Below we look at interest rates as a symbol of, well…stupid.

Predictable is as Predictable Does

In my last report on a Drunken Fed, sarcasm was in full swing as I pretended to wonder what the Fed’s next move would be.

Will the Fed add more spiked punch to an already overflowing punchbowl?

Hmmmmm?

Not much of a nail-biter query for any of you who recognize Fed desperation crossing the centralized border to outright Fraud.

Powell, like Greenspan, Bernanke and Yellen before him, is as predictable as a frat boy on his first pledge night…

After all, when all you have is hammer, the only thing you can do is pound.

Thus, and as expected, yesterday Fed Chairman Jerome Powell announced the Fed would once again pound away at interest rates, which were already at record lows.

Our walking-dead bond market is now so over-bought it yields almost nothing nominally, and when adjusted for even mis-reported inflation, literally yields nothing, in fact less than nothing, as real rates are now negative.

In addition to setting short term interest rates, the Fed has committed to $80 billion per month of more printed fantasy dollars to buy unwanted Treasuries and $40 billion to buy those still deadly MBS bonds which hover toxically over our credit markets like nuclear waste from the 2008 crisis.

Hey, but what’s another $120 billion per month in free fiat beer to a buzz-addicted Fed? Certainly, such money couldn’t be better spent on say…healthcare, education or infrastructure…

Naaa. Let’s support the markets with more QE.

This means the cost of borrowing in the US (at least between bankers and bankrupt companies, not any of you silly mortals with credit card debt) will stay at the floor of .25% to 0 through 2023, a fact which gives “forward guidance” and “accommodation” a whole new meaning and capitalism no meaning at all.

Folks, this is pure centralized planning and now undeniable proof of Wall Street socialism.

It also means (unbelievably) that the corporate debt bubble which the U.S. whistles past each day is about to get even fatter…

For now, drumroll further debt rollovers and walking dead bond issuers trading on a Politburo S&P and surviving off cheap debt rather than arcane notions of profits, earnings or revenues.

In short, the debt party on Wall Street just got another free round of “extend and pretend” as America limps into its 12th year of emergency mode interest rates / policies masquerading as “accommodation.”

Justified or Just Drunk?

Many, of course, will argue that desperate times call for desperate measures.

After all, COVID (or at least COVID policies) have been a gut punch to the global economy and US markets—at least for 19 trading days in March.

Wall Street, it could be argued, deserves a little sympathy from those who set interest rates, no?

But here’s the rub: It doesn’t.

No Sympathy for The Devil

The plain facts confirm that a grossly over-valued Wall Street was binging toward a well-deserved debt hangover long before COVID created the pretext for yet another sympathetic cut in interest rates or a new and unprecedented round of fake money creation.

In short, the 2008 bailout repeated itself in 2020.

As I’ve repeated more than once, and argued mathematically here, COVID created the perfect pretext for yet another bailout for those greedy little devils on Wall Street.

“Allowing Inflation”—How Generous?

And to make debt repayments even easier, the Fed just recently announced a pro-inflation plan, because, hey, it’s easier to pay debt with diluted/inflated dollars—at least for certain players.

Toward this end, the pundits and sell-side “all-is-good” peddlers are fast at work spinning a false narrative that the Fed’s inflation policy is just Powell looking out for regular Joes.

Now that’s rich.

Diane Swonk, Chief economist at Chicago’s Grant Thorton, for example, described “the real goal” of these low interest rates and pro-inflation policies as to allow “more of those hardest hit by the crisis a better chance at getting reemployed as quickly as possible. They won’t sweat a little bit of inflation for that.”

It’s rare that one can find so much stupid in a single sentence. Truly, hats off to this Chief Economist.

Let’s break down this stupid for a little reality check, ok?

How You’re Getting Played

First, there’s Swonk’s claim that those “hardest hit” by the economic downturn are the real targets and beneficiaries of this latest pro-inflation/lower interest rates policy.

Pure bunk.

As I recently wrote here, higher inflation policies are not an aid or “better chance” for those “hardest hit”—i.e. small business owners from San Diego to Scranton—but an absolute groin kick.

Why?

Because inflation just means higher prices (not commensurate higher wages). This doesn’t help the folks (employed or unemployed) in Scranton, PA or Grande Rapids, MI.

The Fed’s solution? No worries folks, just borrow more, as we’ve set interest rates to near zero just for you!

But any of you with a Mastercard or Visa in your wallet will confirm that your monthly cost of borrowing is nothing close to the zero percent which companies on the S&P are paying.

That’s because the rates the Fed is setting aren’t designed for you; they benefit corporate borrowers and broke sovereigns far more than Main Street Joes drowning under the 480 million credit cards now in circulation.

But according to Swonk, ordinary Americans won’t “sweat” this at all.

Equally astounding, Swonk is trying to spin the notion that higher inflation and lower interest rates offer Main Street folks “a better chance at getting reemployed as quickly as possible.”

Huh?

How does the Fed’s policy of targeting higher inflation (i.e. rising living costs) and lower interest rates (i.e. more debt) lead to more employment?

I have no clue. Truly. None at all.

Swonk then says “Powell will bring home the message that the Fed wants to level the playing field and allow wages more room to run.”

Now that’s spin, just pure spin. Level the playing field? Really?

Even assuming wages actually rise with inflation, they will “run” right alongside rising prices.

This means ordinary consumers in an inflationary setting are akin to roller skating uphill or jogging on a treadmill—namely, lots of work, no progress.

Any economist, hell, even any econ student, already knows that deflation (lower prices) helps ordinary folks far more than inflation (higher prices).

But Swonk’s dumb got really dumb at the end, when she used the words “a little inflation,” as if the Fed could contain inflation like a thermostat.

Perhaps Swonk never studied inflation when becoming an “economist,” as inflation is set by forces far greater than central banks, though it certainly can’t keep the Fed from lying about how inflation is measured.

But when it comes to debt-broke countries, inflation can be a nice way to pay down debt—at least until interest rates spring out of control.

The Fed’s Target Audience—It Aint You

Folks, I hate to be a cynic or bearer of hard facts (or do I?), but let me remind you again what everyone in Wall Street already knows: The Fed, especially since Greenspan crawled into the Eccles Building, serves banks and markets, not employees and Main Street.

In case this seems hard to believe, just look at the cold facts set forth here, here and here.

The reason the Fed is “allowing” higher inflation is not about price measures or “leveling the playing field” between Main Street and Wall Street; it’s about money supply.

By printing more dollars, the Fed is deliberately creating the true definition of inflation, which is tied to money supply, not pricing.

More inflation via trillions more fiat dollars makes paying off government and corporate debt easier.

However, it certainly, doesn’t help the dying middle class attain “a better chance of getting reemployed” or a feel any better when their now inflated bills are due.

You see, big debtors, like those at the Treasury and the US bond market, love diluted (i.e. inflated dollars), which is why the Fed is printing more off them.

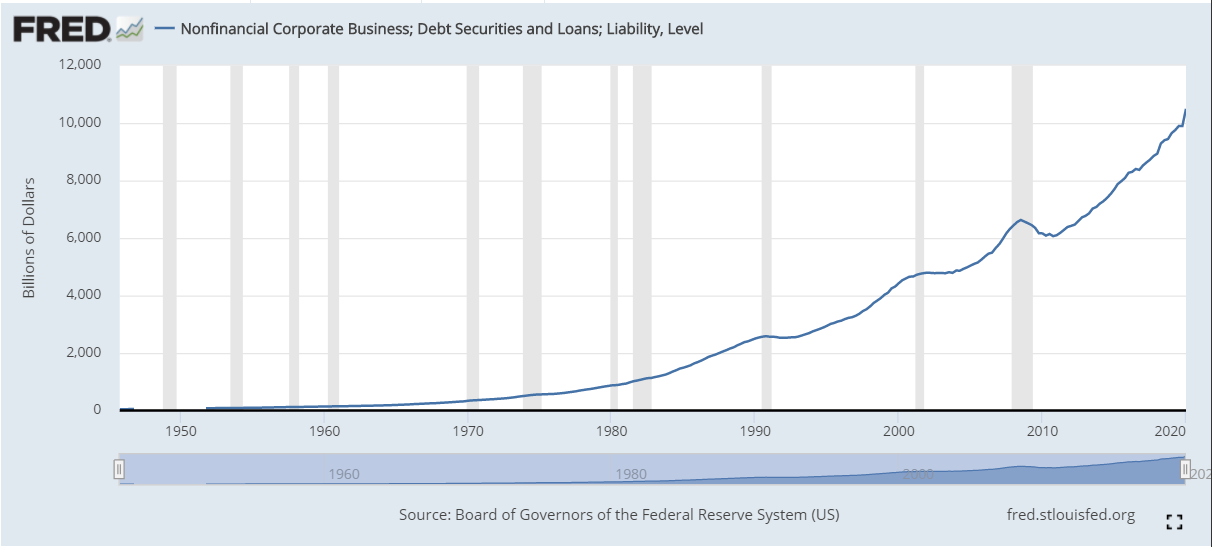

Don’t believe me, just look again at the following graph:

Of course, “economists” and spin-sellers like Swonk like to bend facts behind nice phrases totally devoid of context or truth.

But no one, of course, bends truth better than the Fed.

More Pinocchio Speak

On Wednesday, Powell said the foregoing “stimulus” would be needed as long as the pandemic crisis continued; he also said jobs were forefront on his mind.

Pinocchio could not have said it better.

The only thing forefront in what’s left of the Fed’s mind is to: 1) “sustain smooth market functioning,” and 2) repress the yield (.69%) on the 10-Year Treasury and the cost of debt (i.e. interest rates), as Uncle Sam has now dug itself (and your country) into the greatest debt hole in US history.

“Allowing inflation” (i.e. diluting more dollars) and repressing interest rates is the Fed’s feeble attempt to dig out of this self-created hole with 3 fake shovels: money printing, inflation and artificially repressed interest rates.

Such policies have almost nothing to do with the real economy, which all of us know is suffering.

Just walk outside and see for yourself.

Looking Ahead: The Markets

Notwithstanding all the damage unlimited QE and Grand Canyon-like debt holes do for an actual economy, the question on investor’s minds is simple: What about the Fed-doped stock market?

But here’s the rub: This isn’t a stock market anymore. It’s a Fed Market.

The kind of centralized control of interest rates, dollars and risk asset inflation we’ve seen since 2009 in general and yesterday in particular is simply not a setting for free market forces, and thus simply not a context for measuring free market dynamics.

In essence, the securities markets are now one big nationalized 401K supported (for now) by artificial money and artificially repressed interest rates.

The trillion-dollar question is thus obvious: How long can artificial Fed forces repress natural market forces?

For now, the futures markets actually dropped by 200 points on yesterday’s “accommodative” news—which is a bit telling…But volatility and irrational exuberance, even a melt-up, are not off the table going forward.

So, when will it all end?

As I’ve said countless times, I have no clue.

I’ve been humbled. The Fed is powerfully stupid, but it’s also powerfully effective in artificially inflating risk assets.

In the near-term, as well is for the last 12 years, the Fed’s “accommodation” has meant every dip was a buy—even big dips, as seen in late 2018 or early 2020.

But as I’ve also written countless times, we are in uncharted waters now, and it would be unwise to assume that risk has been outlawed or that the Fed will not hit an unprecedented uh-oh moment when this fantasy of QE and debt without tears comes to an historical, even revolutionary end.

I’ve written extensively on the risks as well as hubris of thinking that repressed interest rates can’t naturally spring to levels that bring debt markets to their knees, and with it, the stock exchanges that rely upon that debt.

The Fed’s toxic love affair with debt and the risks of un-containable inflation (and hence rising interest rates) are real, and discussed at great length here and here.

My advice is to consider those risks soberly and carefully.

As for managing those risks as well as navigating this “accommodation,” we do so carefully and based upon real-time market signals, not just long-winded macro views as outlined above.

In the end, our portfolio solution combines sobriety with daily signals from the markets, not from bonks like Swonk or Pinocchios like Powell.

As always, we invite sober realists to join us here, and for the rest of you, simply stay informed and tread carefully.

Sincerely, Matt & Tom

We have massive, unprecedented inflation… except it’s asset inflation. Every Asset owner including Senators, Congressmen and Fed officials are riding a Fed binge in stocks, housing, p/e etc. They are enriching themselves. It’s fraud and virtue signalling that would take the breath away from the most fervent antifa demonstrator. The Fed and Treasury are manipulating markets in a manner that would put you and I in jail.

The most important aspect of a market is that it sends a price signal about risk. Marx had it right. Let’s just wait for Mandrake to look for the exit. It’s hard to levitate when you can’t find the door.

Dave, Amen…