There are increasing signs of “uh-oh” in the world of the once-mighty Petrodollar.

From Trigger Happy to Shot in the Foot

As we’ve been warning in our most recent reports here and here, Western financial sanctions in response to the war in Ukraine have a way of doing as much damage to the trigger-puller as to the intended target.

In simplest terms, freezing one county’s FX reserves has a way of frightening other counter-parties, and not just the intended targets.

Imagine, for example, if your bank accounts were frozen for any reason. Would you then trust the bank that froze your accounts down the road once the issue was resolved? Would you recommend that bank to others?

Well, the world has been watching Western powers effectively freeze Putin’s assets, and regardless of whether you agree or disagree with such measures, other countries (not all of which are “bad actors”) are thinking about switching banks—or at least dollars…

If so, the US has just shot itself in the foot while aiming for Putin.

As previously warned, the Western sanctions are simply pushing Russia and China further together and further away from US Dollars and US Treasuries.

Such shifts have ripple effects which Biden’s financial team appears to have ignored.

And as everyone from Jamie Dimon to Barack Obama has previously warned, that’s not a good thing and is causing the broader world to re-think US financial leadership and US Dollar hegemony.

Saudi Arabia: Re-Thinking the Petro-Dollar?

Take that not-so-democratic “ally” of the US, Saudi Arabia, who Biden had called a “Pariah State” in 2020…

As of last week, the news out of Saudi is hinting that they would consider purchases of oil in CNY as opposed to USD, which would signal the end to the Petrodollar and only add more inflationary tailwinds to Americans at home.

One simply cannot underestimate (nor over-state enough) the profound significance of a weakening Petrodollar world. It would have devastating consequences for the USD and inflation, and would be an absolute boon for gold.

We will be watching these developments very carefully.

Already, Xi is making plans to visit Saudi Arabia, which is China’s top oil supplier. Meanwhile, Aramco is reaching out to China as well.

What Can Saudi Do with Chinese Money?

Some are arguing that the Saudi’s can’t purchase much with CNY. After all, the USD has more appeal, right?

Hmmm.

Considering the fact that US Treasuries offer zero to negative real yields, perhaps “all things American” just aren’t what they used to be…

Saudis have now seen that the US is willing to seize US Treasuries as a form of financial warfare.

As we warned, what the US did to Russia has massive ripple effects for other nations who fear eventual US actions.

Saudis (like many other nations) are certainly asking themselves if a similar move could be made against them in the future.

Thus, it’s no coincidence that they too are looking East rather than West for future deals, and could use their new Chinese currencies to buy everything from nuclear plants to gold bars in Shanghai—just saying…

Not to Worry?

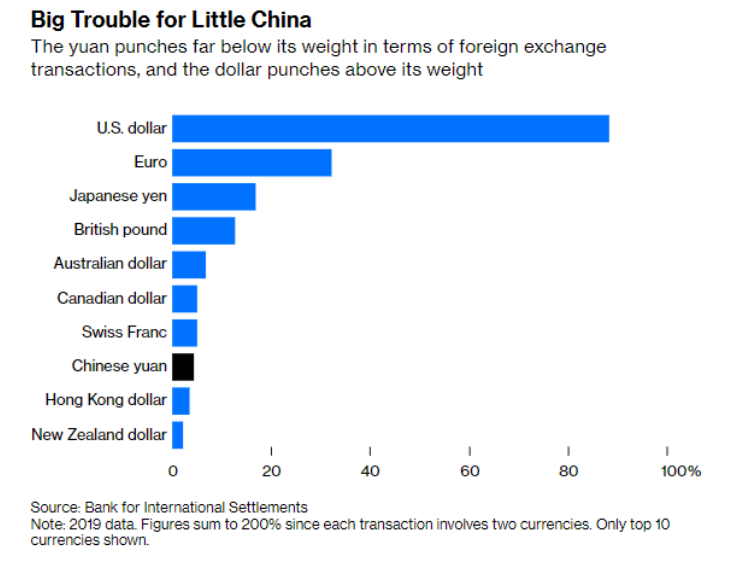

Meanwhile, of course, the WSJ and other Western political news organizations are assuring the world not to worry, as USD FX trading volumes dwarf those of Chinese and other currencies.

Fair enough.

But for how long?

What many politicians and most journalists don’t understand (besides basic math), is basic history.

Their myopic policies and forecasts are based on the notion that if it’s not raining today, it can’t rain tomorrow.

But it’s already raining on the USD as well as US global financial leadership.

We will be watching these macro events very carefully in the coming weeks and months.

But as we warned last week: Once the genie is out of the bottle, it’s hard to put back. Trust in the West is changing.

By taking the chest-puffing decision to freeze Russian FX reserves, the US garnered short-term headlines to appear “tough” but ushered a path toward longer term consequences which will make it (and its Dollar) weaker.

Again, we’ll be watching this very closely.

Matthew, how is it you are always so far ahead of most analyst on the de-dollarization taking place? Thank you for making me see this ahead of time with your coherent writings on the subject. Physically and mentally, you have given me time to prepare for this.

As you know today, we are seeing a move by Russia now ordering Ruble Payments for Energy. As far reaching as this is, it hardly comes as a surprise to your readers.

I suppose any currency borrowed into existence with no intentions of ever being paid back is finished once exposed to its self-inflicted doubt. Great work!