Earnings season is back, and so is the distortion.

39 shares

In the backdrop of what are now undeniably central bank-driven markets riding a decade+ wave of pure (and historically unprecedented) “intervention,” I’m often asked if fundamentals even matter anymore. Earnings season, of course, is always a good time to think of such things.

Below, I’ll show why they do and why this recent earnings season and market boost is getting one step closer to the Fed’s “last hurrah.”

How do I know? Well, part of the answer “lies” in the earnings season and the various games and lies that go with it…

What Many Are Wondering This Earnings Season

This brings us back to the introductory question: Do facts and figures matter when a Fed controls just about everything in our securities markets – including the dishonest narrative?

And it’s a good question.

First, let’s look at the most recent Q3 facts and figures.

Purchasing Manager Indexes (PMIs) are down. The Cass Freight Index is screaming “recessionary slowdown” ahead. Inventories are at highs while sales are at lows – and that’s not because of China, but it’s because consumers are tapped out.

50% of American workers earn less than $33,000 per year, and consumer delinquencies in non-mortgage debt are at new peaks.

And that’s just the beginning. None of this, moreover, gets “priced in” to earnings season hoopla.

Data from U.S. consumers and our dying middle class, which comprise 70% of our slumping GDP, are beyond bearish. Yet every day, the media and D.C. swamp remind us that consumer strength is solid.

But the numbers prove that such consumer headlines are just not true.

This quarter, discretionary spending has tanked to 2016 levels – going sideways to downward.

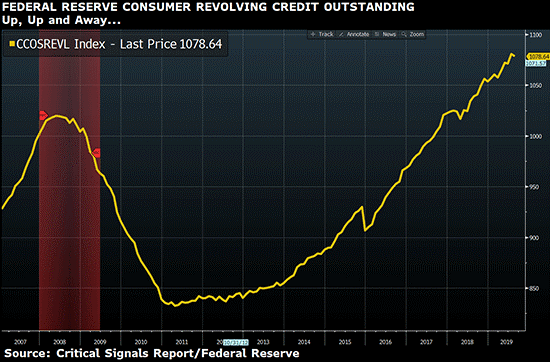

And at the same time, data on revolving credit (i.e. credit card use) is accelerating, which means average Americans are spending less for pleasure yet going greater into debt to simply pay the bills. Again, none of this is factored into earnings season headlines.

This divergence – rocketing credit card debt and tanking discretionary spending data – is a classic recession indicator, as is the divergence between falling copper prices (key indicators of manufacturing declines) and rising gold prices (key indicators of financial fear).

And yet such historical indicators just don’t seem to matter around earnings season, as…

Markets Just Won’t Roll Over

The markets, supported by over $500 billion in the most recent Fed support, won’t roll over.

We saw similar warning signs back in 2016. Recession talk was everywhere. Then came the infamous elections, and “shazam,” the markets ripped on new optimism and new energy in D.C.

The world labeled this the “Trump Bump” – added by the sugar highs of a tax cut in 2017, which corporate America, and hence earnings season driven by debt and spending, loved.

But today, the economy is slumping again in ways highly reminiscent of the 2016 woes and 2016 numbers.

And, once again, the markets, and earnings season, are dismissing such signals and buying new highs as the Fed prints more dollars to keep the party going.

But unlike 2016, debt levels are significantly higher and the hitherto “bump energy” in the current D.C. slugfest (whether seen as a treacherous coup, witch hunt, or fight for justice) is anything but positive.

Meanwhile, on the monetary front, the Fed looks confused and desperate, running around the Eccles Building like headless chickens as glaring liquidity dangers in the repo and treasury markets force the Fed to once again crank out their money printers at a rate of $60 billion per month into June of 2020 despite simultaneously telling the world it’s not “quantitative easing.”

This QE denial, of course, is just an open Fed lie, one of many we are transparently tracking along with the earnings season updates.

At the same time, the “nobody wins” trade war with China continues to cripple global markets and supply chain efficiencies, adding more straws to the back of the global economic camel.

But again: The markets won’t roll over…

So… Do fundamentals matter? Does earnings season?

Riding the Debunked Lies

The media and Wall Street’s sell-side credit these unsinkable markets to the fact that unemployment is at record lows and inflation is effectively extinct, while profits and earnings are up.

But as we’ve mathematically shown here, here, and here, each one of those tailwinds is in fact a quantifiable and empirical lie.

Which means this market is supported by myth rather than fiction, and Fed demand rather than natural demand.

Myths, of course, are hard to quantify, track, or time with traditional signals, including the undeniably bearish data points outlined above and elsewhere.

Hence the same ol’ question: Do fundamentals matter anymore? Does earnings season?

That is, has the Fed replaced natural market forces? Are we entering an era devoid of worry, recessions, and market bears?

A New Fed Divinity

For many, the Fed is almost like a force of near-divine powers.

Although their hubris is rising along with their desperation and dishonesty, the Fed’s words and actions, like their fancy building on Constitution Ave., still inspire awe – which is ironic, given that the Fed is openly unconstitutional, a fact that Presidents Jefferson and Jackson warned about till their last breaths.

There’s a strange and misplaced respect accorded to this otherwise distortive institution, despite overwhelming evidence that it serves a Wall Street minority in an otherwise rigged to fail game in which its record for warning retail investors of a recession is 0 for 9.

But the Fed, and the banks it serves, are running on fumes.

The latest report by none other than McKinsey & Co. suggests that over 50% of the world’s banks will fail in the next recession, as they just don’t have enough money/liquidity.

That’s why our recent repo bailout is essentially a 24-hour pawn shop for banks: they give the Fed unloved and old Treasuries, and the Fed gives them cash to stay alive in a now yield-less “new abnormal.”

Think I’m just a grumpy perma-bear?

Well, Mervyn King, the former head of the Bank of England (think Bernanke with an accent), just announced that the Fed and other central bankers should meet with legislators behind closed doors to make law-makers aware “of how vulnerable they’ll be in the event of the next crisis.”

Even the UN’s very own Secretary General (a non-financial, diplomatic player) is demanding immediate fiscal stimulus to save the world from financial crisis. But again, none of these concerns are “priced in” to the earnings season reports.

But for those who still think the Fed is all-powerful and that recessions are either extinct or can’t be tracked, we think one of the key catalysts of the next recession is hiding in plain sight.

What the Earnings Season Is Telling Us

Q3 earnings season is here, and many are bracing for what is anticipated to be a third quarter of declines compared to the year prior.

The FAANGs will likely keep overall index averages ahead of the curve and certainly ahead of other global exchanges, despite embarrassing data from names like Boeing…

Regardless of declines or gains, you can be sure that the PR departments and Wall Street “analysts” (i.e. marketing department) will make certain those numbers “beat expectations.”

They achieve this earnings season magic trick (scam) by simply lowering the expectations prior to earnings season – hence almost everyone “beats” them.

The Great Big Profit Red Flag

Profits, of course matter to earnings season, and profits, despite what Wall Street would have you think, are more important than earnings, which can be manipulated and twisted easier than a pretzel.

Remember, just because a lemonade stand earns $2.00, its profits might amount to only a dime if the cost of lemons adds up to $1.90.

Again, profits matter.

But profits on Wall Street can be equally twisted into a pretzel of misinformation, as we will quickly discover.

You see, there’s this ironically honest office in D.C. called the Bureau of Economic Analysis (the BEA), which measures total corporate profits across the U.S., and not just those of the 500 companies listed on the S&P.

According to the BEA, total corporate profits across the U.S. are down by 4% at the very same time that the S&P is arguing that average earnings are up by double digits across our top 500 companies just in time fro earnings season data releases.

What gives? How can there be such disparity between profits and earnings, D.C., and Wall Street? More importantly, how can profits be down and earnings up?

Well, for starters the BEA uses GAAP rather than Ex-Items accounting to keep its math more honest.

Secondly, the BEA measures profits in total dollars rather than upon a “per share basis,” which thanks to the once illegal use of stock buy-backs now in vogue today (and responsible for 20% of the markets “gains”), Wall Street earnings season is able to grossly distort (reduce) the number of shares from which these twisted “profits” can magically emerge.

Stated otherwise, the BEA numbers are infinitely more accurate than Wall Street’s fictional S&P report card.

This means our nation is suffering from an actual decline in profits while the markets, and earnings season, promote rising earnings. That’s akin to getting thinner with every pizza one consumes.

According to the more accurate BEA math, however, the U.S. has also seen three consecutive quarterly declines in corporate earnings and profits.

How many investors know this about earnings season? Hardly any. But now you do.

What Does the Real Profit & Earnings Data Say About A Pending “Uh Oh” Moment?

Above, we posed the question of whether fundamentals still matter given how seemingly Oz-like the Fed’s magical intervention has now become.

But we maintain that fundamentals like corporate profits and genuine earnings will win – i.e. get the last laugh over our otherwise laughable Fed and Wall Street math around earnings season.

For now, corporate profits are a key story used by Wall Street to justify stock market valuations. They are, of course, projected to grow in 2020 and 2021, just as they were projected last year at this time – remember that?

But here’s the rub: Maybe profits and earnings (even the distorted versions of earnings season) won’t grow by the projected 12% this year or next, just as they did not grow in Q4 of last hear?

More importantly, the very data behind these reported and projected profits and earnings are demonstrably inaccurate and rigged.

No big surprise there. That’s business/math as usual along the D.C./Wall Street corridor.

But if profit outlooks deteriorate, as they must and will given the deterioration of our empirically weakening consumer class (above), earnings and profits will have to follow suit in the decline.

Similarly, credit quality will in turn deteriorate, and thus credit spreads (between Treasuries and corporate bonds) will widen, which means stock buybacks (the fake wind beneath the market’s wings) will in turn slow down, creating a negative feedback loop of lower and lower earnings and hence lower and lower stock prices.

Bonds and stocks will eventually fall in tandem, and the signal to short junky stocks and junky bonds (perhaps as soon as 2020) will finally become available for those patient enough to wait out the Fed’s last remaining tricks (aka increased QE distortions and third-rate accounting).

Why am I so confident of this?

Because everything I report is based upon this singular conviction and premise: Natural market forces are ultimately stronger than un-natural central bank forces, and truth always prevails over lies.

The Fed has given us no chance at the former, and countless examples of the latter.

Which force will you bet on?

Let us know in the comment box below. We’ll be back on Monday with more on this Alice in Wonderland market backdrop.

Sincerely,

Matt Piepenburg

Comments

15 responses to “The Scary Truth Behind Earnings Season”

- Jimsays:

I agree with your analysis. But, the real issue is when will the market crash. For the investor, that’s the most important issue.

- Randy Blantonsays:

Natural market forces, undeniably.

- Davidsays:

Thanks for the report and keep us informed. I have 80% on the sidelines right now. Wish the recession would happen soon, so I know where I stand. Don’t stop reporting on the inevitable. Other Republicans are basically in denial, even though others from all walks agree with the data.

- LEE GERKEsays:

LOVE THE HONESTY AND CLARITY OF YOUR WRITING

- Erik Wertssays:

I have no doubt that you are correct as to where we are headed. Actually I’ve been amazed that we’ve gotten this far without a very serious financial collapse. I’ve been expecting it for years. I’m just a retired old fart trying to survive on social security. So I’ve been really worried what I’ll do to make ends meet when the bottom falls out.

Recently I’ve started investing what little I can afford, so I’m naturally I’m looking forward to your reports on safe investments. Perhaps I won’t have to worry as much.

Thank you for your insight’s.

- Garysays:

Your articles and commentary are spot on. Sometimes I would like to print

the material and have more time to study the graphs and notes but evidently

there is block on printing more than the first page. Do you think the policy for allowing some printing of articles received through email will change in the future or perhaps it is on my end that something is not working. But I

have seen other sites with common themes of interest not allow any printing.

Thank you for sharing your wisdom and experiences; they help validate

that common sense still makes a difference.

- Roger O’Danielsays:

Two economic theories are in play here that are not well known. They are the bigger-fool theory and the theory of rational expectations.

The bigger-fool theory goes like this. For those who invest in commodities and precious metals, collectibles, real estate such as lake property, time shares, art and similar assets, they have to find a bigger fool than they were to sell it for a realized gain for something others will accept as value for things they need.

The theory of rational expectations goes like this. The private sector execs will size up the situation as it affects them and their company and behave according to their rational expectations. If their peers come to the same conclusion and behave in the same or similar manner, government and FED behavior does not matter.

Another dimension involves the use of currency to buy and own capital stock with the nation’s own currency to reduce its risk of devaluation. They will invest in a foreign nation’s capital stock to reduce the risk of their own native currency’s devaluation.

A third dimension is the traffic flows of international trade, especially diversion of third party nations to avoid the consequences of trade wars.

A fourth dimension is those crypto-currencies that bypass the central banking system altogether.

A fifth dimension is the death of cash and the use of blockchain for central banks or the IMF to launch a global currency for international trade.

A sixth dimension is the migration of people between nations that stress entitlements and job creation. My Cornell professors back in the day called this micro economics using a tool called input-output matrices.

However, one must cleanse the data from the political and financial manure called “window dressing” and “off-balance-sheet” accounting mischief. Good luck with that.

- Lawrence Cromwell says:

Wasn’t Alan Greenspan warning everybody about ‘irrational exuberance’ just before the Great Recession? Back then, the Fed was actually trying to stop Wall street from becoming overheated. This time, what is the Fed doing? Be afraid, be very afraid.

- Jasonsays:

Terrific article and spot on in my opinion. Love your concluding wrap up on natural market forces. Consumers will turn the markets and sentiment shift should soon turn to the downside as spending continues its decline. Having just bought and sold a house this year, that market is definitely still broken. I predict major bubble in ranch style single story home prices in particular as millenials and boomers have crowded this space. Fed cut this week should scream to investors that the Fed is positioning for defense of a slowing global economy. Though they won’t win ultimately, they will likely stick with mid-cycle easing in hanging hat on 90’s similar actions. Cuts will continue and this bull will finally be put to pasture. I also anticipate a protracted period of slower growth and markets after the next crash as all the artificial actions of all the central banks is reset out of failed experimentation and back to investor demanded true market fundamentals. I see 10 to 15 years for this to transpire, as investors grow weary and tired of the rollercoaster ride they will be forced to exit after 20+ years.

- Kevin Geerysays:

It is amazing this house of cards has not crumbled yet. I have been a self-employed carpenter my whole life ( recently retired). If I did not work, I did not get paid. Pretty basic. I realized back in the eighties, lots of people figured out how to manipulate money, therefore they did not actually have to produce anything “real”. Bankers are still making money off my work, and will long after I am gone.

My father used to say, ” The bastards are out to screw you”. True words. The truth always wins.

Good luck to us all. Thanks for a very good piece of writing.

- Franksays:

Thanks and couldn’t agree more. I have many monthly indicators that have been going down since 1/18. Look at money stream on a monthly basis. It has been going down for the last 21 months. So what is driving this market? Why is it going up? The fat cats on Wall Street and corporate fat cats have been getting ready for what’s coming and lightening up on their positions, selling their stock to poor uninformed investors. Don’t know when it will come to a screeching halt, but as you said, soon. This cannot last forever, despite what Wall Street, the fed, Washington, etc., all say.

- mike collinssays:

excellent comment as always, i look forward to your emails

- Mike Ryansays:

Excellent observations; however, now that we know the outcome, how do you suggest we mere mortals act to either preserve capital or profit?

- John P Clary says:

Bear of course but- I am well aware that the market can trade irrationally longer tha I can stay solvent!

- Patrick Fintonsays:

I like your comments, but have you been talking to Joe Biden lately? I am very confused by your statement, “Which means this market is supported by myth rather than fiction.” I always thought that myth and fiction were pretty much the same.

To me your comments have rang true with a conservative bent, but this statement indicates that you may be going over to the “dark” side.