Australian Markets have their own hidden problems that are slowly coming to the surface. Below, we look at what this means for the broader global economy and even U.S. markets.

18shares

As American investors consider the latest tariff headlines, the majority are missing what’s happening to China’s other key trading partner – Australia.

As we demonstrate below, what happens in Australian markets doesn’t stay in Australia.

Australian Markets: Are Things Going Under Down Under?

In our snapshot of the various tailwinds to a market melt-up, we pointed out how the U.S. benefits from being relatively stronger than other broken economies. This, however, is hardly comforting, when one considers that we are just the best horse in the global glue factory.

In other words, and for all the reasons therein described, our economic fate (now on the admitted rise) is still mathematically and historically heading toward the proverbial glue factory…

Any number of events could accelerate this process, including the contagion effect of weakening economies elsewhere. As for weakening economies, it seems that everyone is overlooking the Australian markets.

The Debt Dominos Are Lined Up

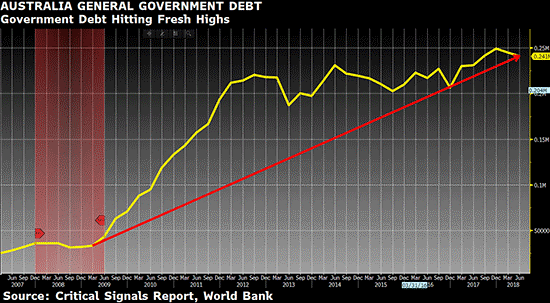

As for which dominoes are likely to fall first in a world awash in more than $250 trillion in global debt (expanded by 2X in a decade) and supported by the same desperate and rigged playbook (printed money and artificially low rates) set by the central banks, the field of victims is wide open.

Never in the history of capital markets have so many countries been so in debt and so desperate (and so deluded) at the same time.

In prior reports, I’ve pointed out the math that confirms the ticking time bombs of can-kicked debt in places like Italy, Japan, and China.

Any number of political and/or economic weather convergences originating in these postal codes could trigger a global domino effect.

Are Australian Markets Teetering?

But one ailing economy that many may have been overlooking is that otherwise magical place down under – Australia.

As for me, there are lots of reasons to love Australia. Its people, landscape, and history (and of course surf spots) are among the finest in the world, and I’ve yet to meet an Aussie I didn’t like – they are a tough, fun, and blunt lot, a lot like the Irish, but with better weather.

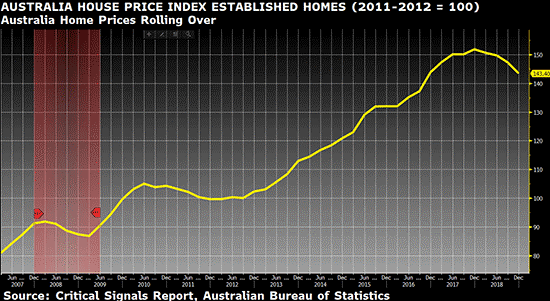

And like Ireland in 2007, Australian markets in 2019 finds itself staring down the barrel of an undeniably dangerous real estate bubble colliding with an over-indebted population. In other words, uh-oh…

Sadly, the set up for Australia’s openly admitted and inevitable recession is all too familiar. Since 2007, Australian markets have thrived on cheap and freely available debt in the form of consistently repressed interest rates.

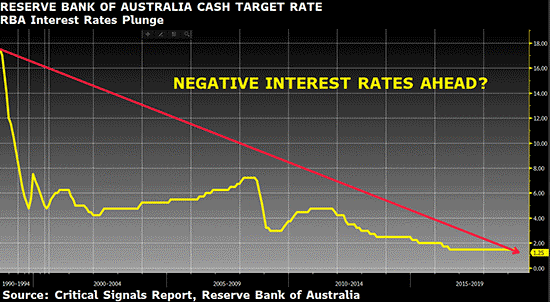

What began at 17.50% back in 1990 has now reached a record low of 1.25%, which is a transparent attempt by the Reserve Bank of Australia (their “Fed”) to encourage more borrowing to encourage more spending. There’s even talk of further rate cuts by year-end.

Ah, the genius of Keynesian thinking on steroids… borrow, borrow, and borrow (and pretend central bankers have outlawed inflation…).

As you know by now, rate cuts are a sign of economic desperation, not strength, and things (and rate cuts) in Australia are turning desperate. Recently, the country began selling lots and lots of gold, which is never a good sign either.

A Real Estate Bubble Running Out of Air

And at the forefront of all this desperation, the real estate bubble in Australia, as was the case in the pre-crisis U.S. of 2006-2008, is starting to wind down. And just like in the U.S., the coastal zones are seeing the biggest hits.

In Sydney, average home prices have dropped by greater than 15%, year-on-year. The numbers are no better in Melbourne. Luxury real estate brokers are being laid off in greater numbers as hundreds of recently constructed homes sit empty.

In the North and Western Territories, even the default rates are beginning to tick up.

Americans have seen this movie before…

Needless to say, the Aussie real estate professionals still employed are trying to sell the same story (i.e. myth), as their Irish and American peers did in prior housing bubbles – namely that a boom time is still ahead, that house values only go up and that now is the time to buy, as rates are so low.

But unlike prior bubbles in prior countries, the Aussies are catching on. Recent articles in the Daily Telegraph, for example, are reminding readers of the country’s massive household debt numbers, much of which lies in mortgage debt.

Aussies are being warned not to fall for the low-rate seductions promised by their big-4 banks and increasingly “liberal” (i.e. lax) loan requirements.

In fact, those same banks were caught red-handed making bad loans to unqualified borrowers. Private banks have been the focus of a recently-released Royal Commission report to prosecute these banks for making the kind of loans that sent the US over the cliff in 2008.

This is good, but as we’ll see, the real skunk in the finance woodpile is the collusion between the private banks, the regulators (former bankers) and the central bank – an all too familiar love affair that ends badly every time…

Australia’s Central Bankers – Equally Fluent in Double Speak

Philip Lowe, Governor of The Reserve Bank of Australia (Australia’s central bank, RBA), deserves much of the criticism. Like our own central bankers in the U.S., the RBA has a genuine problem telling the truth.

Recently, Lowe tried to explain the boom (bubble) in housing prices as the result of surging immigrant demand for housing. This is simply and blatantly untrue.

What Lowe intentionally left out of his explanation was the far scarier reality of Australian debt, lax lending practices, and the dangers that come from his own bank’s policy of seductively low rates.

In short, the central bank down under is ignoring the debt elephant (or crocodile?) in the room. Like his peers around the globe, Lowe believes a debt problem can be solved by, alas, more debt.

Of course, this is the kind of genius thinking that believes a hangover can be prevented by drinking more beer. Sure, the beer goggle fun of debt-driven binges can be prolonged, but not without eventually killing the “economic liver” of the nation.

Sadly, Aussies, like Americans, can go all the way from undergraduate economics to a full Ph.D. program without ever reading (or even knowing) the works of von Mises, or even Andrew White, who wrote over a century ago that a nation saved by debt inevitably dies by debt.

And as for debt, the average Aussie household is drowning in it – and most of it (67%) is linked to mortgage debt (rising) rather than consumer debt (falling). Today, household debt to GDP in Australia is at 120%. (In Ireland, just before its real estate bubble burst in ’07, their ratio peaked at 118%.)

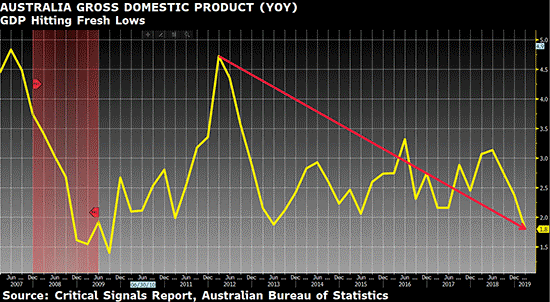

Meanwhile, in the background of this mortgage debt bubble, Australia’s GDP, like U.S. GDP, has been horrid since the last financial crisis and is hitting fresh lows.

Much of this is due to the fact that consumer strength is a major factor in the GDP numbers. Given that so many Aussies are tapped out in mortgage debt, that consumer strength just isn’t there anymore, despite efforts by the banks to get citizen-consumers deeper in debt (and spending) with the carrot of falling rates.

Meanwhile, the latest jobs data is disturbing. Unemployment is rising; the retail sector is in recession and job growth in the Australian construction sector is slowing, despite a currently low and overall unemployment rate of 4%.

But for those of us who recall 2008 in the States, that robust employment number in Australia can tank once a recession hits. To prevent this, the share of government spending in Australian markets is way up as household disposable income (falling since 2012) is way down.

In fact, massively high government spending and enormously high iron ore prices are the only two forces now keeping the Aussie economy and Australian markets up. With business investment in the decline, today 80% of the growth in Australia comes from government support.

Without genuine growth from the bottom up, such support for the Australian markets cannot last, just as a keg-party cannot last without the eventual heaving…

Right now, construction and real estate sector strength remains a high source for jobs, but retail is hurting, and year-on-year car sales are down by 10% in Australia, further signs of weakening household strength.

Overall, jobs, spending, and prices are coming down, down under. This is alarming. And when the real estate bubble pops (as all bubbles do), more jobs will be lost and more homeowners will find themselves in the pickle of negative equity real estate as home prices fall.

For now, the RBA is saying income growth will bounce up in 2019 based on the recent rate and tax cuts allowing more money into the system. This combination of rate and tax cuts is a template we are quite familiar with in the U.S. It certainly buys time for Australian markets, but how much?

Meanwhile, as Australia’s interest rates head into negative territory and GDP tumbles, that good old debt time bomb just keeps growing. Tick tock, tick tock…

The Times They Are a-Changing

In the past, Australian markets have been almost a model for dodging economic bullets. It has not seen a recession in 28 years.

In its entire history, Australian markets have only known two depressions, one in 1892 (due to bank failures in Vienna/Europe), and the other in the 1930s, due to bank failures on Wall Street.

In the Great Financial Crisis (GFC) of 2008, the Aussies fared much better than the rest of the world as well. In 2007, its conservative leadership under John Howard was running a $70 billion surplus while the rest of the world was drowning in deficits.

This surplus, along with the post-’08 global stimulus wave, was well surfed (of course) by the Australian markets. China’s massive, post-GFC stimulus measures were also a direct benefit to Australia as one of its key trading partners.

Furthermore, as QE (money printing) went wild in the U.S., E.U., and China, commodity prices (a boon for the Australian markets) rose at the same time interest rates in Australia fell (from 7% to 3%). This was a perfect wave.

In short, Australian markets surfed right through the ’08 storm.

But today, the riptides are strengthening down under. Debt there has grown to obscene levels as the Aussies paddle toward the shark fins of the biggest credit bubble in their history at precisely the same time it lines up alongside the biggest global debt bubble in the Australian markets’ history.

Enter the Spin-Sellers and Neckties

And sadly, most Aussies don’t see the shark fins approaching. Its bankers and politicians (like nearly all bankers and politicians) are primarily in bed together, and the pillow talk, like most pillow talk, is full of half-truths.

In Canberra, politicians will cover their behinds, ignoring their own self-induced debt addiction via steroid-like rate and tax cuts, which only buys time rather than solutions.

Perhaps the Aussie politicos are hoping, as in the past, to blame the next crisis in the Australian markets on foreign hot spots like China, Italy, or Wall Street.

After all, in the past, Australian markets were always the third or fourth domino to fall, as other countries were more to blame for her economic depressions.

Which brings us back to why Australian markets matter to U.S. investors. Ironically, it is possible, just possible, that the first domino to trigger the next (and inevitable) global crisis will start, rather than end in the Australian markets.

And no one is looking in their direction.

Anything is possible in a world awash in so much concomitant crazy-debt. It’s frankly sickening. But Australia’s mortgage crisis is certainly not the biggest sin when compared to the absurdity taking place today in China’s Housing Bubble or the zombie economy that is Japan.

The U.S. is no less debt drunk, but given the bully-like pre-eminence of its U.S. Dollar, will likely be the last to rot, though hardly the last to escape culpability for making the global markets a debt monster masquerading as a miracle “recovery.”

Time Will Tell

We’ll just have to watch as history unfolds with rhyming consistency, for history, ignored during debt binges, always gets the last, macabre laugh over the fiscal and political antiheroes who take temporary credit for “buying a recovery” on a national credit card funded by a clueless (and increasingly desperate) collection of central banks.

The central banks… clueless? Aren’t they (from the Fed and ECB to the RBA) the smartest guys in the room? Didn’t they go to Harvard or Yale, study math, or speak directly to the gods of banking miracles? Surely, the central bankers will save us?

Just a brief glance at history, will prove to you how naive such happy thoughts truly are.

Our aim at Signals Matter is not to spread happiness or fear, but simply to relay the blunt facts of math, history, and the current market wind speed and direction.

Fancy schools, titles, and media attention are not the answers; facts are. And as market veterans (and hedge fund insiders) who have traded markets for decades, we have no stomach for fantasy, just facts.

And the facts are simple. Central banks from Australia to America are buying you time on historically low rates and historically high debt. Their only way out of any crisis is to print more money and lie about inflation.

It’s just that sad and that simple.

And yes, folks, governments and bankers lie. And ask yourselves this: If the economy is really as strong as the central banks tell us, why have they been at “emergency mode” low rates for over a decade?

The Cold Facts

In Australian markets, as in the U.S., the central banks can’t raise rates; they can only lower them. Which means in the next crisis, with rates already historically low, even the big players in places like Australia and D.C. will likely be forced to go deep into negative rate territory in a last desperate act (and final confirmation) of the death of free market capitalism.

Folks, negative interest rates mean that YOU will be paying banks to take your deposits, the majority of which will then (via fractional reserve banking laws) be re-invested or lent outside of the very banks where you thought your money was “safe.” That’s a scary new reality to consider…

Let’s face the cold facts. Capital markets have devolved into centralized markets, which gives a whole new irony to the term “central banks.” Today, Sweden, Japan, and Switzerland have all gone negative.

Others will follow. They have no choice.

As productivity and GDP growth tank around the globe, the only tools left are cheaper debt and more money printing. The world is experiencing an unprecedented yet slow frog boil toward a historical debt disaster.

But when?

That’s something no one can predict, but it is something smarter folks can track, which is why we created the Storm Tracker. We look at the big picture as well as the daily patterns to give you the most accurate information available in an online platform to track and trade markets profitably in all conditions – period.

How Markets Crash

Remember this, if nothing else – market crashes happen not when asset prices fall, but when debt levels become so high, indeed too high to repay. At that inflection point, the waterfall of crashing markets follows like night follows day.

The central bankers know this, which is why they have plunged their fingers in the debt dikes, nervously trying to force rates (i.e. the cost of debt) to unsustainable lows.

Ironically, however, all that is accomplished via low rates is increasing the debt levels (water pressure) behind the very dam they’re otherwise trying to save.

The hubris (and desperation) of these central bankers is almost staggering.

Sure, they can artificially suppress rates for years, but they can’t stop the rising pressure of rising unemployment and household debt. At some point, there’s just no money in their pockets to pay it.

When regular folks are tapped out – as we are seeing in the dying middle class right now – the central banks will have no one to blame but themselves when the credit dam bursts.

Of course, central bankers are clever and will blame something else – like “animal spirits,” immigrants, foreign wars, or other politicos. But the real blame is in their mirrors, not the headlines of a media that has all the financial acumen of a 10-year-old boy.

We aren’t journalists; we’re traders and we’re investors. That’s what we do. Stick with the Critical Signals Report, and we’ll get you profitably through this next debt wave, one swell after the next, while so many others are paddling toward the sharks.

Comments

10 responses to “Investors Aren’t Looking at Australia – Here’s Why That’s a Mistake”

- Geraldsays:

June 25, 2019

Thanks for a great explanation. I wish I could say I understood it all.

- Nicsays:

June 25, 2019

I do believe you are predicting right:

but When?

and What to do?

- Cathy Ahluwalia Wellssays:

June 25, 2019

This information is utterly profound.

- Robertsays:

June 26, 2019

Very informative

- Mike Posnikoffsays:

June 26, 2019

With central bank rates going lower in many jurisdictions, will banks that borrow from the central banks also lower the rates on mortgages that they hold that are up for refinancing, so the credit defaults are not overwhelming in the short term ? Long term = big problems.

- David Stokessays:

June 26, 2019

Great commentary but but nothing on how you avoid the bank failure bale in risk when you stay in cash; ready to buy when things bottom out? As a baby boomer, the priority is loss avoidance. Is it time to store cash under the bed?

- Patrick Kissane says:

June 26, 2019

You say the “overall unemployment rate of unemployment rate in Australia is 4%”. It is, in fact, around 5.2% at present, Since 1974, the unemployment rate in Australia has only been below 5% in a handful of months. For the 30 years prior to 1974, the unemployment rate was less than 2%

- Carl Sayerssays:

June 26, 2019

Thanks sincerely Matt; for your great insight and explanation of the debt crisis facing the global economy.

However I am also very concerned…. as David Stokes has mentioned with regard to his comments on “Bank failure bale in” ….whereby as a baby boomer I am also trying to retain the value of our savings.

Would you suggest we go to Gold?

- De Pourbaixsays:

June 28, 2019

Do you think that the Australian dollar will go much lower against the US dollar, short, medium and long term?

- Greggsays:

June 28, 2019

Other financial experts aren’t dire in there forecasting. They say banks are stronger than they were in the financial crisis of 08. What are they missing?