Mark Twain once quipped that a lie can travel around the world faster than it takes the truth to put its boots on.

But now the truth behind years and years of open lies masquerading as fiscal or monetary policy (as well as the increasingly obvious manipulations and distortions in the paper gold and silver markets below) is slowly putting its boots on.

In short, the truth, like a cork, is gradually rising to the surface.

A Market History of Dishonesty Labeled as Policy

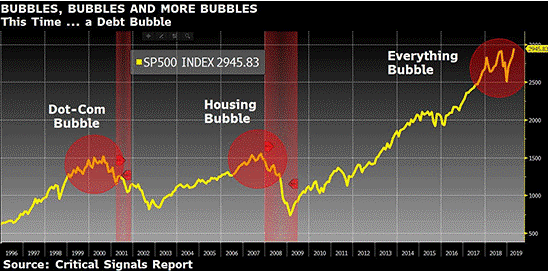

Retail investors, for example, are increasingly opening their eyes to the obvious fantasy, as well as rigged game, of central banks printing money out of nowhere to artificially sustain risk asset bubbles which largely benefit a minority class of linked beneficiaries.

As an avowed capitalist, I’m all about big pay-days, but the salaries of certain hedge fund managers (2 of which I once allocated to) raking in all the rewards of a tailwind bubble fabricated by the Fed defy the definition of “earned income”…

The Bogus Bailout

It was no shocker, for example, that Hank Paulson, the former Goldman CEO turned Treasury Secretary, reacted to the Great Financial Crisis of 2008 by bailing out the very TBTF banks that caused it.

From Temporary QE to Unlimited QE

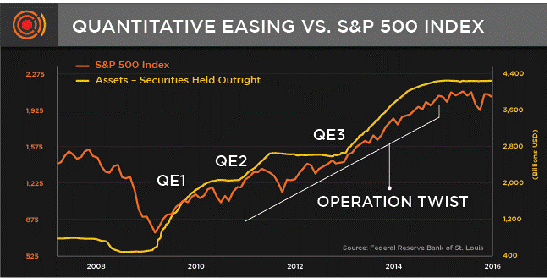

Nor was it a shocker that Bernanke’s promised “emergency measure” of the “temporary” QE1 of 2009 would not end, as promised, by 2010.

Instead, the temporary became an addiction, as QE 1-4 and Operation twist morphed into now “Unlimited QE” to support broken markets well into 2021 and beyond, thanks to equally desperate Fed successors like Yellen and Powell.

The Bond Lie

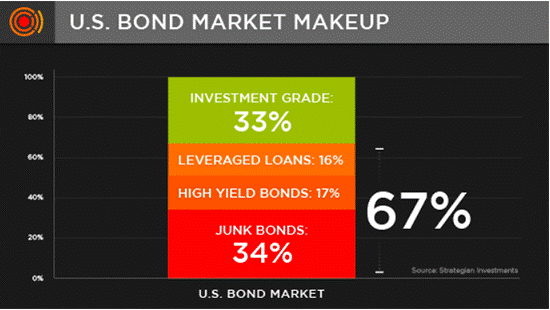

The net result of this “accommodation” was artificial buying of a bond market which is now the greatest and most dangerous asset bubble in the history of capital markets.

With greater than 60% of these bonds at the bottom of the credit class, the idea of bonds as a “safe haven” asset is now an open lie.

DC and the Fed—Openly Strange Bed-Fellows

And now, as Yellen makes her move from the Fed to the Treasury, the insider game of putting fancy lads into fancy offices to continue otherwise rotten “accommodation” policies rolls forward.

Of course, the media applauds the now overt irony of the “dollar princes” marriage of the US Treasury and Federal Reserve.

In short, expect far more “accommodation” and currency debasing “stimulus” from DC.

As I’ve said elsewhere, placing Yellen at the treasury makes as much sense as placing Madoff at the SEC.

Wealth Disparity Too Big to Hide From

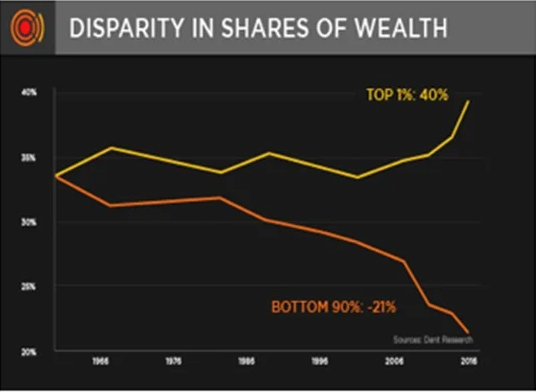

All these open-secret mechanizations along the DC-Wall Street corridor have been an absolute boon to the top 1%-10% who own (and have enjoyed) well over 80% of the inflated risk asset bubble returns.

The correlation between central bank “stimulus” and S&P inflation, for example, is simply obvious.

And yet, Powell, with a hubris and disingenuity that would make a car salesman or real estate broker blush, continues with his denial that Fed policy has any impact on the middle-class economy.

The wealth disparity which has grown in the last 10+ years has a direct correlation to such insider, rigged and grossly failed, pro-Wall Street bubble policies, resulting in the kind of wealth disparity which can no longer be brushed under the carpet or blamed exclusively on COVID.

Emerging from such lies masquerading as policy is a real economy on its knees and soaked in record breaking debt, while stock and bond markets violate every rational measure of sound valuation.

The Great Inflation Lie

In addition, the fiction writing team at the Bureau of Labor Statistics have been engaged in some fantastic math distortions on everything from unemployment to inflation reporting.

The games they play would require pages not paragraphs to unpack, but suffice it to say here that by tweaking the CPI methodologies behind inflation reporting, the BLS has effectively been able to convince the world that 2+2=1.

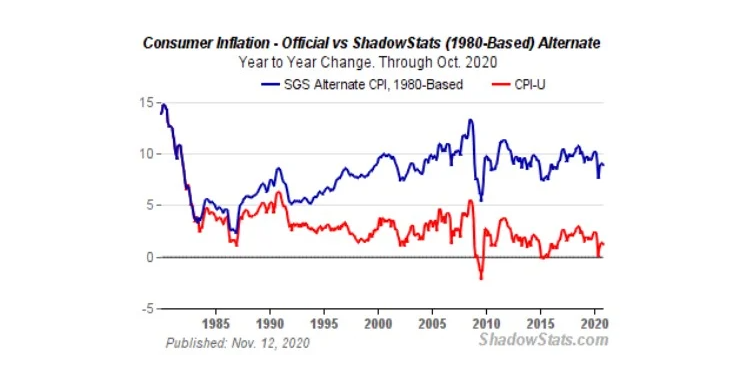

By way of simple reminder, if the BLS were to use the same scale to measure CPI inflation that was used in the more honest era of the 1980’s, then actual inflation today would be closer to 10% (top line) rather than the fictional 2% levels “reported” today (bottom line).

One Too Many Lies Breaks the Back of Trust

But the mad geniuses behind such central bank distortions, as well as the banks, insiders and hedge funds which have front run their “accommodation,” may have taken this rigged game of manipulations, distortions and dishonesty too far…

The “insiders” had always assumed the retail investors (which Wall Street secretly treats as “suckers”—i.e. the “plankton” devoured by the market-savvy “whales”) would somehow not notice the rigged game being played at their expense.

But oh, how things are starting to change.

The conductors behind this rigged orchestra from Basel to DC, or Tokyo to Brussels may know how to rig markets and twist math, but most of them seem embarrassingly ignorant of basic history, regardless of their so-called expertise.

That is, they forgot to notice that when wealth disparity (or global feudalism rather than fair market capitalism) gets too obvious, the natives get smart, and then they get restless.

They look for pitchforks.

A New Kind of Pitchfork, A New Angry Mob

Only now, the pitchforks are being replaced by trading apps like Robinhood.

And the mad crowds are not gathering at la place de Bastille, but rubbing shoulder-to-angry-shoulder on online platforms like Reddit.

A recent crowd of online Game Stop buyers, for example, made headlines short squeezing the hedge funds seeking to profit off yet another retailer death (and Amazon victim) by sending what seemed like an easy short into a record high.

This time, there was hedge fund rather than royal Bourbon blood in the streets.

The same crowd then sought to point those electronic pitch forks at the equally distorted silver market, hoping to bring some form or revenge as well as fair pricing to what is an overtly manipulated (and hence fake) paper market in precious metals.

But even the angriest of crowds can’t defeat, at first, the most powerful of lies and liars…

Hitting a Powerful Wall—The Rigged Paper Pricing of Gold & Silver

The complex and grotesquely manipulated paper market of gold and silver, hitherto misunderstood and ignored by the media bobbleheads and trusting masses, is now making the headlines.

Without getting into the weeds of cash-swaps, BIS immunities, or the Faustian deals which central banks have made with the bullion banks to mask their otherwise undisclosed lack of physical gold and silver, the masses are catching on to what all gold and silver buyers have known for years.

Namely: That paper precious metals are a rigged market.

But rather than make dramatic statements, let’s just do some simple math to let this sink in.

Fake Gold, Fake Pricing

If the global trade in paper gold is greater than $70T a year, yet the annual mine production of gold is just over $200B, do you think there might be a bit of over-looked leverage as well as a massive pricing disconnect between the paper price and the physical value of gold?

Ah… Math and facts, they are stubborn things, no?

Or how about the fact that gold makes up just .5% of global financial investments, yet the trade volume of gold among the LBMA banks in London is greater than the S&P trade volume?

Hmmm.

Weeks ago, moreover, we saw gold tank by $75 dollars in a matter of seconds when a single gold sale of 1.4 million oz into a buyer-less market artificially sent the paper gold price downward, despite no actual movements in the physical market.

Hmmm.

Silver’s Artificial Price Ceiling

Of course, Silver too is no stranger to such blatant yet otherwise headline-ignored price manipulations.

Despite even the most valiant efforts of that rising Reddit mob to correct a pricing wrong, those app-armed crowds didn’t stand much of a chance against the rigged silver market.

Like Pickett’s charge at Gettysburg, they were marching straight into a row of rigged cannons loaded with the cannister shot of bullion bank trading desks—i.e. fatal price manipulators.

With over 100 million oz of silver short contracts outstanding in the futures market, not even an angry mob of silver buyers can fight the manipulated price ceiling in the paper metals market.

For now, that market is simply too big a Goliath for even the most informed (as well as angry) Davids.

One reason Bitcoin is so popular is because its holders feel immune to such price manipulation or big bad banks.

Hmmm.

I wouldn’t be so sure. But that’s a larger topic for another time.

What the Big Banks Fear?

And for those wondering why the central and bullion banks beneath the dark umbrella of that even darker tower at the BIS (the central banks’ central bank) are so concerned with manipulating a downward price (or permanent ceiling upon) upon gold and silver, the motive (as well as means and opportunity) makes perfect sense once you follow the money to their weak spot.

That is, these clever manipulators in their bureaucratic, math-challenged and criminally immune posts in Basel understand one thing very clearly: If gold goes too high in natural price appreciation, the open lie of their failed monetary policies becomes impossible to ignore, hide or even blame on a global flu.

Stated more simply, nothing unmasks the currency-crushing failure of their insane money printing “experiment” better than a rising gold price or honestly reported inflation.

Solution?

Simple: Just rig the paper gold market and tweak the inflation scale.

Or even more simply stated—lie.

That is, manipulate the very basics of supply and demand heralded by Adam Smith behind layers of swap desks and then call the resulting price fraud in gold and silver “policy,” “free markets,” or “natural price discovery.”

Ah, the ironies do abound.

The Natives Are Catching On—and Getting Restless

This dishonest and distorted game, of course, has worked for years.

Largely because it was a reality understood by only a handful of bureaucrats with banking titles and an equally realistic circle of informed commodity traders and COMEX front runners doing the contango on the dance floor of the futures market.

But as growing asset bubbles, tanking Main Streets, and double-speaking, tweet-focused twits otherwise labeled as “experts” get further and further from the plow of reality and honest price discovery, the consequences get too big to hide.

The masses, alas, notice the distortions and begin looking for answers rather than just Fed-speak.

In short, they are armed not only with anger, but insight; not only spray cans and twitter accounts, but trading apps and buy platforms.

Again, the natives are getting restless.

And the Excuses Are Getting Thinner

Of course, nothing worries a corrupt, manipulated and dishonest system more than the truth, and no mob is scarier than an informed one.

How It All Ends

Returning to Mark Twain’s opening quote, even if it takes longer for the truth to get its boots on, one way or another, the truth not only walks, it prevails.

The BIS (or those other excuse-peddlers and euphemism-pitchers at the IMF calling for a New Bretton Woods) can pretend that bond bubbles and negative-yielding sovereign IOU’s can all be blamed on a global flu.

But informed investors know that the global financial system (at +$280T in debt) was broke long before the world got sick.

The angry mob is less likely to fall for a new global debt party paid for by a new digital fiat currency as part of what those shameless “leaders” at Davos are calling a “great reset.”

The great reset?

One has to admire the fancy titles experts give to open charades, as well as “solutions” to problems which they alone created.

Owners of physical gold and silver, of course, have known these tricks, as well as failed experiments, for years.

They have patiently been buyers of real money and real stores of value while the rest of the world squawks, distorts and smiles behind clinched jaws and broken promises/policies.

As more investors slowly realize there’s too much risk in an equally bogus bond market paid for by central bank support rather than natural demand, they shall one day collectively ask a simple question, namely:

Am I getting enough yield for the risk?

In a world with over $18 trillion in negative yielding IOU’s the answer is clear enough: NOPE.

Once the selling commences en masse in this broken credit market, there won’t be enough money printers in the world to fill the bid-ask spread or curtail the real inflation and rising rates/yields now bottled up in frothy stocks and bonds paid for by fake currencies.

No “orderly reset” will stem the breakdown of a disorderly (and distorted) system.

Currencies, already debased, will hit the basement of time, and the current tricks used to keep paper gold down won’t prevent physical gold from getting the last laugh, as well natural climb northward.

Nor will risk assets like stocks and bonds simply “weather the coming storm.” Instead, these highly correlated assets won’t hedge risk, but simply become risk

We’ve talked many times about the danger of traditional, passive stock and bond portfolios when conditions go from fantasy to uh-oh.

We specifically created SignalsMatter.com so that investors would be informed, rather than sold to, and most importantly, to build portfolios which can swim through (rather than be pummeled by) market storms, however ignored or delayed they may otherwise appear.

For more on how we face cold facts with clear solutions, simply click here.

Sincerely,

Matt & Tom