Why a Deficit Matters —A Debt Storm Brewing?

Below, we look at deficits, why they matter, and what they portend.

Debt is Boring

Ahhh debt and deficits. What a boring topic, no?

And yet we at Signals Matter keep boring you with it, here, here, and here and just about all the time here.

Boring also means low ratings for (and hence minimal attention from) the entertainment-based MSM. Whether you listen to FOX News or NPR’s Market Watch, their infotainment spin on economics will keep you amused in squawking but blind to common-sense reality.

Blind can feel good. We get that. There’s a lot of heads in the collective sand when it comes to boring things like national “debt” or the US deficit. Billions and Trillions don’t seem to shock anyone anymore.

Statistics are volleyed about by clueless anchormen and increasingly clueless listeners who think everything is fine because markets and 401K’s are fine.

In short: if today feels good, why worry about tomorrow?

We get that too. We really do. Recency bias is a fascinating aspect of mass psychology in general and the financial sell-side in particular.

The US Deficit—Does Anyone Care?

But as bears wring their hands and bulls buy the dips, we wanted to remind you that our National Deficit, having crossed the $20T marker in September of 2017, took less than 6 months to cross the $21T marker last week.

Did anyone (i.e. you) notice?

By the way, based on budgets already baked into the US economic pie, that number grows by a minimum of $1.2T per year, putting the US deficit at $40T in the next 10 years.

But who cares? What’s a trillion here and a trillion there, and why worry about tomorrow, let alone ten years from tomorrow, when things feel soooo good right now?

After all, it’s so Zen to live in the moment. So refreshing. Cranks like us are just chilling your mellow, spoiling your economic “chi.” We get it. No one likes cranks.

The optimists remind us that Trump is shaking things up, playing hardball with the swamp and making a welcome mockery of the DC’s old way of doing things. That’s cool. We understand. We kind of like it.

But regardless of blue or red identity politics, we try to stick to numbers not network news to find the skunks and roses in the economic woodpile. Frankly, we think politicians of both stripes are just plain disappointing when it comes to debt.

Politics vs Economic Realpolitik

The fact the Republican Donald (a former Democrat) is pro-warfare state, pro-welfare state and also pro-tax cutting is likely to please many of us on one or more of these issues. But regardless of anyone’s personal politics, we need to ask ourselves this:

Having just slashed our tax revenues to 16% of GDP (the lowest rate since 1950), how will America get out of the biggest debt burden in its history?

If Trump wants re-election in 2020, do you think he is about to raise taxes, cut social security or reign in profligate military spending in an era of permanent war?

Unlikely. Perhaps you think or hope that the fine folks in our beloved Congress or Senate will show some restraint, perhaps they’ll save us? But as beltway insider and fiscal realist, David Stockman, recently observed:

“…the alternative of a bipartisan fiscal responsibility coalition emerging in the foreseeable future is about as likely as vows of chastity being taken in a whore house, and we do not employ that particular metaphor at random.”

I couldn’t say it better than that… In short: get ready for more and more debt and deficits.

Meanwhile, those airbrushed geniuses on TV will remind you—and Mr. Stockman—that there’s nothing to worry about. Deficits, they shout, are only 3.5% of GDP—much lower than under prior White Houses. In other words: “Chill out!”

Ah, if only things were as simple as spitting out statistics from the mouths of simpleton TV anchormen/women.

What these paid-for mouthpieces of the infotainment world can’t see behind their prompters and fact cards is what many of us learned in business school, history classes or on a trading desk, namely: markets.

Whether you prefer Tucker Carlson or Kai Rysdall, neither of them (or their ilk, left, right, or center) spent a lifetime in markets.

Again: they read prompters, not market signals. Which explains why neither they, nor the networks that pay them, want to waste your time or mine with boring things like debt or deficits—or, more simply stated: reality.

The Addicts are Running Out of Needles

And what is reality, cold reality? It comes down to the perfect storm we’ve been tracking for years: an entirely unprecedented global powder keg of central bank distortions, unsustainable debt, broken policies, tired business cycles and demographic landmines.

Boring or not, the global market Titanic is now steering toward two undeniable icebergs: 1) unprecedented sovereign, private and corporate debt levels, and 2) an unavoidable pivot on the books of over-stretched central banks from monetary easing to monetary tightening (i.e. a shift from steroid provider, to steroid withholder).

That’s a bad thing for markets addicted to central bank support. The withdrawal is a nightmare.

Net result: a massive de-monetization of the credit markets lies ahead. That means bond yield and rate hikes (the first tremors of which have already begun) are about to shock and awe the so-called “recovery” begun in 2009 on the fantasy of artificial (fiat) money printing and rate-fixing.

In other words, if one were to think of a bond bubble (which creates and supports a real estate bubble, stock bubble, and “everything bubble”) as a big barrel of gasoline, then you need to think of the inevitable and pending “yield shock” as the proverbial “match” about to blow the whole thing to pieces.

Still seem “boring” to you now?

The sell-side optimists, of course, don’t or won’t see this, and certainly won’t focus on this sober, “chi-killing” thought. Moreover, market bears have been whining about this for years, yet everything still seems fine.

Central Banks Have Our Backs?

For many of us, the bears seem to be spinning to nowhere. In this calm backdrop of the now, “deficits no longer matter” because central banks and their economic experts have our backs.

Hmmmm.

In 2000, the experts said tech could only go up; in 2006 the experts said housing markets never go down. Today, the new fantasy is central banks are too smart to screw up (like the 08 banks were too big to fail). If you want to believe such things, that’s your choice.

But we, like many others—from von Mises to Stockman–think deficits do matter, especially as we head toward (rather than away from) the next recession.

Unless, of course, you think the geniuses at the central banks (the same ones who miss-called the dot.com bubble of 2000 or the sub-prime crisis of 08) have figured out a way to outlaw recessions? Again, you’re call.

Maybe you feel that whenever bonds stop being bought or rates get too high and a recession seems to close, central banks can just step in and print magical money, buy unwanted bonds and control market rates the way a gas-pedal controls an electronic Tesla.

Frankly, it’s a nice idea. Just let the central banks save the economy and the political futures of any President staring down the barrel of a recession—and hence political suicide.

Financial Magic or Financial Fraud?

If it were really that simple, then why didn’t LBJ, Nixon, Carter or even Reagan think of this central bank magical solution sooner? You know, why didn’t these guys just call the FED and say: “Please buy our sovereign debt at rates which surpass our annual US Treasury issuance and save our political butts.”

Because, once upon time, even for choir boys like Nixon or LBJ, the very idea of such financial engineering (now the “new normal”) would have been akin to financial fraud and even Impeachment.

Instead of a central bank bailout, these guys (including Ford) had to do the politically unthinkable: raise taxes. In short, ego-maniacs (a presidential pre-requisite) had to consider political hari-kari rather than central bank “cheating” to keep debt in tow.

But then along came Alan Greenspan, the father of central-bank “miracle cures” which (like a modern day Pfizer ad) promise immediate relief yet without mentioning the longer-term side effects.

As Reagan was heading toward retirement and rates were about to head toward the moon (and a recession into your living room), magical Greenspan waved his monetary wand and cried “let’s fix rates, part the Red Sea, and ignore the laws of both gravity and supply and demand.”

In short, with Greenspan, a new era of economic central planning and engineered markets began. DC loved it. Wall Street loved it. Deficits rose, fear fell, and natural market forces, for 30 years and counting, no longer mattered.

In other words: “Party on!”

The Party-Pooper

Unfortunately, a central bank gone wild can distort and thus hide from market forces for a while (quintupling the money supply and cramming rates to the floor buys a lot of time and bull markets), but they can’t hide from reality forever.

In short, Greenspan (and the minions who followed him, Bernanke et al) have been adding gasoline to the debt barrel. What’s even worse, the rest of the world’s central banks reached for the same magical wand.

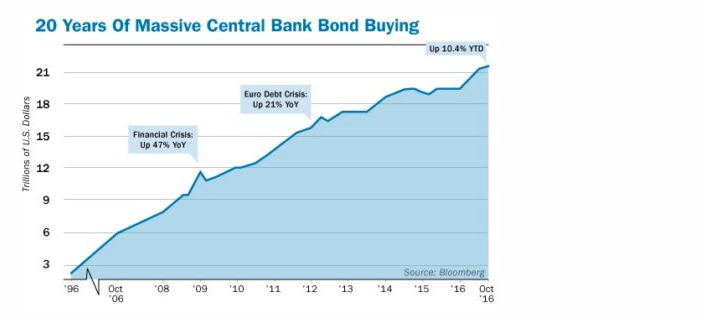

Result? Two decades of artificial bond buying and thus massive debt and deficit growth based on fake (central bank) demand rather than real market demand:

Withdrawal Symptoms Today, Overdose Tomorrow

Needless to say, when fake demand and engineered rate cramming vanishes in the coming shift from QE to QT, and as central banks are forced to raise rather than lower short-term rates, the toxic high of “central bank stimulus” slowly tilts toward a withdrawal twitch, and later death by overdose…

We soberly maintain that such an overdose is as inevitable as the headache of drinking twelve martini’s: you simply can’t have one without the other…

Yes, yes, yes… you’ve heard this pessimistic whining for years. You’re likely tired of it. We get it. Frankly, sometimes we ourselves don’t know what to make of such a drugged-up market.

We’ve never seen so much central bank crazy before—and thus it’s hard to time the behavior of an addicted market, just like it is hard to gauge the behavior of a Canal Street drug addict or Malibu alcoholic.

But the headache that looms in US and global credit markets will need more than one or two aspirin in the morning to fix…More importantly, the central banks are running out of pills and needles at the very same time global debt numbers are surpassing records beyond rational measure or sustainable solutions.

Nervous Doctors

Meanwhile, the academics at the Fed and their bull-whipping acolytes on Wall Street are staring at bogus BLS and inflation charts smiling about the comical delta between short term bond yields and Y/Y “inflation” reports (fictions).

This theoretical meri-go-round of academic posturing is akin to playing chess as the first fires in Rome begin to smoke through the streets. Screw all the theoretical nonsense and fudged data from the BLS; it all comes down to common sense: we are in debt up to our ears.

That is, many sit here blindly hoping the central banks short-term rate magic will save us as a bond bubble the size of Mars is looming in the backdrop. It’s a fascinating example of missing the forest for the trees. Besides, as any bond trader knows: the market, and not the Fed, decide long term rates.

So, when the bond bubble bursts, neither Powell or his equivalent at the ECB, BoJ et all can wave their magical wand against the forces they ironically created. Mars is upon them—and us.

Why? Because central banks can’t buy the entire market. As the ECB’s QE slows down simultaneous to the QT picking up in the US—two cold fronts will collide.

Weather Patterns

And we are already seeing the first hints of the storm ahead. As we warned, and now see happening, bond yields are rising, causing volatility (and the big bad market wolf) to slowly climb from its cave, yawning at first, and soon to be howling.

Early in 2018, we saw bond and stock prices correlate—i.e. fall together. Not a good sign.

We’ve also seen a measurable February “dip.” This week the DOW slid as Trump’s tariff talk stiffened against China, sending Asian markets (themselves a giant, China-lead Ponzi scheme) into a fall.

Are these just “blips” or the first signs of the financial Karma Greenspan and his kind unleashed three decades ago: a credit bubble more dangerous than Jaws in a kiddie pool.

We don’t know. There’s still plenty of dangerous faith in this hated bull market, in central bank magic and even Presidential hype. Faith can keep dead markets alive for longer than they deserve.

Again, that’s why we follow signals and flows, not crystal balls or op-eds from the WSJ.

Nevertheless, we do know how this will end, and it will end badly. How? Because market forces, like gravity forces, still matter.

Until then, our performance (real, not back-tested…) speaks for itself, and our eyes, of course, remain glued to our Iceberg Watch. Frankly, it’s what makes our subscribers sleep at night.

Until that iceberg appears, that wolf howls, that barrel explodes, or that planet mars hits the bond market, please watch those bond yields.

Be careful out there.

Hi Matt –

Extremely well written post on debt. US national debt is now 103% of the US GDP. China’s real debt is close to 400% of its GDP. But the interesting thing is that total US debt to equity is right where it was just prior to 2008 – 55%. Of course, a recession or worse would totally destroy that data. We are living in a world of debt.

Yes, selling bonds is going to become more expensive just as Elon Musk must now pay increasingly higher interest rates to keep Tesla afloat just as more competition is appearing. As you have pointed out central banks are running out of fire power, and efforts to continue feeding the demand for cheap money is coming to an end.

Where do we hide as both stock and bond markets continue to move lower?

Steve