We are seeing dying markets. Slowly at first, and then all at once. Unless, of course, the money printers return, which kills currencies.

Pick your poison.

As far as we are concerned, it is no great secret nor any great surprise that our faith in fiat money (in general) and the central bankers who have debased it (in particular) is anything but robust.

To the contrary, our astonishment with the open mismanagement of global currencies as a whole, and the world reserve currency (i.e., the USD in particular), grows daily.

In fact, to fully un-pack the long series of comical errors and the failed experiment of politicized central bankers seeking to solve a debt crisis ($300T and rising) with more debt, which is then monetized by mouse-click money, would take an entire book rather than single article to address.

Hence my recent release of Gold Matters.

But just because central bankers are desperate, political, fork-tongued, and directly responsible for pushing global currencies, markets and rigged banking systems toward (and eventually over) an historically unprecedented debt-cliff, this does not mean central bankers aren’t otherwise “clever.”

That is, they’ll do “whatever it takes” in the near-term to postpone the fatal fall which they alone have pre-determined for the global financial system.

As per usual, the central bank playbook is about artificial and centralized controls rather than natural supply and demand forces or honest, free-market price discovery.

After all, who needs honest capitalism when we have rigged banking systems and mouse-click money?

As far as I’m concerned, genuine capitalism died long ago, with folks like Greenspan ad Draghi standing over its grave.

Everything Politicized –Including the USD

The comical politicization of science which we saw in relation to the COVID hysteria (debacle), is no different than the inexcusable politicization (i.e., “weaponization”) of finance which we’ve recently seen in the post-Ukraine sanction debacle.

It will thus come as no further surprise that central banks are anything but “independent” and are themselves nothing more than political petri dishes spreading increased “command-control” contamination into global markets as well as global politics and lives.

The road from/between central banking to centralized politics is short and rotten, as confirmed by Mario Draghi’s short skip from heading the ECB to becoming Italy’s Prime Minister, or Janet Yellen’s equally small step from Fed Chair to U.S. Treasury Secretary.

Here in France, it’s equally no coincidence that Christine Lagarde has moved from directing the IMF to presiding over the ECB.

In short: Everything, including money, is politically-self-serving rather than economically free-market. The folks in office to “save you” are mostly interested in saving their positions and guarding the power.

No shocker there.

Yellen: Bold or Just Demented?

And as for Yellen, well…she is certainly a political beast and a fearless devotee of Keynesians gone wild, but she’s also a clever fox guarding the henhouse of that once trusted currency known as the USD and that once respected IOU known as the UST.

Unfortunately, even foxes get trapped.

Inviting Foreign Capital into a Burning Market

As extreme over-valuation in risk assets (i.e., stocks, bonds and property) have become so openly undeniable, and as faith in an increasingly expanded (i.e., debased/discredited) USD has become openly weaker, the folks behind the USD (i.e., Janet Yellen) are trapped.

They will now use all their political tricks and centralized powers to buy more time and postpone the debt, currency, social and political crisis which they alone spawned many years before COVID or Putin became the scapegoats de jour for their own monetary and fiscal exigence.

Toward this rigged end, Yellen’s latest (and desperate) trick is now a deliberate attempt (via rate hikes) to force the USD index (DXY) up to 110 (or above) in a centralized attempt to bring more foreign (i.e., debased) money into the dangerous arms of an already grotesquely bloated, over-valued, volatile and risk-saturated US stock bubble.

And this bubble, as you’ve likely noticed, is starting to leak air…

In short, in order to “avoid” a U.S. stock market crash (triggered by a Fed tapering into a debt-soaked/crippled market), this former Fed Chair’s solution is to coax more foreign money into a burning U.S. theater with fewer and fewer exit doors (i.e., liquidity).

How’s that for clever? How’s that for desperate?

Yellen is effectively politicizing the USD in order to force/cajole/entice foreign capital into crappy US securities (and out of safer global commodities) in order to provisionally save Uncle Sam’s market bubble from an inevitable implosion at the expense of other people’s money.

When will central bankers realize that they can’t keep a market bubble alive forever to save their political rear-ends?

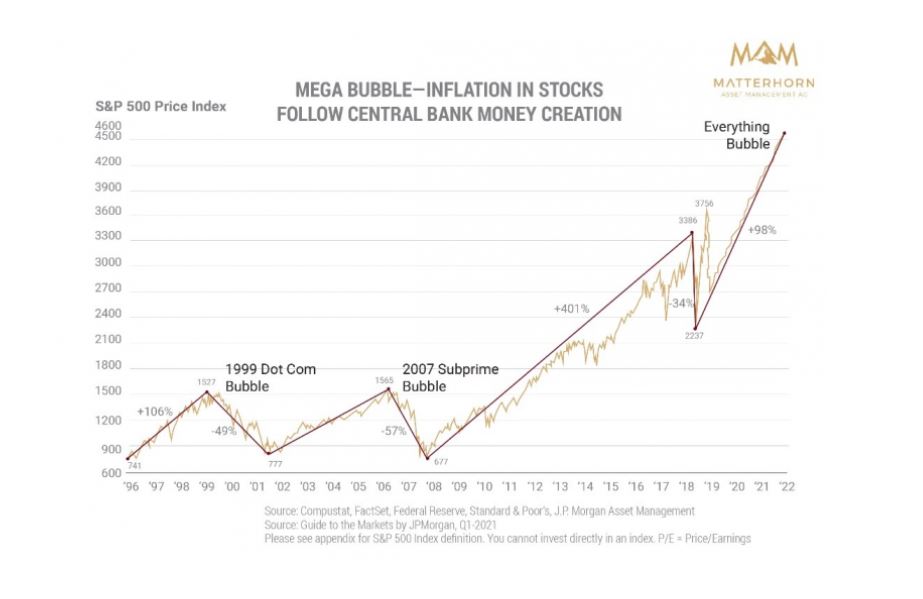

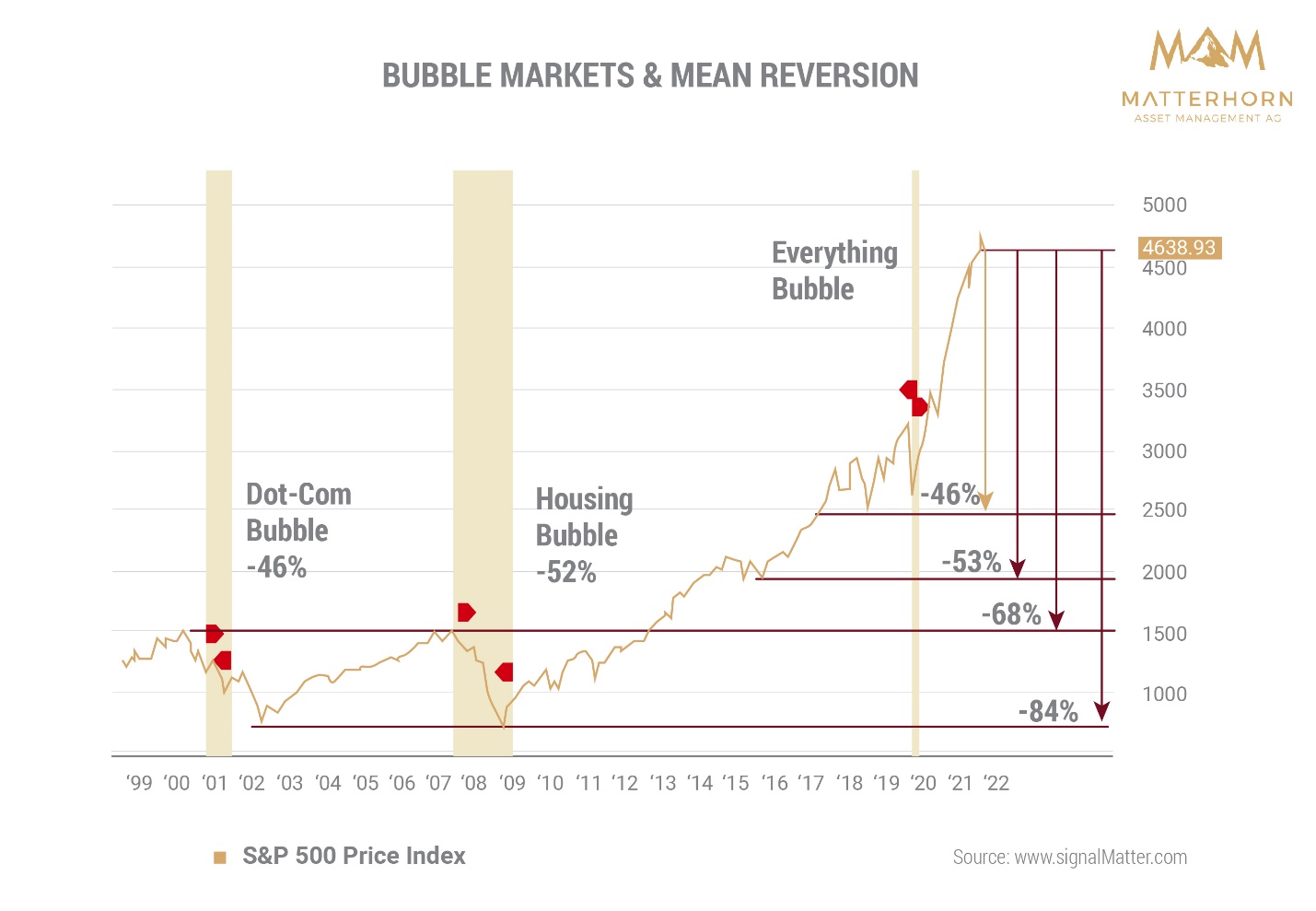

And folks, compared to the dot.com disaster of 2000 or the sub-prime GFC of 2008, does this current market not look like a bit of a (Fed-engineered) bubble to you?

Desperate Not Stupid?

But again, politicized central bankers may be corrupt, dishonest, and desperate, but that doesn’t make them stupid.

In a world or self-interest, Yellen, who likely smiled as the Yen tanked in recent weeks, knows that an artificially strong USD can still be perceived as the best horse in the global glue factory.

That is, the Greenback can still attract foreign money into US markets with no better place left to hide, right?

Well, not really.

Yellen’s History of Getting It Wrong

In fact, Yellen has a long history of getting the macros dead wrong in an effort to look momentarily and politically effective.

Throughout 2017, for example, as the Fed was announcing QT for 2018, I was warning investors of a $1.8T bond wave and a late 2018 tantrum in risk assets, which hit the shores right on cue by Christmas.

Yellen, however, said QT in 2018 would be like “watching paint dry.”

By Christmas, however, the paint was as wet as the tears on investor portfolios suffering daily swings of 10%.

In June of 2017, Yellen was also bold (blind?) enough to publicly declare that “we may never see another financial crisis in our lifetimes.”

But by March of 2020, the markets lost greater than 30% and would have fallen twice as much had not the Fed printed more money in 1 year than in the past decade+ combined.

How’s that for QE steroids?

But as of 2022, Yellen is now running out of intellectual, monetary and policy bullets.

If she thinks she can bribe foreign money into the S&P by manipulating the USD or DXY (temporarily bad for gold), she might be suffering from a disease which is apparently now common in DC, namely: open dementia.

Back to (Debt) Reality

Yellen, it seems, still thinks the old world and old ways can save Uncle Sam.

But that world (see Japan below) is gone.

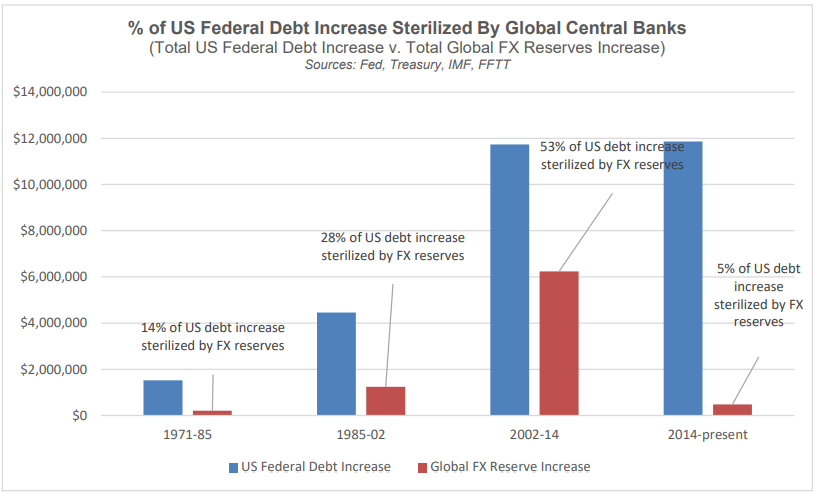

The hard reality boils down to this: Uncle Sam is not trusted anymore, for so many reasons, including a debt to GDP ratio of 125%, a federal deficit at 10% of GDP and a new world in which foreign central banks are now buying only 5% of Uncle Sam’s unloved IOU’s (as opposed to 50% when Yellen was at the Fed in 2013).

Thus, we can applaud Yellen’s bold statements and efforts to bring the DXY to 110+, but an increasingly tapped out and disenchanted world is tiring of bold statements followed by weakening economies, rising inflation and distrusted currencies.

Expect a Pivot

As we see it, the classic hawk-to-dove pivot seen in 2018 to 2019 will be repeated in 2022-23 as the current Fed makes minor (yet painful) rate hike and Treasury sales (i.e., QT) which will send debt-soaked markets south.

This QT effort (and subsequently tanking market) will likely be followed abruptly by more QE and hence more inflationary tailwinds, which despite central bankers publicly claiming to “combat” inflation, is privately desired to inflate away portions of Uncle Sam’s debt while clobbering his nieces and nephews on Main Street with an invisible CPI tax.

Of course, once the QE spigots re-open and DXY numbers fall, gold will continue its climb North.

Meanwhile, More Warning Signs from a Stressed-Out Bond Market

If the dementia exhibited by Yellen and the USD weren’t sad enough, we now turn to the most important indicator in the global markets: The crippled and toxic U.S. bond market.

As we’ve been warning for years, Uncle Sam’s bar tab is too embarrassing to hide and hence his IOUs are too unloved to buy or trust, a distrust made all the worse by the recent freezing of Russian FX Reserves.

And in case you haven’t noticed, there has been a bit of a media-ignored “problem” in the UST market.

In May, the Federal Reserve Bank of New York reported over $500B in April Treasury “fails,” which is fancy-lad speak for counterparties failing to meat their security purchase and sale obligations.

It is particularly alarming to see broad sell-offs in stocks at the same time that US Treasuries are not being bid at auction or successfully/contractually delivered to counterparties.

Why these UST fails in the world’s largest and most liquid bond market were not front-page news at the WSJ or FT frankly astounds me. Who runs their editorial boards???

Turning Japanese

In my last report, I reminded investors of the parallel fates of Japanese and US central bank policies and government bonds.

To be clear, there are real differences between JGB’s and UST’s, just as there are clear differences between the Japanese and US markets and economies. Too much to unpack here.

What is similar, however, is the corner in which US and Japanese central banks have placed their respectively broken bond and rate markets—markets which have immense implications for (and impact on) economic conditions, stock markets and inflation.

Like the U.S., Japan is terrified of falling bonds, rising bond yields and hence peaking interest rates.

To keep these yields repressed, Japan is forced to print Yen to buy its own JGB’s (sovereign debt), as bond prices move inversely to bond yields.

This printing in Tokyo has devalued the Yen in ways similar policies out of DC will devalue the USD.

The level of inflationary, currency-destroying money creation (QE) out of Japan is becoming, well: Insane.

Japan may have to spend (i.e., print) as much as $100B/month to keep yields in control.

The U.S. Fed faces a similar and inevitable corner, and hence a similar trajectory toward Yield Curve Control (YCC) and debased currency strength, as I’ve warned previously.

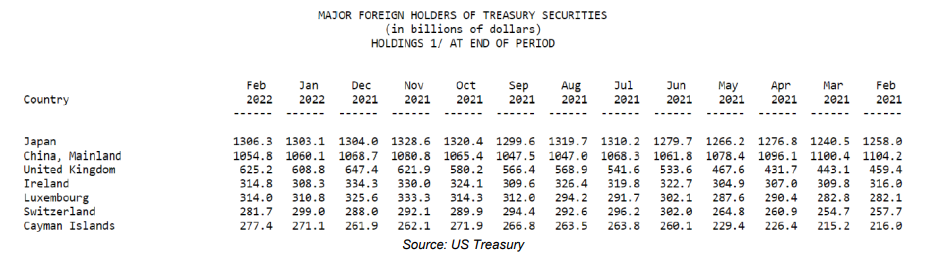

But of even more immediate concern to Uncle Sam is not Japan’s thinning Yen, fattening bar tabs or a QE addiction akin to his own, but the fact that Japan, a key buyer of Uncle Sam’s IOU’s, is now too tapped out to cover two bar tabs at the same time.

In short, Japan can’t afford Uncle Sam’s UST’s, despite Uncle Sam having previously relied on Japan to help keep $1.3T of his bonds (and bond market) afloat:

The U.S. Bond Market: Stressed Out

But a Yen-strapped Japan will soon be buying less U.S. Treasuries. The recent sell-off in long-dated U.S. Treasuries and spike in shark-fin bond yields is evidence that Uncle Sam’s bond market is even less loved and hence in deeper trouble.

Looking down the long and winding road ahead, this means Uncle Sam will need Uncle Fed to “fill the bond gap” by printing more money (hence the QT to QE pivot ahead) to buy his own debt, which just creates massive inflationary (and hence gold) tailwinds.

Such signals from the US Treasury market, combined with my recent reports on the deteriorating investment grade (IG) bond market are extremely alarming.

If we also add the distress signals coming from high-yield (HY) bonds to the pains now open and clear in the UST and IG markets, what we see is a collective U.S. bond market teetering toward a macro disaster whose current setting is the worst I’ve seen in my own career.

HY bond issuance in the US has effectively slowed to a trickle in recent weeks.

As a class, US bonds (UST, IG and HY) are falling, which, to repeat, means I see no realistic, longer-term option at the Fed other than more QE, more liquidity, more inflation and more currency debasement, despite even Yellen’s short-term efforts (above) to temporality send the DXY to 110+ this summer.

Keep It Simple: History & Math

In the end, of course, all bubbles pop, and the current “everything bubble” is an open insult to natural markets, real capitalism, real money and the necessary constructive destruction of mis-managed debt levels, all of which resulted from years of central bank drunk driving the likes of which history has never witnessed.

Ultimately, even more QE or “liquidity” can’t save topping asset bubbles from both popping and mean-reverting, which mathematically looks like this:

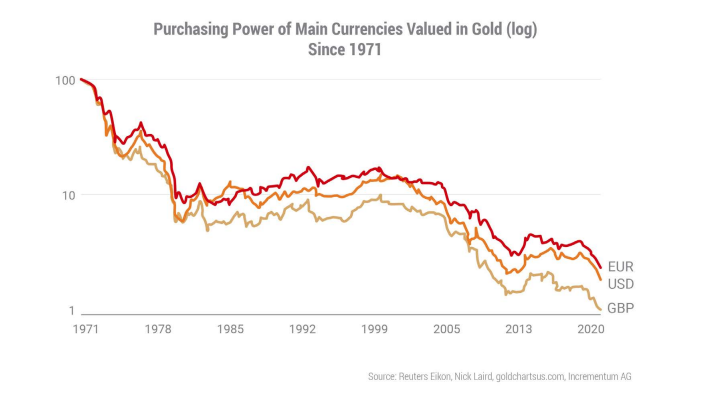

…as well as currency destruction, which historically looks like this:

That’s why tracking bond markets, central banks, yield spreads and stock valuations can be helpful and interesting, but understanding history (and debt) is even more so: All rigged, debt-soaked, currency-debased systems fail.

All of them. Every one of them.

Timing market tipping points and speculating upon central bank policies has its imperfect role and place, but in the end, history (and gold) always gets the last say (and laugh) at politicized financial systems as openly broke (and broken) as the one empirically described above.

Signals Matter’s Blogs & Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly by Signing Up Here. Signals Matter’s Portfolio Solutions Made Simple are geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here.