Below we look at the real numbers behind the trade balance, US consumer debt, a broken Main Street, store closures, margin debt, and the global bond (and hence market) crisis to come.

Trade Wars

I’ve written about the impact of the trade war here and here and will do so again now, as I feel it is a bad decision and the worst time.

Hopefully, this will become clearer to you regardless of which side of the political fence you sit.

At Signals Matter, we like to look at the math, not the toxic stuff of politics, but alas, the two subjects often overlap.

As someone raised in the Midwest, I have a healthy respect for farmers, and as someone who played a lot of baseball in Iowa, perhaps an even softer spot for Iowa farmers.

Interestingly enough, the Midwest also made a dramatic shift in the last election, as hitherto “Democrat” states like Wisconsin and Michigan (themselves replete with tractor-driving voters) threw in their lot for a Republican and in so doing, turned the tide in Trump’s electoral college “upset.”

But here’s the rub. The very candidate who promised to make their fly-over America great again may have missed the mark.

Iowa Farm Land

If you are a farmer in Iowa, for example, then you will already know that Beijing just slapped a 28% retaliatory tariff on soybean imports from the US.

Ouch. Double Ouch.

This means a lot of things, including dramatically declining soybean sales in the future for American farmers, which also means that the price for black earth farmland in Iowa is about to take a plunge.

In fact, I think Trump may have just handed me a “buy” opportunity for farmland in the coming cycle—but that’s for another blog.

For now, let’s look deeper under the hood and use this soybean example to showcase just how distorted and dishonest the pundits have become in the current “everything bubble.”

The data we are going to look at below is nowhere to be seen in the increasingly feckless Main Stream Financial Media (MSFM) that gets everything from the war in Syria to the FANG stocks dead wrong…

That is, just as the Chinese tariff kicks in to make things unequivocally worse for American farmers, the spin-doctors of Wall Street are trying to convince investors of the very opposite.

So, let’s look a bit closer at how the sell-side spins lies into “news.” Indeed, the example serves as yet another sign of a market that climbs on propaganda rather than cold truth.

The US Trade Balance

The market, for example, is currently all excited about the first-blush fact that the US Trade balance improved last month.

This, they argue, is proof positive that being tough on trade (the “art of a deal”) was a brilliant move by the White House—after all, our export numbers are climbing and trade deficits are falling.

Good, right?

Well, those same market ghost writers left out one important fact, namely: the data they are relying upon is based on exports made PRIOR to the Chinese retaliation to our own tariffs. In other words, they are full of manure.

It’s sort of like the Japanese declaring victory after Pearl Harbor: that is—they forgot about the concept of “countermeasures.”

The Chinese are now, well… counter-measuring…

One-Hit Wonder

In fact, the monthly US Trade deficit which decreased in May by $2.6B was almost entirely (80%) due to the fact that soybean exports had doubled that month because US bulk carriers, terrified of the Trump trade plan, were racing like mad to sell before his tariff “solution” could start.

Hence, the recent (i.e. panicked) export “boom” was nothing more than a one-hit wonder, not the sign of a robust US export trend to come.

Again, and quite simply, the export numbers were temporarily up because farmers knew that once the trade war started, their export numbers would go dramatically down…

Which means the export data Wall Street is so proud of is actually dishonest—no less than a used car salesman telling you a Porsche is still a Porsche even if they put a Toyota engine in it.

In short: the larger story of “improving US trade balances” coming out of the MSFM under Trump, NPR, or Santa Claus is simply, as The Donald is remiss to admit or even grasp: “fake news.”

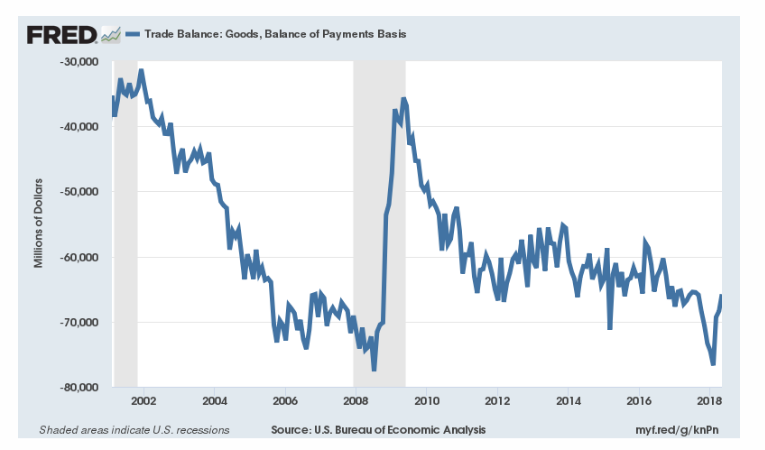

Don’t believe me? The graph below (furnished by our own Fed) makes it embarrassingly clear:

See for yourself?

That is, as we take a gander at the larger business cycle (as opposed to last month’s one-hit-wonder soybean sale), there has been no improvement whatsoever.

None. Zero. Zip. Nichts. Niente. Nada. Rien.

Reality vs Fiction

Instead, reality is far stranger than the media-based fiction we are daily fed about the American economy/recovery. As I’ve written elsewhere, Main Street America (the one that voted “hail Mary” for change) is suffering.

And by suffering—I mean in debt up to its ears.

Record Breaking Consumer Debt

In May, for example, as poor Iowa farmers raced to sell their crops before the tariff guiotine decapitated their future profit margins, US credit card debt soared by $9.8 billion, the biggest monthly increase since November, and one of the highest monthly increases on record.

At $1.39T (!), consumer credit card and revolving debt is at a record high; but that’s just the beginning. When you tack on other metrics of consumer debt (i.e. student loans and mortgages) the US Consumer debt figure is now at an off-the-charts, all-time record-breaking $15.2T(!).

Folks, historically unprecedented private debt levels such as these are a ticking time bomb as any market historian knows.

Unfortunately, red or blue, most of the talking heads and prompt readers in Washington are not very market savvy, let alone historically well-read…

Record Breaking Store Closures and Margin Debt

And as for other painfully embarrassing new records being broken in the good ol’ US of A, 2018 could beat the record that was set last year for the number of store closures in a single year.

Some reports say that more than 12,000 stores are expected to close this year versus last year’s 9,000, and the number slated for closure (think Sears) keeps growing.

Walgreens, meanwhile, recently announced declining same stores sales.

Their solution? Why it’s the American way—they borrowed their way out of the bad news (!!!), recently announcing a $10B loan to pay for a share buyback program to soothe investor nerves, only to see their shares tank by 10% within 3 days.

And the very same debt monster that is eating away at Main Street Americans and US publicly-traded companies is equally visible in the trading pits.

That is, the amount of margin debt held by investors also hit a new record high this month even though the market has sold off 2,500 points from its February highs.

See a pattern here in the “engine” that drives the US “recovery”?

It’s called debt.

Debt—the Backbone of America

And getting back to the trade imbalance lie that is now making headlines, we see that this too is just another example of a debt problem, not a trade problem.

Like its overly-indebted citizens and enterprises, our government has also been attempting short-term prosperity by importing dramatically more than it exports and then paying for those imported goods by borrowing from the rest of the world via “IOU”’s in the form of US Treasury Bonds.

We’ve been doing this for years and years and years.

Of course, the mainstream narrative for this self-inflicted trade pickle is as arrogant as it is misleading. It asserts that the US is so wonderful that money just never stops pouring across our borders by the trillions in the form of “voluntary investment”—so much so that it actually compels us to run a massive trade deficit…

In other words, we have so much money invested within our borders that we have no choice but to spend (i.e. import) more than the rest of the world.

That’s well…a lie.

From Production Based Growth to Debt-Based Can-Kicking

The real truth is we don’t produce anything anymore. Nearly all our US manufacturing patriotic executives moved their operations overseas to profit off cheap labor and thus higher margins for their share-price-based annual bonuses…

And we also know that those same CIO’s in the US love to borrow even more money to buy back their own shares and thus temporarily boost their already nose-bleed level stock prices. Such vision…

Stated simply: It’s a debt-driven bacchanalia here in the GDP-less America.

But why let a debt problem spoil the current fun?

Debt—Why Worry?

After all, our genius central bankers—the likes of which handed us (yet never forecasted) the dot.com crisis of 01 and the sub-prime crisis of 08, don’t seem to worry very much about debt anymore because they actually (and academically) believe that debt is not a big deal?

Huh?

Yep.

For the PhD’s at the central bank (who never actually traded a security or fairly warned you of the market crashes they created in the past), they believe our massive national debt ($21T and counting—also a new record) can always be “rolled-over” and “re-financed”—or more to the point, can-kicked to infinity.

Imagine if you ran a household the way the US handles its affairs? You play polo in Monaco for 40 years, retire in France, and then hand the bill to your kids? Real sweet…

And with this arrogant attitude toward debt in mind, the US has, therefore, run current account deficits for the last 43 years in a row (!)—all because it believes that as the issuers of the world’s reserve currency—it can do whatever it wants and the rest of the world will follow.

In fact, the world has been following us—right up to the edge of a cliff.

Central banks around the globe have been forced to follow our central bank playbook by not only buying up our debt/bonds but their own as well, just to keep their FX rates within competitive par with the ever-diluted USD.

That is, and as I wrote recently here, the central banks of the world have followed the US lead in printing currencies out of thin air to keep pace with the Fed’s “printing press” experimental madness in DC.

They then use this printed money to buy debt (i.e. bonds) that the market itself could not and would not otherwise buy.

In short: we have a globally fake bond/debt market, kept afloat by central bank printing presses… not Adam Smith’s first lesson in natural supply and demand.

This incredibly dangerous trend, however, is slowly coming to an end, as even the Fed has pivoted from QE to QT (i.e. from drinking its own Kool-Aid/bonds to puking them out).

After all, they know their mad post-08 experiment is failing and need to push rates up so that they’ll have something to lower in the next recession which they alone sired.

Net result: the central bank perma-bid/binge (from DC to Tokyo) for sovereign bonds and other securities of the world is about to end.

This means the bond market is about to lose its magical “buyer.”

This means the bond bubble is about to end.

This means that bond prices are going to go down.

This means that interest rates are about to go up.

This means that the cost of borrowing is about to go from cheap to expensive. (So much for the “roll-over”/” Re-Finance” fantasy/meme).

And in a world “recovery” driven by debt—expensive borrowing means that the end of the debt-driven market party is only a matter of time, or more to the point: interest rates…

Keep your eyes on the yield curve folks.

And as always, be careful out there.