Yield curve and coronavirus dangers are rearing their ugly head again, which means the Fed, and U.S. markets are nearing an impasse.

A New Risk – the Coronavirus

The Coronavirus was top in the news last week, and now seems to be a much larger issue than was originally reported by the Chinese (no surprise there), the media, and even our own initial thoughts, based on the evidence then at hand.

In short, the virus could be much more dangerous than was originally reported, as death tolls are now surpassing the SAR virus numbers.

And yes, if the Coronavirus goes even more viral globally, global GDP growth (lead by China) will be in for a hit.

The U.S. Fed was on record calling the virus a “new risk” to global growth last week.

China (the gorilla in the room when it comes to trade as well as transparency) could be in for a severe economic shock that will hammer growth, cutting the Y/Y (year-on-year) numbers from 6% in Q4 2019 to half as much for Q1 2020, impacting Asia first and the rest of us next when it comes to global commerce.

The White House, in a stream of hope selling late in the week, indicated that China’s Xi Jinping had reassured the U.S. that Beijing would stick to its purchase goals which were outlined in the phase one trade deal.

We’ll see. China can only do what it can do under such adverse circumstance.

Here’s the rub, though. The Coronavirus has risen to the level of an “outlier event” or black swan that finance jocks call “tail risk” – a form of portfolio risk that can move markets (and your portfolio) more than three standard deviations from the norm, triggering all manner of market chaos and market moves.

Such sudden moves would include a flight to the U.S. dollar (which we’re already seeing and which hurts U.S. exports), sharp declines in trade and commodity prices, along with a whole lot less appetite for risk, which we saw on Friday when the Dow Jones tumbled by 277 points, almost 1%, clouding an otherwise sunny week for stocks, including, of course, Tesla…

Storm Tracker is Watching

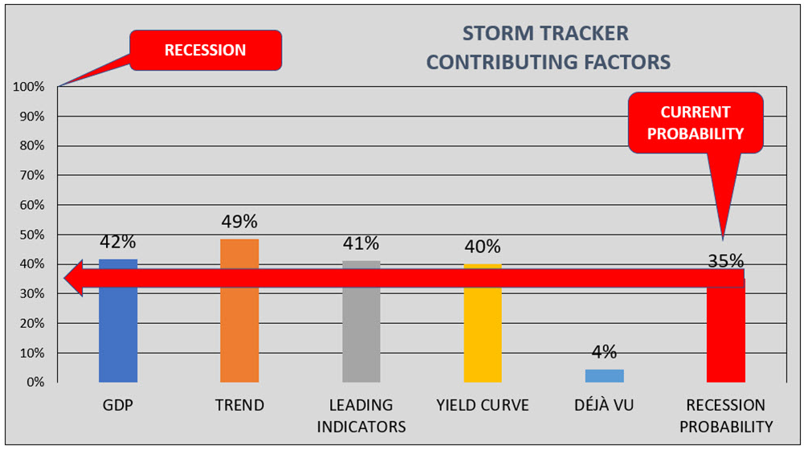

Storm Tracker has its eye on outliers like the Coronavirus, as the impact spreads through changes in GDP growth, trend patterns, leading indicators, yield curves and our other critical indicators and pulse-checks.

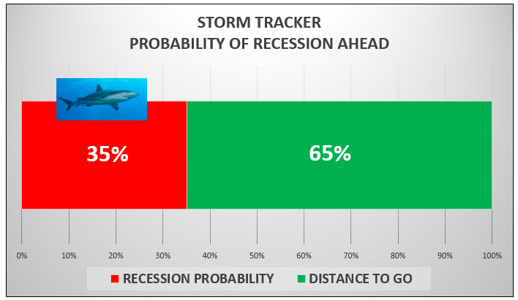

Storm Tracker has since ticked up from 30% to 35% in the last two weeks…

…as its Contributing Factors rise:

Storm Tracker informs on the cash position we recommend in Your Portfolio . To access, Click here to Subscribe, then click on Your Portfolio to see what we’re suggesting now.

Our promotional rate of just $195 annually will not last long at just 53 cents a day, a far better value than what’s otherwise available in the financial media.

Another Risk Ahead – Yield Curve Control

We do want to touch base on one other risk outside the Coronavirus that’s Happening Now, namely late-cycle Yield Curve Control.

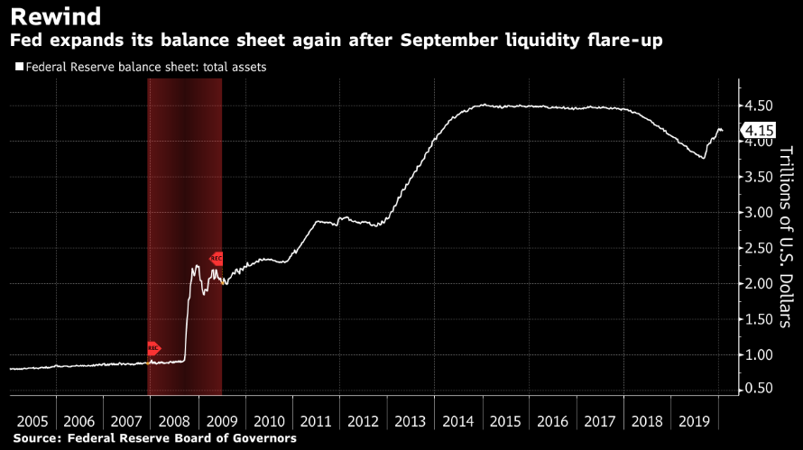

You know by now, and from all of our Market Reports, that in the wake of the late 2019 repo disaster, the Fed has pilled-on even more QE (Quantitative Easing) tailwinds to increase market complacency and straighten out the U.S. yield curve, which just won’t stop trying to invert.

We know that yield curves forecasted every recession since WW II (explained in the 5-Part Storm Tracker Series) 12 months out.

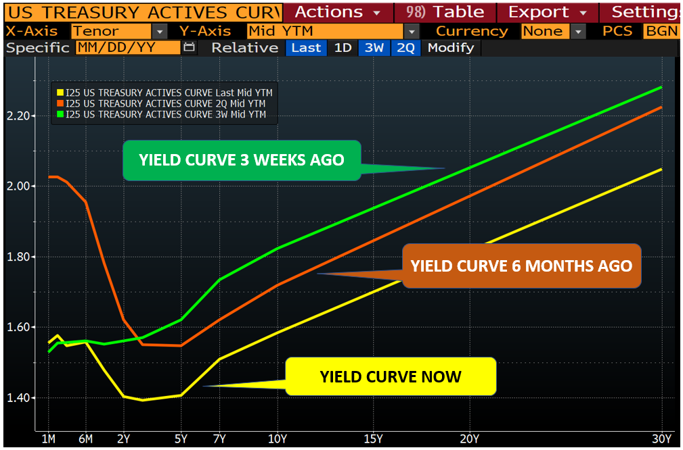

With that in mind, take a really careful look at the yield curves below for a display of what we are talking about when referring to Yield Curve Control.

The brown curve in the chart below plots U.S. Treasury yields 6 months ago – this was the ugly inversion that scared everyone.

The green curve plots yield 3 weeks ago. This was the far prettier slope attributed to the Fed for jumping in with even more QE to straighten the curve. Nice.

But now look at the ugly troughing/sinking yellow yield curve happening in real-time…it’s inverting again!

You see, by continuing to apply stimulus to keep the yield curve sloping positively (rather than troughing/sinking on the left), the Fed’s in rewind mode…it’s expanding its balance sheet again and again!

They just can’t get off the steroids.

This Raises a Big Question…

The trillion-dollar question, of course, is how long will and can this artificial Fed support last, and at what expense to our real economy despite all this aid to the bond and stock markets?

Last week as well, the Senate sent a letter to Federal Reserve Chairman Jerome Powell seeking answers about this kind of ongoing (and extremely expensive) central bank intervention, especially when it comes to yield curve support and emergency repo intervention.

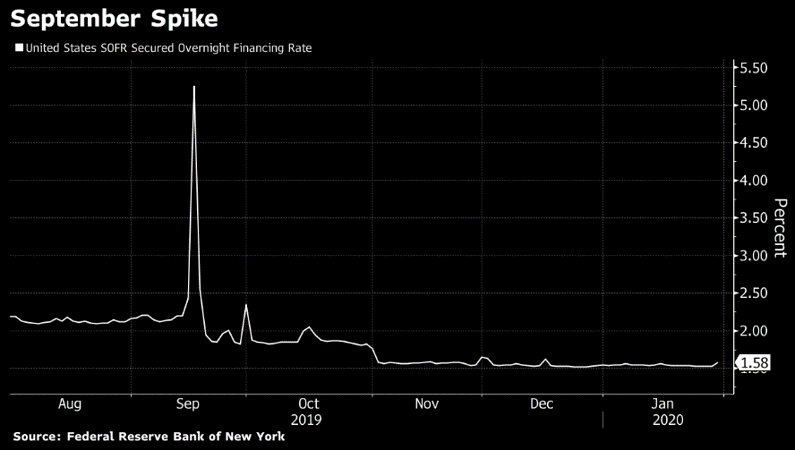

Remember when the Fed underestimated liquidity needs and overnight repo rates spiked, which required hundreds of billions of dollars to be pumped back into the money markets via a combination of repo loans and outright purchases of Treasury bills?

Worry is ramping up that we could see this movie again, which just adds to the worries now linked to the Coronavirus.

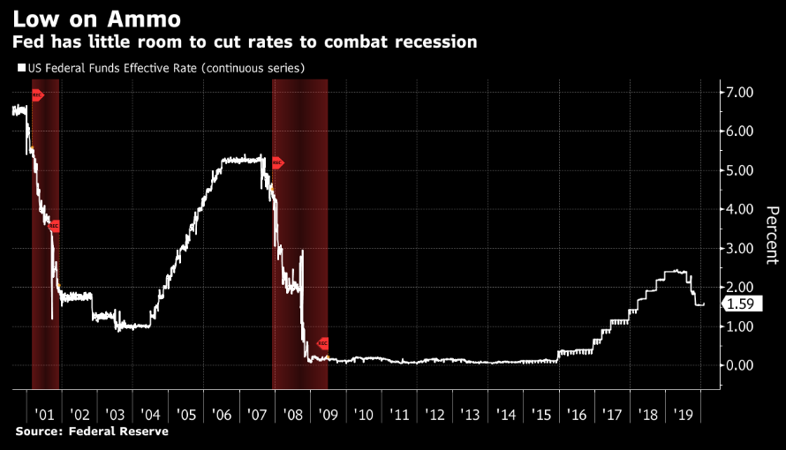

Yield Curve Control is a manipulative, recession-fighting device. But with interest rates already at historical lows, economists like former Fed Chair Janet Yellen have warned that central banks won’t be able to fight future recessions using traditional measures.

Uh-oh?

Former Fed Vice Chairman Stanley Fischer and ex Swiss National Bank chief Philipp Hildebrand opined last week that “unprecedented policy coordination” may be needed to deal with the next downturn, including central banks explicitly financing bigger government budget deficits.

In short: Expect the money printers to go into over-drive yet again, as we are facing a deadly dollar shortage in the credit markets in addition to the deadly Coronavirus.

In short, we’re low on dollar and rates ammo.

Sure, we can print to infinity, but not without severe consequences.

Think about it. The short-term Fed Funds Rate closed last week at 1.59%. But it takes at least a 3%-rate cut to get out of a recession.

Sadly, rates today aren’t even high enough to cut a measly 3%…

Nevertheless the narrative continues to be the same: Borrow, spend, reduce taxes.

Where Will All This Take Us?

Finishing up, you may ask just where the U.S. is headed in all of this.

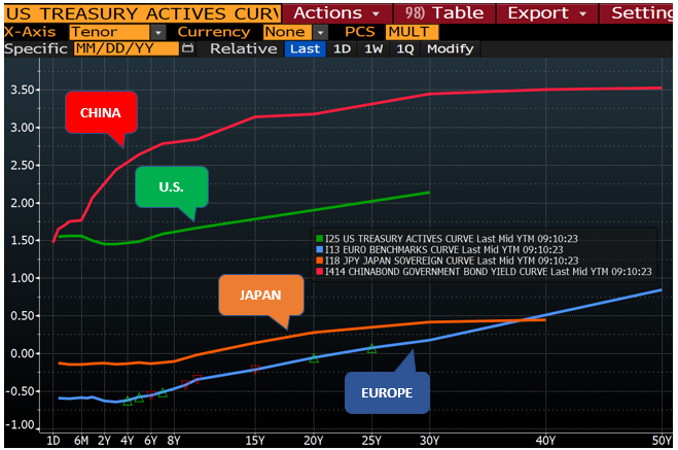

Take a look at this last chart below for clues.

It displays yield curves for the U.S., the Eurozone, Japan and China. We explained this elsewhere in greater detail, but for now, just take a look at the yield curves for the Eurozone and Japan at the bottom of the chart.

Out 6-8 years, they are in negative interest rate territory, which is just plain crazy and a deep warning indicator that the global markets, and central banks, are slowly running out of magical bullets.

If we keep piling on QE and relying upon the Fed rather than growth to keep our yield curve positive, look out below for flat to negative U.S. interest rates if the Fed needs to resort to lowering those short-term rates yet again to keep the next recession at bay.

And remember this: If our rates and bond yields go to zero or below, we’ll no longer be the best yielding horse in the global glue factory, but rather just another pile of glue…

Foreigners will have no interest in our debt, and yet we survive off issuing debt. Who will buy it? The Fed, of course, with more printed dollars.

This is alarming.

Summing Up

Long discourse made simple, the Coronavirus could be the trigger that slows growth to levels below the currently anemic 2% annual rate (that’s before inflation, which means when adjusted for inflation, there’s just mathematically no growth at all).

That’s going to induce the Fed (and central banks globally) to pile on more QE, which is a tailwind for those holding gold as a long-term hedge against fiat currency risk.

Storm Tracker will track all of this and kick up a higher defensive cash allocation. Remainder Allocations (described for Subscribers) will become conservative, as they have in recent weeks.

In short, in this bull and bear sea-saw for the opening days of 2020, there’s volatility ahead.

Your Comments

Before we sign off, we wanted to express our sincere appreciation for your continuing comments, especially Dean M’s query last week on how we would explain the failure of gold to play a leading role, along with bonds, in providing protection against a likely decline in stocks and a dangerous monetary situation?

There’s a lot we discuss Dean, here and here on gold, but think of gold this way: When there’s a fire in the bond theater (as in a global margin call on all the debt now in the system), just about everything gets sold in a desperate attempt to flee the scene and raise liquidity.

Lots of corporate bond holders will then have no buyers for their bonds, and they’ll get burned.

Come Join Us, We’ll Arm You with the Fire Alarms

If you’d like to get a head start, come join our portfolio service and we’ll look for you on the other side to show you exactly where the best portfolio position is recommended.

In the meantime, be watchful, stay informed and stay safe.

Matt & Tom