Below we look at yield compression. And trust me: This is very important.

60 shares

This will be a brief but extremely important Signals Matter Report.

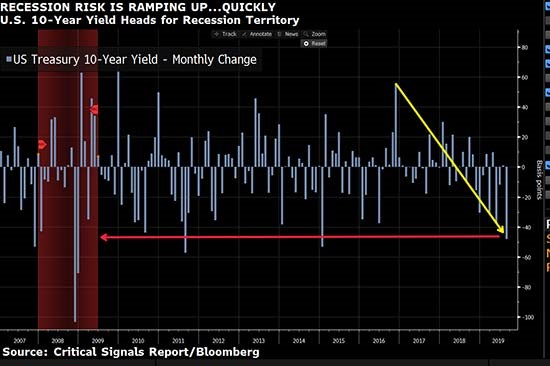

With the month nearly over and as we head into a holiday weekend, we wanted you to know that the U.S. 10-year Treasury Yield may be in for its biggest monthly drop since January 2015. It’s all about Fed-nduced yield compression.

10-year yields are now approaching lows not even seen since the peak danger months of the Great Financial Crisis of 2008… and notably, just before.

So, what does this mean and what can YOU do? When money flows into bonds, their prices rise and yields come down, and when the Fed, among others, buys bonds and yields come way down, that’s really artificial yield compression.

When we see yield compression hitting the floors of history, this is because bond prices (first supported by central banks and now exacerbated by increasingly scared investors seeking “safety” in government debt) are rising toward the moon.

When scared investors and global money (desperately seeking even a sliver of U.S. yield) flock to U.S. 10-year Treasuries, this pushes their prices up even higher and hence their yields even lower – which means our flattening yield curve is flirting with increased inversion disaster – a classic harbinger of trouble ahead.

This is very, very important, and very troubling…

A Deadly Coiled Spring

To help this sink in, think of yield compression in government (and other) bonds as an extremely powerful spring which has been pressed down (coiled to a breaking point) by years of central bank intervention (i.e. trillions in massive yet artificial price support of bonds by drunken, Fed money printing used to buy those bonds).

Years of such dangerous yield compression have been used to keep Treasury yields, and thus rates, unnaturally low of for an unnaturally long time (10+ years), creating the illusion that both high interest rates and rising inflation were and forever remain a thing of the past.

This, of course, is pure fantasy – but fantasy works to keep market and Fed credibility (and faith) on autopilot until, of course, that faith and credibility is lost.

In the interim, such low yields and rates have led directly to the largest corporate, governmental, and household borrowing/debt binge (and bond bubble) in our history, now tallying in at a combined and staggering $72+ trillion.

Additionally, this dangerous yield compression (and hence rate compression) have encouraged companies to use cheaper borrowed money to buy back their own shares at unprecedented levels, thus acting as a debt-soaked tailwind for an equally unnatural rise in our stock markets. See how the bond market impacts the stock market?

Two Bubbles Waiting for the Pin to Drop

Thanks to such unnatural and historically unprecedented yield compression, we now stand before the largest stock and bond bubbles in U.S. market history, both of which rely entirely on keeping this dangerously coiled yield “spring” forever coiled/compressed.

In short, everything hinges upon low yields and low rates, which means everything hinges on central bank intervention and support. Folks we now live in a “Fed Market.”

This week’s continued yield compression means we are getting that much closer to an “uh oh” moment – because the spring is one day approaching a popping/release point.

Unfortunately, the more the Fed and markets compress a coiled spring, the more stored energy it harbors, which means the more powerful that coil will be when it springs into full action and shoots to the sky like a surface-to-air missile after years of artificial yield compression. This happens when the Fed no longer has the credibility, faith, or power to keep this unsustainable yield compression from bursting. This, of course, is hard to predict but easy enough to track–and hence prepare for in order to avoid the carnage that follows.

The Physics of Markets Rather Than Fed Forces

But the moment such stored/coiled energy converts to kinetic energy – i.e. the moment it moves into action, the coil pops, the spring shoots, and hence yields and interest rates rip rather than stay down.

And as we’ve said countless times, once the artificial forces of compressed yields surrender to reality rather than fantasy, yields and rates will fatally rise on natural market forces, which are as real to markets as physics is to science. And when those rates so rise, both our stock and bond bubble pop in tandem, which means money bleeds out of these markets with alarming speed and force.

The data above on the 10-year Treasury merely confirms that these compressed yields and levels are moving closer and closer to their “uh oh” moment, one which the Fed can desperately seek to postpone with its last few bullets of stimulus, but in no way prevent.

Such massive yield compression doesn’t come along very often, but here we are. Like Custer at Little Big Horn, we are slowly running out of both time and Fed ammo.

Stimulus bailed us out in 2011 and 2015, but we may not be so lucky this times around… Soon. our repo markets will need more QE, as will our Treasury markets. The Fed will buy more time. But for how long? We’re concerned. That’s because we’re running out of bullets on the monetary side and any fiscal relief administered now would give us false market faith leading into 2020.

What YOU Can Do Now

First, stick to our Storm Tracker cash levels.

Second, stop worrying about market timing and just listen to common sense.

That is, common sense dictates that interest rates, yields, and inflation have not been rendered extinct by central banks in general or the U.S. Fed in particular. Just because a hubris-driven Fed thinks otherwise means nothing to the humility of our own common sense.

Thus, even if the Fed goes full-on crazy and takes/compresses rates to zero, or even below zero as in Asia and Europe, this only buys time, not miracles.

In other words, rates, yields, and inflation WILL spring at some point from these artificially coiled levels.

Knowing this, it matters not whether this happens tomorrow or a year from tomorrow, or even longer, for the simple fact is it will happen, which means you need to invest now in an asset class that will ultimately rise when the recession hits and interest rates rise, as this is as certain as death and taxes.

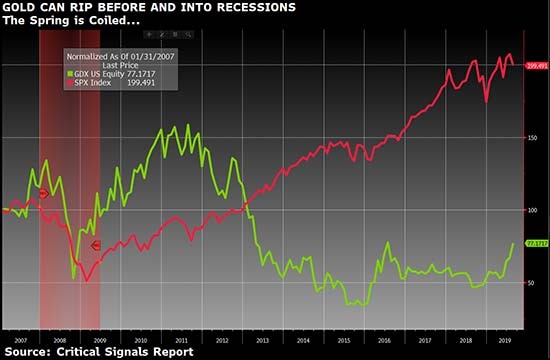

Gold, of course, is an obvious asset to acquire in such a backdrop, and we made a lengthy case for that here. To amplify this recommendation, take a look at this chart below on GDX vs. the S&P 500 Index. Back in 2007, gold just ripped before the 2008 recession set in… AND it continued to rip once the recession started.

The spread between gold and the S&P 500 Index is stretched right now, with these markets coiled up for an explosive move up for gold and down for the stocks.

The hard part is the timing and we like gold for that reason… it tends to be sticky BEFORE and INTO a recession, not to mention the inflationary period we are ultimately expecting.

We’ve displayed VanEck Vectors Gold Miners ETF (GDX) that tracks the performance of the NYSE Arca Gold Miners Index. The ETF invests in materials stocks of all sizes across the globe with its largest allocation is in North American companies, principally those domiciled in Canada. Market cap: $12 billion – investors are piling in.

Can You Help Us Out?

We’d like to know if you already own gold or not. In the comment box below, we’d be much obliged if you could tell us “Yes, I own gold” or “No, I don’t own gold.”

Again, we are not gold bugs or affiliated with gold sellers; we just see the common sense value of this asset in the current market backdrop and future. We’d just like to know if others are catching on.

For now, we wish you a wonderful holiday weekend and will keep you posted in the interim on further developments in these increasingly volatile markets.

Comments

99 responses to “A Dangerous Yield Compression Just Waiting to Uncoil”

- Rob Tompkinssays:

Yes I own gold, and silver. I actually owned a lot more several years ago, but lost a lot on living expenses after I moved to a place that I still truly love in Colorado. After I sold my house there and moved back here to New Mexico (for a job that paid a somewhat, almost decent wage versus what I could get when I was in Colorado) I reinvested in gold and mainly silver.

- DAVE Rsays:

“Yes, I own gold”

- Terry says:

Yes I have gold and silver. Guess i should get some GDX too. Are banks a good place to keep some cash? I read were they can take your money if they need too.

- Marksays:

Yes i do own gold & silver!……keep up the good work….

- Rogsays:

Yes I own gold

- James Stokessays:

No…I don’t own gold.

- ERWIN e ESSIGsays:

YES ONE SHOULD OWN GOLD OR SILVER WE OWN BOTH WAITING FOR THE BIG SHOE TOO DROP AND IT WILL

- kimura says:

Yes, I own some gold.

- Mike Hamiltonsays:

Yes

- Greg L Maupinsays:

No

- Don Sinclairsays:

No I don’t own gold

- Raymond M Joinersays:

Yes I own gold and silver. I am also invested in gold and silver stocks.

- Don Brenengensays:

I do not own gold at this moment

- jcsays:

I bought some physical gold quite some time ago. For a while it was down and appeared to some people to be a foolish investment but now it is clearly a good thing to own. I view this in part as an ultimate hedge against a total collapse of the financial system. It is something tangible I own. It’s not a large amount because I am poor anyway, but I hold it regardless of its fiat value at any given time.

I have also been making money on options in GDX, GLD and SLV lately. Again, not much since I have a very small account with little capital. But these options have been very successful recently.

- Donald Wolpertsays:

Yes, I own gold.

- Melvin says:

Yes, I own Gold.

- Mike T.says:

Yes, I own gold, gold mining stocks and etf’s.

- Tomsays:

No, we don’t own gold at this time.

- Ronsays:

So far I only bought 10 1/10th ounce gold coins for $1220 for emergency purposes.

- Ronsays:

Yes, I have had gold stocks for years.

- Kay Kiefelsays:

No I don’t own gold …yet

- Larry Silbaughsays:

Yes, Matt, I have about 5% of my funds in gold and about 15% in silver, both in the physical product itself. I’m at a point of really not trusting any of the institutions, especially the banks and am reducing my bank funds to a bare minimum and going to cash and will add to the physical gold and silver. I have followed your advice and have about 25% of my stock money in the gold and silver markets and will probably increase that a bit as this thing goes on.

Keep up the great work, I scan the emails daily for your Critical Signals Reports. I consider it an absolutely critical resource!

- Robert Nelsonsays:

Yes, I own gold

- Eric Johnsonsays:

I have been watching this play out for several years learning from your analysis on the growing debt load and heading your recommendations. Over the last three years I have built up a significant amount of both physical gold and gold stocks. Thanks to your insights my portfolio is very happy right now and I am sleeping very soundly

Eric J

- D Jsays:

Gold miners

- Briansays:

Yes, I own gold and gold stocks.

- Ricksays:

yes, I own gold

- Peck Hayne says:

Yes I own a small amount of gold

- Alsays:

Don’t own gold currently

Sold it a few years ago

- Robsays:

Own gold stocks!

- Mark Malinskisays:

Yes I own gold

- Seansays:

Yes, I do own gold

- KEITH DEROUENsays:

Yes I own a small amount of gold

- Anthony J. Cohen says:

I control a gold exploration company with gold and niobium (a rare strategic metal) properties in Canada and Argentina. We have suffered with low equity prices for over a decade, but we think that our time is coming. Your argument about a coiled spring makes a lot of sense. Very well thought out.

- curtsays:

No I don’t own any gold or silver.

- Kaptain Kirksays:

Is this the one??? The last recession we don’t get out of? When sh*t hits the fan? Think about it and of course have gold, silver, food, and last and most importantly protection!!! You know those high powered assault rifles they wanna take with large capacity mags…. Pretty sure 75% of the men in this country that are reading this know exactly what I mean and are 50% prepared. Hopefully this will get all 100% prepared!!! Tighten your boots men and say a prayer. We may need to stand up for freedom, religion, and family! I wish all the best…!!!

- STEPHENsays:

GOLD BULLS ARE IN BIG NUMBERS NOW, ACCORDING TO EWI.

BE CAREFUL ON YOUR OPTIMISM

YOU MAY LOSE MONEY

STEPHEN

- Richard Robertosays:

Own gold and more silver …. and PM mining stocks of all types

- Larry Brungardtsays:

Yes, on gold, and silver.

- Chester Graves says:

yes – I own gold

- dswsays:

yes, own gold

- Gregsays:

I own GLD and GDX small percentage of portfolio

- Matt Lempa says:

No I don’t own any gold. I don’t trust all the hype

- Glenn Hsays:

I’m 20% in gold; 48% in cash.

- tom scott says:

Yes, I own gold….

Bought GDX on 6/1/19 & I am up 29.99%

Also bought IAU on 6/1/19 up 14.25%

Have own GLD for years & I am up 74.8%

Should have bought more GDX. May buy some more.

- Tomsays:

I own physical gold and silver and am invested in some gold stock of various kinds

- Paulsays:

Yes. I am definitely own gold to protect from calamity.

- Anthony Cogburnsays:

Yes I own gold and gold stocks and best of all gold royalty companies.

- Byron Smithsays:

I got into gold early, and most of my positions still are down. However, I don’t regret being overweighted in that sector. When markets have their worst days (and I still have a good representation in “the market”), my overall portfolio often does great. When it doesn’t do great, it does well, or at least OK. In other words, it’s working as I planned. I just executed it a few years too soon, so early on I tempered my overall gains with my gold losses. But when dealing with hubris, I generally bet against the puffed up heads. I underestimated how long they can keep their house of cards standing.

- Suesays:

Yes I own gold mining stocks as well as physical gold and silver.

- Cartersays:

Own gold and silver miners both.

- Tony Wright says:

Long gold, silver, and many different miners, developers and explorers of both.

- Jerry Misnersays:

I do not own lots of gold, but I do own lots of gold/silver streamers, miners, and companies who have gold in the ground (NG & SA).

- Dwane Woodburysays:

I do not own gold but I’m increasing my cash

- Mindy Heathsays:

Yes, we own gold. A combination of individual miners, royalty’s, ETFs, bullion (in a storage facility) and one mutual fund.

According to your storm tracker with regard to moving to cash. Are you talking just within your stock portfolio(s) in general or with all asset classes? Besides precious metals, where is the best place to put your cash—in the long run? Are TIPS or treasuries really that safe if our government defaults? Do you consider liquid, precious metals, cash?

Also, with a lot of (different) analysts warning of a recession, but in the same breath saying that it will be exponentially worse than the Great Recession—due to (at a minimum) government and corporate debt. What (in your opinion) are we really talking about? Depression? Certain sectors (including pensions) collapsing or across the board “prolonged” slow growth, etc? Massive layoffs at the federal, state, county, municipal and private sector levels? Entitlement benefits going away or heavily reduced? Would you elaborate a little more please?

What do you see happening after the market crashes? This will be the first recession that we will live through as a retiree. In our younger years we were always employed and always seemed to do okay during a recession or were able to (in time) make up any losses, but now we’re not so sure.

Also, wanted to say that we so appreciate your updates with these unprecedented times. Your guidelines are held in the highest regard. Thank you!

- Dean de Villierssays:

Yes I own gold and gold mining stocks

- Cynthia Owensays:

I don’t own gold.

- Alec Neavesays:

I am a technical trader speculator of 40 years in the precious metals markets.

The present environment is the most perfect since 1975 for Gold and Platinum/ Rhodium / Palladium.

No one pays any attention to South Africa but I alert you to Sibanye Stillwater SGL listed on the JSE and the NYSE. Biggest Gold / Platinum operator in the world. Parabolic upside to over $5 or more.

I am a private specialist but if you are interested I share all my research.

Alec Neave.

- Torsays:

Yes, I own gold.

- Paul B.says:

Yes I own physical gold and gold/silver shares along with soft commodities.

- GERRY MERRITTsays:

NO I DON’T OWN GOLD.

- Patrick Fintonsays:

No I do NOT own gold.

I have recently purchased silver.

- Leon Bersays:

I own gold

All of this money printing so far went into an inflated stock market, at negative interest rates and Quantitative easing why won’t inflation go further into the stock market. Why will the bond market collapse with higher interest rates if we go into recession, if we have massive money printing (QE) but demand slows down due to recession , all this money will now will go to money velocity, prices sky rocket and price inflation takes off but it will not go into the stock market this time. Its not clear to me, I hope you could write another article explaining these concepts

- Vito sabatellisays:

Yes I own gold.

- Wheatiesays:

I only have a little gold. I have mostly silver – some junk coins and some semi-collectable coins. And I have several mining stocks.

- Tim Gsays:

Yes, I have both physical and ETF gold and silver. I bought the ETFs as a result from reading your reports and am very thankful for it. Thanks for the extra money!!!

- Rod Belyea says:

no

- DWSsays:

No.

- Johnsays:

Yes I own gold.

- Bill Stevessays:

Yes I agree with you Matt! Thank you for your open and honest reporting. I continue to accumulate bullion and coins, both gold and silver. I do own the GDX. I frequently purchase long and short term options on AG and PAAS and others. And I own a few Crypto’s just in case. I actually bought BTC in April 2014 at $410. I am watching for the point where I can short bonds and stocks and buy inverse ETF’s. I appreciate your column very much.

Thank you

- E Myklebustsays:

Yes, I own gold..

- TOM says:

YES OWN SILVER & SOME GOLD AND TRADE THE GOLD STOCKS .THIS TIME THE CRASH THAT COMING AND IT IS COMING WILL CHANGE THE LANDSCAPE OF THIS COUNTRY FOR OUR LIFE TIME.BUY JUNK SILVER DIMES BEST FOR EASY BARTER OR TRADE.THIS IS A VERY GOOD SITE FOR VERY GOOD INFORMATION.I WOULD LIKE TO SHARE SOME GREAT SITES.ON YOUTUBE: SILVER REPORT UNCUT,JEREMIAH BABE,MONEY GPS,GREG MANNARINO,WALLSTREET FOR MAIN STREET,THE WOLF STREET REPORT.LIOR GANTZ AND BOB MARIARTY.EACH ONE ARE GREAT AND VERY SMART PEOPLE AND LEARN SOMETHING FROM EACH BECAUSE THIS TIME IT WILL BE VERY DIFFRENT.

- Tom Hartigansays:

Matt,

I own 100 American Buffalo 1 oz. pure gold (bullion) coins. I bought them back in June 2019 and placed them in a precious metals self-directed IRA. I paid $1,389 per coin. I will sell them when you tell me to!

I am looking to move the rest of my 401k money out of S&P index funds and into cash. The crash is coming. Love your column!!!

- Edouard D’Orangesays:

I don’t own gold coins, but I’m still holding my grandfather’s 100 yr old gold Phillippe Patek pocket watch. Did buy some silver coins, couple of hundred dollars worth, when silver was in the upper $13’s. Plus, have some junk silver. Gold would’ve been a nice investment in the last year, but price has run up a bit too fast lately. I expect a modest correction.

- Cherry Fritchsays:

Yes I own Gold. Thank you for your research.

- Tim Handsays:

Yes I own a gold and silver bullion etf (CEF), and gold and silver shares. I have reduced my exposure to gold shares as was anticipating a correction from golds highs, but a correction has not yet occurred. Will add to positions as feel gold and silver sre in a bull market and will hit previous highs

- Chris Strainsays:

I own physical gold and a lot of silver and I am loving the options market with SLV and AUY right now. Seriously, over 300% returns in one SLV Sept 19 call already!!

- NICK Psays:

I have lots of Numismatic Gold and Junk Silver.

Concerned about too much cash in the bank & government confiscation.

- Peter Pomialowskisays:

Yes I own gold since 2005. Also own 300 acres of mining claims.

- Tom says:

Yes, to owning gold and gold mining type co’s

- Nathan Deansays:

Hi Matt

YES I DO OWN GOLD AND SILVER. I BOUGHT SILVER AT 16 DOLLARS AN OUNCE, I THANK YOU FOR THAT. GOLD ALSO I AM LEVERAGED HEAVY IN MY 401 IN GOLD AND DOING QUITE WELL, I DO KEEP A CLOSE EYE ON WITH TRAIL STOPS. I BELIEVE YOU ARE DEAD ON ABOUT WHAT GOING ON. ITS EASY TO SEE ONCE YOU TAKE THE BLINDERS OFF. LOVE YOUR UPDATES, THANKS SO MUCH!

- Brian Abrahamssays:

Silver miner AG

Gold miner AUY

- Erv Robinsonsays:

Yes, I own some physical gold – and adding to my holding. You are doing a wonderful job with your Critical Signals! THANK YOU!!!

- Shelley H.says:

Yes! I am long the precious metals via shares in CEF, PHYS, PSLV, and a few mining and royalty companies! I’m also looking for a good entry point to increase my precious metals holdings.

Thanks for your awesome articles!

- Bensays:

I own no physical gold or silver but I am invested in IAU and SLV, about 10% of my portfolio. I am about 45% invested in cash. Retired and worried.

- Dansays:

No do not own gold. Some small amount of silver coins. Where do you recommend to purchase such items because there is a lot of places advertising gold/silver purchase.

- Richie Bearsays:

Yes – we own some of both.

Best way to own (based on my research) is buying CEF.

Matt, two quick questions, please :

1) What do you define as “cash” or “cash equivalent” in today’s crazy environment, and

2) When are the Critical Signals Storm Portfolio recommendations coming out – have I miss them?

RB

PS – I looked at my old college “Advanced Finance” textbook from 1982 and did not find a chapter, section, paragraph, or even a sentence on so the topic called “Negative Interest Rates”!

Why is that ?

- Norman Rosssays:

Thanks for explaining this so well. No Gold but a small pile of silver coins.

Time to get more.

- Joe De Los Santossays:

No I don’t own gold

- John Tyrrellsays:

Yes I own gold and gold miners and have recently bought some silver.

- RONNIEsays:

hi, I do own some gold: It is in my IRA . what are ADV. & DISADV of this ? PL. answer MATT or someone else. thanks for your education.

- Don Tapesays:

I own physical gold and silver, GDX and SLV, and a couple of major miners. See a lot of upside finally and plan to hold.

- Bryan Hardinsays:

I own little physical gold and no gold ETF. What I have is gold & silver royalty companies, miners, and CEFs that hold physical gold & silver.

- Torreey N. Webbsays:

I piled into gold about five years go and kept buying more.

I also bought silver and platinum.

These investments are up about $45,000 now.

I plan to buy more.

- William McDonaldsays:

Yes, I own gold.

- William Jewellsays:

Some gold lots of silver/

don’t sell or give away my email

- glenn beldensays:

Thank you for your research and e-mail letter.

Yes I own GOLD and SILVER. Also, GDX,GDXJ, SIL,SILJ.

- Hoeroa Robert Marumarusays:

I continue to observe your analysis with considerable appreciation.

I currently don’t own gold, but that investment position is pending direct change this month.

Thanks again Matt.

- jack kimura says:

Just like to mention how I appreciate your insight.

1 thought on “A Dangerous Yield Compression Waiting to Uncoil”

Comments are closed.