Below we look at how capitalism ends and provide the data to prove it.

81shares

As facts change, opinions change.

For the near entirety of 2018, I had warned my clients and subscribers of a mathematically inevitable spike in 10-year Treasury Yields, and hence a similar surge in U.S. interest rates.

This “yield shock,” I warned, would usher a major market drawdown beginning in October and spreading into Christmas and beyond, which is precisely what happened.

We saw markets fall by 10% in October. Following some recovery in November, by New Year’s Eve, while watching fireworks in southern France, I also watched markets in the U.S. melt down with equal fanfare by 15% over just three weeks in December.

How did I know this?

Simple: At $73 trillion, our massive and historically unprecedented debt bubble was about to be “pricked” by the worst thing that can ever happen to a credit bubble – namely, rising interest rates, which were as easy to see coming as a cavity is to a dentist.

Why so easy?

Equally simple: The Fed is the market, so just track its moves. This, moreover, partly explains how capitalism ends.

Since Alan Greenspan sold out classical capitalism in 1987, all of us hedge fund and Wall Street insiders have shared an unspoken yet now undeniable “secret” – that markets are driven by Fed action, not by supply and demand.

The Fed, moreover, has been Wall Street’s mistress ever since Mr. Greenspan’s era. Folks, Greenspan was no Paul Volker.

For over 30 years since Greenspan came to the Fed, we (and the 1% we serve) have been the sole beneficiaries of easy money and artificially suppressed rates which have allowed us a carry-trade nirvana – namely, zero cost to lever lopsided profits for decades.

It was as easy as it was rigged/juiced. Pure market cocaine. This too, partially explains how capitalism ends.

Wall Street saw record profits, record bonuses, and record decadence, while Main Street, supported by 480 million in credit cards in circulation, plus record welfare assistance and equally record-breaking declining growth, tumbled.

After the 2008 crisis (handed to you entirely by Wall Street’s too-big-to-fail banks) and the Fed’s subsequent Troubled Asset Relief Program (TARP) plus QE 1-3 bailouts, this ease and juiced distortion of “free markets” went too far for too long.

Markets and bonuses for the financier class skyrocketed while America barely got by with a GDP that annualized at 1.7%. It was, and continues to be: sickening.

However, when Jerome Powell took over from Yellen at the Eccles Building, Wall Street paused for a second.

Was the free lunch about to end? After all, the Powell Fed raised rates eight times in two years.

Furthermore, in 2017, the Fed announced it would begin a hawkish shift toward reducing its balance sheet (aka “Quantitative Tightening”) , a balance sheet which had grown by five times since 2008 to bail out Wall Street under Quantitative Easing.

That is, the Fed announced (“forward guided”) as early as 2017 that it would begin dumping rather than accumulating U.S. Treasuries to the tune of $600 billion a year, beginning in October of 2018.

This new hawkish pivot to Quantitative Tightening (QT) sent more bonds into the market, which, coupled with the Treasury Department’s annual $1.2 trillion annual bond issuances to keep America running on “IOUs,” shot a massive $1.8 trillion supply of bonds into the market, which meant a decline in bond pricing and thus a rise in yields and rates.

The rest, of course, is history. The tightening Fed began taking away the Wall Street punch bowl in October, and in lockstep fashion, a spoiled-rotten Wall Street had its classic hissy fit. Again, easy to foresee.

For a brief moment, I wondered if the new Fed sheriff in town actually had an ounce of courage. Was he no longer going to serve his banking masters in Manhattan?

Had a miracle occurred? Had someone at the post-Greenspan Fed finally acquired the backbone of a Bill Martin or Paul Volker and decided to take away the punch bowl of cheap debt, low rates, and fat balance sheets?

Of course not.

The moment its spoiled nephews in Wall Street (and short-sighted politicians in D.C.) had a screaming tantrum, its rich Uncle Fed folded like a chair.

As of March 2019, “Powell had thrown in the towel.” In other words, the Fed was back in Wall Street’s pocket. Tightening stalled, and low rates were resumed.

Net result: The VIX fell and the markets re-surged. In short, more debt + more market cocaine = less classical capitalism. 2019 moved forward with a massive Fed tailwind. This also helps point to how capitalism ends…

Why?

Needless to say, Powell won’t confess the truth – which is that he’s more worried about rigged free markets than the protecting the real economy.

In his March announcement of the decision to not follow through with further tightening and rate hikes, he alluded to “sudden” weak consumer strength and slowing economic growth as the reason for his pivot.

But folks, that’s just, well… B.S. As my recent report on financial reality confirms, consumer strength and economic growth had already been tanking for over a decade.

What made Powell pivot wasn’t a concern for Main Street – it was the market dive of 20% from early October to late December that motivated our “independent” Fed, a body that is regulated almost exclusively by Wall Street bankers rather than the free market values of Adam Smith.

The fox, alas, guards the henhouse. The bankers’ primary concern is more debt-driven market growth, not sound attention to an economy wherein 60% of Americans can’t put $1,000 into their savings account.

Looking Forward

So, what does this mean for the future of your portfolio and the markets?

Well, the yield shock I warned against in 2018 is temporarily over, thanks to Powell. Now, yields and rates are going to fall, not rise.

Wall Street is cheering, but their cheers are a bit nervous, for the hypocrisy of the Fed has revealed the dilemma it now faces: either a rate-driven market crash or a recession-driven market crash?

In March, the Fed basically confessed (after years of saying the precise opposite) that the U.S. economy is weak and that growth is worrisome.

With short-term rates rising and long-term rates falling, the yield curve is now flattening, even inverting, and yield curve inversions have occurred just before each of the last seven recessions.

In short, the two-faced Fed has halted rising yields and calmed the “tightening” storm, thus averting a rate-driven catastrophe, but in doing so, it has all but confessed that a recession is inevitable in the next 2 year.

In short; If rates don’t kill this market, an undeniable, low-growth recession on Main Street will.

But how soon? We have a looming recession on one hand, and a now dovish, low-rate, pro-Wall Street Fed on the other hand. Who will win out, the bears or the bulls?

In the near term, Wall Street will use low rates to continue gaming earnings season with more debt, and likely, more stock buybacks – the same game plan we’ve seen played for over a decade. This is temporarily bullish, which means 2019 looks like it will break new highs.

Still, the bond market is the real indicator, as I’ve said many times.

The yield curve is pointing to slow growth ahead, as the yield on the 10-Year is now tanking, not spiking. 50% of U.S. corporate bonds are BBB rated, which means just one notch above “junk” status. 30% of those bonds are tied to energy names, so rising oil prices, if they continue, might buy these weak companies time.

Nevertheless, slow growth means either a swath of defaulting “fallen angels” in these over-indebted companies, or, at the very least, dramatic cutbacks in spending, hiring, and expansion.

This becomes a vicious circle which prompts further declines in earnings and stocks. This too is bearish into 2020.

On a purely technical level, the markets are showing a classic “head and shoulders” pattern, which portends pain not pleasure. That’s bearish heading into the near-term—i.e. this summer and fall.

Indeed, after over a decade of completely unnatural, Fed-supported market cocaine, these markets are poised for pain—not a recession, but pain, likely in the fall.

Yet I am reminded that markets can stay stupid longer if the Fed stays stupid with it.

1998 comes immediately to mind. I was a young, overpaid hedge fund greenhorn during that tech boom, and in 1998, it seemed clear to all of us in Silicon Valley that the party was over. The market had already tanked in 1998 by 20%. We thought of shorting it!

But then the Fed came in and slashed rates and kept the party going for another two years in what was otherwise a late-cycle bubble, much like today.

Could we see another final resurgence à la 1998 in 2019? That is, much like the sinking Titanic, could we see the stern rise, temporarily suspended, before it eventually sinks to the ocean floor?

In short, will the markets rock and roll, or just roll over?

Sadly, anything is possible as the Fed, rather than natural price discovery, now controls our stock and bond markets. It is, again, sickening. That said, it’s likely we’ll see a repeat of 1998 and thus a bullish overall 2019.

What Should Investors Do?

The simple fact is that a recession is out there, looming like an iceberg off our bow. Now, even our Fed can’t deny this, regardless of which side of the mouth they speak from.

Such bad news, however, is ironically good news, as it portends more Fed “intervention,” and hence more steroids for the 2019 market.

But mark my words: When the markets do tank, they will unleash massive measures of “whatever it takes” money printing, currency devaluations, and zero-to-negative interest rate policies to try and save what is now an unsalvageable market driven by more debt than can ever be repaid. That too, is how capitalism ends.

Again, mark my words: The Fed is and will continue to be a desperate slave to its Wall Street master, which means expect lower rates and more QE by late 2019 or early 2020.

A Pattern of Fed Support for Wall Street

Time after time after time, the post-Greenspan Fed lowered rates whenever Wall Street sniffled.

In the 1990s, they took rates from 9% to 3%; after the dot-com bubble popped in 2003, they then lowered rates from 6% to 1%; and, after the subprime bubble popped in 2008, they lowered rates from 5% to zero.

See the pattern?

But now we are at an already low rate of 2.5%. When this latest and largest “everything bubble” pops (as all low-rate, debt-driven bubbles do), the Fed can’t reduce rates by much, without having to go into negative rates, which as we’ve seen in Scandinavia and the EU, is a policy that simply does not work…

(By the way, do you feel like paying a bank to hold your money? Because that’s what “negative rates” means.)

In the past, the Fed needed to reduce rates by at least 500 basis points (5%) to make any noticeable impact on a dying market.

At 2.5% rates today, the Fed has defeated itself, for it simply doesn’t have rates high enough to reduce in the next crisis/recession. Its primary tool is now effectively impotent, unless you believe recessions have been outlawed?

In short, an inverted yield curve in the backdrop of already low rates is as dangerous as it is unprecedented. Be warned.

So, again: What can you do now? With an obvious recession looming yet for now postponed, you don’t even have to time it right to be smarter than almost everyone else still in the dark about Fed and bond market reality.

In the next 12 to 24 months, the U.S. will be in a recession.

As I’ve said in my recent report on real financial advice, this means you need to take some chips off the table now, even if we see massive market (i.e. Fed) tailwinds in 2019.

For the amounts that remain in the market, stick to income-producing, blue-chip dividend equities, long-dated, government bonds (which go up as yields go down), and add some carefully selected liquid alternative investments.

Given the renewed money printing to come in the next storm, you’ll also want to allocate to hard assets, i.e. key commodities like precious metals (gold and silver).

Mostly, you’ll simply want to get out the way of this inevitable and now recession-driven (rather than yield-shock-driven) market plunge. Remember, Noah built his ark before the rain.

Thanks to 10-plus years of Wall Street bailouts and Main Street assassination, the U.S. is now standing in the shadows of unprecedented debt and equally unprecedented wealth disparity in which three individuals have more wealth than all the combined assets of half of the U.S. population. This is another indicator of how capitalism ends.

Such disparity is appalling and explains the rising Main Street populism which looks to extreme left and right solutions to politically solve a financial problem which is beyond politics.

Instead, the real problem lies with a financial elite and its entirely broken banking system, which demands a clear, blunt insider’s explanation.

In short, I know this because I come from this.

An Insider’s Secret as to How We Got Here

The point made above, and worth repeating here, is that it is an unspoken secret among the wealthy that a small elite cadre of bankers, in conjunction with the U.S. Federal Reserve, have effectively hijacked free-market, classical capitalism, and replaced it with corporate, neoclassical capitalism which is nothing more than financial socialism.

In fact, today the United States, given all the bailing out of Wall Street and its banks, is the most socialist country in the world.

Huh? Yep.

Anyone who read Upton Sinclair’s The Jungle in high school probably never looks at a hot dog in the same way. After all, once one learns how the sausage is made, it often leads to vegetarianism…

Well, as one who has worked since 1997 with (and in) the law firms, banks, and later hedge funds that serve the current banking system, I’ve learned first-hand how money is made, and frankly, it has made me a bit sick.

And by the way, it has nothing to do with capitalism. Capitalism left the building years ago.

2008 Says It All

If you need an obvious example, just consider the epochal shift that occurred in 2008.

What happened then was simply reprehensible: American taxpayers bailed out the very banks that had just fleeced them.

Thereafter, the banks made huge profits and paid themselves record-breaking bonuses while Main Street tanked.

How so? By controlling the cognitive map – i.e. your thinking processes. They do this by simply burying disclosure and omitting otherwise obvious facts and truths from the public discussion. This is yet another indicator of how real capitalism ends.

But we on the inside know how the sausage is really made. Once you understand this as well, the knowledge is liberating. It opens your eyes. Investing will never be the same.

So, let me open your eyes.

The U.S.: Not at All What We Used to Be

After World War II, the U.S. was the world’s largest creditor and manufacturer. We were responsible for 50% of global GDP. Our middle class was thriving.

Today, we are the world’s largest debtor, our GDP can’t even break an annualized rate of 2%, and our middle class has all but vanished, with over 50% of working-class families just $1,000 above the poverty level.

What the hell happened?

The Age of Decadence

In 1965, an otherwise unknown British Lieutenant-General, Sir John Bagot Glubb, wrote a groundbreaking study on the decline of empires.

He showed how empires from Rome, to Spain, to England, typically last no more than 10 generations or 250 years.

During these periods, great empires go through an astonishingly similar series of phases, which include the pioneering phase, the commerce phase, the intellect phase, then the “bread and circus” phase (from the Roman gladiators to ESPN or reality TV), and finally, the phase of decadence.

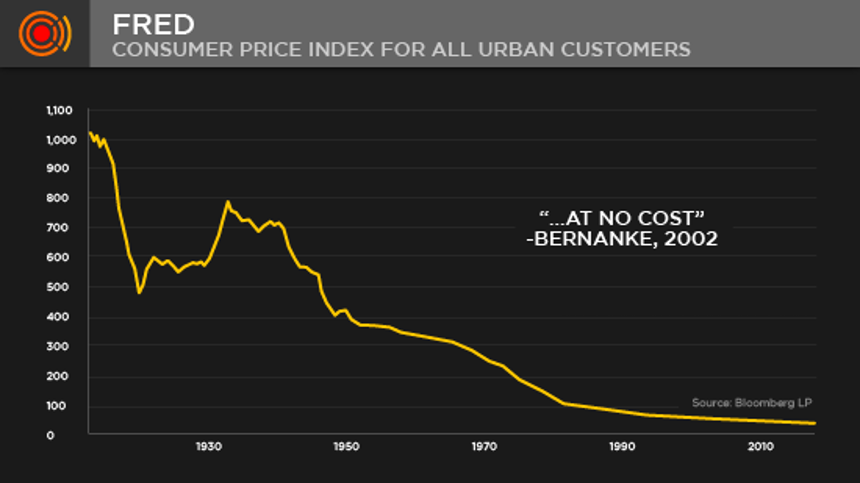

This decadence period is marked by key features repeated throughout history, namely: an overextended military, conspicuous displays of wealth, grotesque disparities between the rich and poor, an obsession with sex, and finally, a debasement of the currency.

Sound familiar?

Today, the U.S. is over $6 trillion in the hole for its “everything war” in the Middle East and Afghanistan; sickening displays of wealth from suburbia McMansions and the Kardashian “bread and circus” shows to the lifestyles of the Hamptons are ubiquitous; the gap between the uber-rich and the poor in the U.S. has never been greater; at $97 billion in net worth, the U.S. porn industry makes enough money in a day to feed five billion people; and having left the gold standard in 1971 and quintupled the money supply since 2008, the purchasing power of the USD has nosedived.

In short, we live in a classic age of decadence. One defined by Sir Glubb as an era in which a “fat generation,” driven by greed and trending, almost unconscious immorality, thinks only of itself at the expense of the next generation – i.e. our children and grandchildren.

According to Glubb’s research, such decadence effectively becomes a systemic problem.

Nowhere is this truer today than in the current banking system. And as one who knows this system well, let me tell you how it really works. I hope you’re sitting down…

The Real Banking System

Henry Ford once said that if everyone knew how banks operated, there would be a revolution. Toward that end, let me revolutionize your thinking…

In a nutshell, banks make money by creating it out of nothing and then lending it out at interest.

In legal terms, this is called counterfeiting or cooking the books. In the current age, it’s called fractional reserve banking, and it’s totally legal.

In the U.S., this legalized fraud began in earnest in 1971, when Nixon took us off the gold standard and our currency was thereafter supported by, well, nothing… (Voltaire described such fiat currency as follows: “All paper eventually returns to its intrinsic value, zero.”)

Banks at the private level use this created money (fractional reserve system) to force borrowers into a vicious circle of debt compounding in the private sector.

The central banks accomplish the same debt compounding at the government level via fancy names like “Quantitative Easing,” which is merely a euphemism for creating money out of nothing.

The net result, however, is always the same: Individuals and governments go into debt hell.

At the Federal level, for example, we now pay $5.50 of debt for every $1.00 of GDP gain. Read that again.

So how do bankers solve our debt problems?

Simple, not by creating more wealth, but by creating more debt. Sound crazy? It is. Using debt to solve a debt problem… That too is how capitalism ends.

Where Did Capitalism Go?

But is that capitalism? Nope. For three generations, capitalism and communism fought it out around the globe, and in 1989 capitalism “won” the battle as the wall came down in Berlin. Thereafter, Francis Fukuyama even wrote a seminal book, The End of History, celebrating the penultimate victory of free-market capitalism.

But with global debt at $250 trillion and the U.S. middle class now in the rubble of that same history, perhaps Fukuyama spoke too soon.

In fact, the kind of neoclassical capitalism in mode today didn’t “win” in 1989; instead, and as we’ll soon discover in the next mega recession, it was just the “second to lose.”

Now, don’t get me wrong. I’m a devout capitalist.

I believe in rewarding ideas that benefit entrepreneurs and society, and which make smart folks rich, from Steve Jobs to Steven Spielberg, from Henry Ford to Henry James.

But sadly, capitalism as we love it is no longer here. We have something far more sinister.

This began when the “neoclassical capitalism” handed to us from the “Chicago School” of Milton Friedman came in vogue in post-war America.

It encouraged debt, privatization, and the deregulation of corporations, banks, and institutions. In short, “corporate capitalism.”

This new brand of capitalism had the surface shine of appealing to our competitive instincts and aimed to convince us that hard-working individuals, smart bankers, businessmen, and other wealth creators know far more than governments and regulators about how to make money in the free, Darwinist, and unfettered open field of supply and demand.

Such ideas are appealing, and I favor free markets over top-heavy government over-regulation.

Unfortunately, we took this too far…

The Repeal of Glass-Steagall – Casinos Replace Capitalism

In this jubilant spirit, old ideas like the Glass-Steagall Act – the 1932 law which regulated banks and kept them from using depositor monies to speculate on Wall Street – were thrown in the trash bin.

Self-proclaimed geniuses like Larry Summers and Robert Rubin got Bill Clinton to repeal Glass-Steagall in 1999.

Good times ahead, right?

Nope.

In the wake of the repeal of Glass-Steagall, our banks went on a spending spree of unfettered gambling with your money. That further explians how capitalism ends, because its not about free market investing, but fraudulent speculation masquerading as banking.

Between 1999 and 2008, the six too-big-to-fail banks (Goldman, Citi, Morgan, etc.) amassed more debt in one decade than the GDP of many countries.

During the run-up to 2008, Goldman Sachs (via traders like Michael Swenson, Josh Birnbaum, and Dan Sparks) was peddling sub-prime securities to the masses while simultaneously betting against those securities to the tune of billions in Goldman profits insured by AIG’s credit default swaps.

Unfortunately, when the crap hit the fan in 2008, AIG was broke – in debt up to its ears.

But no worries, our insider Treasury Secretary, Hank Paulson, a former Goldman CIO, got you to fork out $700 billion to bail out AIG, and thus, indirectly, Goldman as well.

By 2009, bonuses at Goldman were at record highs.

During that same surreal period in American “capitalism,” banks like Wells Fargo were given the green light by “regulators” and blocked state prosecutors to engage in predatory lending whereby they deliberately targeted minorities in once-vibrant cities like Baltimore with loans they could never afford, thus crushing inner-city growth thereafter.

This was not racism; it was just profit-seeking.

Neither was it supply and demand, free-market Darwinism, or natural markets. Instead, and as all of us who made money in Wall Street know, it was a rigged game, pure and simple. Such rigging further explains how capitalism ends.

But the media and bankers still have ideological control over most American thinking. Such control and dishonesty is also how capitalism ends.

They put nice faces in nice suits in front of Congress, FOX, CNBC, et al., on a daily basis and tell you not to worry and that we have new banking measures in place, as well as a fine cadre of “bank regulators” to make sure you’re safe.

But guess what, the very folks “regulating” those too-big-to-fail banks are themselves just other bankers.

Don’t want to believe me? Just consider the list of the following bank regulators who came in post-08 to “clean-up” the banking mess…

Brett Redfearn, Joseph Otting, Steven Mnuchin, Shahira Knight, Dina Powell, Robert Khuzami, and Randal Quarles.

Guess what they all have in common? Resumes and pay stubs from The Carlyle Group, Deutsche Bank, Goldman Sachs, Fidelity Investments, CIT Bank, U.S. Bancorp, and JPMorgan…

In short, it’s a scam. It’s rigged. It’s about insiders helping insiders, pure and simple. That too is how capitalism ends.

Do you still think your elected officials and their regulators are going to save you?

Did you know that for every congressman and congresswoman in D.C., there are five financial lobbyists (legalized bribery) attached to each member of Congress “influencing” their thinking, voting, and banking? This is clearly how capitalism ends.

Is that “constructive capitalism” and survival of the smartest, or simply a triumph of the most immoral, most funded, most politically parasitical, and most corrupt individuals?

But if you still aren’t convinced that something is wrong with such “corporate capitalism,” let’s just get back to 2008…

When the very pyramid scheme of low rates, massive debt, and inevitable market collapse handed to us by our casino banks unfolded, we printed, taxed, and created trillions of dollars to bail them out.

Socialism on Wall Street—the Biggest Bailout in Our History

Again, let me ask you this: Does free-market capitalism work when a government gives private banks nearly $1 trillion in TARP bailouts?

Do “free markets” exist when nearly 70% of our Treasury bonds and mortgage-backed securities were purchased by a central bank after printing $3.5 trillion out of thin air?

Is that “survival of the fittest,” or is that just government monetization of private banking and sovereign debt?

Folks, it’s time to call a duck a duck.

The academic word for such schemes is scarier, but there’s no other word for it but socialism.

Our government is merely a clearinghouse for the financial elite, and our Federal Reserve, which sits on Constitutional Ave. in D.C., is in fact a private (rather than Federal) bank and is no more constitutional than Larry Summers is a capitalist.

Nope. By using tax-payer funds to bail out, and then continue to “accommodate” this broken financial system via rounds of money printing, we have literally become the most socialist country in the world. That of course, is how capitalism ends.

Back to the Future: The Same Story Repeating Itself

Mark Twain wrote that “history may not repeat itself, but it certainly rhymes.”

Tying together all the points made above, we see that whenever markets and banks get in trouble, D.C. and Wall Street get the Fed to rescue the markets, not the real economy.

As we recently saw in March, Powell once again bowed to the S&P, and once again bought Wall Street “accommodation.”

Meanwhile, seven million Americans are defaulting on car loans as Wall Street temporarily recovers from the recent correction.

Ever since QE1 morphed into QE2 and QE3, and every time the Fed accommodates Wall Street by taking rate risk off the table, the markets rise on the back of Fed support, not the forces of natural supply and demand. That’s a classic symptom of how capitalism ends.

No Free Lunches

This was as true in 1998 as it was in 2009, and it is just as true today as it was last month when the Fed essentially announced a low-rate, free lunch for 2019.

By now, however, you know that there are no free lunches. The Fed, which has complete control over the markets and thus your IRA, 401(k), and retirement buys time, not solutions.

For 2019, what was once supposed to see a yield-shock market blowoff has now, thanks to the Fed pivot, become a new bull run balancing dangerously over an inverted yield curve, and thus the stage for recessionary market blowoff further down the road, most likely 2020 or 2021.

Short-term “accommodation” (i.e. low rates) will likely buy more time and a rising S&P, but the ride up is getting frothier, more dangerous, and, just like 2008, more absurd.

Again, every debt-driven market rise ends in a catastrophic capsizing under its own weight.

In 2019 and 2020, you, as an informed investor, need to make common-sense choices today based on all that you know of markets, history, insider facts, and bond market realities.

This means taking chips off the table and allocating what remains into assets that outperform when otherwise broke companies begin to cut back.

We’re here for you.

In the interim, be smart, be patient, and be careful.