Our markets crashed.

As exchanges open down today after the worst week of losses seen (in terms of speed and depth) since the Great Depression of 1929 and the Great Financial Crisis of 2008, there is another benchmark disaster that comes to mind, namely the collapse of France just prior to its “guillotine moment”…

For this reason, and with NYSE closed and the Fed now announcing unlimited, open-ended asset purchases, I see more desperate measures which are reminiscent of a prior, yet ignored moment in time.

I am thus reheating a post originally released almost one year ago, in April of 2019, for your consideration, as its message then is perhaps as, if not more, relevant today. A prior video, available here, was posted of even date in 2019.

Please note as well that I have added current commentary in ALL CAPS to the original post where necessary.

I feel you will enjoy this updated (though admittedly lengthy) reminder and historical perspective of the template of foreseeable disaster in which we now find ourselves.

Our current market disaster was set in motion long before the Coronavirus accelerated events already rendered inevitable by the Fed, the laws of natural markets and the lessons of history.

Despite such obvious (yet largely ignored) evidence, both the Fed and Wall Street, as well as the “financial advisors” whose clients were “all-in” and recently battered by an otherwise clearly foreseeable and avoidable market drawdown, are collectively receiving a media “hall pass” as headlines and prompt-reading bobbleheads blame a virus rather than the failings of a system which has ignored or downplayed objective indicators of risk for years.

Yes, COVID-19 was a deadly and tragic black swan, and yes its impact has and will continue to destroy wealth here and around the world. I am not downplaying its impact.

But it’s equally worth reminding ourselves that markets here and around the world were made unacceptably fragile by years of mismanagement and media negligence, so fragile, in fact, that things will only get worse because they were already so unacceptably bad.

By re-posting the report below, my aim is to remind each of us in these otherwise troubling times that wealth advisers, Fed chairs and Wall Street apologists attempting to appear shocked or caught off guard today deserve less sympathy than they’d pretend to deserve.

In short, the evidence of their failings is nothing new, but simply a little bit of history repeating itself. Below, I simply remind them, and us, of this critically important history lesson.

Please enjoy the re-read below, and of course, I welcome your commentary, critique or questions.

French Money Printing: A History Lesson in Crazy

Originally posted on April 21, 2019 (Current Commentary in ALL CAPS)

Below we look at French Money printing circa 1793…You’ll quickly see a dangerous pattern similar to American politics, QE and low-rate addiction..

Same Story, Different Zip Code

Politicians have one thing in common throughout history: Stay elected. The call to “public “service” has more often than not been a smokescreen for a call to private ego, as politico’s of every stripe yearn for what Nietzsche aptly described as a “Will to Power.”

There are, of course, exceptions to this sad rule, but most of us would now agree that our leaders, left, right, or center, have rather large egos and very small economic IQ’s. As usual, however, we will avoid political finger-pointing and knee-jerk attacks. Our primary focus is the market itself and the Fed Chairpersons tasked to manage it.

As one famous French moralist observed centuries ago: “the highest offices are often filled by those of the least merits.”

And when it comes to economic intelligence, well…that IQ number just gets smaller and smaller with each administration—especially at the Federal Reserve.

Today, our current President wants the same treatment from the Fed that his predecessor received, namely more low rates and the option to print more money. After all, it’s only fair, right?

But such logic is the equivalent of arguing one deserves more poison, because the last guy got lots of poison. The fact that such poison is long-term bad for a country but short-term good for re-election is overlooked by most.

And folks, that’s precisely what “Fed accommodation” is—market poison. Printing trillions of dollars and forcing rates to the floor to boost Wall Street is neither capitalism nor intelligence—it’s just plain debt monetization. SEE OUR REPORT ON THE DEATH OF CAPITALISM.

America is now fully trapped in a central-bank nightmare. Our economy is driven not by actual full employment or surging GDP, but rather by a totally doped stock market supported by the Fed.

The QE1 “emergency measure” slowly morphed into QE2, then QE3, and then later, a low-rates seemingly forever.

That folks, is addiction, not policy. SINCE THIS ORIGINAL REPORT, EVEN MORE FED MONEY PRINTING, TO THE TUNE OF TRILLIONS, HAS FOLLOWED, AND NOT ALL OF IT TIED TO COVID-19.

When Powell pivoted in March to another rate “pause,” it was the final proof that our markets literally cannot handle rising rates, as that market is simply too past the point of no return in debt. SINCE THEN, RATES HAVE DROPPED TO NEAR ZERO, AS THE FED GETS EVEN MORE DESPERATE. THIS WAS HIGHLY PREDICATBALE AND REQUIRED NO CRYSTAL BALLS.

Unfortunately, our record-high stock market (NOW PLUNGING) is the only thing “positive” about our so-called “recovery.” Everything hinges upon capital gain revenues from this market bubble, and thus everything hinges upon keeping this artificial market bubble rising. BUT THOSE DAYS ARE OVER FOR NOW.

Could the Fed therefore find itself printing more money again,(YES) this time to literally buy US stocks (ala Japan) or buy more bonds—thus fully replacing free market supply and demand with Fed demand on call?

NOW, THERE IS TALK NOT ONLY OF MMT INSANITY, BUT OF PRINTING MONEY TO BUY STOCKS, JUST LIKE IN JAPAN…

Could we expand the Fed’s balance sheet from $3.5T to $7T or more and keep rates to the floor for years to “solve” our economic woes? GET READY FOR THIS.

That’s what many are starting to wonder, but that kind of desperation folks, which some experts benignly call MMT (Modern Monetary Theory), is not capitalism at all—it’s pure Wall Street socialism and, as we’ll see below, it is a horrible idea.

But just in case you wonder if any country, nation or band of financial “experts” and elite politicians could ever get that dumb, let me remind you of a little bit of history repeating itself…

Musings from France and French Money Printing

It’s the Spring and I’m back at my family home outside of Bordeaux watching the horses eat all the new grass and swapping away flies. Back in the States, the US is losing $5T in revenues as its GDP continues its long slip from 3% to 2%.

Gosh, a 1% slip may not seem like much, but $5T is a big number, no? After all, the US could use an extra $5T in actual economic productivity rather than debt…

Instead, as our markets and debt levels hit record highs, our GDP stagnated as manufacturing tanked and US jobs got exported to cheaper-labor zones overseas.

In order to survive this sad decline in US eminence, our government desperately “fakes it,” relying on issuing more debt ($1.2T and year) [OUR DEFICIT HAS GROWN TO PAST $23 TRILLION SINCE THIS WAS PUBLISHED] and hoping to collect whatever capital gains it can from its historically inflated stock market, which is likely (CONFIRMED) to rise in 2019 on the inevitable arrival of more low rates and money printing by year end. [THIS WAS PRECISELY WHAT OCCURRED]

Indeed, with everything else dying, our stock market (now totally controlled by the Fed’s low rate debt binge) is the only thing making America at least appear “Great Again.”

Today, almost everything hinges upon our faith in a now entirely artificial stock market. Indeed, if you are looking for a market “signal”—the only one you need is the “Fed signal.” If the Fed “pauses” rates—party on. If rates rise, party over. For this year, however, the party will continue–mark my words. [GOT THAT RIGHT.]

It’s just that sad. We are literally a nation that now relies upon the Fed and a rising market to remain “great.” Meanwhile, the real economy—our Main Street health, gets sicker and more debt-ravaged by the day.

Spin from Washington

That’s why Washington continues its propaganda campaign by simply lying, year after year, about record low unemployment and “contained inflation.” Such memes are absolutely essential to keep the “faith” going.

But as my prior articles soberly and factually demonstrate, these employment and GDP boasts form above are mathematically and objectively NOT true. That too is just, well…sad.

Once you look under the shiny hood of this otherwise rotten situation, it’s pretty disturbing to realize just how desperate and broken the US has become.

In the meantime, the S&P approaches new highs as the Fed, rather than normal price action, replaces the old ways of natural supply and demand. After the crisis of 2008, our central bank printed trillions in fiat currencies out of thin air and crammed rates to the floor.

All that “wealth creation” went straight to the very banks that caused the crisis, and since then, those ”resurrected” bankers used this bailout/handout to lend to a stock market comprised largely of debt-infested corporations who borrow like crack addicts to buy back their own shares and push prices (and PE ratios) to insanely dangerous peaks while Main Street rots. THAT BOND MARKET IS NOW ROTTING FROM WITHIN AS WELL.

Some “recovery,” no?

It’s hard to imagine how a country could rise to such heights yet fall to such desperation.

Never before have we seen a nation go this crazy. But as I pause to reflect on my America from a home in France, I feel it’s the perfect time to offer you a little consolation, for here in France, history at least offers another example of a nation that equally lost its economic mind in the form of French money printing.

Yep—France.

History Matters

Below, we’ll use 18th century France as a template of crazy. What happened then is precisely what’s happening today in the States. And then as now, the story of French money printing ends badly. AND NOW WE ARE SEEING THIS ENDING PLAY OUT IN REAL-TIME.

Although I’m a hedge fund manager, investor and long-time market “veteran,” I use history as much as math to manage my own and other people’s wealth. History allows us to measure the present, peer into the future and reflect upon the past.

Those who study history, respect its paradoxical ability to repeat itself yet remain unique with each era.

Hence the expression: the more things change, the more they stay the same.

Looking, at the intersection of time, markets, and human behavior, we see these patterns of history repeating themselves because individuals have consistently (and emotionally) misunderstood value, AND OVER-VALUATION.

This misunderstanding has been played out in eerily consistent patterns of mania, denial, false-comfort and expert confirmation followed by an inevitable collapse “phase” forewarned by a select minority of smart and blunt-speaking finance veterans. THAT COLLAPSE PHASE IS NOW UPON US.

Today’s markets are part of this history, and are dangerously—overvalued. The timeless pattern and eventual end game are set before us. And so, in order to see this without rancor or “doom & gloom” panic, we need to at least consider history.

History Is No Stranger to Crazy Markets

The history of overvalued, over-traded, and over-exuberant markets is not a new topic. Whether one looks at the Roman Empire, ancient China or modern Argentina, history consistently repeats itself—building bubbles fueled by tulips in 1635, South Seas and Mississippi trade in 1720, land booms in the US (1835) and Prussia (1760), railroads in Germany (1845) or B2B tech platforms in the NASDAQ of 2000.

Looking from the past and into the future, I (like many far brighter than me) have dedicated considerable ink, dollars and time to the current shape and longer-term implications of our own mega bubble.

Nothing in my own views has changed since 2009, when the mania phase of the above pattern emerged. Then, as today, I maintained that a US (as well as global) economy emboldened (i.e. supported) by trillions in fiat money printing and massive deficit creations will suffer devastating consequences further down the road. WE’VE NOW REACHED THE END OF THAT ROAD IN 2020.

Since 09, of course, the markets have been anything but devastating—all part of the typical mania, denial and false comfort phases that come from free money and a refusal to look at what we don’t want to see–i.e. the fact that quintupling the money supply while doubling our debt levels, like binging on a credit card, leads to long-term pain despite its short term fun.

Recapping the most recent year (2018), we saw more examples of this “fun” as well as final month of ominous “pain.” WHICH WE FORESAW AND WARNED OUR SUBSCRIBERS OF BEFORE RATHER THAN AFTER THE CRASH.

Markets kept rising—and then suddenly tanked in late 2018. In early 2019, the “magical” Fed then bought us some more temporary time by pausing interest rates. Once again, the Fed-Lead markets parties on, rising by 17% in a matter of months. AND ONCE AGAIN WE TURNED TEMPORARILY BULLISH AND TOLD OUR SUBSCRIBERS TO DO THE SAME.

The Best Investors Are the Contrarians—Not the “Elites”

To those who believe in deficits without tears or money printing without consequence, the score-card seems greatly in their favor right now, and at nearly every market peak or bullish (yet entirely untrue) GDP or employment report, I am reminded by many of my Wall Street peers just how crazy I am.

I heard the same things just before getting out of the dot.com bubble with millions. Thereafter, many of those mocking my “caution” were hugging their knees and losing fortunes.

Today, I’m hearing the same words…

“Matt, why so bearish? The markets are ripping!” In fact, as bearish as my long-term views may be, I see a roaring year ahead, for no other reason than more Fed steroids.

Yep, and I’ve even benefited from these artificial trends here and there. When a central bank hands you a fat pitch, it’s ok to swing away—for a while that is.

This is because I also know that History is equally replete with the presence of “lone nuts” chastised for calling a lame duck a lame duck when others are describing it as soaring eagle. NOW, THOSE WHO MOCKED ME FOR MY WARNINGS ARE SEEKING MY ADVICE.

In short, don’t get too blinded by these “soaring eagle” markets, for the historical patterns (including French money printing) that I’ll be sharing with you here are far from over.

Declaring economic victory today in such a grossly, QE-low-rate-driven (i.e. fake and “steroid-driven”) market bull is the equivalent of declaring Lance Armstrong a hero in Tours 1-7.

In other words: be patient as well as careful, for eventually, the obvious reveals itself in one form or another—but almost always in retrospect.

There has been an abundance of post-facto pundits declaring: “Of course dotcoms were overvalued, of course housing was over-priced, of course sub-prime instruments and the derivatives markets were a poison.”

But very few experts were speaking this confidently before the collapses. In fact (and instead), the smartest folks in the room were consistently saying the opposite.

On the verge of the greatest banking bailout in history, for example, Janet Yellen was declaring banks safer than ever in 07; an equally optimistic Alan Greenspan was cheerleading market stability minutes before the 08 disaster, itself partially unleashed by another expert, Larry Summers, who told the world (and Congress) to de-regulate derivatives just before those same instruments destroyed our economy (as well as his endowment at Harvard) with nuclear-like effect.

As authors like Christopher Hayes have intelligently shown: beware of the “elites.” Yale’s Irving Fisher, as smart as anyone in 1929, declared the stock market bullet proof a week before it tanked.

Princeton’s Ben Bernanke is no less intelligent, and no less capable of being wrong. Jerome Powell, a similar patsy of the Washington and Wall Street elite, is no different.

The herd’s faith in such elites conveniently adds to their collective need to deny real fears based on real indicators. The cry from the sheep is this: “Certainly the Fed and policy makers know better. Certainly they have our back today and know something we don’t to save us.”

BUT DID THE FED SAVE OR WARN INVESTORS OF THE CRASH THAT HIT US IS 2020? NOPE. THEY JUST BLAME EVERYTHING ON COVID-19 AND PRINT MORE MONEY.

But did the elites save you in 1987? In 2001? In 2006? In 2008? Such faith in headline-making experts ignores the difference between being smart and being wise, for wisdom implies a humility otherwise absent from those who confuse diplomas, job titles and income with a brave common sense.

Hank Paulson, for example, made hundreds of millions at Goldman Sachs before assuming the title of Treasury Secretary and was just as clueless as John Doe when the markets cratered in 08. TODAY, GOLDMAN CLIENTS ARE LOSING MILLIONS IN THEIR PIE-CHART PORTFOLIOS AND ASKING THEIR ADVISORS WHY NO ONE WARNED THEM OF THE RISKS IN THESE MARKETS.

In fact, it doesn’t require genius or a banker’s salary to see the patterns to be discussed herein.

As I’ve written elsewhere, it requires courage—courage to step outside of the herd, to rely on your own informed judgment and facts (rather than the judgment and false, sell-side data of experts).

Instead, it’s far wiser to respect the forces of markets and history the way an old sailor respects the forces of nature, currents and waves.

The economist, Peter Bernholz, studied every event of hyper-inflation since the French Revolution, and in each instance where a sovereign’s annual borrowing exceeded 40% of its GDP, hyper-inflation was not far behind. Every time. The US crossed this 40% line in 2009.

Now, at the dawn of 2019, the US Dollar is the strongest it has been in eleven years, markets are at all-time highs and reported inflation is nearly non-existent.

Is the US therefore the sole exception to market history? This is unlikely. It just means history hasn’t had the final say—yet. NOW, THESE WARNINGS ARE PLAYING OUT, JUST AS EXPECTED.

I’m often told a broken watch is accurate at least twice a day, and that market bears will eventually be right—by accident.

But there’s no accident here. Nor bears. Just common sense, facts, time and markets motioning perpetually toward a reversion to their mean, warning us what history has taught over and over: You can’t solve debt problems with more debt, you can merely buy time and thus postpone—as well as augment—the inevitable crash ahead.

French Money Printing Lessons: The Disaster of 1790

I’m occasionally even told such pessimism is un-American. And so, again, I am turning now to the most un-American example I could think of in market history to illustrate the point.

In short: I will look at the market history (and disaster) of my beloved France.

In particular, I blew the dust off an essay written in 1912 by Andrew Dickson White, the founder of Cornell University.

White’s otherwise ignored book on the crash of 18th century France is a fascinating examination of a sincere (but disastrous) attempt by the world’s then strongest nation to tackle its military, private and public debt woes through the printing of money and extension of debt.

Sound eerily familiar?

Equally worth noting is that the French National Assembly of that era was comprised of the most intelligent minds/ experts of its era– Matrineau, Marat, Tallyrand, Necker, Mirabeau, Bailly, DuPont de Nemours, Larochefoucauld etc.

Yet even the majority of these titans of intellectual firepower and economic savvy were unable to thwart the natural laws of markets. As White noted, they, “like every supporter of irredeemable [i.e. fiat] paper money then or since, seemed to think that the laws of Nature had changed since previous disastrous issues.”

And this law of nature/markets is as simple today as it was in 18th century Paris: you simply can’t print and borrow your way out of debt in the short-term without unleashing a longer-term disaster.

Reading the pages of this ignored, 1912 work, set in 1789 France and from my desk in 2019, is a sort of journey into the surreal.

One could easily change the names, venues or dates of old France and substitute them with modern America today, proving indeed: “la plus ca change, la plus c’est le meme chose.” That is: history repeats itself.

Phase 1: A Big Problem in Search of a Quick Fix

In 1789, France, much like 2008 America, had “found itself in deep financial embarrassment.” Namely, markets had crashed, deficits were growing and the population was losing faith.

In this 1789 French backdrop, as in 2008 America, “there was a general search for some short road to prosperity” (i.e. speedy calls for the printing of money) to give the ailing nation a little boost.

The French Finance Minister at the time was a fellow named Necker.

Unlike our Mr. Bernanke of 2008, the Necker of 1789 recognized the short-term seduction yet long term (and fatal) price of printing an economy out of harm’s way.

Thus Necker, Bergasse (of Lyon), Cazales and Maury initially sought to fight off the seductive call of free money with classical oratory at the National Assembly, proclaiming the result “could only be disastrous,” as printing was nothing more than “a panacea…a way of securing resources without paying interest.”

These blunt-speakers reminded others of recent history, 70 years prior, in the era of John Law when it was learned how easy it was to print money, yet how difficult it was ‘to check its over-issue” and how “securely it creates a class of debauched speculators, the most injurious class that a nation can harbor.”

Sound familiar? Today, the vast majority of American investors (aka “debauched speculators”) are “all-in,” looking to make their fortunes in a stock market that is little more than a casino.

But against these ultimately prophetic warnings, Marat, (MUCH LIKE POWELL) “friend of the people” and others seduced the herd/crowds with promises of “stimulating” the economy with just the right amount of French money printing and interest rate suppression.

Sound familiar? Remember Paulson? Geithner? Bernanke?

And so, in 1790, France made its first real toe-dip into printing money (the equivalent then of our own “QE1”) with the issue of 400 million in new money (a relative hiccup compared to our 2008 equivalent in the US).

The result? As expected, free French money printing felt pretty good. The printed money was initially backed by French real estate confiscated from the nobles and the church and was promised (like our current corporate class) to “be free of default risk.”

The French Treasury of 1790 was understandably relieved, old debts were paid with new money, credit was revived, trade was increased and everyone was happy—much like the post 09 “V-shaped” markets in the U.S.

Phase 2: From “Emergency Measure” to Addiction

But just like those accustomed to one too many beers, the buzz began to slowly lose its impact, and within time, the French Assembly, along with the speculators and traders from Bordeaux to Marseilles, wanted another “fix” of French money printing.

Sound familiar?

Despite original promises by Marat to temper the printing, the addiction became too tempting, and thus another round of money was printed (a veritable “QE2” of its day) in the form of another 800 million in “assignants.”

The parallels then to our own flirtation with printed money in post-08 America are striking.

But then, as now, a small cadre of blunt-speakers tried to warn of the long-term destruction wrought by short term printing (think, today, of Stockman, Keen, Rickards, Tom and I…).

Mirabeau, for example, spoke of the printed money as “a nursery of tyranny, corruption, and delusion; a veritable delirium…a loan to an armed robber” with inevitable dangers of inflation or a bursting debt bubble.

But soon, even Mirabeau got hooked on the drug of quick fixes and easy French money printing, and later declared that “just one more round” of free money would be OK…but nothing more. As Professor White later observed in 1912: “the current toward paper money had become irresistible.”

Of course, we have seen that same “current” from the Eccles building in DC as our US Central Bank evolved from a one-time 2008 “emergency injection of TARP and QE1” into a long-term drug dispenser of new money and low-rate debt for years to come—creating and extending an identical exuberance, market bubble and class of “debauched speculators” as US markets reached record highs.

Phase 3: The Good Times

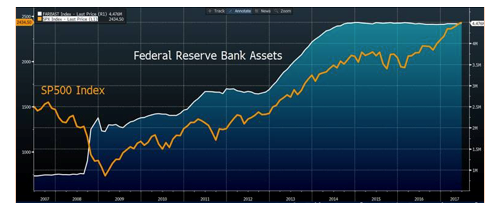

As for that “mania,” even the most delirious bull today cannot deny the correlation of our market rise to the rise in our money supply (Fed Reserve Assets) and unprecedented debt levels.

As indicated above, such short-term “good times” are expected components of the fatal pattern we are now trapped within.

Phase 4: Keep the Fantasy Going with Fantasy “Data”

This same pattern also contains the false comfort (i.e. lies) of experts whose bullish rhetoric keeps the herd marching obliviously, even comfortably, toward cliffs. The France of the 1790’s didn’t have CNBC or the Private Wealth Management teams of Goldman Sachs et al, but they had even more talented orators at the assembly.

One, a certain Monsieur Gouy, even suggested the French simply liquidate its entire national debt by printing a large amount of money to be used, in his own words, to solve the nation’s problems, “by one single operation, grand, simple, magnificent.” WHICH IS SIMILAR TO THE MMT MIRACLE SOLUTION BEING TOSSED AROUND DC RIGHT NOW.

These were of course comforting and tempting words. Such myopic seductions were followed by pamphlets and more brilliant speeches appealing to stimulating the economy and offering dashing projections of how printed money and cheap debt leads to growth and prosperity.

Sound familiar? Remember Yellen’s promise that we’d never see another recession in this lifetime? LAST MONTH, THAT SAME YELLEN IS NOW RECOMMENDING THE FED PRINT MONEY TO BUY STOCKS IN THE CURRENT RECESSION…

And these were the words of “elite” and “trusted” men like Talleyrand and Mirabeau—certainly no less bright in IQ than anyone on Fox, CNBC, Goldman Sachs or the FOMC.

But as Andrew White noted in 1912, smart people don’t necessarily understand monetary policy, and calling upon “experts” just because they show boldness and optimism “was like summoning a prize fighter to mend a watch.”

Phase 5: Minority Voices of Reason Ringing the Warning Bells

Then, as now, there were lone voices of dissent, even exasperation. Necker, the Finance Minister, ultimately resigned in frustration over excessive French money printing. Economists like Maury attempted in vain to illustrate how the first issues of printed money always bring prosperity, but “those that follow bring only misery.”

A fellow named Le Brun attacked the whole scheme in the Assembly, prophetically declaring “that the proposal, instead of relieving the nation, would wreck it.” WHICH IS PRECISELY WHAT TOM AND I HAVE BEEN WARNING.

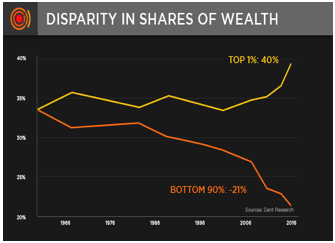

Thereafter, additional lone wolfs like Boislandry, Du Pont and de Nemours published pamphlets, predicting with haunting accuracy “that doubling the quantity of money simply [and debt] increases prices, distorts values, alarms capital, diminishes legitimate enterprise and so decreases real rather than speculative demand that the only persons helped by it are the rich who have large debts to pay.”

Stated in 1790, but no less true in 2019. As this familiar graph reminds us, the only real beneficiaries of our totally drunken and fake “recovery” have been the wealthy, not the rest of America.

Of course, then as now, such sober and blunt warnings and calls for restraint were not as popular as those promising continued prosperity, free money and, as one expert declared with a confidence foreshadowing Irving Fisher or Larry Summers, “the end of further concern.”

France in the 1790’s, like the US today, was thus fully committed to a policy of debt and delusion. Again, and for a while, the economy moved along, even prospered.

White observed, “that the great majority of Frenchmen now became desperate optimists, declaring that printing and debt is prosperity….The nation was becoming inebriated with false hope.”

Sound Familiar?

Such observations remind me of an S&P that never seems to stumble, a DOW hitting all-time highs and a bond-market which defies all laws of risk because of the short-term safety-net of a Federal Reserve that has completely lost sight of market forces, courage, humility and alas: history.

Phase 6: Ignoring Reality—and Data

In fact, history tells us that the current party can’t last forever; our “safety nets” are full of weak-spots. Now as then, “troublesome holes” had begun to appear. As White noted of that debt-soaked and market-topping France, “soon the markets were glutted and demand began to diminish.”

SINCE THIS WRITING, WE’VE SEEN THESE SAME “TROUBLESOME HOLES” APPEAR IN THE BROKEN REPO MARKETS…

In other words, bubbles were approaching their apex and the natural forces of market cleansing were approaching. No one, however, wanted to face these facts.

Phase 7: The First Signs of Panic

Without warning, panic set in. In the years after the easy money started to lose its punch, the markets began to see a series of sudden and steep falls.

Sound Familiar? Remember September of 2015? December of 2018? OR HOW ABOUT FEBRUARY AND MARCH OF 2020?

Phase 8: Calm the Panic with More Fantasy

The French “solution” then? More French money printing and lower rates again!

Sound familiar? Think of Powell in March 2019…OR THINK OF THE RECENT MASS MONEY PRINTING TO PROP THE BROKEN MARKETS—TRILLIONS PRINTED IN WEEKS AND RATES CUT BY 100 BASIS POINTS IN MARCH OF 2020.

And thus the French, like the FED’s QE3 or Powell’s recent rate “pause,” went back to the printing press. AND THEY’VE GONE BACK TO IT AGAIN AND AGAIN SINCE OCTOBER OF 2019.

By 1793, hundreds of millions more were printed.

And then, as Professor White noted: “Out of this easy money came more speculating and gambling and luxury, and out of this, corruption and false economic data which grew as naturally as a fungus on a muck heap. It was first felt in business operations and markets, but soon began to be seen in the legislative body and in journalism.”

Sound familiar?

Today, market journalism is less a reporting of facts than it is a pulpit for market making salesmanship bordering upon propaganda. Need proof? Again—just read my free reports on the 5 biggest lies of the modern markets. They are sober, math-based facts, not Wall Street spin.

As to the extraordinary dishonesty and collusion of the Wall Street spin sellers, Media bubble-heads and Washington politicos, this is not part of some “grand and evil conspiracy.” Instead, it’s just par for the course behavior in an industry that thrives on buy rather than sell orders.

In the France of the 1790’s, like the US of today, a corruptive luxury was enjoyed by bankers and expert market consultants whose entire survival depended on keeping investors “all-in, all the time.” And then, as today, their salaries and income were entirely incongruent with their actual “expertise.” NOW THOSE SAME “ADVISORS” ARE RECEIVING VERY ANGRY CALLS FROM THEIR CLIENTS.

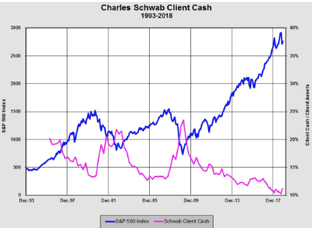

Thus, as markets reached highs, investor cash-reserves sank to the basement.

Sound familiar? Today, investor cash levels are at all-time lows as our markets reach all-time highs.

In 2008, for example, had the natural laws of markets been left free of money printing, FED intervention and artificial rate suppression (i.e. debt creation), the majority of those very same bankers and experts would be au chomage… That is: out of a job.

Phase 9: Blood in the Streets…

But as for the mania in France then, and the current mania in US markets today, the ending is the same. The French money printing experiment all came crashing down in dramatic fashion. NOW IT’S CRASHING AND THE MAJORITY INVESTORS WERE ALL-IN, AND THUS SUFFERING MASSIVE LOSSES, AS NO ONE WARNED THEM AT THE FANCY BANKS…

We have no guillotine in 2019, but economic heads will roll in one metaphorical way or another soon enough. TODAY, HOWEVER, THE FAILED ADVISORS, FED GOVERNORS, POLITCAL SPINN-SELLERS AND MEDIA HYSTERIA PUSHERS ARE TURNING ALL EYES AND BLAMES TOWARD A VIRUS RATHER THAN EACHOTHER.

In France, the disaster was so massive that heads literally did roll—lots and lots of them…

History Lessons and Current Realities

The lesson of 18th century French money printing (or subsequent collapses in Germany, Poland, Brazil, Bolivia etc.) is that EVERY debt party comes to an abrupt and tragic end once artificially supported markets run out of steam and suffocate under the weight of their own debt.

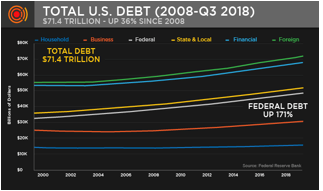

Today, the US is drowning under the greatest debt bubble in recorded history. That should be an immediate cause for concern, no?

You cannot massively and simultaneously print money and increase debt without grossly distorting markets, no matter how long the “fun” or how delusional the delay.

Eventually, the printed money inflates asset classes while deflating real economies. The bubbles pop. Markets collapse. The evidence today is ample enough, but the collective courage to look at it is temporarily lacking.

But folks, here’s our debt:

Here’s our “good times”:

And here’s our GDP flatlining as the market party rages:

At some point, however, faith in this unprecedented print/debt experiment will be too hard to maintain. When that faith dies, the markets go with it.

It only takes one of an otherwise vast list of possible events to trigger a collective panic and destroy these markets and the US economy that sinks with it. AND AS WE WARNED HERE, ONE SUCH TRIGGER COULD INDEED BE A BLACK SWAN, INCLUDING A GLOBAL VIRUS. THIS WAS NOT PYSCHIC POWER OR MARKET TIMING TRICKERY—IT WAS SIMPLE MARKET EXPERIENCE AND FIDCUCIARY HONESTY.

Nothing sustains our inflated markets today but misguided faith and artificially suppressed low rates which the Fed dishonestly manages with nervous fingers in a broken dyke. NOW, THAT DYKE HAS BUSTED.

In the interim, it is normal for the majority of humans to ignore such facts and questions. The answers are too upsetting. For those still reading this, “viewer discretion is therefore advised.” Just consider the following cold realities, which serve as a kind of highlight reel of years repeating myself:

- Since 2008, the US has increased the money supply by 5X, printing more money in less than a decade than was cumulatively created since the birth of our nation;

- In the same period, the US has more than doubled its debt levels to over $21T (NOW THAT NUMBER IS WELL PASSED $23 TRILLION AND RISING AT WARP SPEED); when we include un-funded liabilities to the balance sheet, the number is greater than $200T. The pre-08 ratio of debt to capital of the US Central Bank was 22:1; today its 80:1. Bubbles are always and everywhere fed by debt/easy credit. The greater the credit preceding the bubble, the greater the “pop.” Current global debt levels, at 250T, are the highest in history; just follow the algebra;

- In that same period of excessive printing and debt creation, actual GDP growth has been anemic at 2.4%. For every dollar of sovereign debt created, the US sees 3 pennies worth of growth;

- Actual, bread-winner US employment is at depression levels; despite reporting tricks, the true percentage of the working age population that is in fact employed (including part-time work) is 59%. When positive reports highlight declining unemployment rates, they conveniently omit the millions of individuals who have simply given up and left the labor force. 50 million Americans are on food stamps today;

- Despite Main Street’s woes, Wall Street speculation has singularly benefited from debt-sustained markets (equity, bond, currency) which are in fact bubbles of unprecedented size poised for eventual collapse. The correlation of QE announcements and interest rate “pauses” and S&P peaks is 1:1. Meanwhile, five of the six “too big to fail” private banks have exploited the recent US ZIRP policies and are more levered today than during their pre-08 excess. They share over $40T in derivative exposure; today, for each dollar of economic growth, there’s 30 dollars of bank debt (a 30:1 ratio; in 1980 that ratio was 2:1);

- At over $750T, the Current notional value of derivatives (i.e. levered paper) trading in global markets equals 10 X global GDP. The current ratio of stock market capitalization to GDP is a bewildering 203%. (In 1929 the pre-crash ratio was 84%.) These numbers defy reason and, as complexity theory suggests, are beyond the measure of even the most sophisticated risk management systems.

In other words, having printed more money and incurred more debt than any other time in history, all we have to show for this staggering monetary experiment is higher unemployment, weak GDP growth, inflated stock/bond and currency markets and an historically unmatched and over-levered central and private banking system.

These facts point to a higher excess than anything seen in 1790 France or even 1929 America, and yet the majority of investors today still think we are in a “recovery”? We are not. We are in a “historical cycle.” A bubble. And it will end badly.

Bears or Just Blunt?

Does this make me or Tom bears? Are we hiding in caves? No. We are just blunt.

We are former hedge fund managers, veterans of the biggest banks (who know their tricks), family office executives and painfully familiar with market risks and hence risk management and wealth creation.

We both advise to some of the wealthiest individuals and families in the world. I’ve personally been the general counsel and CIO of large family offices and got paid big fees for protecting that wealth.

Today, Tom and I want to make sure all Americans are informed of, prepared for and protected from the risks we see as plainly as a dentist sees a cavity. Everyone, not just the ultra-wealthy, deserve the same facts and advice.

In essence, Signals Matter was created to be your safe-zone for market clarity and blunt speak. Why? Simple: It’s just the right thing to do. WHICH IS WHY OUR CLIENTS ARE SAFE, WHILE THOSE WHO RELIED ON THE “ELITES” ARE DEEP IN THE RED AND LOSING FORTUNES.

For now, I hope this eye-opening lesson from history and French money printing offers both perspective and guidance as we begin our shared journey into yet another tragic example of history repeating itself.

The road ahead is filled with change and pain for the broader economy and markets, but for informed investors, such crisis also offers tremendous opportunities. For those armed with the facts, common sense and patience, we plan to make this road a lot more enjoyable. OUR SUBSCRIBERS ARE INDEED ENJOYING THIS ROAD BECAUSE WE INFORMED RATHER THAN DAZZLED THEM WITH FALSE HOPE OR ILLUSIONS OF GRANDEUR. WE LEAVE THAT TO THE FED. DID THEY PROTECT YOU?

For now, and as always, be informed, be calm and be careful.