As market anxiety mounts, we continue to look to the market itself for signals on how to properly react. Below we look at (and share) eight critical signals of “uh-oh” with you.

As usual, buckle up…

Stocks Flopping and Gasping Like a Fish on the Dock

On Monday, trading in US stocks was halted to prevent further losses as each of the three major exchanges (DOW, S&P, and NASDAQ) hit 7%+ descents.

Stocks, of course, fell like rocks. Margin calls stacked up and the selling sped up. Stocks are now oversold and trying to rise from the ashes. By Tuesday, those same exchanges surged north rather than south.

Futures markets were limit down, then limit up.

Such massive price swings are hardly a sign of “rational price discovery.” But folks, there’s almost nothing rational about these markets…

That kind of volatility and whip-sawing, i.e. 1000 point moves down on Monday, and up another 1000 points (dead cat bounce?), intraday on Tuesday, are classic symptoms of volatility and danger ahead.

This stock price volatility is Market Anxiety Signal # 1.

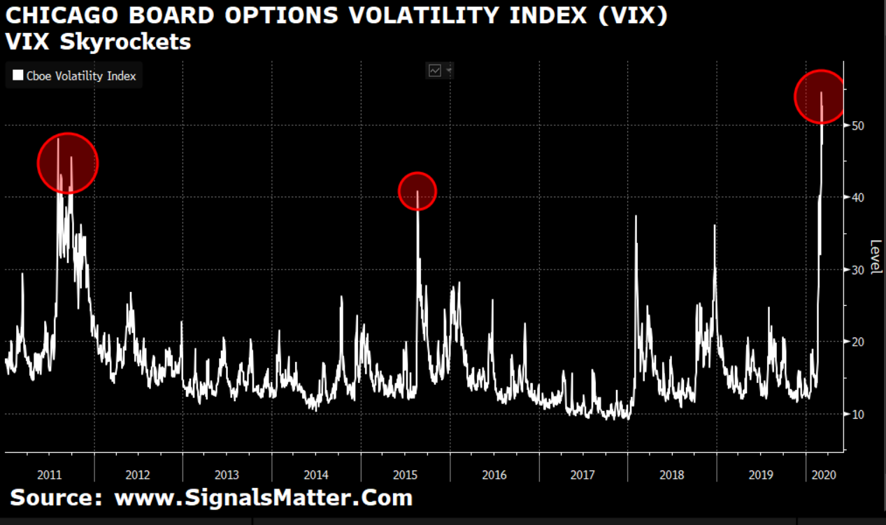

The VIX (aka “Fear Indicator”) Skyrockets

Based on the VIX, we’ve seen a week of VIX and hence fear-spiking which surpasses data seen even during the Great Financial Crisis of 2008.

Last week, the VIX saw 46, which was an extreme event.

But by this week’s opening day, the VIX hit 54 as the DOW fell 1000 points, forcing the aforementioned circuit-breaking halt (i.e. “Uh-Oh” moment) on the markets.

This VIX spike is Market Anxiety Signal # 2.

Treasury Yields Hit the Basement of History

If that wasn’t alarming enough, we’ve also seen a week where the flight into the safety of Treasury bonds sent bond yields into the history books.

Tanking bond yields are classic symptoms of an anxious market.

Yield on the world’s most significant 10-Year sovereign bond (recently at 0.55%) is heading toward zero.

When yields get this compressed, the eventual “spring” upwards is only that much more dangerous. We explain the tragic implications of this deadly yield compression at greater length here.

For now, however, such low yields simply mean that when adjusted for inflation, the oh-so-critical 10-Year Treasury is rewarding investors with a negative 1.7% return.

Some reward, eh? Still think these markets are “rationally priced”?

Such tanking and compressed yields are Market Anxiety Signal # 3.

Global Bond Yields Are Tanking in Synch

Sadly, this yield absurdity is not just a U.S. problem.

As of today, over $16 trillion in bonds across the globe are trading at negative nominal yields.

To us, this figure alone is all the evidence one needs to see just how broken and rigged to fail the financial markets are.

Such staggering levels of negative yields, moreover, are not created by recessions or low inflation, they are artificially created by central banks.

This environment is simply tragic, as investors now have literally nowhere to go for safety.

Nor is there anything “natural” left in these artificial, Fed-driven markets for investors to gauge natural market behavior and hence natural risk signs.

Genuine Capitalism, which has now been ruined by monetary policies that are, well, absurd, require natural and efficient flows of capital to stay alive, but when $90 trillion worth of global bonds reach such artificially-sustained bubble levels, it turns the $85 billion stock market into little more than a roll of the dice.

These totally distorted bond markets and their negative yield profile are Market Anxiety Signal # 4.

Oil Prices Reach the Danger Zone

At the same time, the Russian and Saudi Arabian cold war (price war) in the oil space just sent oil futures to lows not seen since 1991.

This is Market Anxiety Signal # 5.

Credit Issuance Halts

Perhaps most disturbing, yet largely overlooked as stocks were tanking, was the fact that corporate credits had essentially stopped dead in their tracks.

For over a week, not a single corporate bond was released.

As I indicated on Monday, the ticking time bomb that is the corporate debt bubble is the real virus killing these markets.

We’ve been warning for months that the low rate Twilight Zone created by the Fed has been the sole reason otherwise zombie companies with more debt than income have been allowed to survive—that is by borrowing today to pay for yesterday.

But for at least seven days, even the Zombies were unable to raise their bloodshot eyes as credit issuance halted.

Debt, folks, is what greases the wheels of the post-2008 debt-driven “recovery.” Debt allows otherwise sick companies (think GE and Boeing) to borrow funds to buy back their own shares and issue dividends despite making no profits while pretending to evidence earnings “growth.”

In short: dead men walking. Zombies.

And just imagine what happens, and will happen, to those tanking, debt-soaked energy names that everyone was buying like mad just 2 years ago when oil stocks were yesterday’s hero rather than today’s goat.

When the credit (i.e. debt) markets seize up, things fall apart. This week’s volatility is what that looks like in real-time.

But the real illness—the debt illness and the hidden sins of the US credit markets, can easily send these markets even lower.

What we are seeing in the credit markets is Market Anxiety Signal # 6.

Where We Stand Now—A Market with a Broken Back

In short, we are witnessing history in the making with all the foregoing sources of market anxiety converging at once.

The financial system, so completely distorted by over a decade of central bank “support,” is now like a ship with a blind captain, as evidenced by all the historical gyrations discussed above.

And now, as a black swan virus triggers even more uncertainty ahead (i.e. Market Anxiety Signal # 7), all that the financial experts of the world’s governments and banks can think to do, is alas, crank rates even lower and create more debt, as that is all they know how to do with their backs this firmly and habitually pressed to the wall.

But lower rates or more absurd money printing won’t be much help to the supply-chain woes handed to the global markets in the backdrop of a global virus.

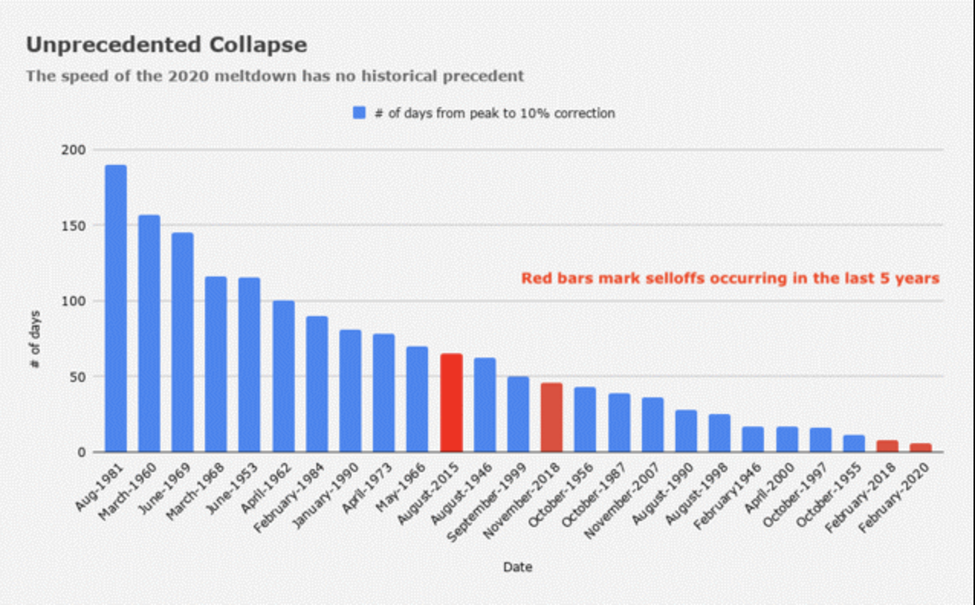

In short, the old tricks just aren’t working, as made empirically clear by the record-breaking speed and size of the current market crisis.

Since 1946, we’ve never seen 10% market drawdowns (25 in total since World War 2) occur this fast and furiously.

Such a rapid and deep fall in the stock market is Market Anxiety Signal #8.

The Storm Clouds (and Market Anxiety Signals) Converge

Now, all the key risks of which we’ve been warning for months, including the hideous dangers of passive ETF’s, robo-trading, tanking pension funds, increasing Fed impotence and dangerously compressed bond yields are converging at warp speed.

Again, folks, this is not fear-mongering or doom and gloom posturing. These are just cold facts, and being careful now is just common sense driven by a twist of market skill.

If you see these signals of market anxiety and risk as well as we and our subscribers do, then join us by subscribing here or by reading our Number #1 Amazon New Release, Rigged to Fail, by clicking here.

Now is NOT the time to rely on the media alone to stay informed.

The markets themselves will tell us all we need to know, and Tom and I know where to look for those market’s signals—all of which are extremely anxious, as per above.

We’d love to have you in our community of informed, patient and smart investors.

In the interim, we once again remind our subscribers to visit their dashboards and see in greater detail What’s Happening Now, What’s Ahead, and what to do about it by way of Your Signals Matter Portfolio.

Folks, stay informed, stay safe—market anxiety is rising, but informed investors can remain calm.

Sincerely,

Matt Piepenburg