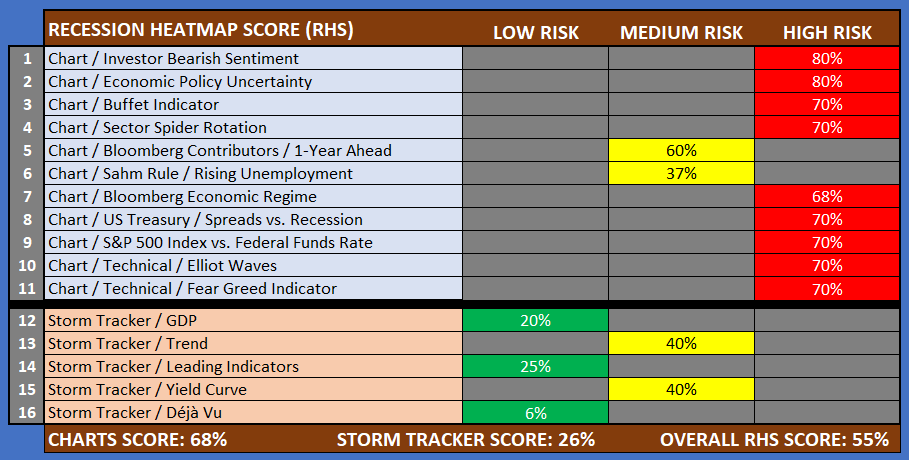

What seemed amusing in 2024 has turned serious in 2025. The likelihood of a potential recession has increased significantly this March, rising from 36% last December to 55%. Correspondingly, we have been receiving calls asking, “What’s going on?” and “What should I do?” at an accelerating rate, mirroring the rise in our current Recession Heatmap Score (RHS) to 55%.

What’s Going On?

In summary, markets are becoming riskier due to a combination of factors.

Concerns about inflation in the U.S., potential interest rate hikes, and the sustainability of GDP growth are contributing to economic instability. Geopolitical issues, including ongoing conflicts and trade disputes, are disrupting global supply chains and undermining investor confidence. Additionally, rapid advancements in technology, particularly the rise of Artificial Intelligence (AI), are causing significant industry changes and adding to market volatility.

Since our last note in December, there has been a US presidential election, resulting in new economic policies that are bringing disruption and uncertainty since President Donald Trump took office. What could be beneficial in the long term can be detrimental in the short term.

Lately, we are seeing trade wars, aggressive deregulation, immigration restrictions, and tariffs—along with retaliatory tariffs on imports from China, Mexico, and Canada—affecting U.S. companies, consumers, the labor force, productivity, and now, the financial markets.

What’s Should Investors Do?

First and foremost, investors who delegate investment management to Wall Street should consult with their financial advisors. What is their plan for you in case the markets experience a significant downturn?

Here’s what you can expect to hear: Try not to get rattled. We’ve seen this situation before. Focus on your long-term goals. Yes, the stock market can be volatile in the short term, but historically, returns have been solid over the long run.

In other words, stay the course while considering a shift in some stock allocations to bonds, with perhaps a 10% allocation to alternative investments. The key here is that the overriding message is to stay invested. Wall Street believes that enduring volatility is beneficial in the long run. According to Wall Street, trying to time the market can result in missed opportunities.

We’ve Seen This Movie Before

We have indeed seen this situation before, and it’s not a pleasant one—specifically, the Great Recession, which lasted from December 2007 to June 2009, and the COVID-19 pandemic, which occurred from February to April 2020.

During the Great Recession, the S&P 500 index plummeted by 55% from its peak to its lowest point, taking 3.5 years to fully recover. In contrast, during the COVID-19 recession, the S&P 500 fell by 34% and managed to recover in roughly six months–due entirely to the unlimited QE which followed.

While shallower recessions tend to have quicker recoveries, the extent of a decline affects the returns needed for recovery. For example, an asset that drops by 55% needs a 110% gain to recover, while a 34% drop requires a 68% increase.

COVID-19 was an unprecedented, more short-term event, whereas the Great Recession was more driven by economic factors, making it a more appropriate comparison for today. The underlying causes and severity of a recession significantly influence the recovery trajectory.

Tracking Recessions

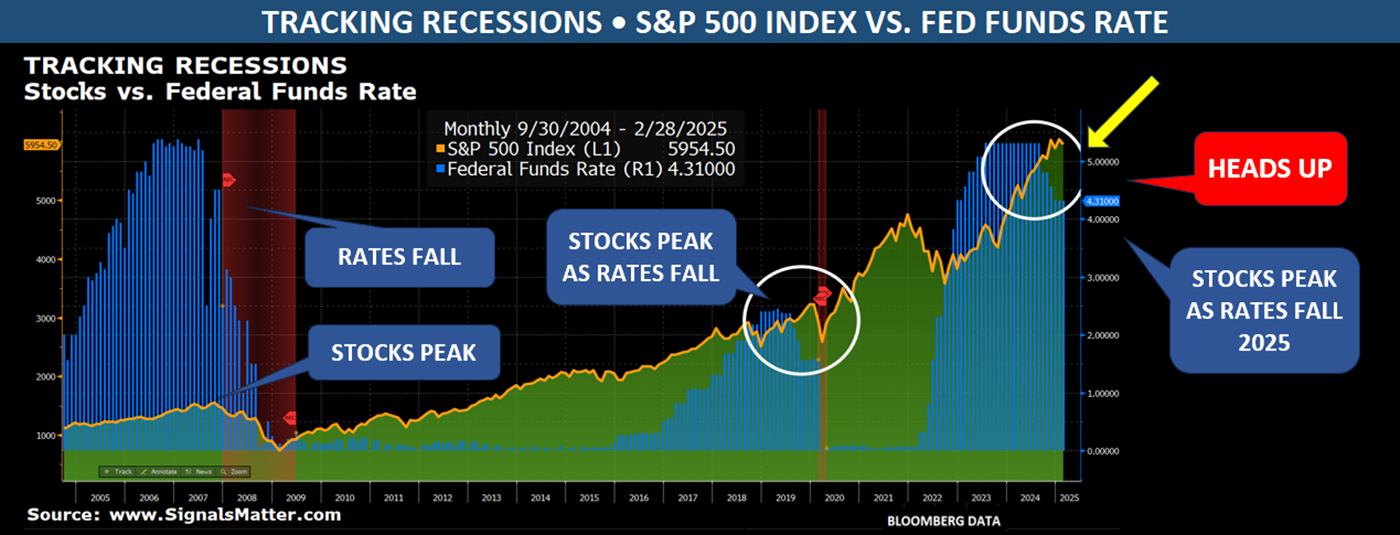

Visual graphs are incredibly helpful for tracking recessions while simplifying complex information—this is our specialty at Signals Matter. Below, you’ll find two clear and digestible visuals that illustrate the Great Recession and the Covid Recession in relation to interest rates and stock market performance.

The first chart compares the S&P 500 Index against Federal Funds Rates, highlighting the Great Recession and the Covid Recession in red. The Federal Funds Rate is the interest rate at which banks and credit unions lend and borrow from one another on an overnight basis.

A significant discrepancy between the S&P 500 Index and the Federal Funds Rate can suggest a potential recession. When the Federal Funds Rate declines while the gap between it and a rising stock market widens, this has often been a precursor to recessions.

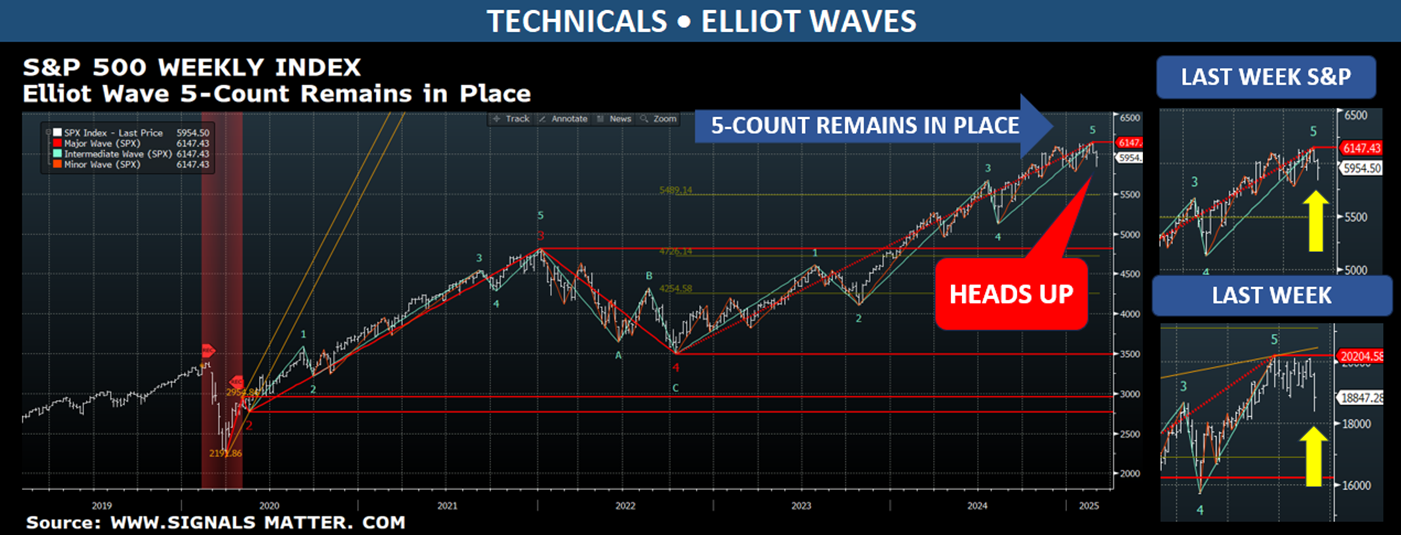

Here’s an overview of the Elliott Wave Theory, a more technical methodology developed by Ralph Nelson Elliott in the 1930s.

The theory posits that market prices move in repetitive wave patterns influenced by changes in investor psychology. These patterns consist of impulse waves, which follow the main trend, and corrective waves, which move against it. Stock prices typically fluctuate in waves labeled 1 to 5, with a “5” representing an extreme position.

The chart below illustrates the Elliott Curve for the S&P 500 Index and (by side bar), the Nasdaq-100. Currently, both indexes are at a “5-count,” which is considered extreme and may signal a recession ahead if stock markets continue to decline.

What to Do?

Follow us. Our well-designed graphs convey important insights, act as powerful communication tools, and provide information about our Portfolio Solutions.

At Signals Matter, we feature 15 recession graphs on our website, which are updated weekly. These graphs form the foundation of our Recession Heatmap Scoring (RHS). Additionally, they inform our portfolio strategies, which differ significantly from traditional stock and bond investing. Low risk scores allow for a more aggressive portfolio approach, while high risk scores indicate a more conservative, hedged strategy.

Our Portfolio Solutions

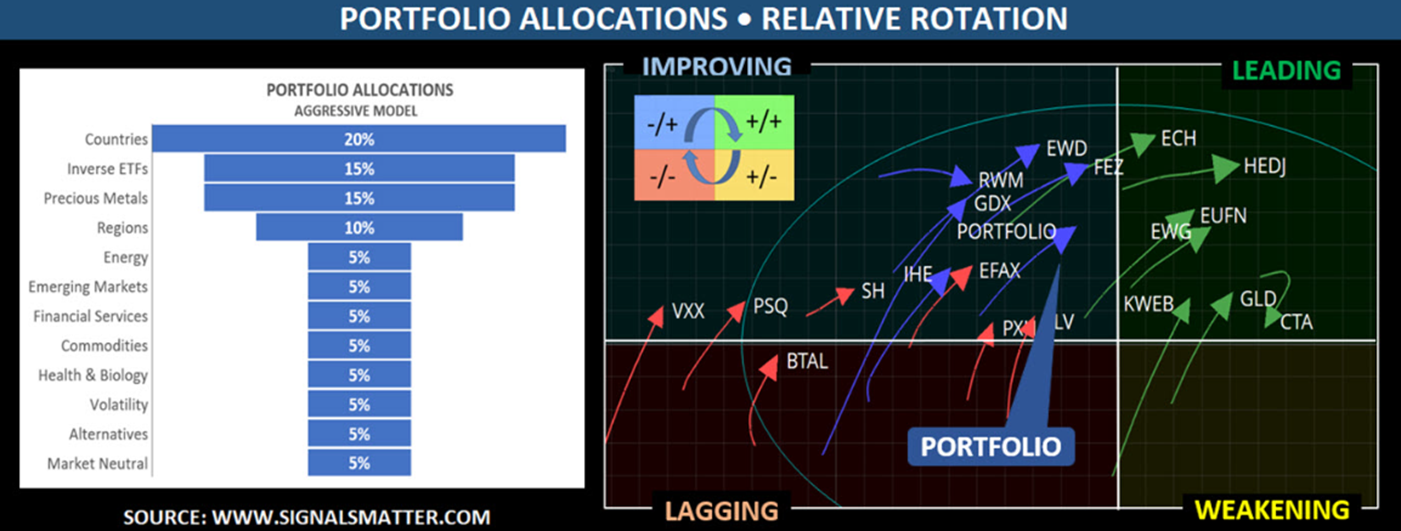

Signals Matter offers five portfolio solutions that range from Conservative to Aggressive: Conservative, Moderately Conservative, Moderate, Moderately Aggressive, and Aggressive. While these terms may sound like Wall Street jargon, the solutions within differ.

Each portfolio is composed of 20-25 carefully selected ETFs, with allocations that adjust based on our economic outlook and the investor’s risk tolerance. To assist investors in defining their risk tolerance, we provide a 3D Risk Profile tool that quantifies Subscriber risk capacity, risk tolerance, and risk composure.

When market risk decreases, we favor a strategy that allocates up to 100% to equity sector ETFs that are performing well. Conversely, when risks increase, we take a contrarian approach.

Recently, as risks have been rising and stocks have been falling, our current allocations include inverse ETFs (which increase in value when stock markets decline) and volatility ETFs (which gain as market volatility rises), among other varied allocations outlined below.

Our goal is to make money in all investment environments, whether bullish or bearish. So far this March, we have outperformed the S&P 500 Index by over six times in just four days. While past performance does not guarantee future results, it highlights that traditional stock/bond investing has become increasingly risky.

In Summary

The key takeaway from our analysis is that there is currently a 55% risk of a recession occurring within the next 12 months, an increase from 36% last December. It’s important to note that recession indicators typically emerge only one to three months in advance of a need to take action. Waiting for the NBER to tell you we are officially in a recession is far too late to take action.

Our subscribers actively monitor updated signals and charts on a daily basis, helping them determine when it may be prudent to invest or take a more conservative approach, all for just $97 per month. This amounts to $1,164 annually, or 1.16% of a $100,000 portfolio. Given that portfolios often fluctuate by 1-2% in a single day, a subscription to Signals Matter is a small price to pay.

Additionally, some of our subscribers choose to automate the investing process by allocating to our hedge fund, Signals Matter Partners LP, which we launched earlier this year. Go to Signals Matter Advisors for further information.

Many Ways to Join Us

Signals Matter Market Reports reflect the company’s long-term macro views and are posted free of charge at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Portfolio Solutions are geared to shorter timeframes and may differ from our longer-term perspectives. Our actively managed Portfolios are available to Subscribers who Join Here and to Accredited Investors who directly invest in Signals Matter Partners, LP. For further information, click Direct Invest or Book a Meeting with us.