Hear ye, hear ye…there’s been a black swan sighting among the “grey swans” and we wanted to update.

If you’re new to Black Swans, they come in multiple flavors.

To some, the black swan (Cygnus atratus) is a large, extremely rare water bird, a species of swan that breeds mainly in the southeast and southwest regions of Australia.

To others a black swan represents the healing powers of love and romance that teaches us how to protect our loved ones, a lot like my black-Labrador puppy, Aubrey, contributing below.

But to those of us in the world of finance, a black swan is an unpredictable event beyond the expected that can have potentially severe, if not catastrophic, consequences when it hits the global economy, turning good times into, well…bad times.

In short, not cute and cuddly, not at all.

The black swan Craig Stephens illustrates above seems to be on a mission, heading out with a destination in mind, this time with a flock of infant Coronaviruses trailing obediently behind.

Let’s Discuss

Black swan events, like the Coronavirus, are no joke. I mentioned them as well in my prior list of things to watch for in 2020.

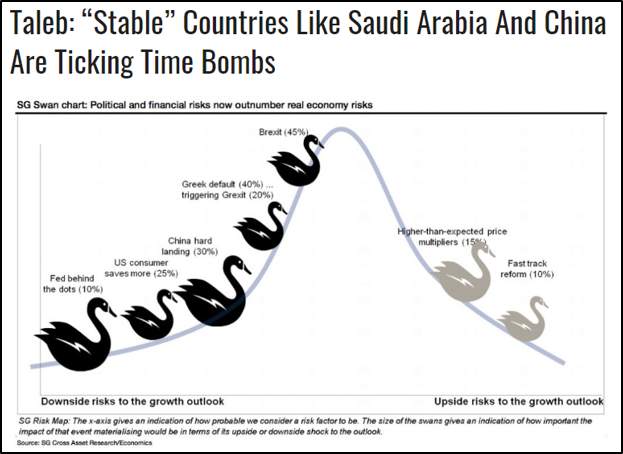

The term Black Swan event was popularized by Nicholas Taleb, finance professor, author and former Wall Street trader, who noted that a Black Swan event is impossible to predict, yet catastrophic in nature, like a 9-11 vs a 2008 “Lehman moment.”

The former, no one sees coming, the latter: No one wants to see coming. I call those more predictable but media-buried dangers “grey swans”…

Recently, I reported on the biggest of all grey swans–the deliberately ignored and GDP-confirmed economic depression in which we have been for years.

The safe approach to black swan events and hidden grew swans, is to presume that, while they rare, they are always a possibility, especially at the end of a cycle when the tide goes out and reveals the jagged rocks (i.e. grey swans) of low growth, low productivity, dangerously compressed interest rates and a complicit Fed.

Investors must plan accordingly and that’s why we developed Storm Tracker which tracks the impact of Black Swans like the Coronavirus, and grey swans like the dollar shortage, giving Subscribers the early warning and portfolio adjustments they need to avoid yet another market Uh-oh moment, compliments of both black and grey swans.

That’s also why we wrote Rigged to Fail, an in-depth synopsis of the failed monetary voyage we’ve been discussing for so long that’s poised, like those grey swans, to hit a generation of unsuspecting investors.

Luckily, we also provide solutions.

A long time in coming, Rigged to Fail was just published and is available at this Amazon.com link and FREE to pre-informed CSR readers in eBook form for five days only, beginning this Sunday, February 23 and until 5pm on Thursday, February 27. A print version is coming right on its heels.

High Sigma Events

In hedge fund speak, Black Swan events are called high sigma events, volatile events that can trash your portfolio beyond what you could imagine or predict, with standard deviations of 5-10 times the norm.

It is Nicholas Taleb’s view, seemingly stable countries like Saudi Arabia and China are ticking time bombs (more like ignored “grey swans” like than unknowable “black swans”) that could trigger an Uh-oh event.

We’re now adding the Coronavirus to the list of black swan events that could be dangerous to the global economy and to your portfolio.

Taleb argues that appearances can be deceiving when it comes to the perceived (vs. actual) political stability of a given country.

Countries with relatively decentralized governments and a wide variety of political expression, like the U.S., it is argued, are actually relatively stronger, though David Stockman has been calling the Trump Disruption an “Orange Swan” event since 2016. But We’ll stay out of that political fight.

But counties that have strong centralized governments, coupled with a lack of political diversity, makes grey swans like Saudi Arabia, Venezuela, North Korea and China more fragile—i.e. ripe for a black swan moment.

China, the big gorilla in the room when it comes to global trade, is butting up against a trifecta of adverse conditions, namely higher tariffs, out-of-control debt and now the Coronavirus (a classic black swan).

In short: China is the classic case of a Black Swan emerging from a nest of otherwise predictable yet media-ignored grey swans.

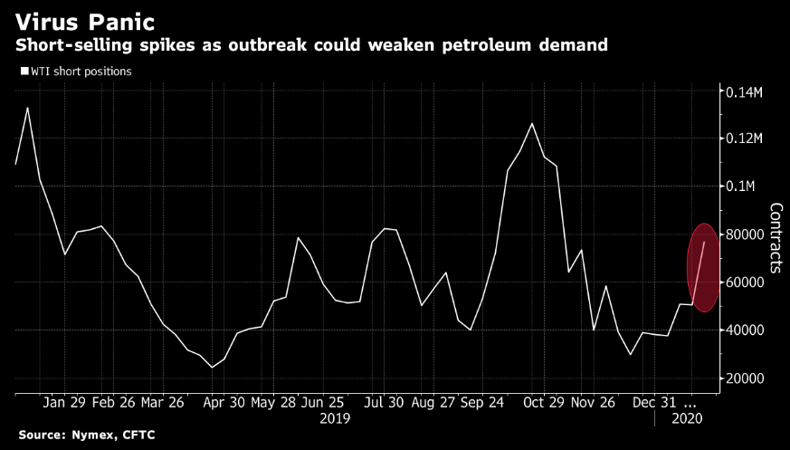

Black Swans can emerge quietly, in one sector (like oil below), then in another and another, accumulating to point that the burden is just too big for the system, and then slowly, to rapidly, the system cracks.

As for this slowly building momentum, we’ve been watching the oil markets…

When fear over Chinese strength and commodity demand happens, market participants flee and commodity prices in particular, can plummet as they are now.

Not Here to Scare You

Yep, we track a lot of bad news, despite being bullish here and here when the Fed was handing us some fat pitches in 2019.

We’re not here to scare you, truly. We’re here to prepare you. With stocks so heady, few are thinking about taking some cover or looking for grew swans.

We, however, have the responsibility to manage risk, and thus constantly ask: What could go wrong next? Where are those grey swans?

That is: What are the early warning signals, like the spreads we introduced in Tuesday’s Critical Signals Report?

Folks, to be forewarned is to be forearmed. To be overly complacent is unwise, like a sitting duck.

That’s why we penned this article on the Coronavirus and Yield Curve Dangers and revealed mathematically why U.S. is already deep into an official, yet media-ignored, ECONOMIC depression. In short: a Classic Grey Swan among all grey swans.

The facts we recently shared on this economic depression should raise more than one eyebrow.

And that’s also why we wrote Rigged to Fail. Starting this Sunday, it’s yours for FREE for five days only.

In the interim, stay informed, stay safe and keep an eye out for those grey swans which the media otherwise glosses over–yet they are right under our noses.

Sincerely,

Matt and Tom