Is a market melt-up coming? Yep.

73 shares

For most of 2018, I warned my clients of a yield/interest-rate spike in Q4 that would send markets tanking and wipe out any gains for the entire year, which is precisely what happened.

This was easy to see for one simple reason and signal: The Fed.

Namely, Powell was nervously, yet wisely, raising rates and tightening his balance sheet in order to give the Fed more ammunition for the next market downturn.

Heck, he even forewarned the markets of this “tightening” in late 2017. His “forward guidance” meant more bonds were dumping into the 2018 market, which meant three things: Bond prices would fall; bond yields would rise; and hence interest rates would go up with bond yields.

The rest was simple, but Powell didn’t see it–we did. In a market driven by historically unprecedented debt levels, those rising rates were like shark fins to a surfer: bad news.

Hence, the market promptly got eaten alive in Q4 of 2018 and early 2019. The bear (rather than a shark) had roared. We knew it would begin in October, as the was the month the Fed promised to sell the most bonds at once—hence the fatal yield (and rate) spike.

But then something bullish happened…

Specifically, the Fed famously pivoted in March of 2019, stopping the rate hikes (and soon to be cutting rates, mark my words).

And now, markets, led by the balance-sheet-challenged tech sector, are once again ripping north due entirely to a forward-guided “pause” in rate hikes and the Fed halting its balance-sheet tightening which began in the fall. Soon, they’ll be printing more money (“easing”) again, mark my words on that as well—likely by the end of 2019.

This suggests a market melt-up is heading our way.

In short, the Fed just signaled another green light for markets to rise. Simple as that, the Fed has handed the markets another “fat pitch.” Folks, it’s a “Fed market,” not a stock market…

Whatever one thinks of the Fed, we can all agree it is now the number-one signal and driving force behind U.S. stock and bond markets.

And if the Fed is sending us another green light, we have to take the potential for a market melt-up seriously, which is why even a dumbfounded Fed and market critic like myself is turning temporarily bullish – real bullish for 2019.

The Seven Tailwinds for a Market Melt-Up

So, let’s look at some key reasons why we could likely see the DOW and S&P break all-time records and trend up in 2019.

Reason #1: The Fed – of Course

Again, if the Fed keeps its word, keeps rates low, and keeps its balance sheet from tightening, markets will rise. Plain and simple.

Since 2008, the U.S. central bank has completely taken over – and thus distorted – normal price action in the markets. Again, today’s stock and bond market is literally a “Fed Market.”

The evidence is crystal clear. In 2009, the Fed printed wheelbarrows of money ($3.5 trillion) to buy the toxic securities that our reckless banks had wrongfully packaged, sold, and held – single-handedly destroying the U.S. economy in 2008.

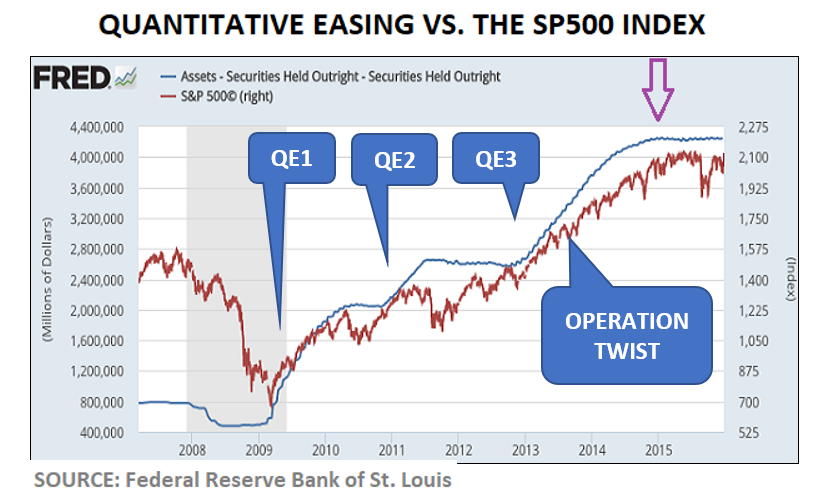

The Fed’s subsequent “emergency measure” was euphemistically called Quantitative Easing; here, I’ll call it “QE1.” But it was just “faking it” as a blatant market steroid, pure and simple. Just look (further below) at how the markets reacted after QE1 began in November of 2008…

But like any steroid, quick fix, or whiskey shot, such stimulus can quickly devolve into an addiction. Thus, in November of 2010, the markets asked for – and the Fed delivered – a little more: QE2. And as expected, the markets got high…

And by this point, markets were not only drunk, but full-on addicted.

Addiction, of course, needs more steroids to thrive, and thus, once again in September of 2012, the Fed pumped in another batch of printed money – QE3 – and once again, the markets peddled even higher…

This was getting crazy – even embarrassing – so when another kind of “steroid request” came in from Wall Street in 2011, the media and the Fed tried to give it another name, which they cleverly called “Operation Twist.”

Call it whatever you want, but again, it’s just “faking it” and simply boiled down to a clever Fed maneuver to reduce long-term rates (short-term rates were already at zero) and thus encourage more “debt solutions” to an existing debt problem.

Taken all together, none of us can deny how these market steroids propped up the biggest and fakest market bubble in the history of capital markets…If you don’t believe me, just look at the facts:

Officially, this “money printing” ended in late 2014, and as expected, the markets immediately panicked, and Wall Street threw a hissy fit, like the spoiled child of the rich Uncle Fed…

Low Rates Help Too…

Naturally, the rich uncle came to the rescue of its spoiled nephews on Wall Street, as the Fed now measures the real economy by the stock market, not tanking GDP. Not long after the markets dropped, they immediately rebounded on more low-rate debt, the second “syringe” in Uncle Fed’s dirty bag of steroids.

As a result, the markets now know their rich Uncle Fed will break out more QE when the markets really tank again, typically around the time of the autumn repo market “re-tweaking,” which means the markets can still act like drunken kids on spring break – free of all fear and only looking to get lucky at every turn.

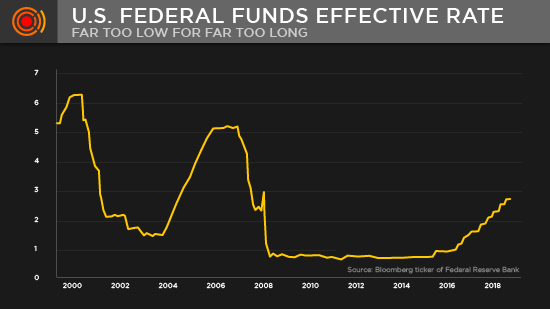

Notwithstanding this magical money printer, the Fed still has this other steroid in its dirty medical bag, namely low rates – in fact, once it even had zero rates – known as ZIRP, or “the Zero Interest Rate Policy.”

This lasted from 2008 to 2015. Thereafter, the Fed took baby steps to raise rates (eight times in two years), but at 2.4% today, this interest rate is still ridiculously low by any historical measure – effectively giving the markets a “zero-bound” interest rate market. And mark my words, the Fed will be lowering rates again soon…

Just look how low rates are today compared to their historical averages…

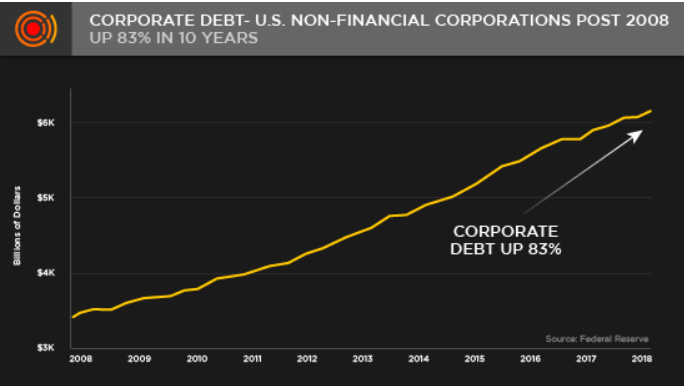

Of course, when interest rates – i.e. the cost of borrowing – are this pathetically low, everyone borrows, including the companies in our stock and bond markets. Since 2008, this borrowing spree has surpassed all-time records, and now U.S. companies have more debt than at any other time in U.S. history…

Such debt levels guarantee – and I mean guarantee – that markets will eventually collapse in equally record-breaking fashion under the weight of their own decadent borrowing.

Just as sub-prime mortgages ushered in the 2008 crisis, bad corporate debt will usher in the next crisis.

But this won’t happen until interest rates rise, and for now, the Fed is doing “whatever it takes” to keep rates stapled to the floor. Literally everything hinges on this point alone: keeping rates low.

And to keep interest rates low, the Fed has two very powerful “tricks” up its sleeve. First, it artificially sets them low.

Second, because interest rates rise when inflation rises, the Fed blatantly lies about U.S. inflation, a clever little Wall Street secret that I have made mathematically clear in a full report, The Inflation Lie. Full stop. Period.

Despite such dishonesty, debt, and distortion, we must accept the signals for now and not “fight the Fed.” Because now, however disingenuous, “acommodative,” heroic (to some) or corrupt (to others) the Fed is, we must nevertheless accept that even a corrupt cop is still a cop. In other words: Don’t fight him…

Again, as long as the Fed wants to (and can) keep rates low, the markets will continue to rise.

Reason #2: Accounting Tricks and Rising Earnings

Speaking of corruption, another little insider secret on Wall Street is a legalized accounting trick called “ex-items” accounting, which – like Al Capone – allows companies to carry two sets of “financial books” – one that’s real, and one that’s fake.

The fake set of books is the one the market sees, and it allows broke companies to otherwise look profitable. I have written an entire report on this: The Profits & Earnings Lie, and I won’t go into details here, but suffice it to say this accounting trick makes earnings look better than they really are, and so long as earnings appear strong, the markets go up.

Today, earnings are “strong” on the surface.

Again, the fact that these earnings are empirically dishonest is not the point now; dishonest or not, rising earnings push up markets, and like the dirty-cop Fed or that dirty-cop earnings game, one can’t fight it. One can only ride with it for now, and we see a nice rise for 2019 by year end.

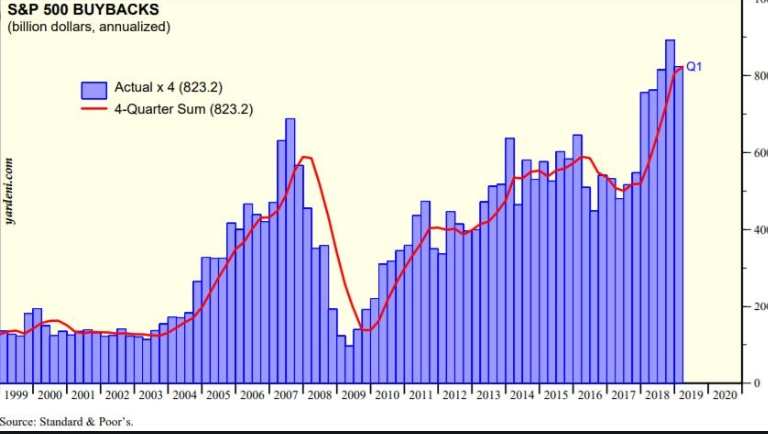

Reason #3: Stock Buybacks

As mentioned, the Fed has artificially (as well as dishonestly) kept rates low for over a decade; this means over a decade of record-high debt in the markets. Companies have used this debt to buy back their own shares at record levels since 2008…

Stock buybacks push markets up, for when companies buy back their own shares (i.e. drink their own Kool-Aid), the size of the share pools shrinks, and thus the value/data on the earnings per (reduced) share count artificially goes up, sending more investors chasing after stocks and thus pushing the markets up even further.

Furthermore, with companies buying their own stocks, this pushes up the price of the shares, accounting for at least 20% of the market’s “gains.” Such practices will be a further tailwind for the market melt-up.

Reason #4: Investor Confidence

At the end of the day, markets run on faith, and faith loves good news. Markets are no different – they run on good news, not real news, and certainly not really bad news.

The markets, for example, have been telling us for years about record-breaking “synchronized global growth,” “low inflation,” equally “record-breaking low unemployment,” and even “profits and earnings surges.”

That’s all good news – great news. But again, and as I’ve shown mathematically elsewhere: Not one word of this is objectively true – not a word of it.

But as I’ve also said, there’s no use in fighting a corrupt cop, corrupt Fed, corrupt accounting, or even a bias-contaminated and sell-side financial media if the markets are otherwise drinking the spiked Kool-Aid.

As I’ve written elsewhere, the greatest lie behind this otherwise duped investor confidence is the record-high job data coming out of D.C., which my free report The Unemployment Lie completely demolishes.

For now, the majority of trusting yet misinformed investors still think all of these “good news” reports are true, and thus the markets will continue to climb on this “fake news,” – a phrase we are all otherwise tired of hearing…

Reason #5: Politics

Whatever one’s politics, be it red, blue, or polka-dotted, we can all likely agree that politicians of every era, stripe, and leaning are primarily driven by one thing: Staying in office – i.e. getting re-elected.

And nothing, and I mean nothing, kills a political career like a tanking market and tanking economy. One can just look at the terms of Jimmy Carter or the first George Bush for confirmation of this.

As for 2019, the last thing our current administration wants is a financial meltdown before the 2020 elections. That’s why it put such inordinate pressure (or a “tweet storm”) on the Fed to pause the Fed’s prior rate-hike trend and balance-sheet tightening in March of 2019.

And the Fed, as we all saw, quickly and obediently bent to Washington, D.C., which is funded by Wall Street. There are five financial lobbyists from Wall Street for every member of Congress in D.C.

Such pressure to keep the Fed “dovish” cannot and should not be underestimated. There is tremendous pressure to keep the Fed “acommodative” – and thus the markets rising on lower rates – into 2020.

Furthermore, any potential political “good news” quickly sends markets up. Take the tariff war with China. I’ve examined this is in great depth in a separate special post on China as well, and the math confirms that nobody wins a trade war, no matter how much (and justly) we want to stick it to China.

That fact aside, any good news regarding a “trade agreement” with China, or even talks of an agreement, will act as a short-term political tailwind for a market melt-up.

The unspoken fact, however, that both the U.S. and China are otherwise too over-their-skis in debt anyway will be largely ignored in the short term.

Reason #6: The U.S. Is the Best Horse in the Global Glue Factory

We have already shown (and will continue to reveal) just how fundamentally debt-soaked, Main-Street-sick and collectively (as well as historically) broke the U.S. is today. The data is objective and staggering.

But as someone who lives half the year in Europe and tracks global markets obsessively, I can report that as bad as conditions are in the U.S., they are even worse in Europe and Asia.

Again, we provide separate and extensive data confirmations elsewhere on the levels of debt and recessionary pressure in places like China and its real estate bubble or Europe, rotting from within thanks to Italy, Greece, Spain, and Brexit. For now, I am sticking to broader themes.

And the key theme to point out today is that European and Asian economies are poised to crash prior to the U.S. markets.

This means there could be a brief but very real period of foreign investors seeking a “safe haven” in U.S. markets, a force that will be a temporary but massive tailwind for otherwise dangerously over-valued U.S. stocks and bonds.

Right now, year-to-date flows from overseas confirm that the U.S. is still a “safe haven” – the best horse in the global glue factory.

Reason #7: War Is Good for Markets

Contrary to both common sense and popular assumptions, both the facts of math and history confirm that war has been universally good for U.S. markets.

Once again, I have written a full and separate report on this, War Is Sadly Good for U.S. Markets, but I want to touch on some key themes here.

The simple facts boil down to this: When the world is fighting, money comes into the U.S.

After the Iraq war opened in 2003, for example, hundreds of billions of dollars flowed into the U.S. markets from the Middle East as NATO bombs landed on Baghdad. Between 2003 and 2008, the Dow rose steadily upwards.

During the Vietnam War (which killed 58,000 Americans and 1.2 million Vietnamese), the Dow gained 53%. When the war ended, the markets promptly fell – and fell hard. In the 1970s, unemployment, inflation, and market risks skyrocketed.

During the Great War (1914-1918), the Dow nearly doubled.

And as for WWII, the Dow rose by 164% between Pearl Harbor in 1941 and V-J day in 1945.

If one were to follow such simplified historical correlations, one might defy logic and be bullish rather than bearish in times of war – especially during our modern version of permanent war.

In the Middle East today, there are now eight countries officially at war involving over 160 different militia, separatist, and anarchist groups. And as for the globe in general, today 61 countries are actively engaged in war, with 540 anarchist, separatist, and rebel groups falling beneath this sad, statistical umbrella.

In short, as the world struggles in military quagmires, money flows to the “safety” of U.S. markets. Both the US and Israel don’t like Iran, for example, and are itching for an opportunity to expand a war there, so be on guard…

Other Reasons Markets Will Rise

In addition to each of the foregoing tailwinds, numerous data-focused experts have tracked other trends and cycle metrics, which point to near-term spikes in the U.S. markets prior to an inevitable and historical crash.

There are some, for example, who track the economic data and cycles of a long-dead Russian economist killed under Stalin. This otherwise unknown economist’s pattern recognition was remarkably accurate in predicting booms and busts based on political division metrics, wealth disparity peaks and sovereign debt level data.

According to such metrics, the U.S. is ripe for one last market surge before a final and crushing collapse.

Others track demographic and Fed data with consistent accuracy, and they too are calling for a melt-up cycle in the near term, one that follows historical patterns (1748, 1838, 1928, 2008) that lead to a last-gasp, needle-peak high just before collapsing into a significant, historically painful crash.

Given these cycles, as well as each of the points and tailwinds we track at Signals Matter, there is abundant evidence to foresee U.S. markets making a final and significant surge to record-breaking highs, with a Dow well past 30,000, which in fact is just 15% higher than where it is today.

At Signals Matter, we will guide you through this melt-up cycle to capture these tailwinds and massively improve your portfolio returns.

One other and important caveat we are noticing, however, is that unlike prior market melt-ups, such as in the late ’90s, we are not seeing the same “exuberance” or “mood” in this otherwise “most-hated bull market” in recent history.

That is, despite many similarities with past melt-ups – i.e. tech surges, rising IPOs, and excess valuation spreads – the evidence of “exuberant over-valuations” and ecstatic investor sentiment is generally not as pronounced this time around, but that can change on a dime, especially if more money printing kicks in this year.

In this way, the recent rise in markets after the December pains may already be evidence of a more tempered “melt-up.” In the end, the degree of this melt-up will hinge on interest rates and/or money printing, and thus dangerous Fed manipulation/engineering.

In short, things are altogether “weird” out there, and the temporary rise ahead faces an even bigger fall thereafter—be it months or years down the road.

We will warn you about the market meltdown that follows the melt-up. In our next report, we’ll show you eight reasons/triggers for the equally inevitable (and historical) meltdown to come.