Below, we look at the implications behind a 100-year Austrian bond…

35 shares

The global bond market is spiking, which means unprepared investors in stocks, credits, and even real estate are poised for a beating.

The first symptoms of this credit crisis are appearing in Europe, from where I’ve just returned.

As career bond traders, we know what to look for and what to do when bonds are taking their last breaths, and now so will you.

But what does the Austrian bond market have to do with real estate prices and a global debt bubble that is about to pop in the face of our stock or repo markets?

You might be surprised…

The Biggest Market Bubble No One Wants to See

In 2017, the Republic of Austria issued a 100-year Austrian bond, enticing investors to take on Austrian debt that central banks were front-running/buying.

This was a fat pitch for those who understood central bank bond-rigging, and the results were sexy for the insider bond jockeys, many of whom I have known.

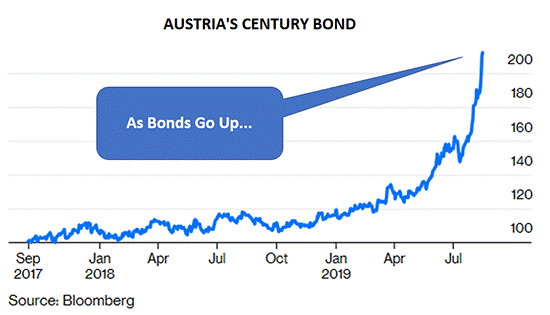

Since then, the price of that century Austrian bond has more than doubled. This is what we call a bond melt-up. Key institutional and informed investors ran to buy “safe” Austrian bonds like water in a desert of risk.

Seems like a really good thing, right? I mean it’s a 2X home run.

But here’s the rub (and the legacy of Babe Ruth): For every home run, there are a lot more strikeouts that follow.

The bond price spikes and yield basements (think Austria) that we are seeing today around the world (as central banks around the world buy their own national debt) are classic symptoms of a fatal credit bubble enjoying its final rise before the fall.

And this global bond bubble (of which the media has almost no clue or coverage) is the issue today. Period. Full stop.

The Austrian bond example is an extreme example of crazy, but not as uncommon as you may otherwise guess. Here’s how its bond price has skyrocketed:

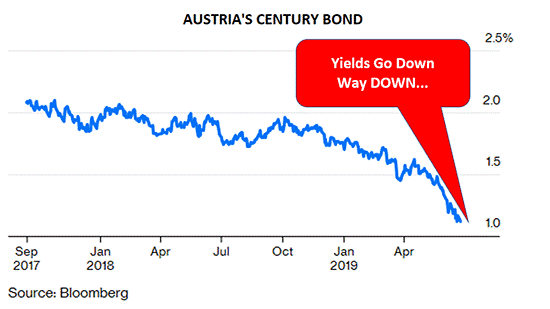

And when it comes to bond yields (which go down as bond prices melt-up), this is what a strikeout looks like in a sovereign bond bubble whose pathetic yields (less than 1% for that Austrian bond) defy sanity.

They tank, like this:

But you may be saying to yourself: Hey, it’s just little ol’ Austria. The rest of the world hasn’t lost its mind, right?

Wrong.

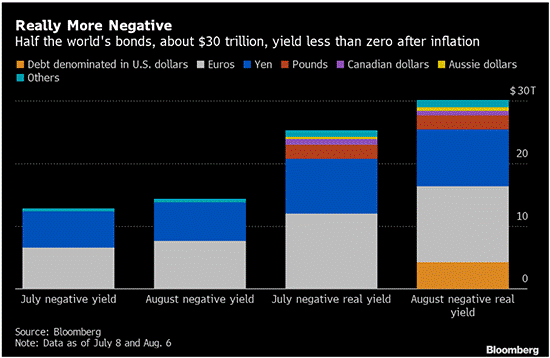

Unfortunately, and outside of the U.S. (where yields on our 30-year Treasury are at record lows), 44% of every other sovereign bond on the globe is producing negative yields.

Read that again. 44%.

This is absolutely crazy – so crazy that it has never been seen before. Ever. Not once, in the over 5,000-year-history of IOUs from one crown, castle, province, or nation. Not once.

Please, read that again, too.

We are now in uncharted waters. Never a fun thing. The over-all bond market (government to private) is now telling us that half of the world’s bonds yield less than zero when adjusted for inflation.

What Negative Yields Really Mean to YOU

And what does the Austrian bond example in particular, or a world of negative yields in general, have to do with the future of YOUR money and the current state of the credit markets?

A helluva lot.

You see, when sovereign bonds go negative, this effectively means sovereigns (i.e. nations) have gone broke.

Or stated more bluntly, a negative-yielding bond is a sexier way of avoiding what it really is: a defaulting bond.

That’s right. Over 44% of the nations around the world are constructively defaulting on their debt, meaning buyers of their bonds are purchasing an instrument that destroys capital (loses money) the moment they buy it.

Does that suggest a healthy, normal bond market? How long do you think that’s gonna fly?

Grass-Roots Signs of Crazy

Think about Holland. There, you can actually get a negative mortgage. That’s right. I saw them myself this summer. Banks will pay you half a percent to take out a loan.

In Switzerland, checking accounts offer a negative 0.75% return – which means you pay banks almost 1% a year to risk your cash. I saw those as well.

Crazy? Yep.

But, again, maybe you’re thinking that’s just all “overseas crazy.”

Like the ECB forcing foreign pension funds to buy negative-rate debt to float their dying monetary system by forcing yields to the floor and experimenting with Hail Mary solutions like 100-year Austrian bonds, which other countries (basket cases?) like Poland and Italy have flirted with (50-year bonds).

Perhaps this crazy can be contained? That it could never spread to our fiscally sane shores?

Germany and France, for example, have vehemently disavowed such long-duration, fantasy bonds like the Austrian bond.

But if you think Uncle Sam ($22 trillion in debt, and thus effectively in default on loans it never repays, but merely extends/pretends) will be as disciplined, the desperados at the Dept. of Treasury are tossing around the idea of 50-100-year bonds as well.

Why? Because desperate is now the norm as our bond market, like the stern of the Titanic, slowly rises one last time before sinking to the ocean floor. We could yields spike in repo or Treasury markets by year-end, which will just mean more Fed money printing to suport broken bonds and hence more market party’s on Wall Street.

Keep It Simple-Stupid

So, what does all this boil down to?

I can fall back upon fancy jargon or complex graphs, or I can just stand up to common sense.

Since the early 1980s in general, and post-2008 in particular, the central banks of the world (with our Fed in the lead) have 100% destroyed the global bond market.

Together, they printed over $15 trillion of fake money to buy bonds no one else wanted. That’s a front run.

The inflation that D.C. misreports did not go into the CPI scale, but into the stock and bond markets, which have reached historically unprecedented highs (top line), which mean bond yields (the bottom line) have sunk to historic lows.

See for yourself.

Bonds, in particular, have seen the real melt-up, and have risen so high that yields (which move inverse to price) are now negative ($15 trillion and counting) for the first time in homosapien history.

And we all know what happens when an asset class reaches record heights: They eventually fall to record lows.

And that is when the real pain kicks in. That’s when the party of the last decade becomes the nightmare for the next one.

U.S. Corporate Bonds and Real Estate – Look Out Below

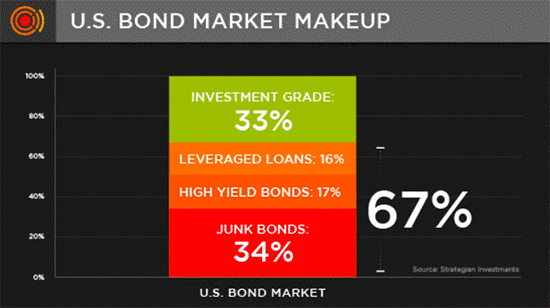

With yields this low, investors have no choice but to go further out on the risk branch to seek yield in increasingly junky credits (i.e. swing at bad pitches), as over 60% of the U.S. corporate bond market is effectively that: junk with zero to little yield for massive risk.

Meanwhile, real estate brokers (who have as much macro savvy as a tree stump) will tell you to buy more homes (at record price highs), as mortgage rates have never been so low.

But you know better. Just like the yield-chasers (gamblers) who will accept 90 pennies today rather than one dollar 10 years from now, many misinformed homebuyers think it’s great to get a cheaper mortgage today than face a housing crash tomorrow.

Think about it. Sure, you can save another 10% on mortgage prices today but ignore the reality that before your mortgage is paid, the value of your home has dropped by more than 30% as home demand tanks alongside a cash-strapped Main Street tumbling into a recessionary rather than growth cycle.

Low rates vs. tanking home values? Not much of a smart arbitrage for the future, eh?

For now, however, in the “good times,” no one wants to see this. After all, if it hasn’t rained yesterday or today, it can’t rain tomorrow, right?

What Pops a Bond Bubble?

But why will assets like bonds (including the Austrian bond…) and real estate fall rather than rise down the road – when the rain comes?

Simple: That which artificially rises to record highs inevitably and naturally falls to record lows – as we saw in “Phase 2” of the last real estate bubble when supply (inventories) grossly outpaced demand (viable buyers).

For now, however, investors don’t want to think about tomorrow. Like yields, time has lost its value. Money is chasing after short-sighted candy in exchange for long-term lemons. But how long do you think buyers will want bonds that yield nothing? The selling will come…

Like sovereign bonds (now at record highs), real estate and other debt-held assets will fall in price like rocks when bond markets sell off and hence yields (and interest rates) spike – the death knell to every debt bubble in the history of markets.

And what will cause bonds to fall from these astonishing record highs?

First: They will fall under their own grotesquely unprecedented weight. Bonds have never risen this high. Ever. And what goes up eventually comes down. Market forces are a lot like physics: Don’t fight ’em.

Second: Once sovereign debt is no longer sustained by faith in central bank (fantasy) money-printing, tapped-out pension funds, and less gullible investors whose wages have not budged since 2008, demand for those bonds will fall in the meltdown in price, faith, and trust that follows every melt-up.

Third: A global and/or national recession will test the strength of corporate earnings, and hence corporate debt servicing. Corporate bond defaults will start slowly (the “zombies” die first), and then will turn fatal as declining price momentum spreads across the entire credit sector.

As for U.S. government bonds, the only way to sustain them will be more money-printing from the Fed, and hence more currency dilution of the dollar (a big plus for gold owners).

Eventually, even the paltry yield offered by U.S. Treasuries (our 10-year is actually in negative territory right now, when adjusted for inflation) will not be attractive to other broke nations and buyers falling all around us, even if we are indeed the last nation to rot in the global meltdown to come.

Thus, the current deflationary scenario we are seeing in yields will morph into an inflationary nightmare as yields shoot to the moon. Deflation, by the way, always precedes inflation. Thus, rather than debate “inflation vs. deflation” – just prepare yourself for both.

Inflation, in turn, will rise with interest rates, and the current debt bubble will pop with historical panache – sending the global economy into a hangover unseen in modern times.

At that point, those who bought gold will be able to withstand the windspeed of this debt tsunami.

Meanwhile, of course, the mainstream media is focusing on tweet wars and royal family jets. Almost no one sees the nuclear debt-rocket flying above this mountain-high credit bubble. It’s frankly immoral how few people are getting the truth from our media, advisors, or central bank.

But not you. Not anymore.

Timing?

As we so often say, it’s never safe to “fight the Fed,” especially when it’s desperate and cornered, as it is now. We expect more Fed “support” by year-end, and thus more ripping market highs.

In the near-term, the Fed will roll out lower rates and more money printing to stave off the inevitable recession. Rather than try to time FOMC double-speak or political hat tricks, we rely on our Storm Tracker to track market signals, and so should you.

And as for those Oz-like folks at our central bank, all eyes were on the Fed minutes on Wednesday, which rather disappointed its spoiled Wall Street masters by its moderate tone, but there’s another chance today, Friday, to peek into their mysterious ways…

From the peaks of the Tetons in Jackson Hole (from which skyrocketing bond prices can more easily be seen), Fed central bankers will assemble to discuss the troughs in interest rates – globally – and we’ll be all over that in future posts.

In the meantime, stick with us. We’ll keep you in the know, patiently waiting for the next shoe to drop and the best buying (and shorting) opportunity of a generation…

Comments

16 responses to “What a Simple Austrian Bond Says About the Future of Stocks, Markets, and Real Estate”

- Jim Conwaysays:

August 23, 2019

Great article…..incisive, down to earth,

Predictive and SCARY but credible.

- Eck says:

August 23, 2019

Thank you these insights. I look forward to reading more.

- Howard Shawsays:

August 23, 2019

Will the residential rental market crash also ?

- Jerome says:

August 23, 2019

Mr. Piepenburg: WOW what a eye opener,Thank you so much,this info is right on Que ,seems like 2008 all over again theres not much equity in real estate, who’s gonna get whacked this time around , Banks or Pension funds or Both ?

- Glenn Hsays:

August 23, 2019

I understand the issues you point out in regard to recent issues of government bonds. But, I’m not sure what this means for an investor who has assembled a balanced bond ladder of 20 to 30 year Canadian Government bonds yielding of 3% to 4%? Are you saying all bonds will tumble, or just the junk?

- Marksays:

August 23, 2019

Love your analysis!

- Robertsays:

August 23, 2019

Keep me posted

- SUMANLAL J KANERIAsays:

August 24, 2019

Core point is missing here. It’s all about demand and supply. Yields are crashing because demand for money is dwarfed by supply of money which was created to keep public happy and distracted from endless costly wars being fought with voluntary military service. This phoney money will have to undergo slow deflation and bankruptcies. There is no way around it.

- Mel Robertssays:

August 24, 2019

Thank you for your dead pan honesty.

- Richardsays:

August 24, 2019

What industries and companies excel in a inflationary and deflationary market?

- Miroslav Dvoreckysays:

August 24, 2019

The reality is truly sad, like Mr.Piepenburg describes it. The mainstream media help to black-out it, especially heere in Europe. Thank to author for this contribution.

- Pervaz Hameed says:

August 24, 2019

How do we Survive? What is Safe for

The future? What investments?

I am now a retired Senior Citizen! So how should I plan for a reasonable

Retirement?

- Pervaiz Hameed says:

August 24, 2019

What is the best way to secure a

Reasonable Retired life when All this

Happens?

- Tom Fenn says:

August 24, 2019

Thank you Matt for the heads up, well written; scary toxic subject – I “will” take heed!!

Appreciated

- Martinsays:

August 25, 2019

Fantastic article big thanks

- SUMANLAL J KANERIAsays:

August 26, 2019

How do you plan retirement under this scenario ?

Simple.

Liquidate all your assets and park proceeds in treasury bills.

Then take distributions as per life expectancy tables. You will be living life not on return on your assets but on your assets.