For months, readers have been inundating us with questions about precious metals and whether or not they should buy gold.

43 shares

We’ve addressed these questions on many occasions and have touched upon this topic directly in separate reports.

In short, gold matters.

Candidly, with the nearly endless stream of gold bugs spinning “MUST BUY GOLD NOW” messages for years, we were reluctant to openly join this mad chorus.

But as macro conditions (from global political tensions to central bank desperations) continue to deteriorate, we are convinced that NOW is the time to directly and thoroughly address the “buy gold” question.

Let’s dig in…

Getting Emotional

Perhaps more than anything, gold is an emotional issue.

Some swear gold is the only asset worth owning while others maintain that this metal is a “barbaric relic” of an ancient system, no longer relevant to the modern world of complex monetary engineering by which recessions are now seen as extinct creatures.

Even the great Oracle of Omaha, Warren Buffett, doesn’t see any value in gold, and no reason to buy gold. For him, gold (unlike silver of which he owns over $1 billion) has no technical or other identifiable inherent value or use. He says, “it doesn’t do anything but sit there and look at you.”

Well, we take a different view here.

The Technicals

I just returned from a few months in Europe, where I met and spoke with some of the best minds in the precious metals space, most of whom are officed in Zurich.

The Swiss are part of a continent that has seen generations of economic cycles, horrific wars, and market moves that pre-date the birth of the U.S. (and Warren Buffett) by centuries.

In sum, they have the history, math, and data to give us Yanks an important perspective on (and comfort with) why one should own and buy gold, and why NOW is the time to consider it.

In terms of purely technical jargon and data, gold recently broke through $1,500, which is $150 above the long $1,350 resistance line that’s been in play for the last five years.

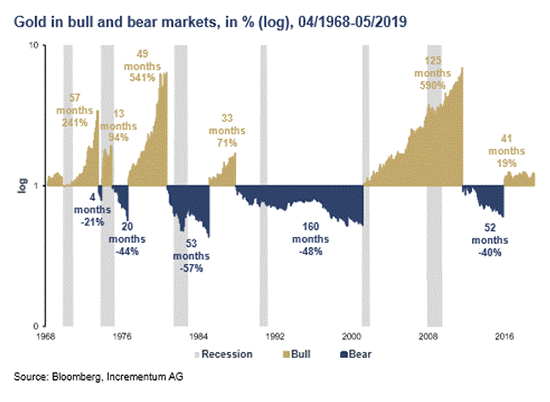

Furthermore, even on the inevitable pullbacks, including the dramatic moves seen in 2018 (when gold opened the year at $1,400, sank to $1,180 in August, and then closed the year at $1,300), gold has been increasingly making higher “new lows” since bottoming in 2015.

In short, a rising trend pattern has been set for gold, and we believe (like the Swiss) that gold is entering the first stages of a gold bull market, which some of you may want to consider in deciding upon whether or not to buy gold.

The Not-So-Technical: TRUST

Technicals are one thing, and market instinct and facts are another.

Ultimately, and as we’ll unpack in detail below, gold is about trust, and makes its greatest moves higher when trust in everything else – from markets, central bankers, media bubbleheads, big bankers, and politicians – make their greatest moves lower.

We can all agree that the times are changing. Trust in monetary policies, economic stewardship, Wall Street, media financial reporting, and economic sustainability are at record lows.

As our Rigged to Fail report made mathematically clear, investors have been conned for years by what is little more than a debt-driven “recovery” emboldened by half-truths on everything from employment and inflation to GDP and earnings.

This trend is also global, from Tokyo to Beijing, from Rome to Australia.

Italy is in open rebellion, Brexit (deal or no deal) is a glaring vote of no confidence for the Eurozone, and the yellow vests were everywhere I drove in France.

In many other corners of the continent (from Poland to Hungary or Spain to Portugal), political, populist, and economic tensions are rising palpably as European markets, overwhelmed by immigrant waves, declining GDP, and growing debt are nearing a breaking point at worst – and a recession at best.

Even Germany, the European Union’s economic centerpiece and export-dependent heartbeat, is approaching a recession only made worse by an as-yet unresolved trade war between the U.S. and China.

Needless to say, the U.S. is not fairing much better.

Sure, markets are still gyrating around record (yet increasingly volatile) highs as retail investors continue to drink the Fed Kool-Aid that all is fine and will forever be fine – as if the stock market was the same thing as the real economy, which it is not.

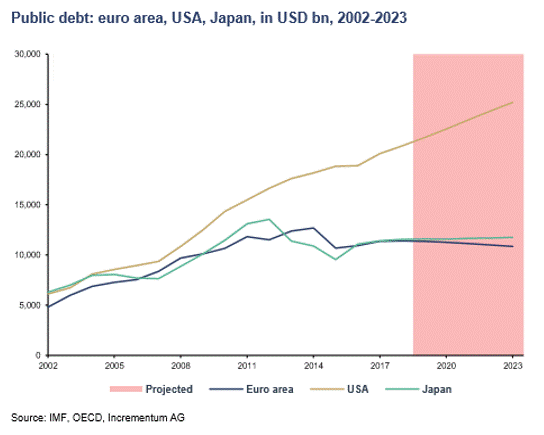

We’ve bought the post-’08 market highs on pure debt, not productivity, and these cancerous debt levels are heading toward levels twice that of the Eurozone and Japan.

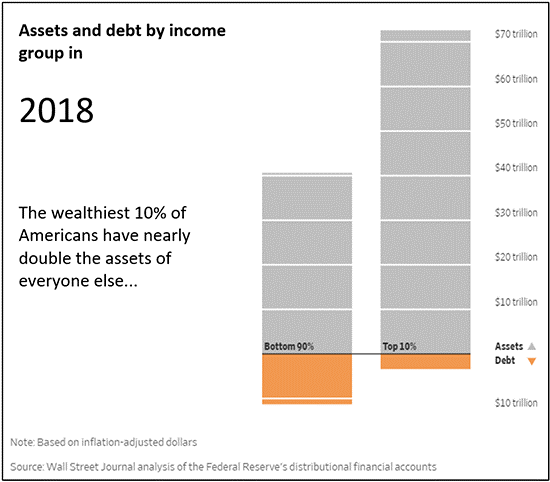

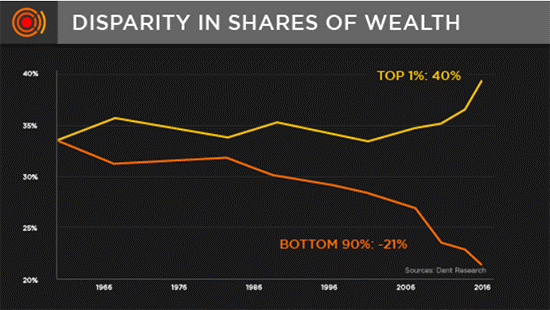

This debt has bought a small percentage of Americans great wealth, but graphs like these below on record-breaking wealth disparity are all the confirmation you need that the alleged “great recovery” since 2008 has benefited only 1-10% of our once robust nation.

This wealth disparity is pushing the rest of Americans toward the bottom – and hence extreme left and right tensions/populism.

The Top 10% vs. the Bottom 90%: Who has the bucks and who has the debt in the U.S.A.:

Who’s winning, who’s losing?

Social and political trust are crumbling all around us at the very moment markets approach their last hurrah before the long march south. This is never a good mix…

Recession Off the Bow

As for recessions, the U.S., like Europe, is teetering on the edge of one right now, as last week’s dramatic yield curve inversion clearly forewarned. That said, the Fed (and will. step in with more money printing to postpone the pain.

The only question today is whether enough political tailwinds can postpone a recession until after the next election cycle in 2020.

Regardless of such borrowed time, indicators on everything from rail freight and consumer debt, to the myriad leading, trend and bond market indicators examined in our unparalleled Storm Tracker are telling us with Paul Revere-like clarity that a recession IS coming.

And guess what: Gold loves a recession. But should you buy gold now?

Gold and Recessions

Those who have done even the most basic gold research know already that gold traditionally acts as a hedge against falling stocks and ultimately as a “put option” (i.e. countermeasure) to aggressive, yet failing monetary policies (i.e. debt-crazy, money-printing central banks).

As for the Fed, there’s no debate any more that they are now in full-on desperation/crazy mode, cranking rates to the floor again and giving up any pretense to further balance sheet tightening as they prepare for the inevitable (yet increasingly less effective) money printing “solution” once our markets take yet another nosedive, like the kind we saw last Christmas.

This was (and remains) as easy to foresee as a cavity to a dentist. But Q4 of 2018 was just a tremor, not the big quake to come.

As early as 2017, I warned readers that markets would tank massively in October of 2018 and into the Christmas holidays. Was I a psychic? Nope. It was easier than that.

The Fed literally told us in October of 2017 that they’d be dumping big chunks of their bond holdings starting in October of 2018. This meant higher bond supplies into the market, lower bond prices, and hence higher yields, which meant higher rates.

As I warned then, higher yields/rates would immediately create an “uh oh” market sell-off in a debt-driven market bubble, which is precisely what occurred. We all remember the bloodbath of Q4 2018.

Thus, by Q1 2019, the Wall Street subservient Fed pulled a shameless U-turn and immediately paused further rate hikes, and as of July, are now capitulating to D.C. and turning away from “tightening” toward further rate reductions – i.e. desperation masquerading as policy. By the end of 2019, we’ll likely see more QE as well, so get ready for a melt-up.

Today we are in full central bank “emergency mode,” which the Fed falsely calls “accommodative” to keep retail suckers fully invested in a dangerously topping market careening toward a recession by every honest indicator in conventional (and non-conventional) analysis.

That is, we are now heading toward three consecutive quarters of earnings declines – and hence an earnings recession as our yield curve screams ominously “iceberg ahead!” while markets globally reach lower highs.

In other words, we are seeing the classic signs of synchronized global slowdowns, with 64% of world PMIs in the negative, 16 central banks cutting rates simultaneously, from D.C. to Sydney, and small-cap stocks – the very pulse check of the real economy – getting clobbered as momentum and volume in this key sector rolls over. Hence more reasons to expect further money printing in Q4.

As these critical market signals point toward recession, as faith in our “experts” wanes, and as our shamefully ignored Main Street rots our economy from the bottom up, an obvious recession looms as trust and data points fall all around us.

Such falls and looming recession indicators mean more countries, institutional players, and individual investors are turning to buy gold. Big time.

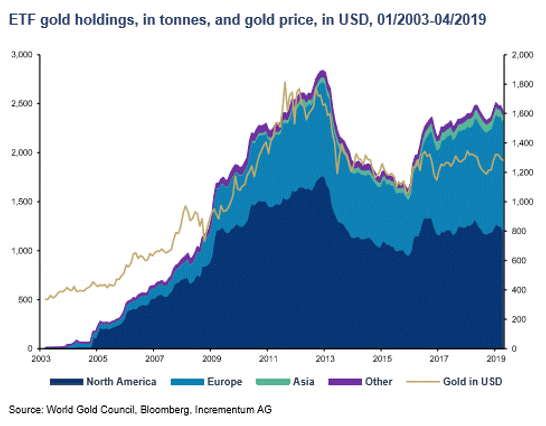

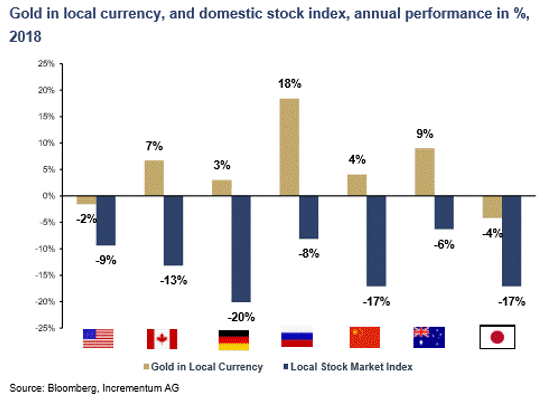

Since 2018, we have been tracking massive waves of gold buying at every dip in its price. Flows into gold ETFs and gold mining stocks skyrocketed in Q4 of 2018, and dramatically outperformed falling stocks in every major market as stocks tanked:

You see, gold loves a bear market – it always has and always will. Investors buy gold when their fear-levels rise:

In other words, if you want to load up your guns before that bear attacks, it might be wise to “think Swiss” and arm yourself with some gold bullets – for it outperforms tanking stock prices quite effectively.

Countries Losing Trust

It’s not just that more investors are catching on to the rigged to fail signals all around us. Countries and central banks, the very skunks who rigged this system, are themselves running for the safety of a buy gold stance.

Central banks around the world are now adding to their gold positions. Last year, they bought over 650 tons of this precious metal. This year, and according to the World Gold Council, that buy gold number will rise to 750 tons.

The Naysayers

Despite all these otherwise objective indicators of trouble ahead (and turning to buy gold as a solution), there are still headwinds to consider for the gold bugs. Let’s consider the counter-arguments.

- The Rising Dollar is Bad for Gold?

Consensus thinking has always maintained that as the USD goes up, gold prices go down. In prior markets (before central banks distorted the entire playing field, including currencies, in 2008), this thesis was confirmed by both history and math.

But in the backdrop of the post-’08 distortion, the global patterns have changed, and a rising U.S. dollar won’t keep gold from rising as well.

Why?

Primarily, it’s because demand for gold from Emerging Markets (EM) countries has skyrocketed. Countries like China, India, Russia, Turkey, Poland, and Vietnam are playing the long game and don’t give a hoot about gold’s daily price fluctuations. They are increasingly becoming major buyers of gold.

Why do they buy gold?

Because the EM zip codes have no choice but to buy gold. With over $11 trillion in USD-denominated debt owed around the world, EM countries have been forced to devalue their currencies to pay back this USD-based debt, which means on a relative basis, the U.S. Dollar is in higher demand and hence stronger.

EM countries that are caught in this dollar-debt-trap and local currency devaluation strategy have no choice but to increasingly buy gold as “insurance” against their weakening currencies.

In 2000, 19% of world GDP came from EM countries. Today, that percentage has climbed to 50%. With such countries showing high affinities for gold as a local currency hedge, the rising demand for gold will, in turn, push its price higher over time.

This means we are now in the distorted scenario of seeing gold rise WITH a rising U.S. Dollar.

Finally, it’s also worth noting that the U.S. Dollar’s relative rise is under longer-term threat, as more countries (including the big players in Europe) increasingly seek ways to de-dollarize by getting away from the stranglehold of dollar-denominated banking regulations/SWIFT transfer systems.

Over the coming years, the U.S. dollar is poised to lose its coveted dominance as a reserve currency, hitherto weaponized in the oil and banking industries to control foreign policy. This shift, however, will take years, not days or weeks.

- Bonds Are a Safer Hedge in A Recession?

Traditional portfolio thinking has always advised that bonds are a haven for falling stocks in a recession. But as we’ve argued elsewhere, traditional portfolio thinking will now get you slaughtered. More folks see better safety on a choice to buy gold rather to buy bonds.

This is because today’s post-’08 bond market has completely lost its way into over-valuation, thanks to central banks artificially propping the credit markets with trillions in printed money while global rates were cranked to the basement of a 5,000-year history.

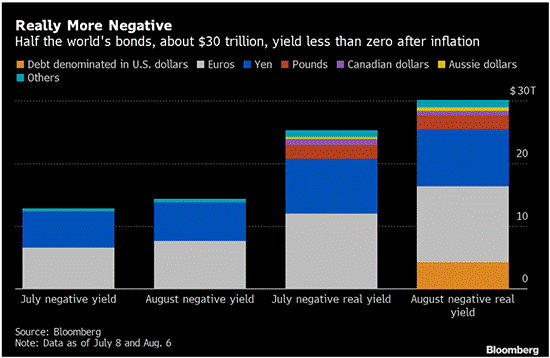

Bond markets are so incredibly inflated and distorted by central banks pumping up prices to such unnatural levels that over $15 trillion in global bonds are now at negative-yielding levels for the first time in world history. (Remember: bond prices and bond yields move inversely.)

These negative-yielding bonds are effectively proof of a camouflaged sovereign bond default playing out. When this bond bubble pops under its own weight – gold prices will soar as more investors buy gold.

That figure alone should shock you. It’s staggering proof a rigged and failing experiment by post-’08 central banks.

Meanwhile, our media is handing us political drivel stories like school-yard gossip rather than hard facts about the economy. It’s embarrassing.

Here in the States, over 60% of U.S. corporate bonds are junk, high-yield, or levered loans – in other words, they’re crap. When a recession comes, many of those zombies will default.

And when adjusted for inflation, half of the world’s bonds are now yielding negative returns – meaning you are guaranteed to lose money the moment you acquire them.

Crazy? Absolutely.

Thus, if you think bonds are a safe hedge in a recession, think again.

But for the near-term, U.S. Treasuries will continue to rise in price as rates and yields fall to zero (or below) in a desperate attempt to postpone the next recession.

The prior conditions of rising yields/rates on the U.S. 10-year of which I warned in 2017 are temporarily gone, due entirely to the Powell Pivot in Q1 2019. But sovereign bonds are now like the dot.com bubble: They will crash under their own weight one day.

In other words, rather than see rates rise to 5% in the near-future, they will first go to zero, which means U.S. Treasuries will go up for a while.

Yet despite this artificial rate compression, gold still rises, even on so-called “good news” from the rate-reducing Fed – which didn’t prevent markets from falling in early August – never a good sign.

- Low Inflation Means Low Gold Prices?

Another common/consensus view in the gold space is that low inflation means low gold prices.

Once again, however, the paradigm has shifted since the central banks took over our markets in 2008. Everything is now topsy-turvy.

So how can gold be rising in a low inflation world?

First of all, inflation, as reported by the U.S. CPI is a blatant and now confirmed lie. Everyone is catching on. Real inflation is closer to 10%, not the reported 2%.

But even if you chose to believe the fictional inflation numbers at the Bureau of Labor Statistics in D.C., our “low inflation data” did not prevent gold from hitting $1,500 last week as more money followed the gold buy.

Why?

Because the smart money know the game is rigged to fail, and the big players (institutions, central banks, funds) are going to buy gold despite the “low inflation data.”

Furthermore, and depending on who wins the next election in 2020, the growing popularity of fantasy solutions like modern monetary theory (MMT), heralded by the left, is pushing for even more ghastly money printing to “solve” our debt problem.

Our debt “problem” isn’t a problem, it’s a fatal illness.

More money printing, as proposed by MMT, will not come without inflation. Thus, one way or the other, low inflation or skyrocketing inflation, gold will continue its steady climb over time, which is why we say: buy gold..

Realism

The foregoing signals all converge on what we consider to be the single most important long-term asset to protect investors from a market recession while also favoring significant returns over the next decade, with gold passing well beyond the $2,500 mark in the coming years.

As for how much gold to buy, like the Swiss, we recommend an allocation of anywhere from 10-15% of your investable funds into gold-related stocks, primarily in such public market vehicles as the Sprott Physical Gold Trust (PHYS, $2.4 billion in assets) or SPDR Gold Shares (GLD, $38 billion market cap).

Direct, physical gold purchasing is also an option for those with the means and interest to do so as their way to buy gold.

Does this mean gold will only go up? No. In fact, we anticipate pull-backs in gold when commodities lag stacks during QE-driven melt-ups, which we expect oward year-end, as the Fed will likely be forced to “carry” a tanking bond market in the fall of 2019.

As shown above, gold can make violent moves as markets change, and we are not recommending gold as a speculative trade, but as a long-term play/investment – a.k.a. insurance.

In the coming weeks, days, years or months, for example, gold prices could be also be dramatically cut by a resolution of the trade war. In such an event, prices would likely fall to the $1,350 resistance line or lower. Stocks will surge for a bit, and then the deluge will come…And then more QE, etc, round and round we go until the music stops and the Fed no longer has a chair to sit on. How long can this “accomodation” last? Who the hell really knows. We just know this much: It can’t last forever and when the jig is up, gold will be your best friend.

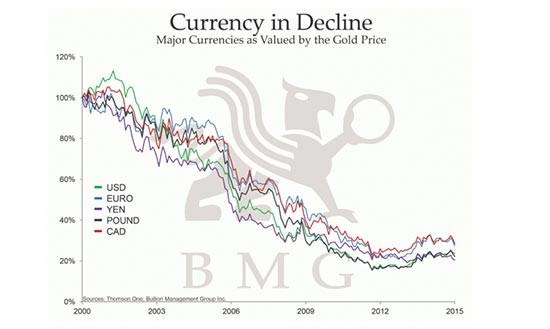

The Real Reason to Buy Gold

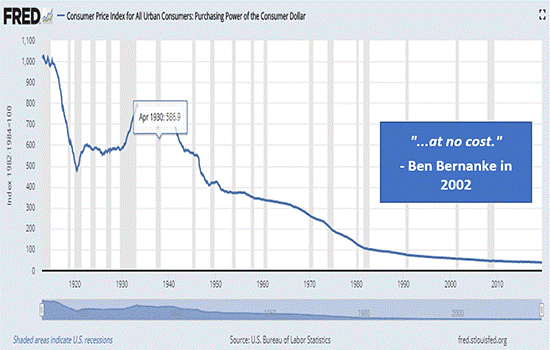

Notwithstanding all that has been revealed above as to recessions,the Fed, inflation, bond decay, etc., perhaps the most important and obvious reason for considering to buy gold right now boils down to these simple but compelling images, which plainly reveal that every dollar (euro, pound, yen, etc.) you own is losing purchasing power by the year, month, day, and second.

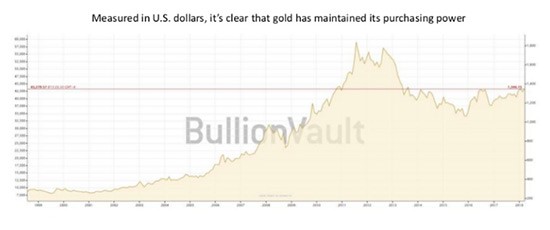

Gold is not merely recession insurance or a portfolio and volatility hedge to declining stocks and bonds in a rigged market gone mad by central bank over-intervention.

Nor is gold merely a tactical countermeasure to fluctuating inflation and interest rate moves.

Far more importantly, gold is simply the ultimate historically confirmed antidote for nations, banks, and currencies who have lost their way in the backdrop of inconceivably high debt traps that send sovereign currencies (and trust in them) to the floor.

If you’re in the U.S., we know you’ve worked a lifetime to amass wealth, retirement savings, and family protection while your central bank and economists (including the delusional dreamers behind MMT or the current Fed mouthpieces at the Eccles Building) have been crushing the purchasing punch of every U.S. dollar you’ve earned, saved, and invested.

Yet look how gold’s purchasing power relative to the U.S. dollar has done…

Bitcoin?

Many who understand the weakened purchasing power (as opposed to relative strength) of our currency might choose the Bitcoin or crypto path as another alternative currency option.

We get this. As a speculative trade, cryptocurrencies can offer incredible upside (and volatile downsides) which gold can’t beat in terms of speed or range.

But cryptos like Bitcoin have been “trusted” for 10 years or less, whereas gold’s track record for saving smart investors goes back millennia to the very origins of market exchanges, from the first merchants of Persia, the dynasties of ancient China and the Empire of Rome, to the once wise economic leadership of our very nation – that is, before Nixon lost his and our way back in 1971 when we left the gold standard.

In a pinch – and we are indeed heading for pinch – I’ll take gold over crypto for the long game simply because gold has been playing this game the longest.

In other words, I trust gold – and you should, too. Time to buy gold?

Comments

11 responses to “This Is the Single Most Important Asset Right Now: Here’s Why You Should Own It”

- Steve says:

August 21, 2019 August 21, 2019 at 8:37 pm

Perhaps the best reasoned, and revealed assessment I have seen. Thank you.

- Greg Olinsays:

August 21, 2019

Why not Silver instead?

- Larrysays:

August 22, 2019

Thank you. One of the best suggestions for “why now gold” that I have read or heard

- Paul Andre de la Portesays:

August 22, 2019

Makes a lot of sense. Thanks for the analysis.

- William Berkleysays:

August 22, 2019

Others have written in the past few years their own version of owning gold . Yours has been the most succinct, insightful and thereby credible.

However I remember reading that the Elliot Wave guys posited that gold would have to fall to around US$ 950 before the great upward leap.

Would that make sense to you?

- John macksays:

August 22, 2019

Since the USA is the world’s largest gold holder ( 8000 tone’s ) does that not put a firm floor under the dollars value ?

- Hoeroa Robert Marumarusays:

August 26, 2019

Your analysis is appreciated Matt.

Are there any gold investments you would you recommend for Australia according to this analysis?

- Jack kimura says:

September 9, 2019

I trust and like what you are telling us. I do have gold and silver, like we should.

- Jay Kleesays:

October 12, 2019

The bullion banks on the Comex currently have a record naked short position in gold. Many people believe (as I do) that gold prices are routinely capped on the Comex by these banks. In addition to spoofing (for which JP Morgan just got busted) the bankers routinely dump $billions in short contracts onto the Comex in the space of a minute or two. Definitely not the most lucrative way to cash in a short position, but a good way to move markets to the downside.

Now on Monday, the PBOC will begin offering a “financially settled” gold futures product on COMEX, priced in renminbi. Because the Chinese are big buyers of gold, it seems to me it will be in their best interest to help cap prices on the Comex as well. I was wondering if you have any thoughts on this?

- Wm Martinisays:

October 12, 2019

You build a strong case,however I have always lost money on Gold stocks!

- For the goldsays:

October 24, 2019

Good write up. I concur with this thesis.

Try to ignore the daily gyrations in the spot market. We are on the cusp of a new bull market in commodities; it should last 10-12 years.

My only “regret;” I didn’t buy more back in 1999.

I bought even more in 2008.

I still have every troy oz I bought back then.

I sold nothing back in 2011; I didn’t “need” the money; I’m in it for the long term. I retire in 9 years. I’m fond of my gold “hodlings” I might never sell LOL.