44 shares. Here we look bluntly at the unemployment lie that has been in play in US markets.

The political scholar, sociologist, and public intellectual DaShanne Stokes once quipped that, “When you’re dealing with frauds and liars, listen more to what they don’t say than what they do.”

What Washington and Wall Street have been saying about the U.S. unemployment rate is a classic – and I mean classic – lie by omission.

Okay, I know we are all getting pretty tired of the daily barrage of claiming everything is a lie, or “fake news,” or “fake this,” or “fake that.”

I am too.

I’m just as tired as you are of having to question and second-guess the 24/7 barrage of drivel and opinion-spinning that pours down upon us from the left, the right, the bulls, the bears, and just plain “BS-ers” of every stripe.

But as another public figure, the late Senator Daniel Moynihan, also observed, “Everyone is entitled to his own opinion, but not his own facts.”

And as a founder of Signals Matter, I am singularly committed to offering precisely that: facts, not rants or opinions.

Why?

Because our topic is markets and your money.

Money, of course, matters. It affects every area of our lives.

As such, we need to work with facts.

The Lighthouse of Truth in a Fog of Lies

As someone who has spent 20-plus years navigating the waves, estuaries, swamps, storms, and even calm sunrises of three major market cycles, I’ve seen endless market spins disguised as truth.

As a hedge fund manager and family office executive responsible for investing billions of dollars around the world, it was my job to analyze numbers rather than listen to salesmen or prompt-readers.

I’ve seen and known many.

I’ve gotten pretty good at sifting through the “fog of lies” and bluntly going straight to the clear lighthouse of facts.

These facts have often astounded me.

They reveal a massive disconnect between what is reported and what is real.

Knowing the difference has helped me preserve, and make, lots of money.

And sadly, there is a lot of spin disguised as truth right now, especially as market fundamentals become increasingly distorted.

Fortunately, there are lots of opportunities for informed investors to reap the benefits of not following the wrong herd or message.

As my free reports “The GDP & Inflation Lie” as well as “The Profits & Earnings Lie” make mathematically clear we’ve been lied to for years about these otherwise extremely important economic and market indicators.

The dangerous implications of (and motives behind) such distorted indicators and data measurements cannot be overstated.

Markets Led by False Calms and False Facts

These distorted facts (from the employment lie to earnings distortions) have been used by D.C., Wall Street, and the increasingly discredited mainstream media to create an exceptionally false sense of calm in our broader economy and specific markets.

After all, markets rise on good news, not bad news.

The financial world therefore has a vested (and naturally conflicted) interest in seducing you with good news and then collecting your dollars, fees, and trust under the near perpetual mantra that “all is rosy.”

Bad news, alas, is bad for business.

This is why one European finance minister recently admitted that “when the data is bad, we just lie.”

Sadly, the “lies” just don’t end when it comes to such otherwise significant matters as inflation, GDP, profits, or earnings.

Perhaps the biggest lie of all – the one we constantly hear whenever the stock market gyrates down or seems too dangerously high – is that the U.S. economy is booming, as our record-low U3 unemployment numbers confirm.

Unemployment Lie and Data – the Biggest Lie of All

But here’s the rub, folks: That unemployment headline is an absolute and complete myth.

Hard to believe?

Yep.

But that’s why we need to look at facts.

Once we do, you’ll see exactly how you’ve been lied to for years.

It will likely even piss you off. And it should.

Okay, so let’s stick to facts rather than rants.

In other words: Let’s just do the math.

The Lies by Omission behind the U3 Unemployment Lie Trick

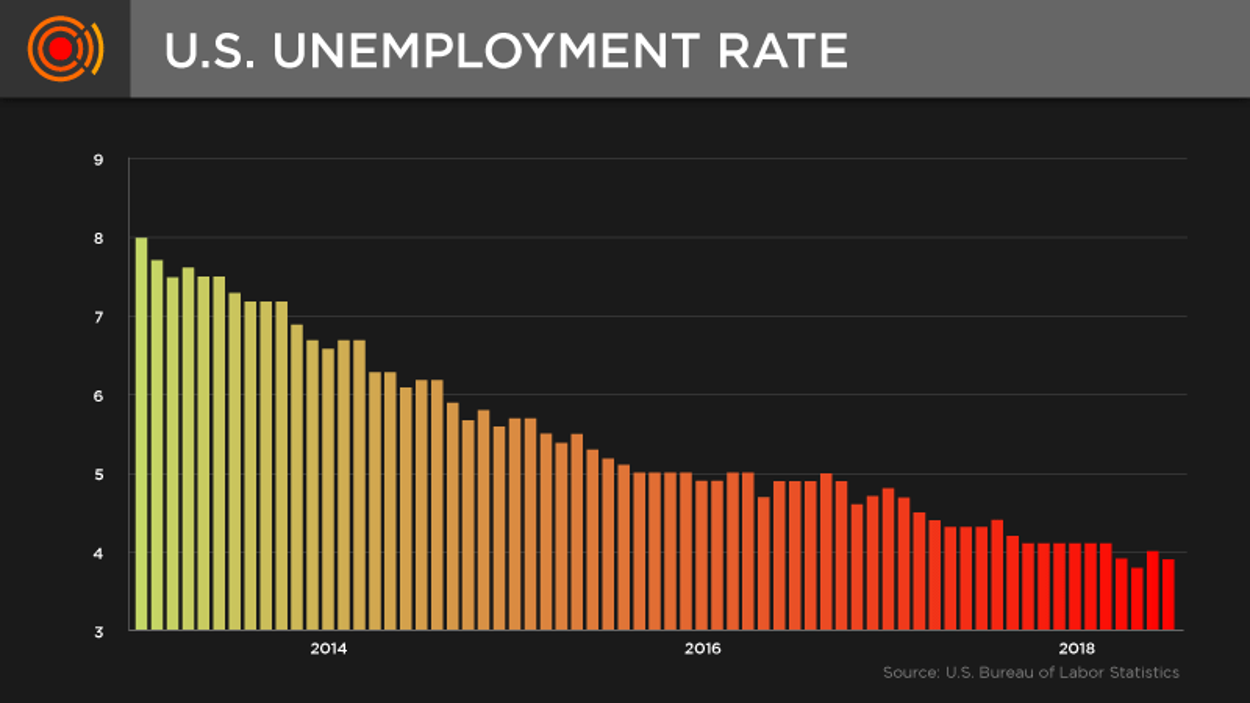

As of today, the headlines are filled with the most recent U3 unemployment news, which places U.S. unemployment at an incredibly low level of just 3.8%.

This is the fantastic rate that allegedly justifies what we are constantly told amounts to “full employment.”

And the “data” looks pretty impressive indeed…

Wall Street just loves to push this “full employment data” at us, especially when we naturally start to worry about flattening yield curves, a back-stepping Fed, a market that lost double-digit gains in just one infamous December, or the fact that more and more adults are living with (or off) their parents…

In short, as genuine concern naturally rises, the unnatural lies from D.C. and Wall Street immediately increases in a manner that is nothing short of propaganda rather than facts.

Looking Deeper under the Hood at U3 and U6 Unemployment Rates

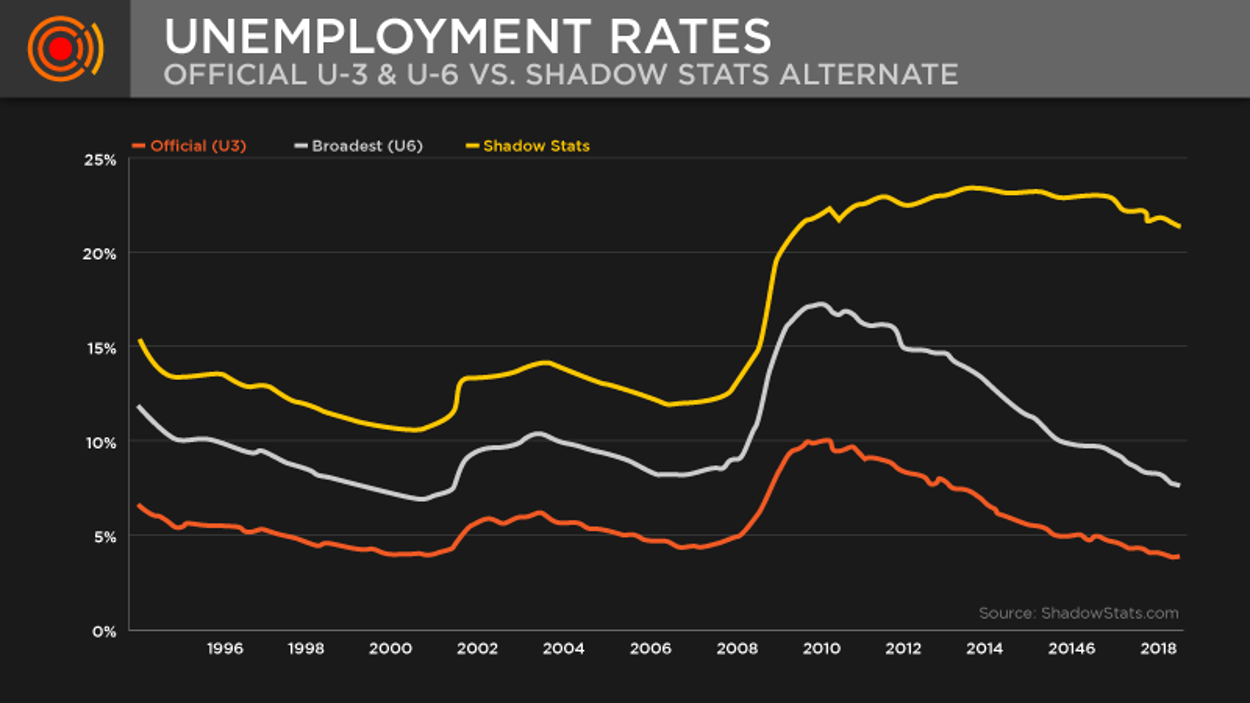

So just what is the U3 unemployment number?

According to the Bureau of Labor Statistics in Washington (i.e. “The BLS,” otherwise shortened herein as the “The BS Department”), the U3 rate represents, “the total unemployed, as a percent of the civilian labor force.”

But if we dig just a few inches deeper, we soon discover that this BS report is as bogus as a 42nd Street Rolex.

But first, let me also remind you that the same BS report also includes a second unemployment measure otherwise known as the “U6” unemployment rate.

This U6 rate never makes the headlines yet today shows an unemployment rate that is much higher – at 7.3%.

But it, too, is pure fiction.

The BS Department defines the U6 rate as “the total unemployed, plus all persons marginally attached to the labor force, plus total employed part-time for economic reasons, as a percent of the civilian labor force plus all persons marginally attached to the labor force.”

In simpler English, the U6 rate essentially looks at the rate of unemployment for part-time jobs.

Thus, even the BS Department in D.C. will admit that the unemployment rate in the U.S. isn’t really the headlined 3.8 %, but rather the broader U6 rate of 7.3%.

Why the U3 and U6 Rates Don’t Matter Anyway

But again, even the larger U6 figure offered by the BS Department in D.C. isn’t even close to the actual number of unemployed Americans.

Let me explain why.

First, when the Fed, the media, and the BS Department announce the monthly “job creation” data behind these percentages, they leave out a few facts.

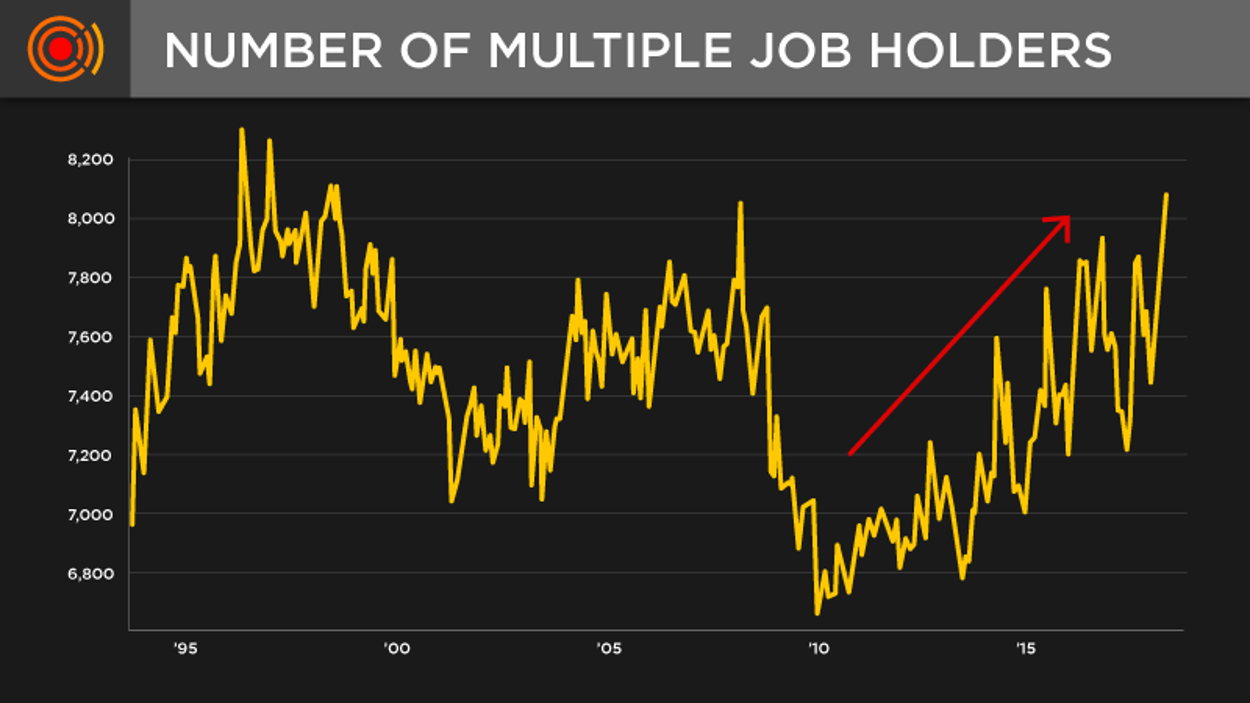

Namely, when considering those Americans “marginally attached to the labor force” – i.e. the part-time burger-flipping jobs or other “government temp jobs” that D.C. itself creates – we see that the BS Department numbers are not increasing at all.

Instead, the figures actually refer to the same single persons juggling two or three or more simultaneous jobs at a time, not two or three more people getting new jobs.

Thus, the new “job creation” does not mean more folks getting jobs.

It just means that those folks who are already “employed” are now juggling more than one job to survive.

This is hardly a booming sign for Main Street employment.

In fact, things are so bad in this labor force that the number of “employed” folks juggling more than one job is now skyrocketing.

It Gets Worse…

But folks, the facts get even worse if you take a little more time to look under the hood.

You see, when the BS Department headlines U3 (or even U6) unemployment rates as a percentage of the “civilian labor force,” they do a clever job of not fully disclosing the real nature of that “civilian labor force.”

In fact, not included in the “civilian labor force” from which the BS Department takes its unemployment percentages are the tens of millions of Americans who have simply stopped looking for jobs.

Please re-read that.

What it effectively boils down to is that Washington’s method of measuring unemployed Americans is akin to measuring the number of people under six feet tall, but using the NBA as its sample pool.

The percentages are “factually” low but dishonestly gathered…

That is, if you leave out everyone else not in the NBA, the percentage of “short people” looks a lot smaller than the broader pool of reality.

This trick of omitting larger, unpleasant data from the “reported” data is equally used by the BS Department when measuring inflation, as we’ve seen in a separate report – “The GDP and Inflation Lie.”

Once uncovered, such tactics (tricks) are both shameless and infuriating.

Unfortunately, it’s also the truth of how you’ve been lied to.

Thus, if you want to know the real percentage of unemployed Americans, you have to actually consider the real number of Americans seeking work, not just the ones the BS Department carefully selects.

If you do so, the real percentage of unemployed Americans (closer to 25%) gets a lot higher and looks more like this…

But the Facts Get Even Worse – the Overlooked Poor

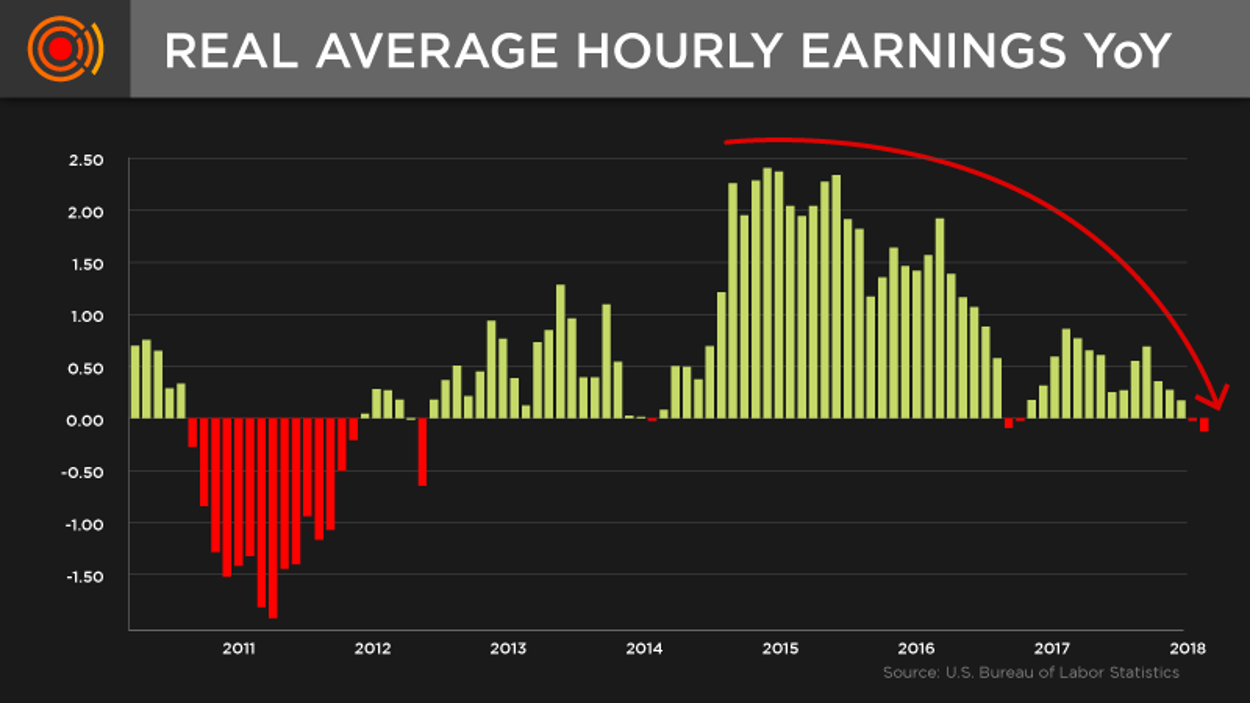

Even if you look at those Americans who are legitimately employed, we discover that the vast majority of them are barely scraping by.

Don’t want to believe the unemployment lie?

Well, let’s look at a few more “data points” overlooked by D.C. and Wall Street.

In fact, the U.S. Census Bureau seems to be a bit more forthcoming (i.e. honest) than the Bureau of Labor Statistics.

As the Census data recently confirmed, one in three Americans earns income that is less than 50% above the poverty line.

This means that 100 million Americans are either living in poverty or are just a paycheck or two above it.

This honest figure of the “overlooked” or “near poor” (confirmed as well by The New York Times) represents a figure that is 75% higher than the official account published by the BS Department that has been giving us so-called “Full Employment” data for years.

Please re-read that, too.

I mean, how can Wall Street and D.C. be giving us unemployment “good news” that represents a 75% margin of error over the U.S. Census Bureau?

More Simply: Just Look around You – the Real America Is Suffering

But even such undeniable lies of D.C. math aren’t as obvious as what our own two eyes tell us.

Heck, even if you live in a chateau, Madison Avenue penthouse, or Palm Beach yacht, just take a walk 50 miles in any direction and open your eyes.

If you do, you’ll see the real America, one in which a recent GOBankingRates survey confirmed that 80% of employed Americans are living paycheck to paycheck.

Today, 60% of our fellow citizens can’t afford to put $1,000 into a savings account; seven million of them are defaulting on car loans; there’s $164 billion in defaulting student debt for Q1 2019; and with 480 million credit cards now in circulation, the majority of Americans are using MasterCard to pay VISA to get through each month.

Meanwhile, those same Americans are seeing stock markets soar on Fed “stimulus” as their average earnings are tanking.

Still convinced our fully employed, Main Street consumers are thriving?

Well, keep walking around, for if you do, you’ll see stores closing at every strip mall.

And don’t blame all this on the success of Amazon.com, a company that makes no profits and pays hardly any taxes.

The simple fact is that consumer income and strength are tanking.

Businesses, alas, are tanking with our fully employed Main Street, as this list of bankruptcy filings confirms.

Do you see some familiar names?

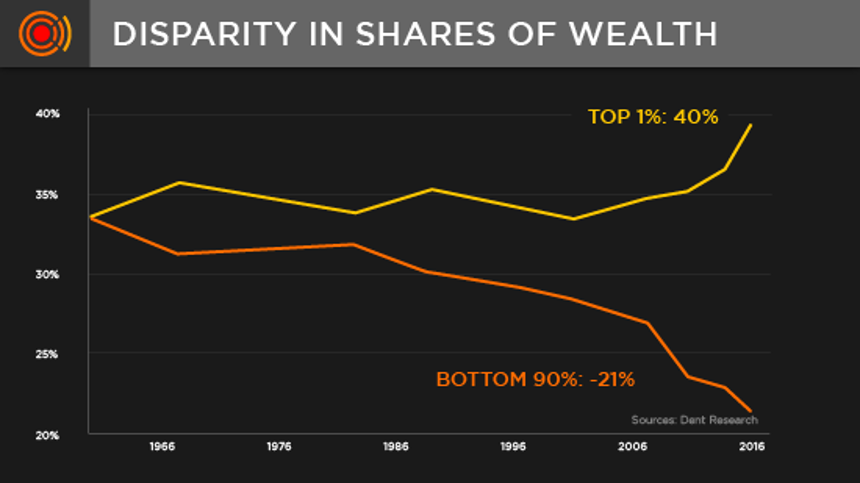

Sadly, as Main Street melts away, the fancy lads I represent on Wall Street are making a killing in a totally Fed-rigged, Wall Street-focused, and debt-driven market bubble, which explains this oft-repeated graph that ought to be a national embarrassment to all Americans, rich or poor, red or blue…

Turning from the street to the farm belt, the data there is just as alarming, as “Big Ag” multi-national conglomerates consolidate U.S. agricultural lands, pushing our farmers into loan delinquencies, the levels of which are now the highest in nine years.

Summing It up – Sifting through the Fog of Lies

So, folks… there you have it: math and facts.

The U3 unemployment data touted almost daily by the financial media, the D.C. politicos, and the Wall Street spin-sellers is simply and empirically NOT TRUE.

The BS Department has deliberately fudged the numbers by ignoring tens of millions of out-of-work Americans from its civilian labor sample.

Furthermore, the data on earnings, multiple-job juggling, poverty rates, loan defaults, credit-card juggling, savings data, wealth disparity, retail bankruptcies, and even farm-belt health are right in front of you.

Again – verify it for yourselves.

So, the next time you hear another bubble head, prompt-reader, financial expert, or advisor tell you the economy is strong because we are at full employment, I hope you’ll not be fooled anymore.

Enough is enough.

Now you have the facts.

Facts are liberating. And in the case of the unemployment lie, they are also infuriating.

That’s why we need to plan our futures and portfolios around reality, not lies.

As this report, as well the free reports The GDP & Inflation Lie and The Profits & Earnings Lie bluntly confirm, we are walking/investing in a minefield of myths.

In the interim, be smart; be patient; and be careful out there.

Thanks for your revealing report. It was a sober multidimensional look at the depression we are in. Another group that might be helpful looking at are, the tremendous amount of people living on welfare; that is borrowed (leveraged debt) from the cabal of Central Banking Moguls like the Rothschilds, who cornered the Bank of London in 1825, but also hijacked the U.S Treasury, with the Federal Reserve Act of 1913. They are essentially a band of Jewish paperhangers who invented “fractional reserve banking” and compound interest. The actual debt our nation owes these organized criminals is estimated to be over 200 trillion USDs! The amount admitted to is over 30 trillion, which doesn’t even service the interest we pay out, let alone the principle amount.

We are in far worse trouble than the crash and depression of 1929. We owed very little to the criminal bankers in that year.

QE began earnestly in 2008. If we had reversed course back then, it would have been tough. But our selected leaders, who represent these criminals, decided to “kick the can” all the way to insolvency. Now we will be offered CBDC or Fed Coin. The Federal Reserve Bank will not only decide how you spend your “digital fiat currency” but also how much of it you will have to spend. “The Fed will become your buyer and lender of last resort.”

I credit Mr. Greg Mannarino of Trader’s Choice.net. for that ingenious piece of terminology.