Hear at Signals Matter, we’re more focused on what the market is telling us, not the fight between bears and bulls.

32shares

Today, the partisanship out of DC, from where I’m overlooking the Jefferson memorial, is nearly unbearable. Red vs blue is everywhere-especially in the media circus.

As for Wall Street, a similar war is playing out between bears and bulls. We find this equally unhelpful.

Our mission to inform investors with math rather than bears and bulls opinions extends, we hope, beyond the pale of a mere bears and bulls ego agenda.

We are not fans of spin-selling optimism nor fear-mongering doom, but listen instead to what the markets (now driven exclusively by cheap debt and central bank money printers) tell us.

The Realism

Our readers know that we have never held back any punches when it comes to making a mathematical mockery of the Fed’s rigged-to-fail stimulus destiny or the empirical evidence (by nearly every traditional metric) of the systemic recession risks underlying the most hated (and artificial) bull market we’ve ever experienced.

Does this make us, as many have rightly asked, perma bears in this bears and bulls omni-war?

No. We are realists who respect math, history and cycles.

These disciplines currently confirm a bearish realism. Despite such macro outlooks, however, a full review of our 2019 reports confirms that we are bears who know when to be bullish-that is: bullish when the market gives us a signal. We are, alas, beyond bears and bulls.

Below, we look back at the various moments in which we’ve been bears and bulls in near equal measure, and with good reason, depending on what the market’s signals rather than the media’s adjectives were telling us.

Are We Bears?

By this time one year ago, when the stock market was tanking and the world was nervously wondering if another 2008-moment was upon us, we had already told our subscribers to get out of the markets and deeper in cash by as early as October from a beach near Malibu.

Why so bearish among the bears and bulls then? Because with the Fed tightening its balance sheet and raising short-term rates, we knew that yields and rates would spike and hence the debt-driven stock market would fall like a rock, which it did by Christmas eve.

Was this a bearish stance? No-it was simply a smart move driven by market signals–again way beyond bears and bulls.

Are We Bulls?

We also said that 2018’s tanking Q4 would recover once the Fed pivoted, which it did within a matter of weeks.

By Q1 2019, Powell paused the rate cuts which had sent Q4 2018 over a cliff and thus, right on cue, we became market bullish, as we openly declared here.

Was this a bullish stance? No-it was simply a smart move driven by market signals-namely when the Fed “accommodates,” the markets trend up. Again…beyond bears and bulls.

Toward the Spring and into the summer, the Fed was not only pausing rates, but making a full U-Turn toward lowering rates.

Once again, we said this would be a tail wind, and even wrote an extensive report on the Melt-Up to come and the safest ways to invest such an event.

Was this, and other bull-case reports written because we are bulls?

Again, the answer is no. Current market signals drove our sentiment, not four-legged animals with horns or fangs. We were, once more, beyond bears and bulls…

Are We Bears?

By the early summer of 2019, however, we saw dangerous signs from the yield curve as the Fed’s rate cuts took short term yields equal to, and then below, longer term yields.

And at the same time the yield curve was inverting, Deutsche Bank was showing signs of effective collapse.

In short, we urged caution and higher cash allocations as per our storm tracker, which is indifferent to bears an dbulls and all baout market signals.

Then, by the end of the summer, these financial and credit risks raised enough concern that we explicitly warned readers to prepare for a bumpy autumn.

Thereafter, and almost on cue once again, we saw the repo markets tank and the treasury markets run out of money.

A bumpy autumn Indeed followed-no big surprise. We saw the signals, not bears and bulls.

Why? Because once again the markets were telling us so, not because we were bears and bulls, psychics or “doom and gloomers.”

Are We Bulls?

But never ones to look a gift horse in the mouth, we suddenly turned overtly bullish in mid-October when that same Fed suddenly turned the money printers back on to the tune of $60 billion per month.

From a river bank in Utah, I literally “screamed Risk on!” and offered three fat-pitch recommendations to ride this temporary tail-wind.

Was this because we’re bulls?

Again: Not at all. We were simply tracking the markets, which effectively means tracking the Fed…We saw a clean shot and we took it. Nothing less, nothing more. No bears and bulls, just signals.

Informed Investors See Opportunities Rather than Bears and Bulls

Which brings me to the seminal point of this brief article. Even in a Fed-driven market Twilight Zone as fundamentally distorted, rigged and twisted as the current one, there are always windows to take on risk, as well as obvious periods to avoid risk.

The issue, therefore, is not about being a loyal to bears and bulls, but simply investing as realist adapting to clear signals, bull or bearish.

Although no one can boast perfection when it comes to market timing, we feel we saw those windows of risk and opportunity fairly clearly and for no other reason than this: We, as well as our Storm Tracker and Heat Map tools, know how to read market signals rather than media headlines.

A Year of U-Turns

2019, of course, was a perverse year of central bank U-Turns and classic Fed confusion.

One day the Fed was raising rates, and the next it was pausing rates. Thereafter, it was lowering rates.

In 2018, Powell was tightening the balance sheet with conviction, and by 2019, he was easing that same balance sheet in desperation.

Like chickens with their heads cut off, the Fed governors ran up and down the Eccles Building trying to justify a set of vacillating policies which they now know are running out of credibility.

As I recently wrote here, the Fed literally has no choice going forward but to print more money and keep rates low.

Why?

Because with corporate, private and government debt now at record-breaking, unprecedented levels of madness ($73+ trillion and counting), the Fed knows our economy and markets can’t survive if the cost of that debt rises.

It’s just that sad and that simple.

Plain Crazy

Which brings us back to where we began-with a reality check and ultimately an unabashed and openly bearish out-look over the long-term.

Why?

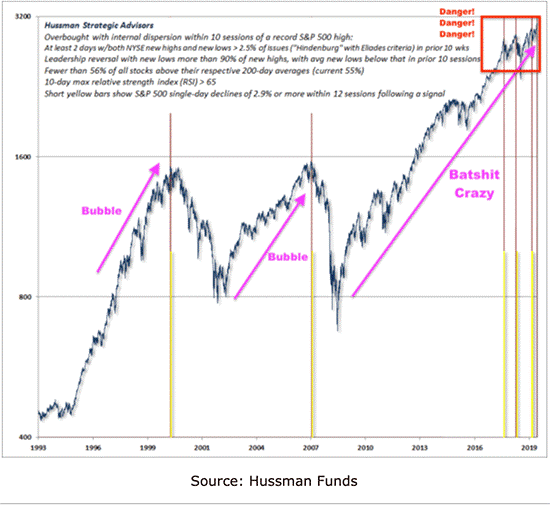

Because as our readers already know, and as Adam Taggart and Chris Martenson recently described it, our market has gone “bat shit crazy” (pardon their French).

Why so crazy? The answer is as clear as the following chart:

As Taggart further observed, and as we have reminded readers countless times, such inflated markets, driven entirely by central bank money printing and record-low interest rates around the world, have resulted in a record-breaking mountain of horrific debt yet no economic growth (as measured by GDP) to show for it.

This means if you still need any proof that the central banks’ post-08 “experiment” (masquerading as a recovery) has been an utter failure for the real economy, just look at the following chart, also courtesy of Hussman Funds:

This failure further explains why 75% of Americans can’t afford a home, despite the lowest interest rates in our history or why 40% of Americans can’t afford even a $400.00 emergency.

Stated otherwise: the stock market is not the real economy, yet eventually Wall Street, as always, will take Main Street down with it.

And as for these staggering market highs, they are literally riddled with historical risk, which is why even when we saw a “bullish window”-as we did three times in 2019-we repeatedly recommended that investors manage these known risks via smart, Storm Tracker cash allocations.

We also reminded you to keep a keen eye toward complacency bias, which always finds its most dangerous levels when investors are seduced by the eerie calm of rising markets.

In short-one must manage risk yet respect uncertainty, for they are two very distinct concepts, one which can be measured, the other which cannot.

Risk

Risk, the kind we track daily, can be measured and invested.

So yes, we are macro bears who can turn micro bullish when the markets give us a clear signal. This sets us way past the bears and bulls.

But most importantly, we humbly accept (and hedge) the uncertainty that is otherwise inherent to the great, rigged and totally Fed-distorted markets in which we now find ourselves.

Our dynamic cash allocations, in both bear and bull windows, allow us-and YOU-to manage known risks while simultaneously employing the simplest yet most ignored rule in making true wealth in the markets: Buy at bottoms, not tops.

And looking at the graph above-does that not look something like a top to you?

And yes, markets can go higher, much higher, before all the forces we described here send it into a melt-down.

Uncertainty

Uncertainty, unlike risk, is not something easily measured or managed.

The uncertainty, for example, surrounding these grotesquely distorted Fed-supported markets therefore demands the humility and patience of informed investors, not the stubborn adherence to a bears and bulls ego war.

In short, we are in uncharted waters now-a time of open uncertainty because no one really knows for how long (and how much) the Fed can print money and repress rates to keep this farcical and openly artificial market alive.

No one.

Despite today’s notable yet temporary Fed support, the known risks regarding dollar supply issues and unsustainable fiat money creation are real and undeniable.

Nevertheless, timing the culmination of the uncertainty surrounding the Fed’s limited powers is nearly impossible, though anticipating its ultimate (and disastrous) end-game is not.

The Fed’s reckless money printing and low rate debt bubble, however, will end badly, and therefore has given us the confidence to recommend gold as another sensible insurance policy (beyond cash) in which to hedge these inevitable risks.

Mr. Market Knows More Than the Bears and Bulls

Despite such measurable risks and immeasurable uncertainties, readers constantly and naturally ask when will this market crash?

For us, the answer has always been the same: We don’t know. No one does.

No one, except the markets themselves, which is precisely why we track them so carefully.

Instead of making predictions, we listen to the market’s signals (bull and bear) and then translate the same back to YOU, which means we are “bulls” when known risks are reduced and manageable, and we are “bears” when known risks are rising and avoidable.

This also means that when this historically distorted market inevitably tanks, we (us and YOU) will be two steps ahead and creating wealth while others are counting their losses.

Until then, we’ll keep you informed and in the game, and only swinging at the fat pitches rather than the curve balls.

Sincerely,

Matt

Comments

5 responses to “Reality Check: Facts Rather than Bears & Bulls in a 2019 of Fed U-Turns”

- Larry Wallissays:

December 13, 2019

Since you mentioned gold as a hedge, which type of gold investment make the most sense and is the safest gold investment strategy?

- George Anstadtsays:

December 13, 2019

The supposed independence of the Fed is belied by the long track record of markets performing well before presidential elections; the music is not likely to stop until Nov. 2020. Global indebtedness even worse than the US puts other nations in a poor position to force reason here. Japan has a multi-generation history of stimulation and default; the average person in Japan expects this.

What can we learn about smart individual investor behavior if you apply your system to the historical Japanese data?

- richard privratskysays:

December 13, 2019

You obviously have a pulse on the market based upon indicators that appear to be spot on

- Herbertsays:

December 14, 2019

So at this moment are you a bull or a bear. Can’t tell by your long article. Seems to go in circles

- Melsays:

December 15, 2019

Wow, scary things are coming. Thanks for helping us navigate through all this.