Below, we consider the amazing risk posed by passive Index ETF’s.

42 shares

This week, the Wall Street Journal came out with an article regarding the massive growth, as well as competition and consolidation, within the now $4 trillion passive Index ETF market, one that has grown by over 90% in the last five years.

That’s all very interesting, but the WSJ article conveniently left out the key risks hidden beneath this industry’s otherwise massive growth story in passive index ETF’s…

So today, let’s dig deeper and look at the opportunities as well as dangers lurking beneath the passive index ETF market growth…

The Best of Times, The Worst of Times

Exchange-traded funds (ETFs) remind me a lot of the first line of Dickens’s novel, A Tale of Two Cities: “It was the best of times, it was the worst of times…”

In other words, there are some things we adore and some things we hate about passive index ETFs.

Passive Index ETF’s can be the wind beneath market success or the anchor that can take securities, and your money, to the bottom of history…

A Friend in the Best of Times…

As for the “best of” characteristics of passive index ETFs, there are many, and over the years, we’ve made countless references to (as well as recommendations of) a wide swath of ETFs, as they have certain obvious qualities, namely:

(1) Certain ETFs act as proxies for over-all indexes like the S&P or the NASDAQ, and thus we can trade an entire Index, long or short, with a simple “click” when the signals tell us.

(2) ETFs can be great sources of risk and reward “diversifiers” for broad sectors, i.e. “baskets” of tech stocks (Investco QQQ Trust ETF – QQQ, $17 billion market cap) or commodity exposure in the energy sector (Energy Select Sector SPDR ETF – XLE, $11 billion), thus allowing investors instant exposure to a range of “like-minded” stocks within a single vehicle/trade.

(3) In addition to allowing investors to trade (and spread risk exposure) across “many marbles in one bag,” ETFs also give us easy, as well as inexpensive, access to specific assets like gold (SPDR Gold Shares ETF – GLD, $43 billion) and Silver (iShares Silver Trust ETF – SLV, $7 billion), all with minimal headache.

(4) As alluded above, ETFs also allow investors to bet against the market without having to go through all the complex administrative and counter-party borrowing maneuvers otherwise required to borrow stocks when entering into a short trade or option strategy (i.e. “put-buying”).

That is, by going “long” (i.e. buying) an inverse ETF, we can bet against a market, sector, or specific asset class (from oil and precious metals to the overall market itself) with one ETF purchase. Easy peasy.

We discussed the advantages inverse ETFs over short-selling or put option-buying here.

(5) By and large, passive index ETFs involve no active management, and thus, unlike mutual funds, are far less expensive and, in the right conditions, highly liquid, and thus easy to enter and exit.

The exception here would be actively managed ETFs that trade selected allocation strategies, but size in these is quite slim and illiquid.

Such qualities may explain why the ETF industry has grown so remarkably in the last decade, especially in the post-’08 market surge.

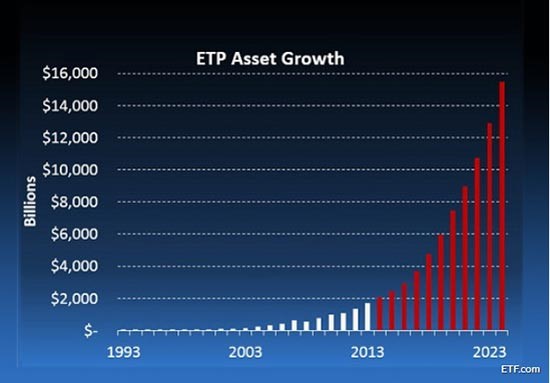

In 2008, for example, the ETF industry was valued at $800 billion. But as of today, that number has skyrocketed in size to $4 trillion, representing a 5X growth in just over a decade.

Indeed, exchange-traded products (ETPs) overall are projected by ETF.com to continue to grow exponentially in the years to come, raising assets to $15 trillion in 10 years, topping mutual funds!

And as the recent WSJ article revealed, all of this is being led by two big players in the passive index ETF space, namely Blackrock’s iShares and the Vanguard Group.

Together, Blackrock and Vanguard have quashed other competitors whose passive index ETF’s often have less than the minimal $50-$100 million asset size needed to ensure safer liquidity for investors.

In short, the big boys are winning the passive index ETF fight for subscribers, and thus more and more investors are piling into the same ETFs.

And that is precisely where the hidden danger lies in the passive index ETF universe.

Your Enemy in the Worst of Times…

Ironically, embedded in the very success of the most popular passive index ETF’s lies the kernels of their ultimate failure – as well as the ultimate failure in the overall markets and sectors they track.

In fact, the sheer size and passive nature of these bloated passive index ETF’s is why market legend Michael Burry (made infamous in the book/film The Big Short for predicting the mortgage catastrophe way ahead of Wall Street) now considers passive index ETF’s as the greatest threat to modern investors since the sub-prime crisis.

Why?

Because just as in the build-up to the 2008 market crisis, investors are passively herding into the same passive index ETF instruments today without paying any regard to the massive risks (i.e. overvaluation and illiquidity) embedded within the bubble hiding right beneath their noses.

The extreme growth of, and over-dependence upon, the most popular passive index ETF’s means that too many dollars are pouring into them from hedge funds, pension funds, retail investors, sovereign wealth funds, and other institutional players.

This “over-inflow” causes the index ETF’s to gain in valuation by the sheer volume of their passive inflows rather than the actual quality of the underlying assets within the index ETF’s themselves.

In other words, index ETF’s in general, and the stocks within them in particular, are rising on momentum (trade volume) rather than the fundamentals of their underlying balance sheets.

Or stated even more simply, many otherwise rotten boats are nevertheless rising on a rising tide of one-way-flowing dollars.

Take the popular tech FANGs for example – an acronym for Facebook Inc. (FB), Amazon.com Inc. (AMZN), Netflix Inc. (NFLX), and Alphabet Inc. (GOOGL).

To gain exposure, there are choices here, either investing conservatively in tech ETFs with considerable FANG exposure, or investing in more concentrated (but much smaller) leveraged ETFs like MicroSectors FANG+ Index 3X Leveraged ETN (FNGU, $125 million).

There are three flavors of leverage offered by MicroSectors ETFs (1x, 2x, and 3x), but the heard heads for the riskiest, 3x, exemplified by the greed mentality that is prevailing.

These tech and other index ETF’s have seen massive inflows over the years, inflows which partly explain why tech names otherwise showing no actual profits (think Amazon) can nevertheless be trading at equally massive 85X multiples of price to earnings.

The good, the bad, and the ugly are thus rising together within the tide of passive investor flows now pouring into the index ETF’s that hold them.

The same “rising tide effect” can take place in the broader market indexes like the SPY and QQQ mentioned above.

That is, massive inflows into these popular index ETF’s trickle down into the stocks which comprise these exchange-proxy ETFs, thus pushing all the S&P and NASDAQ stocks up together, despite the fact that many of those stocks are absolute lemons.

Index ETF’s are thus directly responsible for creating dangerous over-valuation (and hence price distortion) in the broadest markets as well as across the sector-specific corners of the market, like tech.

No One’s Looking

Of course, during the good times (such as the absolute abomination that is the current Fed-driven Twilight Zone of the post-’08 stimulus), no one – and I mean no one – wants to see these risks.

All investors see are markets rising, index ETF’s growing fatter, and hence the stocks within these ETFs hitting record highs.

Again, we saw the same willful ignorance during the rise of subprime mortgage-backed securities (MBS), which everyone was piling into before that market suddenly tanked.

In other words, now, as then, investors act like they don’t need to worry because the dollars just keep flowing into these vehicles, which are growing slowly but steadily, year after year, inflow after inflow.

But here’s the rub: When those inflows inevitably and eventually turn into outflows, the index ETFs, along with all the stocks piled up inside them, begin to fall in price rapidly and deeply, going down, way down, far faster than they grew.

That is what has us (and even Michael Burry…) so worried.

Why?

The Fall Is Faster Than the Rise

Because we know that markets fall faster than they rise, and that when assets grow too fat on momentum, popularity, and herd ignorance masquerading as collective confidence (as we saw with the subprime MBS bubble of 2008), the size, scope, and speed of the subsequent fall can be devastating.

As any who have lived through a market bubble knows, the bigger the bubble, the greater the subsequent fall.

Today, the size, scope, and speed of the much-heralded ETF rise thus poses an equally obvious (but largely unspoken) risk of an equally devastating fall.

This will be particularly devastating to the pension fund industry, which is way too top-heavy in its exposure to passive, broad-based index ETFs.

We discussed this ticking time bomb/disaster in the pension fund space here and here.

Balancing the Good with the Bad – How We Use Index ETF’s

Given these obvious “Big Short-like” risks, how and why do we recommend or use index ETF’s in our own trading and investing?

Well, the short answer is this: very carefully.

For all the “pro ETF” reasons initially raised, we do see their value and role in the markets, yet we are also painfully aware (and vigilant) of the “ETF cons” revealed above.

We balance this pro/con reality in various ways.

First, we carefully screen the daily trading volume, liquidity, investor flows in and out, and market action of every ETF we trade on an ETF-by-ETF basis.

Not every index ETF is the same. Even similar ETFs can track differently, which is why we track them all, live, in excel spreadsheets that highlight risk and differentiate the good from the bad.

Secondly, at the macro level, we watch for the larger signals, both technical and fundamental, which inform us as to the risks of a broader market sell-off nearing. And those I have reported upon.

Normally, in closing, I’d give you some ETF picks at this juncture, but here’s the rub: Equity ETFs that are greenlighted now in many respects – as in blend, growth, and value-oriented equity picks – are suffering capital outflows right now and they’re noticeable. That happens when markets are at a top. The setup has to be complete – no other way.

Bottom line…we know that when those sell-offs come and someone yells “fire!” – the exit doors in most of these now “favored ETFs” will be the size of a mouse hole.

In other words – investors and markets will burn.

Take heed and be safe out there. We’re here to help.

Sincerely,

Matt Piepenburg

Comments

7 responses to “What the Wall Street Journal Isn’t Telling You about ETFs”

- Patrick D. Achensays:

My wife and I have never been in a ETF, should we be in them?

- Dave Woodsays:

What do you recommend? Actual mutual funds?

- Jeffre Hagyardsays:

So where does one go for protection? Cash? Inverse ETF? Options?

- Z.says:

Give us the ETFs symbols when the time is right !!!

- Terry says:

Just read one of the pundits saying gold is going to rise but then fall to 700 dollars. The only safe move is the U S dollar.

- Gilbert Holguinsays:

So as a small investor ( who has lived through that infamous 08 bubble) which ETF’s would you lean towards? Are penny stocks something to experiment with even on a small scale?

- Robert Tompkinssays:

Thanks for this very interesting article on a subject I have never seen discussed before. From what you say the 1/2% of my wealth that I have in a gold ETF will be fairly safe and not one of the ETF’s that is in danger of a rapid fall.