Portfolios Built by Wall Street's Best

The legendary Warren Buffett said this of investing: “Rule 1: Never lose money. Rule 2: Never forget Rule 1.”

The key to growing your wealth is just that: Avoid rare but massive losses. Our market and macro insights keep you a step ahead, providing an undeniable edge that maximizes gain while limiting loss in any market environment.

We build and share our portfolios with all investor and income levels using key concepts hitherto available only to Wall Street’s top 1%. We reduce the complex by using Main-Street language and clear charts that provide a market edge, from sector rotations to money flows, leading indicators, yield curves, proprietary timing tools and more.

We actively manage our Portfolio Suggestions and Model Portfolios to protect your hard-earned wealth and keep you ahead of the game rather than guessing in the dark.

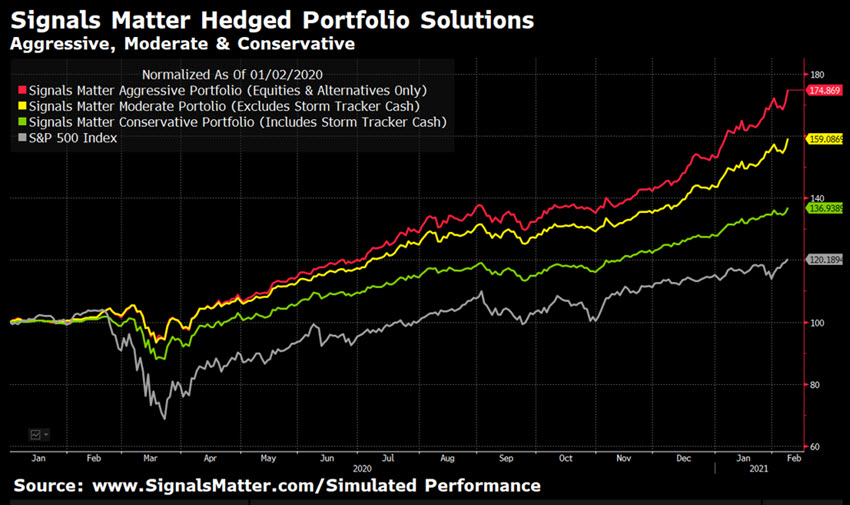

Hedged solutions applied within each of our Conservative, Moderate, and Aggressive Portfolios enable market-beating returns with less volatility, unleashing the power of compounding.

Our Suite of Portfolio Solutions

Past performance is not indicative of future results.

Is Your Current Portfolio Built for the Next Inevitable Recession?

Did you know? The S&P 500 is currently in a delicate and decisive moment. During and following prior recessions in 2001 and 2009, the S&P lost 50% of its value. A similar and inevitable slide would take the S&P back to prior peaks in 2000 and 2007. Don’t let your hard-earned wealth fall that far.

We are here to help. Secure your wealth with a truly diversified portfolio, built to succeed in any market environment. You ride the gains with our simple-to-manage portfolio solution without the volatility (i.e. stressful price swings) of standard investment approaches.

BUBBLE TROUBLE

Mean Reversion Ahead? What Would Happen to Your Portfolio?

Source: www.SignalsMatter.com