Below, we look at a market Fat pitch, compliments of the Fed’s strong right arm–a money printing fast ball that will be a home run for the stocks and bonds outlined herein.

54 shares

Last week, the Fed rolled out the money printers yet again, to engage in a $60 billion monthly bailout of the Treasury market – specifically in the short-duration (six months or less) T-Bill space. That’s a market fat pitch.

Annualized, this money-printing adds up to another $720 billion in fiat money creation and nosebleed-level deficit financing.

Holy cow… here we go again. Pure desperation mode at the Fed – and a golden opportunity for those who see right through it.

Let’s discuss…

Fed Speak or Pinocchio Speak?

The Fed says this most recent round of money printing (and market fat pitch) is NOT quantitative easing (QE).

But as with inflation, employment data, and GDP reporting, the Fed is once again doing what it does best in times of panic – lie.

No surprise there at all.

One needs to think of central bankers as a cadre of little men and women in red overalls equipped with Pinocchio noses. This makes their policies far easier to grasp.

Take the Dallas Fed President, Robert Kaplan, who openly admitted last week that the need to print new money was directly related to a recent treasury issuance.

But Kaplan also said that such printing (a market Fat pitch) didn’t constitute QE despite his nose growing longer with each word spoken.

Mr. Kaplan: When a central bank prints money out of thin air to buy otherwise unwanted Treasuries – that is the very definition of QE.

In short, QE is back because the artificial, Fed-supported system is once again cracking at the seams. But remember: Bad news is good news in the Twilight Zone.

This Is Crazy – The Dollar Shortage

Our totally rigged to fail markets have crossed yet another fine line from the sublime to the ridiculous.

The simple fact is that the U.S. system is running out of dollars to keep its Fed-driven economic machine greased.

We saw this recently when the U.S. repo market blew apart last month, prompting the Fed to immediately (and I mean immediately) print more money and dedicate over $1 trillion in rollover repos into that broken machine.

The Fed said this measure was only temporary. Now, the Fed is pushing repo support into 2020. Again, think Pinocchio.

Last week, another “supply and demand mismatch” occurred in our Treasury market. That is, there was simply not enough dollars to buy short duration treasuries.

Solution? Easy – print more money…

The bottom line is there just ain’t enough dollars to go around.

The fancy lads call this a “dollar shortage.” We call it a recipe for disaster – as well as an opportunity to make money in what amounts to yet another market fat pitch–so wing away!

That is, rather than laugh or cry at just how bizarre and dishonest things have become in the “new abnormal” of the U.S., let’s just take advantage of this balancing act between dishonest and crazy and make some smart money – for the Fed is now handing us three market fat pitches.

But first, let’s talk about how we got here, where we are now, and how we can take advantage…

How We Got Here

At $72 trillion and rising, total combined U.S. government, household, and business debt has never been higher or more unpayable. We all know this now. The Fed does, too.

Unfortunately, sometime between the Second World War and the birth of Netflix, America stopped producing an income commensurate with its debts.

Solution? Just go deeper into debt and ignore the elephant in the room. Or, to use a different metaphor, just keep kicking the debt can down the road.

But that’s not much of a solution.

The utter lack of economic courage and fiscal honesty from our economic elites is nothing short of staggering. Years from now, our children and grandchildren will read of this period in utter astonishment.

Today, the U.S. lives off debt, which means it lives off issuing more and more bonds each year to stay afloat. It’s that simple and that pathetic.

There you have it. America in a nutshell: a debt Frankenstein’s monster kept alive by a cartel of Pinocchio’s printing money and telling you this is a sustainable solution.

Everything Hinges Upon Low Rates – Hence More Faking It

With such a debt nightmare before us, the only way to sustain this is to keep the cost of that debt down.

Everything hinges upon this.

And the only way to keep borrowing costs down is to keep interest rates down, and the best way to keep interest rates down is to keep treasury bond yields down.

And the only way to keep treasury yields down is to keep their prices up (price and yield move inversely).

And the only way to keep bond prices up is if someone (or something) is buying those bonds.

And if no one else will buy those bonds, then that “thing” (otherwise known as the Fed) can simply print money and buy the bonds itself.

Again, that’s not capitalism; it’s faking it.

Where We Are Now

Last week, our Fed did precisely that – more faking it with a nervous smile and a Pinocchio nose.

The Fed committed to printing $60 billion a month of QE to purchase short-duration U.S. Treasury Bills at the same time it aims to further cut interest rates. That’s a market fat pitch for short-term Treasuries.

I have to hand it these Pinocchio’s. They move fast when they are desperate and lying.

Remember, precisely one year ago our Fed was promising to “tighten” rather than “ease” its balance sheet, and the aim promised then was to raise rates three more times.

But we all know what happened last October. The markets began to unravel, and by Christmas Eve, they fell apart. Debt and rising rates can’t work – and the Fed discovered this by New Year’s Eve…

Thereafter, the Pinocchios gathered their cheat sheets, polished their noses, and then fully pivoted in March, committing to further rate cuts rather than hikes.

As of today, we’ve gone from a 2018 of Quantitative Tightening to a 2019 of full-on Quantitative Easing – all in the course on 12 months.

That is what I call a panic in the Twilight Zone.

Taking Advantage of the Pinocchios–A Market Fat Pitch

The Pinocchios running our Fed have long ago confused the stock market with the economy. Today, the stock market is our economy. Sad but true.

And with the Fed cramming rates to the floor of 5,000 years of market history while printing money like Ponzi scheme maestros, one can, at least for now, expect the desperation to continue and hence the markets to temporarily rise.

That’s a market pitch we’ll want to swing at for the near-term.

The Fed’s entire narrative now rests upon more steroids, and they won’t go down without a fight.

How do we know this?

Well, in order for this broken machine to stay alive, the Fed is desperately aware that the U.S. stock market needs to rise in pace with, or above, the U.S. Treasury market.

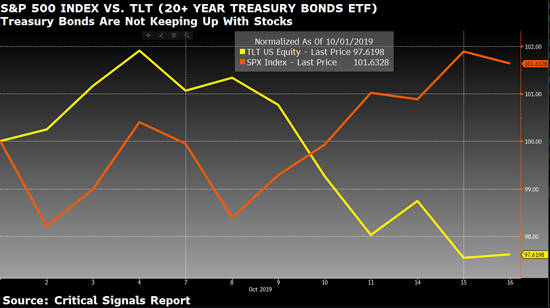

That’s why we track the S&P 500 Index (SPX) against the iShares 20+ Year Treasury Bond ETF (TLT).

Since last October, the SPX (in yellow below) has not been keeping up with the TLT (in orange below), but has in fact fallen sharply against it.

The Fed knows that debt keeps the companies within the SPX alive and that if the cost of that debt rises (i.e. if short-duration debt prices tank and hence yields/rates spike) the party ends brutally and swiftly.

Last week, the Fed saw that no one was buying short-duration T-Bills, and thus brutally and swiftly stepped in to buy them, thus keeping short-term yields artificially suppressed.

Three Market Fat Pitches Ahead

This means a number of things for informed investors in the near term, namely…

- The S&P 500 Index (especially the tech names) will rise for now, as the Fed just bought the stock markets another round of cheap debt beer to keep the party going…Market Fat Pitch No. 1.

- If the Fed is openly purchasing T-Bills, it goes without saying that short-duration Treasuries are going to go up in price, not down. That’s Market Fat Pitch No.2. It’s essentially a Fed “front-run”…

- And if the Fed is printing over a trillion dollars to finance its own debt and bailout both short-duration treasury and repo markets, then it equally goes without saying that more printed money means weakening purchasing power for dollars and ultimately a longer trend up for gold and silver. That’s Marekt Fat Pitch No.3.

In short, and despite some inevitable pullbacks here and there, the Fed has just signaled a temporary but undeniable buy signal (or market fat pitch) for: (1) the S&P 500 Index; (2) short duration T-Bills; and (3) gold and silver, like the SPDR Gold Shares ETF (GLD), which tracks the bullion rather than the stocks, and the iShares Silver Trust ETF (SLV).

Sadly, most retail investors are getting this wrong, and thus not swinging the market fat pitch.

Instead of piling into short-duration Treasuries, they are going further and further out on the yield curve to get a tiny smidgen of extra yield on longer-dated Treasuries, like the 10-, 20- or 30-year Treasury bonds.

Bad choice. For just a tiny bit of extra yield, they are exposing themselves to considerably more inflation and rate risk down the road.

Why? Because such investors believe that Pinocchio has outlawed inflation…

The Bigger Picture

Despite the above market fat pitch handed to us by the Fed for the near-term, the dangers underpinning the longer-term scenario are equally hard to deny.

Whenever a central bank has to rely upon a money printer to get markets out of a pickle, it’s a fairly obvious signal that things are economically falling apart.

What’s falling apart right before our eyes boils down to this: a chronic dollar shortage.

Again, we’ve seen the signs of this twice in just the last four weeks. Once in the repo markets and now again in the Treasury auctions.

There’s just not enough dollars to meet debt demands.

What’s even worse is that this dollar shortage is not just a problem within the U.S.

Instead, it’s a global problem.

As I recently wrote with regards to the Eurodollar disaster, U.S. dollars held overseas have been multiplying like cancer cells, as bankers around the world (and outside of Fed control) lever-up these dollars into increasingly desperate and dangerous derivatives instruments – yet another grotesque quadrillion-dollar time bomb ticking beneath our markets.

Yet as these overseas U.S. dollars multiply beyond the control of the Fed, they are also getting “clogged in the pipes” of these highly complex and ultimately unmanageable derivative instruments.

Stated otherwise, these U.S. dollars are “stuck” in a banker’s mud, and thus at the very same time the U.S. Fed is running out of dollars in its repo and Treasury markets, further and even more dramatic dollar shortage events face global markets.

In short, there’s going to be even more need to print dollars down the road, and thus more chances to swing at a market fat pitch.

But at some point, the stimulative effect of those fiat dollars is simply going to end – which means the party here and abroad will end, too.

For now, however, the party continues, thanks to a market fat pitch handed to us by a resurgence of printed dollars and an increasingly desperate Fed running out of both solutions and credibility as the mismatch between dollars needed and dollars printable slowly crawls toward a brutal moment of “uh oh.”

This all ends badly. Very badly.

Unless, of course, you think printing dollars for infinity is a solution.

If so, we’d like to introduce you to Pinocchio.

Sincerely,

Matt Piepenburg

Comments

7 responses to “The Fed Just Gave You a Buy Signal for These Three Securities”

- Robert L. Tompkinssays:

Matt, I like your humour!! Necessary to have some in these times.

- andrew hubert willmannsays:

OK,OK but what is PRACTICAL conclusion in 50 words?????

Andrew

- Lindysays:

Hi Matt,

I simply love reading your post. Your writing on the economic state is painful yet vibrant and with integrity, well analysed. Do you have a paid membership for your recommendations? Also, why don’t you write for your readers, based on your experience, the strength and weakness of buy call/put options. With your clarity of thought, much could be gained from such a dynamic thinker as you are.

Thanks

- Dudley Tipton says:

We need a year of Jubilee where all debts are forgiven, property is returned to the original owners and we have a fresh start in 2020!

Jewish citizens in Israel have practiced this over the centuries in 50-year increments and it solves the problem where debt becomes unsustainable.

- Michael Dunsiresays:

Absolutely spot on brilliant article.

- Lyle J. Ratnersays:

Fun Fun Till your daddy takes the T Bird away. Sound like something we have seen before?

Love your work! Keep it up.

Lyle

- Jonathan D. Johnstonsays:

Thank you for the report. Artificial intelligence seems to always create challenges which require integration of human minds. Keep us updated.