Below we track years of desperate yet deliberate central bank bubble creation (and can-kicking) to its ultimate end-game: A currency bubble and hence currency destruction.

Bond Markets Matter

When tracking markets and asset classes, one eventually accepts the Shakespearean reality that “the bond market is the thing.”

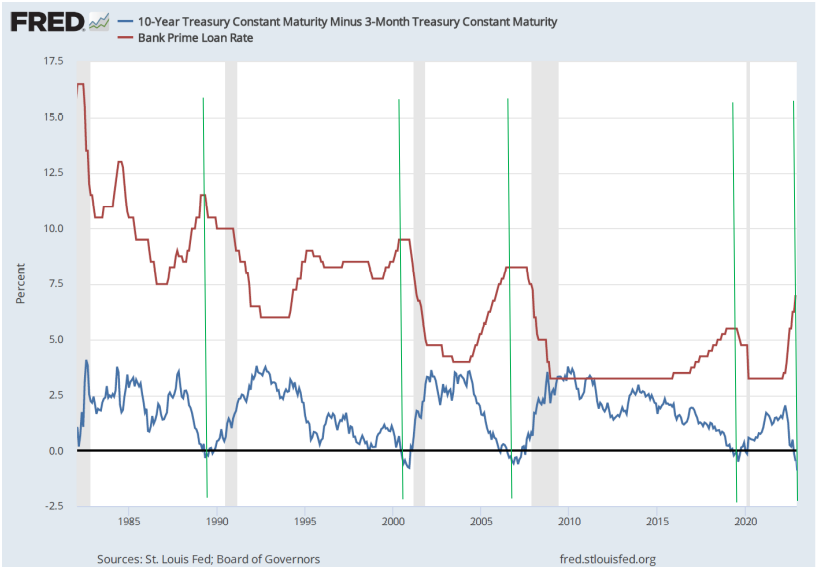

When a completely distorted global financial system is driven exclusively by the greatest and most toxic credit bubble (and hence crisis) in history, the cost of that debt (i.e., the interest rate) becomes a primary protagonist.

When rates are low, for example, bubbles grow. When rates are high, they pop.

Of course, the bigger the bubble, the more fun the ride up; but conversely, the bigger the bubble, the more painful the pop.

And by the way: All bubbles (tech, property, credit and currency) pop.

We are now entering that pop-moment, and the central bankers know it, because, well: They created it…

Once Upon a Time—Natural Market Forces

Once upon a time, there was a concept and even a dream of healthy capitalism and natural market forces in which bonds were fairly priced on the basis of a now extinct concept once known as natural supply and demand.

Nod to Adam Smith.

That is, when demand for a bond was naturally high, its price rose and its yield (and hence rate) was naturally low; conversely, when demand was low, its price fell and its yield (and hence rate) rose.

This natural ebb and flow of yields and hence interest rates kept credit markets honest.

As rates climbed and the cost of debt rose, debt liquidity naturally slowed down and the system prevented itself from over-heating.

In essence, the bond markets had a natural pressure gauge which triggered a natural release of the hot air within a bubble.

Then Came the Un-Natural and the Dishonest

Then came the un-natural influence of un-natural central bankers against which our founding fathers and Constitution warned.

Like everything centralized and human, as opposed to natural, these short-sighted bankers ruined, well: everything.

Rather than allow bonds, yields and hence rates to be determined by natural price forces, these banks had the arrogant idea that they could control such forces, the hubris equivalent of a sailor attempting to control the powers of an ocean.

Nod to John Smith of the Titanic.

The Fun Part

For years, central bankers have artificially supported sovereign bond markets by purchasing otherwise unwanted bonds with money created out of thin air.

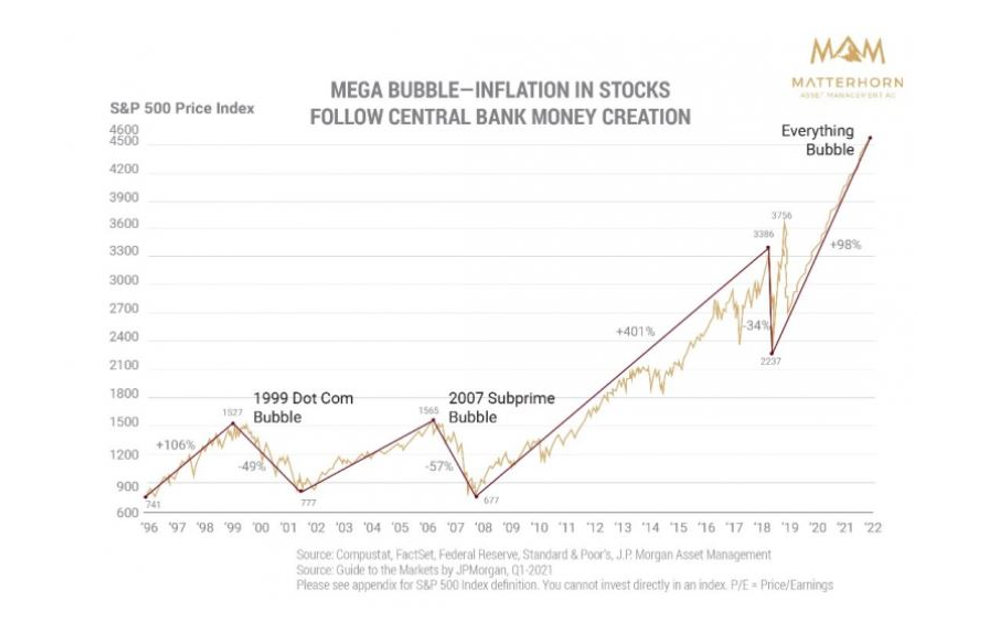

This absurd yet popular “solution” of repressed rates created bubble after bubble. That was the fun part.

It is also the part which breeds a school of academic apologists and theories (nod to MMT) who justify and defend the same as an unsinkable market.

Remember Janet Yellen’s claim that we may never see another recession? Or Bernanke’s Nobel-Prize winning observation that we could print trillions at “no cost” to the economy?

Meanwhile market participants, enjoying the tailwinds of low rates and easy/cheap access to debt, ignore the bubble dangers (i.e., icebergs) ahead as they enjoy the admittedly fun part of a rising bubble.

And oh, what fun a cheap-debt-driven and artificially controlled series of cheap-debt-induced bubbles can be…

Like the tuxedo-clad 1st class passengers on the Titanic’s A-Deck, investors (the top 10% who own 90% of stock market wealth) pass cigars and brandy among themselves and speculate like children comparing portfolios, all the while ignoring the rising iceberg off the bow.

How Icebergs Are Made

When it comes to making icebergs, our central banks have a perfect record, and the leader of this pack is the U.S. Federal Reserve, a private bank which is neither Federal nor a reserve.

Just saying…

For those paying attention rather than passing cigars on the A-Deck, you’ve already noticed this pattern of bubble-to-bubble and hence debt iceberg to debt iceberg creation before.

The Fed, with the complicit support of the commercial bankers and policymakers, for example, “solved” the tech bubble of the late 90’s (kudos to Greenspan) which popped in 2000 by creating a real estate bubble which popped in 2008.

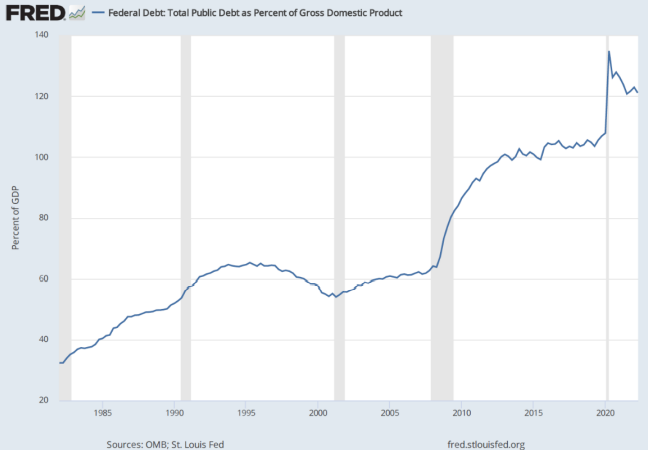

Through the same playbook of artificial rate suppression, the Fed then “solved” that housing bubble (kudos to Bernanke) by creating a global sovereign debt bubble/iceberg (kudos to Yellen and Powell), the very A-Deck upon which we all stand today.

Today’s Iceberg: A Global Credit Crisis

Having bought time and bubbles, from tech to housing to sovereign bonds, the Fed is now running out of places to hide its latest iceberg. This kind of can-kicking is more like sin-hiding.

Having squeezed a tech bubble into a real estate bubble, and then a real estate bubble into a sovereign debt bubble, where can the central bankers now hide their latest Frankenstein, bubble and iceberg? (I love metaphors.)

The Currency Bubble

For me, at least, the answer is fairly clear.

The only way to hide and “solve” the greatest sovereign bond iceberg (crisis) in history is to bury it beneath wave after wave of mouse-clicked, debased and hence increasingly worthless fiat currencies.

In short, the Fed will hide its latest credit bubble behind the last and only bubble it has left in a history-confirmed pattern used by all failed financial regimes, namely: Creating a currency crisis (i.e., debased money) to solve a debt crisis.

Of course, if you read that last line (as well as centuries of economic history) correctly, this just means there are no solutions left, just a choice of crisis options: drowning bonds or drowning currencies.

Pick Your Poison: Credit Crisis or Currency Crisis

Just like the officers at the wheel of the Titanic were the first to realize their ship was sinking, the central bankers from DC to Tokyo are equally aware that they were driving too fast in a sea of icebergs.

Now, they are struggling to “be calm” in voice as their crew scurries to count unavailable lifeboats and keep the passengers from panicking too soon.

Among this crew of policy sailors on the financial Titanic, two camps are forming. After all, even when a ship is sinking, there is always different expressions of the human instinct to survive.

One camp is hawks. The other camp is doves. In truth, however, both camps are doomed.

Hawks Squawking

The hawks are telling the passengers (investors) to fear not.

Yes, they are raising rates to fight inflation, but this, they calmly say from the shivering A-Deck, will not cause the global credit and hence financial markets to sink into a contagious recession/depression.

This is the camp of Larry Summers, William Dudley, Jerome Powell and the likes of James Bullard at the St. Louis Fed.

Bullard, for example, thinks a Fed Funds Rate of anywhere from 5% to 7% may lead to a mere “slowdown in growth” but by no means a recession.

Well, that’s rich. This coming from the same office that said inflation was “transitory” and a recession is not a recession.

Based on prior GDP prints and the inverted 3m/10y yield curve inversion of late, I’d argue we are already in a recession, but then again, why let facts get in the way of a good lifeboat narrative.

As the Fed captains all know, when the truth hurts, just lie.

The hawks, it seems, somehow believe that they can raise rates (to as high as 7%) to kill mis-reported inflation (as high as 16%) [???] without killing the credit market.

Hmmm…

At the same time, however, Powell needs inflation to outpace interest rates to achieve a deep enough slope of negative real rates to inflate away the USA’s $31T public debt.

Like Captain Smith on the Titanic, Powell is trying hard to stay calm but knows the end game.

Dead Market or Dead Currency?

In short, Powell is in the mother of all conundrums, dilemmas and self-made corners. He literally has no good options left.

If he keeps raising rates to “fight inflation”—he risks sending the global credit markets below the cold-water line.

But if he pivots, eases or allows more liquidity (i.e., QE) back into the bond markets, he saves the bonds but kills/debases the currency and hence creates more rather than less inflation.

Again. Pick your poison: A dead bond market or a dead currency?

The Choice Has Been Made

But in case the suspense is killing you, I’d say the answer is already in front of us.

As hinted above (and shown below), the only and last option left for debt-soaked regimes is currency debasement.

History proves time after time after time that there are no exceptions to this sad rule.

Despite his words to the contrary, Powell will ultimately be forced to kill the currency to allegedly save the credit markets—thus once again squeezing one bubble (in credit) into another bubble (currency), which is what all the central bankers have been doing for years: Pushing one bubble into the next until the final one pops.

Stated otherwise: There just aren’t enough life boats for Captain Powell’s financial Titanic.

Facts Speak Louder Than Words

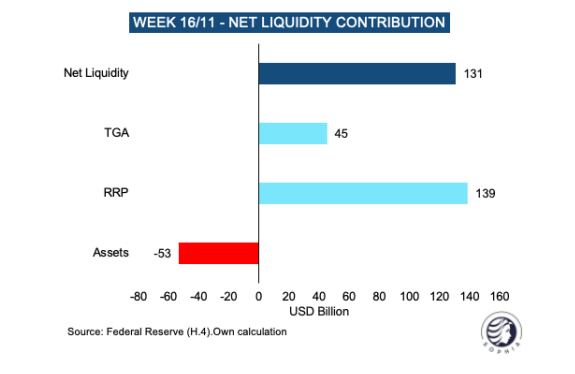

As I’ve argued all year, Powell may talk Volcker-tough, but he’s moving toward more fake liquidity and hence more inflationary money printing.

If you think otherwise, the evidence is already before us—and I’m not just talking about “moderating the pace of rate hikes.”

In order to survive, the credit markets need more balance sheet expansion (i.e., QE), which by definition, is inherently inflationary.

Nod to Milton Friedman.

Again: Powell will choose inflation (and currency debasement) over “fighting” inflation, because Powell secretly needs inflation and negative real rates to inflate away Uncle Sam’s bar tab.

Nod to Stan Fischer.

This eventually means letting the USD expand in supply and hence sink in value.

Or stated simply: A currency crisis.

Just Follow the Pattern/Banks

Toward this end, the other major central banks and currencies of the world are already doing this.

The yen, euro and pound of 2022, for example, have sunk to record lows to monetize local debts—the USD will eventually follow in 2023.

In fact, this unspoken preference for liquidity over “inflation fighting” is already evident rather than speculative.

As per the chart immediately below, November saw $45B in Treasury spending and another $139B in repo liquidity—for a total of 131B in net liquidity into the market, a number which far overshadows the $53B of so-called “QT” tightening by Powell.

In short, one may speak like a hawk but act like a dove.

Meanwhile, stocks and bonds were falling together.

Can we all say: “Uh-oh”?

As per the bars at the far right of the graph below, for the 1st time in 60years, we saw a UST market (blue bar) fell faster and further than a top-20 stock market drawdown (grey bar).

Hmmm. Can we blame this historical fall in USTs on inflation?

Nope.

In the 1970’s, and as per chart above, we saw inflation, but never USTs (blue bar) falling further than stocks.

Why the critical difference today?

Easy. Bonds are falling in price because demand is falling in fact. This bond drop is not because of inflation, but because no one trusts the debtor—i.e., Uncle Sam.

Unlike the 70’s, US debt to GDP today is at 125+%, and thus American IOUs today just aren’t what they were yesterday.

…and fiscal deficits are at 10% of GDP.

That’s what I call a debt iceberg…The bigger it gets, the lest investors trust the debtor beneath the surface.

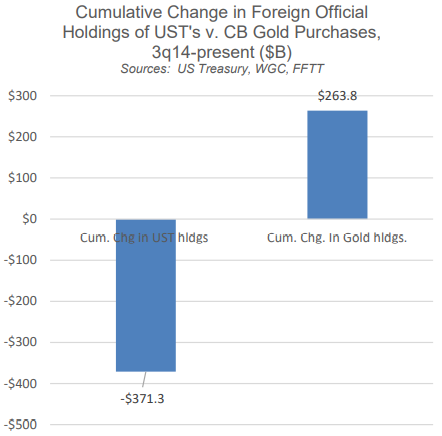

Toward this end, foreign banks are turning their backs on Uncle Sam’s unloved USTs (IOUs)…

Frankly, I’ve never seen such a grotesque convergence of debt icebergs heading for our economic bow.

Watch the Currencies—They’re Already Drowning

As global central banks debase their currencies (yen, euro and pound) to monetize their unloved and unpayable sovereign debts/bonds, we can expect more volatility in the FX markets and pairings as the current USD, like the bow of the Titanic, rises temporarily high above the waves before sinking deep, deep below them.

Can the Fed save that sinking dollar/Titanic by cranking up rates ala Powell at the expense of the US economy and markets as well as at the expense of its global friends and enemies who can’t pay back $14T worth of USD-denominated debts when the USD is too expensive?

I think not.

Nor am I alone in calling out this impossible dilemma of bad options and bad bonds. Druckenmiller and Dimon are saying the same thing.

Stated simply, the only way current central banks can keep their unloved bond market afloat is by drowning their currencies in more QE, which, needless to say, will be very good for gold…

This QE (currently hiding in the ignored repo markets) will be the last resort until the widely telegraphed and pre-planned “great [disorderly] reset” toward CBDC becomes the next embarrassing reality.

This collective lack of faith in USTs and USDs is why global central banks are swapping out USTs and buying physical gold…

As I’ve written and said before, it’s hard to imagine how we ever got to this obvious consequence of too much debt and too much artificial, “centralized capitalism.”

Were policy makers sinister (i.e., intentionally creating a red carpet toward CBDC and more total control) or just irretrievably stupid?

Either way, the end result is the same: The global financial system will sink, and though the USD may be the last to go under, under she will go.

Signals Matter Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Our Portfolio Solutions are generally geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here. For three ways to engage with us, please click: 3 Ways to Engage.

This further illuminating economic analysis is appreciated, and to reciprocate,

…. I would offer the following addition of analysis of my own;

As the pattern of global economic outcomes SM has defined across the years, has remained constant of its negative projections,

…. then so it guides informing of the macroeconomic issue as one underpinned by dynamics retaining even greater weight of gravity.

Here I would observe the conclusions of this report;

“it’s hard to imagine how we ever got to this obvious consequence of too much debt and too much artificial centralised capitalism,”

and,

“Were policy makers sinister (i.e., intentionally creating a red carpet toward CBDC and more total control) or just irretrievably stupid?

I contend it’s not hard to imagine at all, and yes,

…. ‘policy makers were both sinister and intentionally, irretrievably reckless.’

For if you observe the dynamics defining the globally adopted culture of neoliberalism, I contend,

…. you cannot fail to observe the neoliberal platitudes informing it, observed in these economic outcomes,

…. of application such as;

– ‘just doing it,’ and,

– ‘cutting red tape’ to increase efficiency [read: remove balanced regulation], and especially of cost savings [read: false short term economy], toward,

– the ultimate pursuit of ‘zero sum game’ outcomes.

It means of course inflation, and stagflation outcomes will be inevitable – the latter some may recall, neoliberal economics ‘promised’ to ‘save the global economy from’ at the commencement of the 1980s.

And then of course deflation is reliably projected ‘waiting in the wings,’ not like Frankenstein, but Dracula.

For what more appropriate metaphor for such neoliberal economic swindling, can be found,

…. to define exposure of its true intent, according to,

…. the unmistakable economic pattern of its known outcomes?

The dynamic purpose of neoliberal economics is revealed of its intent as a Ponzi scheme, to inflate value for short term profiteering,

…. that induces the leveraging of debt.

…. Essentially, it’s just the same ole economic carpetbagging ‘skin game’ that has created every economic crisis leading to economic purgatory since before Methuselah.

It doesn’t allow price discovery to inform the competent economic management of true market capitalism, for if it did,

…. it would rapidly fail.

It was Richard Carlson whom cast doubt upon the truism quoted of Emmy Rossum; “When something looks too good to be true, it usually is,”

…. by suggesting those who adhered to such prudent risk management application, were capitulating to the negativity of ignorance that promotes suspicion and cynicism,

…. restraining “people from taking advantage of excellent opportunities.”

Just with global debt levels now unprecedented, of more than US $300 trillion ‘in the hole,’ and increasing,

…. ‘what’s hard to imagine’ is when such ‘optimism’ crosses over to ‘the dark side’ of reckless, licentious, economic profligacy?

…. So how is that rocket science?