Folks, we are heading toward a command control economy. Good grief…

Over the years I’ve written almost ad nauseum about the market crazy I see (and saw) around me as a fund manager, family office principal and individual investor.

The list includes: 1) an entire book on the grotesque central bank distortions of free market price discovery, 2) the open (and now accepted) dishonesty on everything from front-running Tesla tweets and bogus inflation reporting to COMEX price fixing, 3) the insanity of 100-Year Austrian bonds or just plain negative-yielding bonds going mainstream, 4) the open death of classic capitalism and the rise economic feudalism, 5) asset bubble hysteria seen in everything from BTC to Amazon; 5) rising social unrest, 6) the serious implications of Yield Curve Control and the gross mispricing of debt that has midwifed the greatest debt binge in recorded history, and 7) the ignored power of logical delusion that so characterizes the madness of crowds in the current investment era.

In short, there are a great deal of things which simply astound me.

Fortunately, however, there are sane voices among the mad crowds, including Austrian fund manager, Ronni Stoeferle, who recently had a lengthy discussion with an equally brilliant, and hitherto deflationary thinker, Russell Napier.

Among the many compelling take-aways from that discussion is the fact that Mr. Napier is now turning inflationary.

As we’ll see below, this broader and structural inflationary pivot, now undeniably on the horizon, has massive implications not only for precious metal ownership and risk portfolios, but also the very structure of the financial world going forward.

In short, the inflation discussion is not just an academic topic nor fodder for podcasters and economic tenure-seekers—it’s a critical signal of the repressive financial world hiding in plain site and staring us straight in the eyes as we limp toward an ever-more repressive tomorrow.

Expect Inflation. Period. Full Stop.

In college, I once read that the only certainty is uncertainty. In short, be weary of anyone who says anything is certain.

That said, I am now arguing that inflation is certain. Hmmm.

Why?

Well, I’ve written at length in the recent weeks on the many factors which now make inflation inevitable rather than theoretical. Specifically:

- Inflation, based on the hitherto honest rather than current CPI scale, is factually at 9%, not the farcical 2% range. In short, inflation is already here;

- Unlimited QE, by definition, means greater money supply, and inflation, by definition, is about precisely that: Increased money supply;

- QE for Wall Street (and the embarrassing new reputation of MMT) is slowly being joined by “QE for the people” in the form of unprecedented, “COVID-justified” broad money creation and fiscal deficits which direct money (and the velocity of the same) straight into Main Street, a classic tailwind for rising inflation;

- The now openly felt winds of a commodity super cycle is driving commodity prices higher in everything from corn to plywood, all further (and undeniable) tailwinds of increasing inflation;

- Finally, and perhaps most importantly, governments around the world have never, not ever, been as deep in debt as they are today, and the only way to dig themselves out of the Grand Canyon of debt in which they and their central banks put themselves (and us) is to now inflate their way out of it. In fact, just last week, the ECB openly confessed as much.

But in case none of the foregoing objective realities has you convinced of inflation’s arrival and growing windspeed, Mr. Napier gives us even more reasons to accept, as well as expect, its, well…certainty.

The Structural Shift Toward Open Inflation: Government Credit Guarantees.

Unknown to many, inflationary forces far stronger than just monetary and fiscal stimulus have been in open and deliberate play by the world’s major governments in the form of government credit guarantees to commercial banks.

This is a critical structural shift.

Why?

As we wrote in Rigged to Fail, central banks have been in bed with commercial banks and broke governments since their not-so immaculate conception.

Governments are all too aware that commercial banks can’t thrive or create credit and loan money at the artificially repressed rates otherwise so crucial to keeping their massive sovereign debt obligations affordable.

By recently guaranteeing bank credit risk in everything from business loans to mortgages, governments are not only aiding and abetting bank survival in a low-rate new abnormal, but are effectively (and slowly) taking control of the commercial banking sector.

Such credit guarantees from governments ensure bank money creation to manage everything from housing and the green agenda to consumer and corporate debt needs.

This new direction represents a permanent structural change in the banking system which despite being largely ignored by the average citizen, will mathematically lead to an even greater expansion in broad money growth, and hence, by definition, a deliberate and now structural as well as global expansion in the inflation rate.

In short, global governments are permanently taking a more centralized role in the global banking system and hence the Politburo-like financial system in which you now sit.

The major global markets are now seeing undeniable and intentional broad money growth—tripling the rate of growth in just the last 6 months.

But What About Interest Rates? Well, Here’s the Kicker…

Of course, everything we learned in school, in both economics and history, suggests that if inflation rises, then rates must rise as well, right?

Well, sadly, in this brave new Orwellian world of government centralization and shameless debt expansion, nothing we learned in school is now much of a guide.

In short: Everything has changed.

Given these grotesque debt levels (compliments of a politician and central banker near you, rather than the COVID excuse), policy makers literally have no choice but to inflate their debt away.

But being the clever little weasels that public policy makers are, they will, of course, make every effort to have their cake and eat it too by deliberately allowing inflation (to get out of debt) yet also repressing the cost of that debt by turning to yield curve controls to artificially repress rates.

This is great for banks, but yet just another sucker punch for regular Joes.

Such rate repression is a must for increasingly red Uncle Sam, rather than a choice or pundit debate going forward.

Given current global debt levels (>$280T), naturally high nominal rates would literally kill the markets and governments with the same, rising-rate bullet.

That is, if rates were allowed to rise naturally (i.e., in the bygone world of genuine capitalism), the interest expense on government debt would scream way past 50% of GDP in seconds and the post-09 debt party would end in dramatic fashion immediately.

Thus, central banks will kill free market price moves in the bond market. They have no choice.

This is no secret, by the way. Just last week, the ECB so much as confessed this new direction.

In simple speak, the only way to get out of debt is to keep inflation rates above interest rates— and the greater the gap, the faster the road out of debt, something the French (my homeland) have known for centuries…

Of course, this open sham wherein inflation runs higher than nominal yields is also a perfect, textbook setting for negative real rates, which as all gold investors (rather than speculators know), is what I recently described as the ideal setting for a structural bull market in precious metals.

But what about my favorite economists—the Austrian School?

Haven’t those Austrians always warned that the money creation needed to repress yields/rates via artificial bond buying leads inevitably and without fail to currency destruction and a bursting bomb within the financial markets and broader economy?

In short, won’t there be a terrible, terrible price to pay for this new abnormal of rising inflation?

The short answer is “yes,” but the only issue remaining is what flavor of terrible are we talking about?

Austrian School Disaster vs Command Economy Nightmare?

Austria’s Ludwig von Mises warned that all artificially rising bubbles end in catastrophe—including (and depending on the size of the bubbles) rising inflation, crashing securities markets, and the advent of social, economic and political chaos which always follows the death of paper money.

Today, of course, such a loss of confidence in paper money is real—from the Austrian school’s warnings to the legitimate and rising popularity of alternative crypto currencies like Bitcoin.

Russell Napier, however, doesn’t see such a von Mises-like explosion.

Rather than allow such events, he believes modern “democracies,” now deeper and deeper under the command economy of governments aligned with central bankers (think Yellen at the Treasury and Draghi as Italian PM), will simply take over the economy rather than allow (for now) its natural death ala the von Mises forecasting.

So, pick your flavor of policy poison: Either the entire system implodes (ala von Mises), or we enter a Brave New World of command control government wherein capital controls become the new, tragic normal of an economy an market in full-on hospice care.

Either way, of course, we still face the inevitable slings and arrows of misfortunate-inflation.

Where to Hide from Inflation?

But in a command-control new world, where can investors go to protect themselves from rising inflation?

Well, the regulated big boys in their big banks and other institutions won’t have a lot of choices.

This is because the entire survival of an increasingly centralized, command-control economy (20% of US income now comes from government handouts) rests upon having less rather than more escape routes.

Centralized economies, whose bread and butter is by definition “financial repression,” will never, not ever allow alternative escape hatches or open channels for monetary outflows which might otherwise threaten their needed inflationary agenda or sacred currency.

Instead, they will tighten rather than expand creative and alternative solutions to inflation and dying currencies.

Bad News for Bitcoin

This also means Bitcoin is facing a dark future, for the simple reason that brilliant loopholes like Bitcoin are a direct threat to the centralized world of financial repression to which we are not only heading, but already experiencing.

One of the key appeals of Bitcoin, for example, is its anonymity profile. This brilliant and revolutionary blockchain move has my greatest intellectual respect, but sadly, centralized governments will not tolerate such tax less “coins” or anonymous ownership.

Bitcoin is simply too scary a threat to increasingly repressive financial systems. In fact, if Bitcoin where to truly succeed, governments would truly fail.

Which bet will you want to take?

This is why governments, including at the US Congress, are already submitting legislation to strip BTC of its anonymous profile.

This does not mean an outright ban of the sexy crypto (yet), but such a move will certainly remove much of Bitcoin’s lipstick and investor appeal.

Are You Prepared?

Rising rates are all the hoopla right now, as if even 2% on a 10-Year bond is somehow a market blasphemy given how thoroughly broken modern credit markets have now become.

Yes, rates will rise if left to natural market forces, but in the near-term, Uncle Fed and his magical money maker will do their best to repress rates for the simple reason, again, that they have no choice.

Meanwhile, they’ll pretend to target 2% or “slightly higher” inflation, knowing full well that the CPI measure of inflation is an open lie.

Such deliberate charades allow truth-challenged policy makers to inflate away their debt while artificially repressing the cost of the same. In short: It’s good to be the house when you’re running a casino.

This combo of rising inflation and cheap debt is a policymaker’s dream of having your cake and eating it too.

It’s also a further boon to otherwise walking dead companies on the debt-soaked securities exchanges, whose Wall Street interests are key to the Fed’s long-term plan.

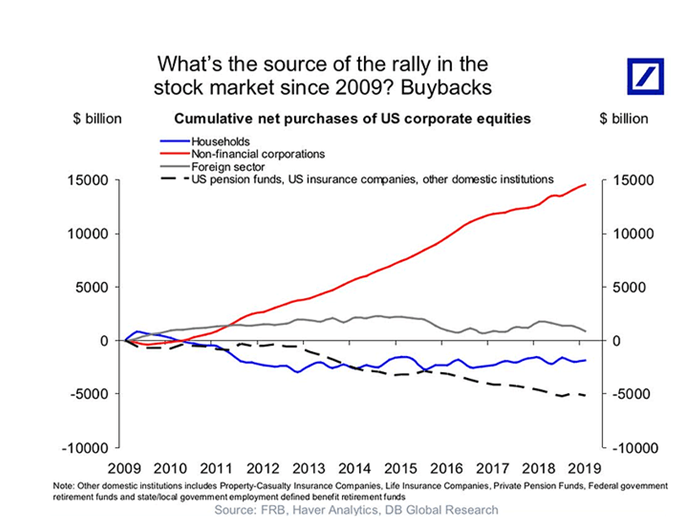

Knowing that rates will be favorably and artificially low in the near-term, corporate CEO’s (whose salaries are based upon share price) will do what they always do, use cheap debt to borrow more money which is then allocated to buy their own shares.

Ah, aren’t rigged markets a grand thing?

And in case you think we’re joking about those grotesque stock buy-back schemes, just see for yourself:

As always, we are tracking this rigged game with signals not adjectives and forever scouring the market data to find the right sectors to protect and grow portfolio wealth in a market backdrop increasingly defined by absurdity rather than anything even remotely resembling honesty or natural supply and demand.

Best,

Matt & Tom