Be warned: A market meltdown eventually (and always) follows a market melt-up…

55 shares

Market history confirms that markets can melt-up to almost unbelievable highs just before they crash–i.e. meltdown.

In 1928, one year before the Great Depression, the Dow surged to a needle-like peak just before crashing by almost 90% over the next three years. Thereafter, it took the Dow another 25 years to recover its losses.

Sadly, we see (and foresee) an almost identical pattern taking shape today – that is, an epic melt-up preceding an epic meltdown.

We’ve already surveyed the many tailwinds behind the near-term melt-up in our recent free report, The Seven Tailwinds to a Melt-Up.

In this report, we’ll examine some of the numerous triggers to an equally inevitable meltdown. As you’ll quickly discover, many of the triggers for a meltdown are simply inverses of the causes of a melt-up.

Trigger #1: The Fed

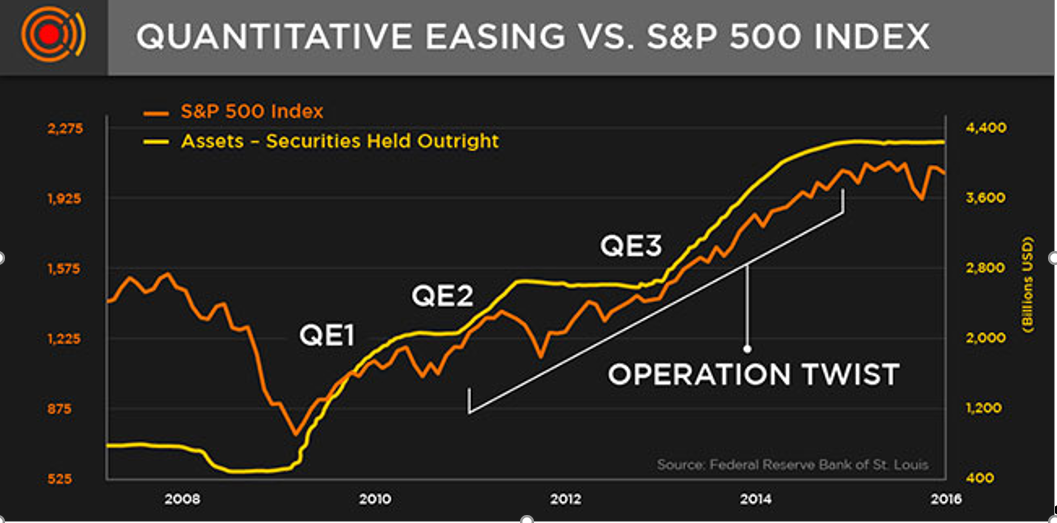

The Fed giveth, and the Fed taketh away. We know that low rates and the delivery – or even promise – of more money printing (i.e. Quantitative Easing) cause historic market highs – even a Dow at 30,000. or beyond.

By basic inverse logic, rising rates and a tapped-out money printer will cause an equally historic low – a Dow at 5,000.

The Fed is currently in a pickle. It knows that interest rates need to be at least 5% in order for the Fed to be able to cut rates to help stall the next recession. At the current 2.4% rate, that’s not high enough to be effectively reduced.

That’s why Powell tried to gingerly raise rates eight times in two years. But as we also saw, whenever he raised rates, markets started to die and spiral to Earth. By December 2018, he knew the markets could take no more hikes—they tanked. The days of the Fed raising rates are thus behind us, full stop. The Fed simply can’t do this anymore.

So, in March of 2019, Powell threw in the towel and paused further rate hikes. No big surprise there. Going forward, he’ll be lowering rates again, and even printing more money. He has no choice now…MARK MY WORDS: we’ll see lower rates and even more money printing by year end.

Thus, by trying to prepare America for the next recession, the Fed had actually triggered a correction in late 2018, early 2019. This is the dangerous and ironic tightrope act the Fed is negotiating with interest rates.

At some point, depending on politics, Fed staffing, or desperation, the Fed may want or wish to push rates up so that it will have something to lower in a crisis. If not, the Fed will otherwise be impotent and obsolete in the next recession. But as I said, the Fed literally is powerless now to attempt such wisdom.

A rate hike would trigger a market sell-off. The facts make it painfully clear that when rates are low, markets rise (see below) , but when rates rise, markets fall…

Of course, before that happens, some strongly maintain the Fed can even go to negative interest rates – a truly desperate and historically embarrassing policy that has been tried in Europe and Asia. I don’t see that happening soon or at all, but I do foresee rates below 1%.

This buys time but has proven to not work at all in preventing recessions. Just ask the Italians.

We can only wait and see what the Fed will do. Again, I am convinced they will lower rates in 2019, but not to zero or below—not that soon…

Finally, even if the Fed decides to once again print money (which they WILL) in another market emergency this year, it will become increasingly difficult for the American people and investors to trust such a long-term “plan,” as such measures merely inflate the markets at the expense of the GDP-flattening real economy.

At some point, that real economy simply rots from the bottom up, and a bubbling stock market will not contain the pains for the languishing Main Street.

Furthermore, another big round of QE, which is likely inevitable, will dramatically dilute the value of the U.S. dollar and could eventually trigger an inflation level that even the Fed can’t hide (i.e. lie about), which in turn would lead to naturally (rather than Fed-controlled) rising rates, which in turn would crush the stock market – a vicious circle.

This would take time though, and not happen over night, so there’s still time to ride the bull.

In any event, the bottom line is this: The Fed’s ongoing credibility and staying power is a major factor to watch for in triggering a market meltdown.

Trigger #2: The Bond Market

This point can’t be overstated or repeated enough: Rising rates will kill a debt-driven stock market.

The majority of people think the Fed controls interest rates. But genuine market veterans know the bond market is the ultimate force behind rates.

When demand for government bonds is high, bond yields – and thus rates – fall. The post-2008 Fed had been buying most of our government bonds for years, thereby pushing up bond prices and lowering yields and rates. (Remember: yields [and hence rates] move inversely to bond prices).

In this indirect way, the Fed has only temporary control of the bond market.

But such distortive control can only last for so long. At some point, one which we track carefully, bond holders (rather than Fed appointees) collectively realize they are not getting enough yield for the risk of holding onto bonds.

Thus, they start selling bonds, slowly at first, and then all at once.

In such a sell-off, bond prices fall, and thus bond yields and rates rise.

Once the yield on the 10-Year Treasury bond passes 2.6% and holds, the party is over. Debt-soaked companies can’t pay the higher rates; earnings fall; and the markets tank.

That’s why we track bond yields – as they are a critical meltdown trigger.

Trigger #3: A Main Street Recession

Most think that a market crash leads to a recession. But when markets are sustained by the Fed rather than the economy, the economy gets ignored and rots from the bottom up.

Once this rot spreads too far and too deep, GDP and employment stall dramatically – triggering a market crash from the bottom up.

Wall Street and Washington know this fact but try to hide it. I’ve shown mathematically and objectively in other reports just how dishonestly U.S. unemployment numbers and GDP growth are “reported.”

At some point, these public lies can no longer be glossed over from the top down.

Our blunt reports on the real U.S. economy, its dying middle class and record-low growth will both blow your mind and anger you. For now, however, the myths of a strong economy persists to the benefit of the current bull market.

Once these myths no longer hold true, things fall apart in the markets quickly. The most telling example of this was the pitchforks coming out in France in the 1790s.

Trigger #4: The ETF Bubble

ETFs are like a box of chocolates: “You never know what you’re gonna get.” Essentially, ETFs package good and bad stocks within the same security, which – just like a stock – is then traded on the market.

ETFs are popular because they offer a way for investors to buy many different names under one ETF – e.g. a “tech” ETF that holds a wide range of tech names.

What most investors don’t realize, however, is the good names in those ETFs help push up the value of the bad names – because when an ETF rises in price, all the names within the ETF – good and bad – rise with it, along with the markets in general.

During rising markets, investors pile into ETFs, especially the big pension funds, IRA accounts, defined benefit accounts, retail investments, pie-chart portfolios, etc.

It’s an easy way to get diversification under one umbrella. This massive inflow into passive ETFs pushes market prices to the moon as bad stocks enjoy the tag-along effect of rising with the good stocks in the same rising ETFs.

The dangerous nature of ETFs, however, is only seen when markets tank.

ETFs rise slowly over the years in size and popularity during the good times, but then sink like rocks in the ocean whenever a sell-off starts.

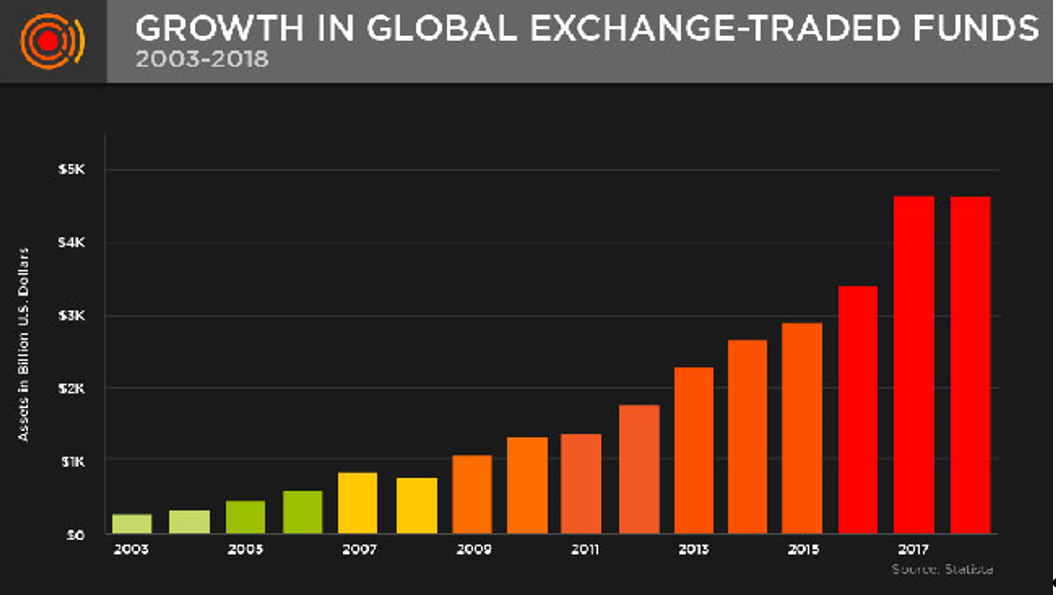

Since the Fed stepped in and created an artificial “recovery” in 2009, the ETF market has grown to massive and unsustainable highs. In 2008, ETFs had an $800 billion market cap. Today, that number has grown by greater than eight times to the staggering high of $4.6 trillion!

This, folks, is a classic danger sign, as well as a classic trigger for a market meltdown. Once the “bad stocks” in these ETF packages start to tank, the others in the “chocolate box” fall with them.

Furthermore, once ETFs start to sell off, there aren’t gonna be any buyers for that $4 trillion elephant. The “experts” call this a “liquidity crisis.” It just means there are no buyers as you are trying to sell or get out.

The price declines are sudden and fatal.

Again, ETFs rise happily and slowly in good times and then fall like nuclear bombs in bad times.

That is why a sudden shift in the ETF space could be a deadly meltdown trigger.

Trigger #5: The Robot Market

Today, Wall Street and the markets are 90% driven by what we call “robo-traders” – i.e. algorithm-based software programs created by smart techies from places like MIT, Harvard, Berkeley, and Caltech.

These smart folks know a ton about applied math and technical signals but almost nothing about market dynamics, history, or investing. The “techie geeks” create complex trading software that tracks trend lines and volatility bands with robotic consistency/accuracy.

In this AI-driven environment, today’s stock market is much like the “Terminator market” – i.e. it looks human on the outside but is all robot underneath…

Of course, when the Fed puts 10-plus years of low rates and QE steroids into the markets, the robots trade like a herd of very smart cattle.

They see trends and buy every dip because with the Fed – rather than natural supply and demand – supporting the markets, every dip has been followed by a “recovery.”

The robots know that since 2008, the markets have dipped over 10 times on a weekly basis, and every time, the markets recovered.

The robots helped greatly in this dip-buying “support” and have been our “friends” for years.

But robots are not human – which means they don’t feel emotion and are no more your true “friend” than the toaster in your kitchen.

That is, at some point, when markets are no longer “supported” by pure Fed steroids, the signals these robots will be receiving en masse to “buy, buy, buy” every dip will suddenly shift into “sell, sell, sell” the dip.

This means that the robo-traders who made you so rich in the good times will absolutely murder you in the bad times. It’s not personal though – they’re just “Terminators.”

Needless to say, the fact that nearly the entirety of our markets are traded by robots rather than Homo sapiens ought to scare you more than Arnold Schwarzenegger saying “I’ll be back…”

At some point, when the robot traders see a collective sell signal, the meltdown will be unprecedented and impersonal – i.e. “pain will be back.”

Trigger #6: The Last Horse in the Global Glue Factory

As mentioned already in our prior report, The Seven Tailwinds to a Melt-Up, the U.S. will benefit during the melt-up phase from being relatively stronger than the markets in Europe and Asia. During the melt-up phase, flows from these regions will push U.S. stocks and bonds even higher.

But there’s a catch. Soon thereafter, as all the rest of the world is rotting, the U.S. will rot, too. Being the last to rot buys time – i.e. a melt-up, but it doesn’t change the fact that the U.S. markets will still rot in the end.

Why? Because markets today are global, not regional.

Once the flows from overseas run dry, the global economy will be too weak to become a consistent buyer of U.S. stocks and bonds. Foreigners with money in U.S. markets will need that money, and thus they’ll start selling their U.S. securities.

Global flows into the U.S. will essentially morph into a global contagion. But again, this is unlikely for 2019 or even 2020, as we are currently enjoying in-flows, not droughts, from overseas.

Furthermore, keep in mind that according to PR Newswire, some 44% of S&P 500 sales are derived from foreign sales. As these overseas territories head into a meltdown, so will the long-term earnings of American companies on the S&P.

Again, eventually, everyone suffers together.

Trigger #7: Derivatives Markets – Death by Complexity

Markets are as complicated as a Swiss watch: If just one gear breaks – time stops.

Trying to identify which of the many broken “gears” of the global markets will trigger the next meltdown is next to impossible.

Modern markets are infinitely more complex – and thus more dangerous – than their historical counterparts. And it is precisely this complexity that makes such a meltdown equally as certain.

Since 2000, the global bond market has more than tripled to well over $100 trillion in size, backstopping another $600 trillion in an over-leveraged derivatives market.

The gross notional value of those toxic instruments alone is now well over $710 trillion, which is off the banks’ balance sheets and over nine times the size of global GDP and well… horrifyingly complex.

Such staggering outliers/numbers have made modern portfolio theory (i.e. buy-and-hold “pie-chart portfolios”) largely obsolete and capital markets infinitely more complex (and unsafe) than any risk-management model (from VaR to regression analysis) can adequately measure.

Advanced in the 1960s, a risk-measurement concept known as “complexity theory” maintained that certain systems can reach a scale of risk that cannot be modeled or predicted.

In this backdrop, “complexity” does not equal “complicated.” (The components of a watch, for example, are “complicated,” yet understandable; the emotions of a random selection of teenagers, however, are “complex” and subject to infinite possibilities).

Complexity theory argues that certain systems can morph and take new dimensions – i.e. fly away – with a limitless array of risks that can’t be modeled.

Today, the ever-expanding range and size of exchanges, counter-parties, and asset classes – as well as the equally increasing range of instruments, leverage strategies, and market participants – make capital markets increasingly difficult for any individual or program to model with meaningful probability.

Such complexity begins and ends with the impossibility of modeling the range of risks stemming specifically from the derivatives trade, the astounding notional numbers of which are more of an abstraction than a controllable risk.

Such realities are reminiscent of Frank H. Knight’s seminal (1936) work, Risk, Uncertainty, and Profit, which addressed the difference between probability and uncertainty. The former, he demonstrated, can be modeled, whereas the latter cannot.

Our highly complex and derivative-stained markets are precisely that – beyond probability.

Today, even the best math geeks at the regulators’ offices (or the trading desks I know) can’t rely on traditional risk analysis because no matter how far back one “regresses” in time, current market complexities are outside of history.

Nevertheless, the Wall Street I came from continues to rely upon these outdated and inadequate predictive models.

Unfortunately, even the best risk modeling won’t keep investors protected against the cold complexities of modern markets.

Consequently, those relying on such models will find themselves just as ill-prepared for a crisis as they were in 1987, 1998, 2000, and 2008.

At Signals Matter, we accept the reality of this complexity – and thus the inevitability of it backfiring on the markets and causing a crash seemingly out of nowhere.

In sum: The very complexity of our markets will lead to their own collapse.

We at Signals Matter, however, accept this complexity, as well as the simplicity of its warnings. In the end, the most complex markets still collapse when record-high debt levels fall under their own complex weight.

That’s the hard yet simple truth of an otherwise overly complex market.

Trigger #8: Black Swans

A black swan is a market trigger that no one can predict, measure, or track. It literally appears out of nowhere.

A traumatic terrorist event, a fraudulent or failed mega-bank whose secret debts are hidden from the world, a sudden global virus, or an unprecedented meteorological event are all examples of a black swan that can send markets tanking.

Investors must therefore consider black swans to some extent, especially older investors relying on retirement portfolios. No one, including us at Signals Matter, can protect you from these.

Thus, depending on each individual’s tolerance for risk and loss, black swan considerations may be a factor in how much money you place in the markets.

Summing It Up

The foregoing examples are all possible triggers of a meltdown. There are many more, including, for example, sudden declines in the housing market.

We at Signals Matter track countless triggers, but we are not arrogant (or foolish) enough to predict a specific trigger, as almost no one gets them right.

What we can do, however, is see (and inform you of) the backdrop of debt and Fed distortion clearly enough to know that markets will indeed melt down, as there are just too many triggers pointed at a sitting market duck that is already too indebted, overvalued, and “fat on central-bank engineering” to escape the gun sights of a pending market meltdown.

In future free reports, we’ll show you how we at Signals Matter employ three strategies to help you through the three stages of markets transitioning from a melt-up to a meltdown.

Really grab my attention.

My question is for middle class Americans who could easily loss everything if/when this happens. I’m wondering how 529s, IRAs and 409s should be handled to mitigate losses? Should we pull.out and take apenalty now to invest in some area that will retain some worth after a melt up and crash?

That is a valid question–and hinges upon timing risk and personal risk tolerance. If one can afford to leave the casino early, it’s a valid option. One can also request a far larger allocation to cash equivalents/money market holdings in their 401K’s to avoid an early withdrawal penalty yet protecting from marekt risk.