Economic depression now?

Huh?

Well…despite profitless stocks like Tesla breaking levels of price insanity and markets ever-edging toward new highs, the U.S. economy is already and mathematically in an economic depression.

No way?

Way.

For many months, we’ve tracked and signaled the rise of the Fed-driven stock market while showing deep concern over the staggering disconnect between this unprecedented bull market and a tanking real economy.

Such disconnects have prompted reports underscoring a rigged-to-fail market scenario, and even inspired us to write an entire book, Rigged to Fail, on this very topic, which will be released on February 23.

For many of you, such pessimism can seem tiring, even “gloom and doomy” and we understand how such stances can seem almost trite at worst, or hard to believe at best, especially when the media, the pundits, the politicos and the markets keep re-affirming how great the economy is.

Besides, we’ve seen all those books about the market crashing any minute–for over a decade…

Truly, we get it. No one needs or likes to hear bearish opinions all the time when most of us have so many other responsibilities, concerns and issues to juggle on a daily basis.

Fortunately, or unfortunately (depending on your tolerance for blunt-speak), we too have no interest in bull or bear opinions.

Instead, we have an ultimate preference for facts, math and data.

And folks, the facts we are about to share below are staggering.

But first, let me give credit where credit is due, and thank Emil Kalinowski of Wheaton Precious Metals for the data points and charts shared below.

First, Let’s Consider Recessions

Signals Matter, of course, seeks opportunities to capture upside when the markets send us a fat pitch and more stimulus from an experimental Fed.

We were bullish throughout 2019 for no other reason than the Fed made us so.

But most importantly, we are dedicated to protecting investors from the inevitable market fall that accompanies a recession, as the real money is made buying at bottoms rather than chasing nosebleed tops.

That’s why our Storm Tracker tool was designed: To obsessively track the distance between your portfolio and the next recession while safely capturing moments of upside along the way.

Which raises an interesting question, namely:

What Really is a Recession?

The technical definition of a recession is two consecutive quarters of negative GDP.

Unfortunately, that’s not always helpful.

For example, despite being in an obvious recession after the dot.com collapse of the early 2000’s, we never saw two consecutive quarters of negative GDP in the U.S.

And Germany, from whence I recently returned, is only an eye-lash from an official recession, yet already experiencing one now. Just ask anyone on Haupt Strasse.

As for Japan, it’s a zombie economy propped up by a central bank and frequently experiences alternating quarters of negative and positive GDP in the backdrop over 1 quadrillion in debt…

In short, recessions are a kind of mystery, and like the US Supreme Court’s definition of pornography, one may not have a clear definition of it, but one just knows it when one sees it…

The U.S. Recession—Real, But Not Even the Biggest Problem We Face…

As for the U.S., much of the optimism that launched 2020 is being challenged by hard facts now rearing their otherwise media-buried head.

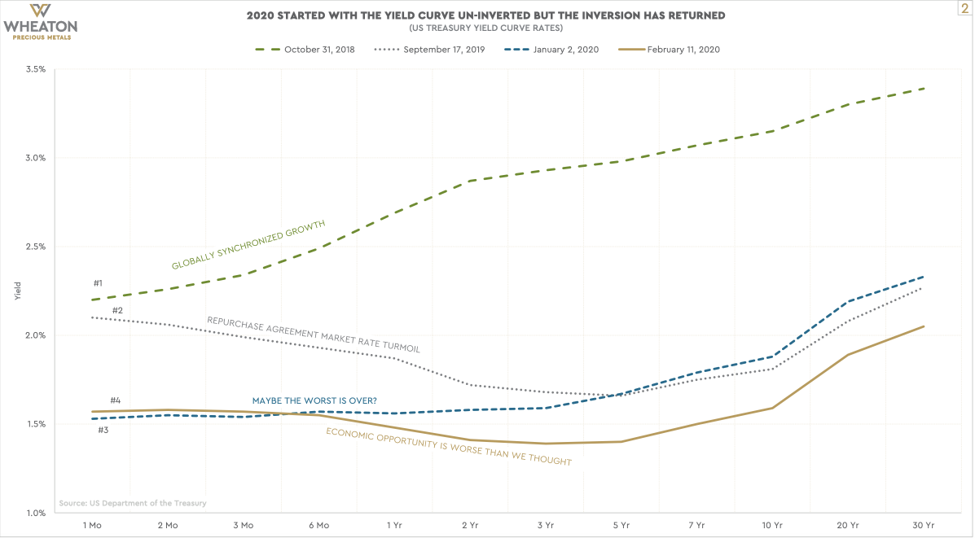

Yield curves, for example, are inverting again, and this has been a precursor to every U.S. recession since the Second World War.

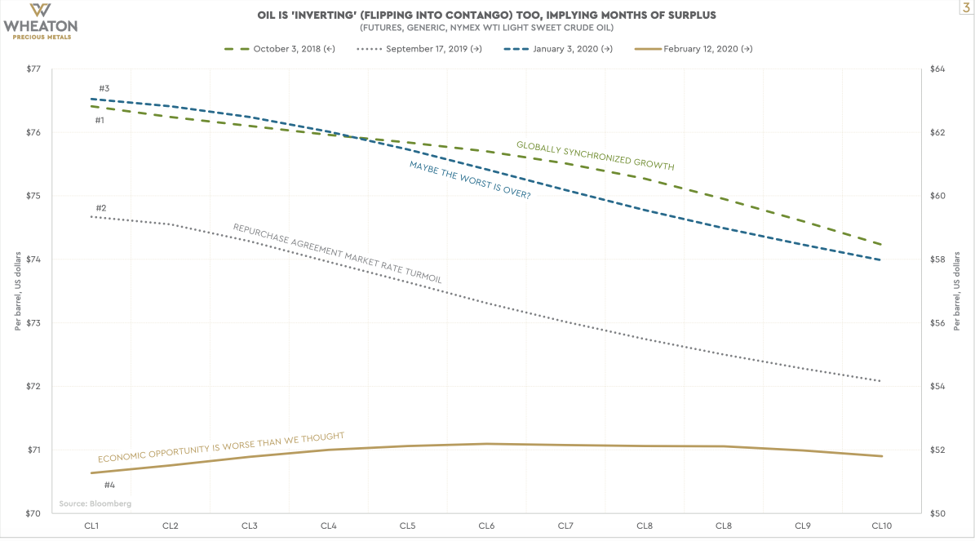

In addition, markets are seeing the energy sector tanking as over-supply in the oil markets (lead by less Chinese demand) and an inverted curve in the WTI futures market (what the fancy lads call “contango”) is sending warning signs to informed investors that economic opportunities are worsening, not improving.

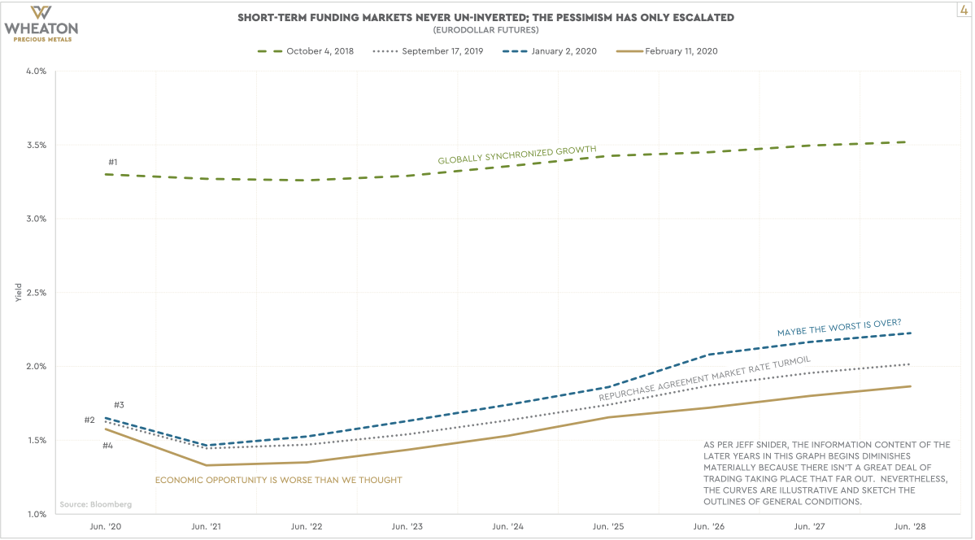

Adding insult to recessionary injury, the highly dangerous U.S. Dollar shortage, a topic all but completely ignored by the media’s prompt-reading “experts,” is showing inversion in the highly toxic repo markets, which are drying up and surviving only due to a Fed respirator (i.e. money printing).

Since June of 2018, the Euro Dollar future curve has also been inverted. Uh-Oh…

Folks, given inversions in the yield curve, the oil markets, and the dollar-thirsty repo markets, even our infotainment prompt readers masquerading as financial journalists will will have no choice but to warn of a recession soon.

But sadly, and as introduced above, the recession, however serious it may otherwise be, is not even the biggest news of the day.

In short, the recession realities and fears whose distance to landfall we track daily pales in comparison to the bigger picture of the economic depression in which we already find ourselves.

Don’t want to believe us?

Again, we get this. It just seems impossible to accept. That’s why resort to facts not drama.

So, let’s look at the facts.

What Defines an Economic Depression?

As discussed above, there’s not a great deal of consensus on just what defines a recession—we just sort of know it when we see or feel it.

But as for an economic depression, most of us who have spoken with our grandparents or even bothered to stay awake in history class can agree that there was at least one “Great Depression” in the 1930’s.

What some of you may not remember from History class, however, is that the U.S. (and world) endured an even “greater” economic depression between 1873-1896, otherwise known as the “Long Depression,” one so severe that it took down the financial security of President U.S. Grant himself…

Thus, we can historically agree that there was a Great Depression and a Long Depression, both of which were global in scope and pain.

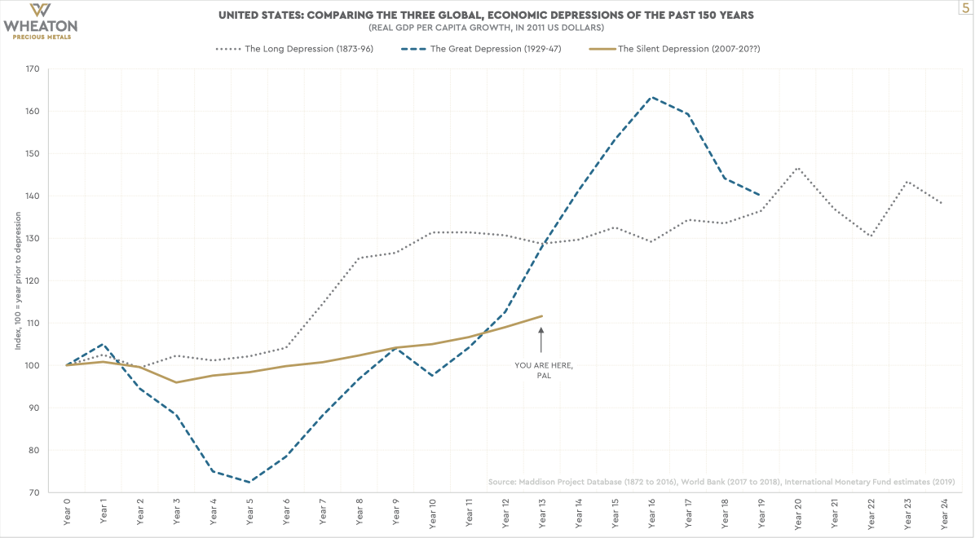

Comparing Past Depressions to the Current Economic Depression

Taking the critical data that defined both the Long Depression and the Great Depression, we have to look at one key metric, namely the growth rates of inflation adjusted (i.e. real) GDP per capita.

During both the Long Depression and the Great Depression, those GDP growth rates per capita were just awful, and used by economists and historians to signal genuine economic pain.

And here, folks, comes the kicker…

For if you compare growth rates of inflation adjusted GDP per capita from 2006 until today, you’ll discover that the U.S. data, right now and for the last 13 years, is worse than it was during both the Long Depression and the Great Depression.

In other words: We are already in an economic depression.

The Great Financial Crisis of 2008, which began in 2006, has neither been solved nor “recovered,” but merely hidden and postponed behind an absolutely blind financial media and an entirely Fed-driven stock market.

But as we’ve said repeatedly, don’t confuse a grossly inflated stock market with an economic recovery, as they are NOT the same thing.

For our non-US readers, be advised that a total of 28 countries are included on the list of nations whose GDP growth per capita places them at the same, or worse, place they were during the Long Depression and Great Depression.

And for our English-speaking neighbors in Canada, the UK and my personal favorite, Australia, your respective nations, like the U.S. are worse off today (when it comes to such fundamental economic drivers like GDP!) than they were during the two deadest periods in the last 150 years.

But this is what happens when central banks (from up in the UK or Canada to down under in Australia) sacrifice economic productivity (i.e. GDP…) for a booming securities market and then task the media into calling that a “recovery.”

Good on ya…

Why This Economic Depression is a Silent Depression

Why the silent economic depression?

The Bubble Heads…

Well first, and as I’ve made clear many times here, here and most recently here, the main stream financial media knows as much about blunt market risk and fact reporting as Justin Bieber does about composing a Mozart symphony.

In short, no one is talking about these darker realities; instead they’re speculating on Tesla or licking their WeWork wounds—the very kind of silly behavior we saw during the final stages of the dot.com and sub-prime bubbles of 2000 and 2008.

Not only is the media ignoring these deeper facts, they are deliberately distorting them, which just adds further evidence to the file about the media being a complicit part of a deliberate attempt to keep artificial markets supported by propaganda and fraud rather than facts.

This may seem like an incendiary, even exaggerated statement.

Again, we get this.

Most of us are honest and trusting folks, and despite our flaws, want to believe others are as basically good as we are—including the Ken and Barbies of the corporate financial media.

In the past, as far back as 1873 or 1930, the financial press was all over the above data points to announce, warn and debate a genuine economic depression. Investors were afraid, but at least they were informed.

In the modern era, however, the media is less, well…transparent.

Modern Media—Modern Lies

Let me share some sample examples, just a few among countless others, to factually drive this sad point home.

In December of 2019, none other than the much acclaimed and white-glove periodical, The Economist, ran an article in which it celebrated rising stocks (omitting the Fed stimulus of Q4 2019 that was behind this) and then went on to say that the “U.S. economy was powering along,” and that recent repo market concerns “were not important.”

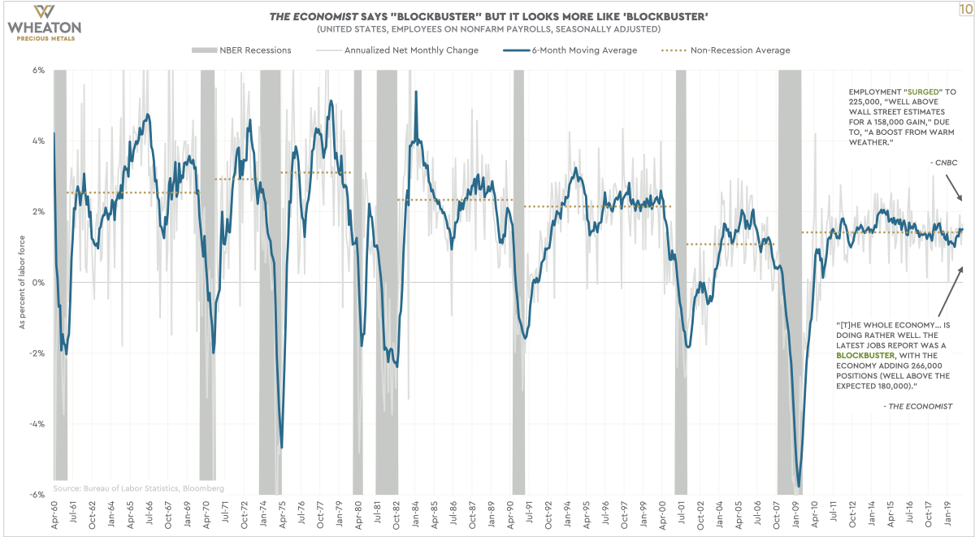

The article closed by saying the November employment gains were “blockbuster.”

Ok, so let’s snap back to reality and look at those “blockbuster” employment gains and that “powering along” economy.

As for employment data, we’ve consistently reminded readers what an open farce the statistical data is when it comes to the employment lie.

But if you need more evidence to let this sink in, the employment gains as a percentage of the labor force that The Economist was lauding, you’ll see that The Economist deliberately omitted the longer term context of this data (i.e. from the 1960’s till now), which in fact shows that our employment gains are anything but “blockbuster”…

Just gaze over to the far right.

Then in January, CNBC jumped onto a story about “employment estimates” and called it a “surge”—but again this is simply, factually and empirically untrue.

All you have to do is put this so called “surge” into an historical perspective rather than the truncated and de-contextualized version handed to you by the 24/7 news soundbite-spinners to see that you are being openly played.

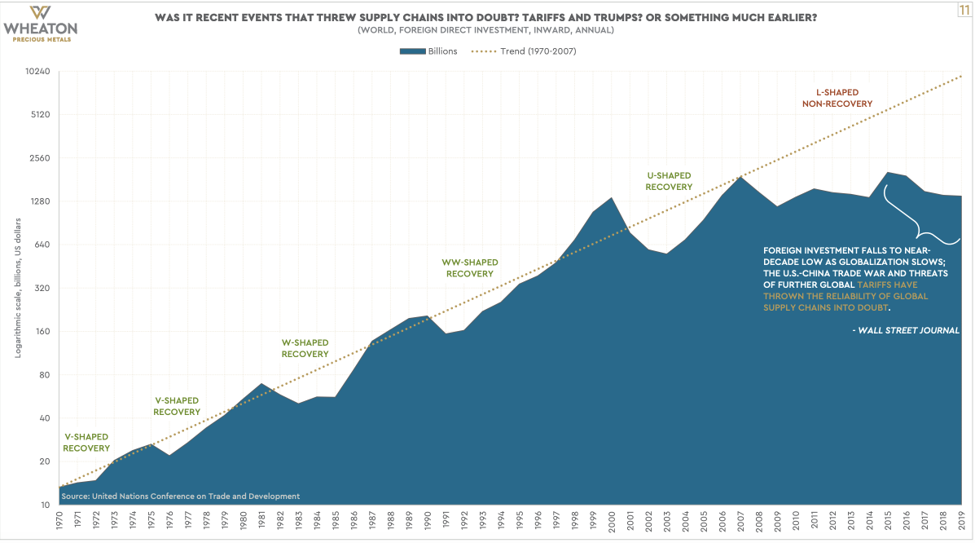

By way of yet another example, none other than the infamous Wall Street Journal came out in late January with an article addressing the UN’s report on global foreign direct investment.

This article focused exclusively and only on recent years, noting somberly that global FDI (or foreign direct investment) had fallen in each of the last 4 years.

This point was true, but if you look at the 50-year history of that same FDI, you’d realize it stopped growing 13 years ago, not just in the last four years!

Sadly, however, this 13-year fall was not acknowledged by the WSJ, and deliberately so, as such broader facts would confirm that our recovery from the debt crisis that began in 2006 has not recovered at all.

Instead, such dramatic declines are hidden behind a dangerous stock melt-up confused as an economic recovery.

Finally, whether you get your news from the left or right, the radio, TV or paper, we can all agree that everyone is lauding American economic productivity and blaming China for any miner hiccups along the way.

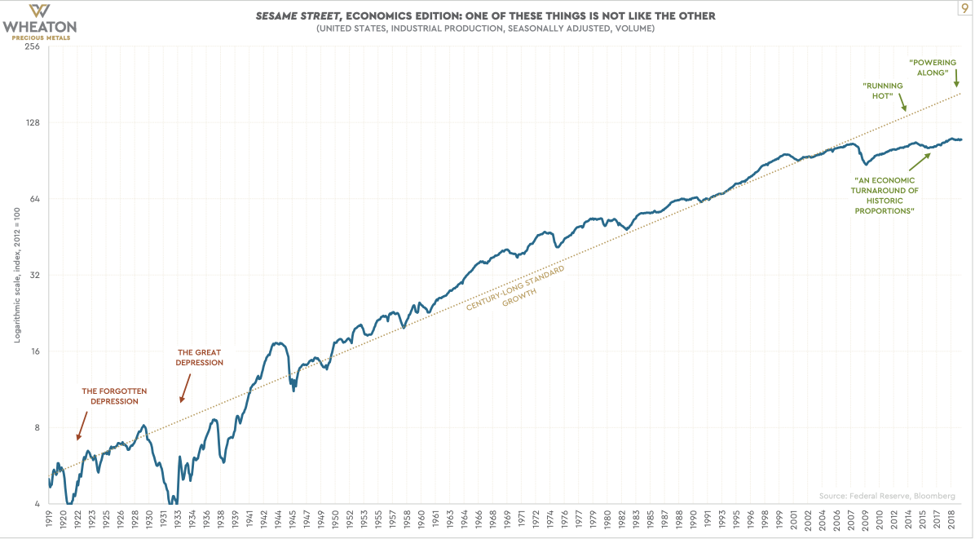

Tom and I are no fans of China’s economic games, but we are even bigger fans of truth, and the graph below confirms the truth that industrial production in the U.S. had dangerously fallen off a century long trend even before the China tug-of-war.

The only time that U.S. industrial production ever fell off this critical trend line was: 1) during the forgotten economic depression of the early 1920’s, 2) the global Great Depression of the 1930’s and, well… 3) today.

Industrial production has fallen off a century long trend, a data point of incredible significance to ordinary investors, yet what has the financial media had to say about such extraordinarily important facts?

Nichts. Nada. Rien. Bubka. Crickets…

Again, in previous periods, going all the way back to the mid 19th century, the financial and even general media actually raised alarms over such stubborn facts. Investors could rely on the reporting of cold truths.

But today, in an almost comically unprofessional financial media whose board members include Wall Street insiders, we see mostly stock-pickers and “facts” spun out of any semblance of context.

In short: Puff pieces are the norm. Blunt speak as to pension fund or ETF risks are the exceptions.

This may, we repeat, seem incendiary or dramatic. Being played or lied to by an industry we were otherwise conditioned to trust is never a good feeling.

Truth Distortion is a Classic Set-Up for an Uh-Oh Moment

I can’t help but think of Michael Burry, the understated and misunderstood hedge fund genius who was among the first to call out the sub-prime lie (and crisis) that ultimately rocked the U.S. stock markets in 2008.

He later stated that one of the ways he new that sub-prime bubble would burst to pieces was due to all the lies, distortions and fraud that supported those toxic bonds.

That is, wherever one sees lies, a fall is not far off.

Today, and unlike the sub-prime debt crisis that preceded the 2008 disaster, the debt crisis has now been transferred to both the corporate and government level, which means there’s more at risk, but a much more powerful sequence of lies to sift through.

In prior reports, we’ve made efforts to factually point out lies handed to us from the Fed and the Bureau of Labor Statistics in DC on everything from inflation and GDP to employment and profits and earnings.

In short, the lies and distortions are hiding in plain sight, but very few ordinary investors are seeing them.

Furthermore, with a Fed and its magical money printer in full swing, this disconnect between a doped market and a dying Main Street can continue longer than truth can be heard.

Tom and I remember how even as sub-prime mortgages were defaulting on mass in 2008, the price of the ABX ETF that held those same mortgages was actually going up rather than down.

This was because some traders within some of the big banks we’ve worked with were simply engaged in fraud, trying to artificially keep a dying asset class alive well past its natural expiration date.

Of course, in the end, gravity prevailed over dishonesty and those markets (and banks) tanked.

We think a similar, and much larger example of fraud at the media, Wall Street and Federal Reserve level is taking place right now, with far more at risk, and thus far more tricks up their sleeves to keep the current securities bubble alive.

But like all great tricks, lies and rigged games, even the current bubble is destined to end, and the silent economic depression in which we empirically and factually now find ourselves will eventually transition into a stock market depression as well.

That’s why we at SignalsMatter.com are so dedicated to tracking both economic facts (as per above) as well as direct market signals in our industry leading portfolio service.

This combination of blunt-speak, fact-based (rather than media-fed) data and direct market signal tracking keeps us, and you, ahead of the risk curve and prepared to buy more at the approaching bottom, where the real money is made while others are looking to the media for excuses that will come too late.

Simply brilliant. So wie immer 🙂