Market volatility is back, setting up a perfect scenario for trouble first and a Fed bailout second. But for now, corporate insiders are cashing in…

23 shares

You may have noticed that yesterday’s markets saw an intra-day swing of 450 points. That’s market volatility.

Market volatility has once again reared its ugly (yet oh-so-predictable) head.

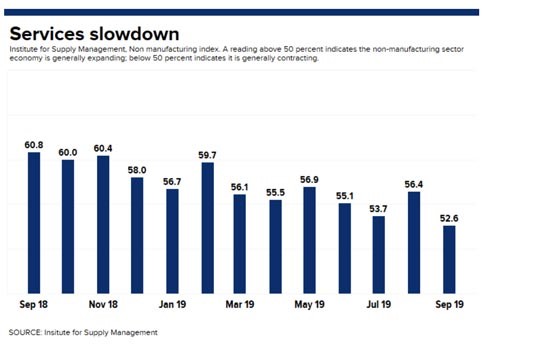

Last week the market volatility came from our broken repo markets. This week, it’s the painfully awful ISM services index data that’s sending the markets into yet another hissy fit.

The ISM data measures the health of the non-manufacturing sectors of the economy, and they are anything but healthy numbers – just a couple percentage points away from full-on contraction.

And you can bet that’s reason for concern and market volatility.

And yet by the day’s close, markets rebounded on this bad news.

Crazy?

You betcha…

Bad News Is Good News?

But that’s the character of the “new abnormal” – a stock market entirely dependent upon Fed intervention (i.e. further distortion masquerading as “accommodation”).

In this totally rigged to fail market, bad news, like extreme market volatility, is ironically good news for the markets, for it means more Fed stimulus (more forced lower rates and inevitable money printing) is soon to come, and we all know how much Wall Street loves Fed steroids.

Thus, critically bad recessionary data like declining industrial production and declining business services means nothing to a stock market sustained by a rich Uncle Fed ready to dole out more printed money and lower-rate debt.

But it’s not just the moral hazard of the spoiled Wall Street speculators/nephews enjoying 11+ years of handouts from the Eccles Building that keeps these entirely fake markets going.

Fat Rats, Sinking Ships–Corporate Insiders Cashing In

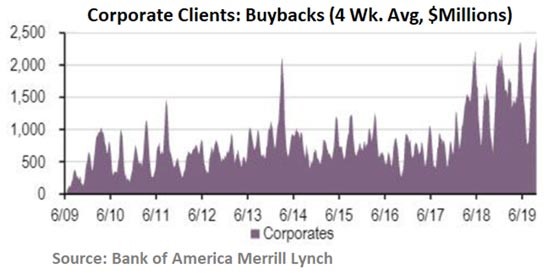

The markets are also rising on yet another (and equally bogus) scam, namely the corporate insiders are engaging in stock buy-backs, whose four-week averages just reached their peak.

In other words, the same companies and corporate insiders that comprise our markets are the top buyers of their very own stocks in what is otherwise a self-serving circle of pure crazy.

After all, who needs natural buyers of stocks when corporate insiders, drunk on $430 billion in September bond-issued debt (a record high, compliments of Fed-crammed rates), can buy their own shares on borrowed dollars?

Again, it’s crazy – like an author achieving “best seller” status for buying his own books. That’s the same for today’s corporate insiders.

But read on, the scam perpetrated by corporate insiders gets even crazier.

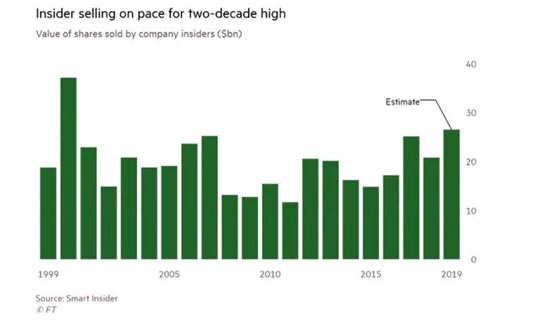

At the very same time these corporate insiders are artificially boosting their stock prices via record-high stock buyback schemes, the same corporate insiders (CFOs, board members, and CEOs) are selling their own personal shares and stock options at record levels – effectively front-running their own stocks in order to later cash out.

This is shameless.

As of mid-September, corporate insiders (along with their venture capital backers and other early stage investors) have sold a combined $19 billion of their own personal shares.

When annualized, this means the level of corporate insiders cashing out is now on track to be the largest executive exodus of corporate insiders self-dealing (i.e. selling) since the pre-dot.com crisis of 2000.

In short, the rats are fattening themselves just before abandoning their own ships – and at a new record pace.

Actually, that’s not only shameless and crazy – it’s repulsive.

In a nutshell, corporate insiders are using once illegal stock buying powers to push up the valuations of their companies so those same corporate insiders can jump ship at a nice profit and then leave you – their retail suckers – holding a bag of losses after these corporate “leaders” have safely pocketed a nice fortune, risk free.

That’s like Captain Smith taking the only available life boat on the Titanic and then waving goodbye to the stranded passengers.

Thus, if you needed yet more evidence that the current markets are rigged to fail, now you have it–corporate insiders are winning this rigged game.

You really can’t make this stuff up.

Sincerely,

Matt Piepenburg

Comments

4 responses to “Executive Rats are Jumping Ship as the Volatility Iceberg Looms”

- ALAN CORNWELL says:

If we can expect more QE and therefore share price increases backed up by share buybacks there appears to be an opportunity for some short term gains on one last push of this bull market. But we know it will end in tears.

Do we take a risk with a small portion of our capital or stand back and watch it happen?

- Jim Welgesays:

Matt

Where this really smells is when the corporate officers and board arrange the buybacks, then shortly thereafter exercise their incentive options to buy at a bargain price (Markets 38 the option allow a buy at 15), then in short order after exercising the options to buy, sell their stock,

It goes without saying that the buybacks are window dressing for EPS, which does nothing to increase the top line or expend money on projects to make the company more efficient.

Supposedly this type of activity occured in the late 1920’s and was a contributing factor in the over inflated markets before the 29 crash. This is very eerie, I hope were not in for a rerun!!!!!

- jack kimura says:

Just how long will it keep going, until it starts to go the opposite way? I know you have told us what to look for. But, might there be something more specific. I know it’s a broad question.

- Rolfsays:

dear Matt,

this state legaliced scam only works with corrupt FEDs and politicians being part of the selve feeding scam. The working class will be left holding the empty bag. The civil war is a shure thing to come with masses having nothing to feed but armed to the teeth and by far outgunning the police, Fema etc. Some are comparing the coming doom to the Roman ampire but it will be so much worse with today’ s population and arms of mass destruction. You see the rise of populist leadership etc, around the globe… I appreciate your publications…may God be with you…