As markets reel, rebound and then reel some more (as of today’s open) in the backdrop of a viral pandemic, many have forgotten what made markets this vulnerable, namely: Central bank extremes.

A Week of Dangerous Market Swings

Fortunately, our portfolio service has had its eyes on these central bank extremes for years, riding the tailwinds or avoiding the headwinds of the Fed’s policies and signals with transparent awe.

As we’ve said so many times, these are no longer natural securities markets, they are now centralized “Fed Markets.”

This most recent week of central bank extremes (i.e. dramatic rate cuts and more money printing) as well as extreme market swings was no exception nor surprise to our readers, though our portfolio did exceptionally and unsurprisingly well.

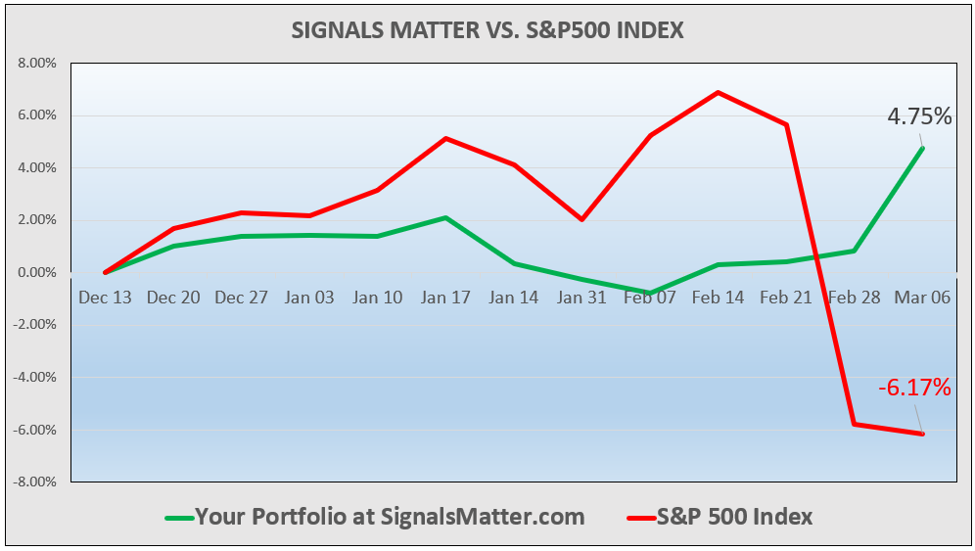

While traditionally allocated portfolios have been smacked by a volatile and declining S&P 500 Index, Your Portfolio at Signals Matter (even with significant cash allocation) is up 4.75% since mid-December through today’s writing (Friday 9:40am), compared to a S&P 500 Index down -6.17%– that’s a 10.92 percentage-point spread over 2.8 months:

Past Performance is Not Indicative of Future Results

That’s what we call an All-Weather Portfolio that is keeping you safe in this Market Storm, where risks are elevated and continue to rise due entirely to volatility created by central bank extremes which have left our bubble markets totally fragile, and hence vulnerable, to any headwind.

Here’s what current volatility looks like in absolute terms as this week heads for a Friday close, and in relative terms back to the last “spike” in 2015:

Dip-Buying and Dippy Investing

In our last post, we discussed this Fed desperation and these central bank extremes at length, commenting on the dramatic fall in the markets on the very day of extreme Fed rate-cutting “stimulus” at levels not seen since the Great Financial Crisis of 2008.

In that report, we also braced readers and subscribers alike for the inevitable “dip-buying” to follow, as the computers which now dominate these Fed-driven markets have been trained for over a decade to do precisely that—buy the dips.

Alas, and almost as if on que, the robo-reaction was fast and furious as markets surged forward the next day, with the DOW gaining 800 points by the Wednesday close.

The dips, alas, were buying the dips as expected.

Reason to relax? Could we breathe a sigh of relief in this setting of central bank extremes?

Hardly.

Informed investors by now understand that such volatile price swings are signals of “Uh-oh,”not calm and certainty.

One day, instead of buying a dip, all investors will be doing do is shouting, “look out below.”

In short: Central bank extremes have placed markets in extreme circumstances of extreme risk and extreme volatility.

Healthy Markets Don’t Move Like This

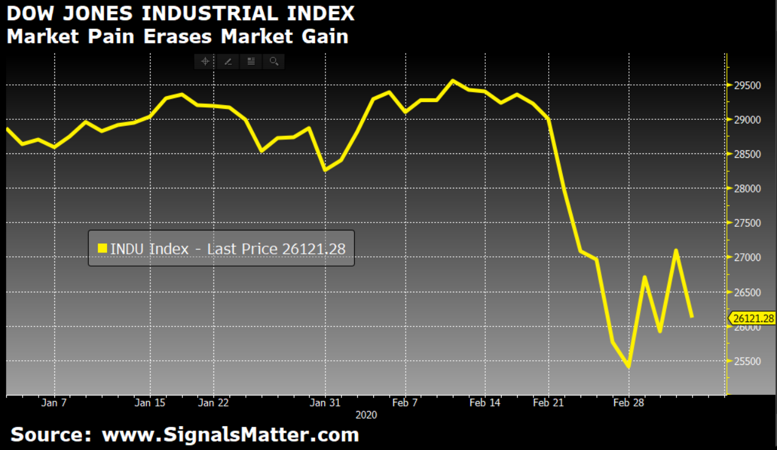

Even by the Wednesday close, the DOW was nevertheless still down 12% from its record highs, reached only a mere matter of weeks prior on February 12.

Such extreme and sudden market surges and falls are typical in markets mislead by central bank extremes. These rapid-fire rises and falls are obvious warning bells to informed investors.

For example, the Tuesday “tanking” we just witnessed sent the markets to their August lows, of which we had previously warned our subscribers in our report, a bumpy autumn ahead.

Needless to say, that autumn was bumpy indeed, as the subsequent repo disaster in September confirmed and of which our read on the central bank extremes had forewarned.

Today is no different, and central bank extremes are once again signaling us to prepare accordingly.

By Thursday, for example, just one day after the Wednesday “rebound” from Tuesday, markets were again heading south, flipping and flopping like a fish on the dock.

Again, one does NOT need to be a “market timer” or psychic to understand how markets behave in the current Twilight Zone.

Instead, one merely needs to accept that central bank extremes, and the markets’ reaction to them, are the critical signals to both anticipate, track and navigate.

What a Sick Market & Healthy Portfolio Looks Like

Aren’t convinced? That’s fine. Just step back and look again at this market’s behavioral data from a simple-math perspective.

That is, step back and consider these insane markets from a sane distance.

You can plainly see that in a matter of just 170 days, and thanks entirely to central bank extremes (i.e. renewed QE in October and continued, predictable rate suppression), the DOW was able to climb an astounding 3,770 points to reach its 29,550 February high.

Again, we called this 170-day surge well in advance by simply tracking the money printing signal that began in October, when we literally screamed “party on!” in the wake of an obvious tailwind from these central bank extremes.

But we also warned to party responsibly, as these markets were loaded with risk; hence we kept subscribers safely in smart, cash-hedged portfolios. The cash is there to stabilize, and our remainder portfolio allocations are there to locate profit, charted above.

Lately, our remainder (non-cash) positions have included allocations to a rainbow of low-volatility fixed income strategies; the Euro and Japanese Yen (as the Fed dropped rates, making the US dollar a relatively-less competitive safe-haven currency); to gold and to equity spreads (safer in the market than picking sides); and even a conservative allocation to the VXX itself (a long volatility ETF), that’s has simply popped.

To view, track and enjoy the Signals Matter Portfolio, please Sign Up Here.

And to see how we track these storms, Download our FREE 5-Part Strom Tracker Series Here.

So, why all these central bank extremes? Because 11+ years of central bank “accommodation” bring long-term distortion, uncertainty and risk.

The Fed Giveth, and the Fed Taketh Away

Still not convinced?

Then simply step back even further and you’ll also see that it took only 2 weeks of market pain since that happy “February Fed High” to erase every single dollar of those Fed-steroid-driven gains.

See why we favor prudent “partying”? See why we hedge risk rather than chase Fed-doped tops?

Folks, such rapid price action moves and central bank extremes are not evidence of rational or even “accommodated” markets, but classic signals of more pain and volatility ahead and further confirms my oft-repeated reminder that markets fall much faster than they rise.

Or stated even more simply and with repetitive consistently: Now is NOT the time to be “all-in” in these topping and gyrating markets.

Again, we’ve been calmly and consistently warning of these central bank extremes and signaling our subscribers into carefully prepared portfolio allocations to weather these increasingly inevitable and dangerous conditions with signaled-confidence rather than guess-work.

We do this in both tailwinds and headwinds and stay away from inane bear vs. bull debates.

The only thing we track are the markets themselves.

Rotting from Within

As of yesterday’s Thursday-close, the DOW was at 26,121, and as of today’s open, it’s struggling again.

But such daily updates are of lesser importance, as the key trend-signal these nervous markets are giving us as to price fluctuation is that things are just, well…rotting from within.

And for that, once again, we can thank years of central bank extremes and not just the more recent, and convenient, excuse of the Coronavirus, as Wall Street still tries to believe the Fed will save them from virus headlines.

Day traders, robo-machines and Wall Street dragon-slayers are now, of course, waiting anxiously for their rich Uncle Fed to step in with more cheap and printed cash to keep their market frat party going a bit longer—despite a tanking real economy.

This means, ironically, that the Wall Street class is looking to the Fed to save them without noticing that it was this very same Fed (and its reckless, post-08 policies) that got them into this current jam in the first place.

Again, the ironies just abound…

Which is More Lethal—COVID-19 or the Fed?

For now, the world in general, and U.S. markets in particular, are panicking in synch about the devastating and global impact of the “deadly” Coronavirus, which despite leaving 98% of its victims in full recovery, is being headlined as the most dangerous global contagion.

There’s no denying the perceptional-impact of this virus on global supply-chains and markets.

For us, however, the real and most dangerous (as well as carefully ignored) global contagion is, and has been for over a decade, the horrific and lethal effects of central bank extremes.

These core central banks have sent the world into over $250 trillion in debt and called that a “recovery,” rather than a binge. The ramifications of such experimental hubris will have far more security-killing impact than the now much-hyped Covid-19…

Again, the ironies just abound. This market was dying long before the first, tragic Coronavirus victim.

Meanwhile, headline virus fears are keeping workers and service providers around the world away from factories, airports and even local business meetings which require a mere subway ride from uptown to midtown Manhattan on the 5 and 6 trains.

This disruption of business and industrial activity is an obvious and massive problem, especially in a fragile world in which the Fed and other major central banks have rendered markets so incredibly vulnerable to any “shock” whatsoever—be it viral, financial, political or monetary, of which the list of potential “shocks” is long and distinguished…

By conceiving and then mid-wifing the greatest debt bubble—and hence bond and stock bubble—in the history of capital markets, these central bank extremes have thereby made the financial world fatally fragile, and hence vulnerable, to just about anything—including a bad outbreak of the flu…

Nor should we forget to mention the cadres of U.S. CEO’s and CFO’s at places like Nike and Apple who have so fully outsourced and offshored labor and supply-chain jobs outside of the U.S. (to boost their share-based salaries) that any disruption in the 10,000 mile-long supply chain (of logistics, inventory, freight etc.) sends markets to their knees.

Not very pro-American, would you say? Thanks Nike and Apple…

Markets on Their Knees

Which is where markets are today: On their knees, begging for more “stimulus” and blaming the virus rather than central bank extremes and the CEO’s drinking their own (and the Fed’s) Kool aide.

Such CEO and central bank extremes have made us this vulnerable, this weak and this dependent upon a Fed which is running out of monetary bullets.

Meanwhile, we’ve naturally got Powell assuring us the “economy is in good shape” on the same day he’s cutting rates by 50 basis points and injecting $100 billion worth of printed money into the markets—a pure emergency mode move, much like Bernanke assuring us all was “contained” just days before the markets imploded in 2008.

The Real Pandemic is On Constitution Ave

So yes, we are suffering from a pandemic, one at the viral level and one at the offices of the world’s leading central banks.

And yes, both pandemics will be devastating, but for now the bankers can blame the virus for what ails us, but as blunt-speaking market veterans (rather than virologists), the pandemic which frightens us the most is located at the Fed’s impressive office in DC and the central bank extremes that brought us to this vulnerable “Alamo moment” of uncertainty, volatility and low ammunition.

Looking Ahead—More Stimulus, Of Course

Looking forward, and with more headline and market pain and volatility to come, we can absolutely assure you that the Fed’s desperate money printing and rate cutting will also continue.

Central bank extremes won’t end just because they no longer have the same punch.

The only question now is how long can the Fed keep this market alive on steroids?

Rather than guess, we simply have to watch the market itself and plan accordingly—and we do that very well at Signals Matter, tracking hundreds of signals and reducing them to actionable advice to YOU.

One day history will track the central banks’ trajectory from hero to goat with retrospective wisdom.

For informed investors at Signals Matter, however, no rear-view mirror is needed to gauge these central bank extremes and the market’s reaction to them.

The Fed literally has no choice but to act with whatever dwindling tools they have left.

And we can also assure you that this desperate money-printing/cheap-debt “solution” is not a sustainable antidote to the economic illness our economy has already suffered long before this virus hit, but which has been hidden behind the greatest stock bubble (and pending disaster) ever recorded.

Again, subscribers to Signals Matter already get this. It’s not doom or gloom—just common sense with a twist of market skill.

If you see this as well, then join us by subscribing here or by reading our Number #1 Amazon New Release, Rigged to Fail, by clicking here.

Tell us what you think and leave an honest review. We’d love to have you in our community of informed, patient and smart investors.

In the interim, we remind our subscribers to visit their dashboards and see what my colleague, Tom Lott, has to share in the more detailed What’s Happening Now, What’s Ahead, and what to do about it by way of Your Signals Matter Portfolio.

Until next week,

Sincerely,

Matt Piepenburg