Folks, if you had any doubts about what drives our market, yesterday’s 25 basis point rate cut should now make it obvious that the only wind beneath this market’s battered wings is the Fed itself and just astounding levels of fed intervention.

35 shares

Furthermore, if you had any doubts about the total disconnect between what the Fed says and what’s actually true, this rate cut (a blatant emergency measure) should now make it obvious that although the Fed says all is “solid,” it knows we are heading toward a recession, one which dangerous Fed intervention can postpone for many, many months and even years to come.

Powell’s infamous Wednesday statement spoke of “data dependence,” but the facts prove otherwise. The facts are all the evidence you need that the Fed intervention is not only playing you, but it’s also desperately resorting to fiction rather than truth.

Powell noted that: 1) the “labor market remains strong;” 2) “economic activity has been rising at a moderate pace;” 3) “job gains have been solid;” and 4) “unemployment has remained low.”

Unfortunately, none of this is factually true.

But even if Powell actually believes what he says (he doesn’t, he just has to push a “be calm, carry on” message), the real question then would be this: If things are so “solid,” why the emergency-mode rate cut and more Fed intervention?

Powell, of course, is trying to use words rather than facts to stave off a recession. The staggering level of myth spinning we witnessed yesterday is a screaming and classic indicator of a market ripping while the rel economy is on the brink.

In fact, PMI, labor, GDP, manufacturing, and job-loss data are all in the red both nationally and globally. Never have so many fundamental signals been simultaneously in bearish mode. Nevertheless, Powell loves the word “solid.”

Solid what????

Free Markets and Main Street Are Gone, But Free Thinking Remains for the Informed Investor

As our Rigged to Fail report made demonstratively clear, we currently live in a financial system where Fed intervention and centralized markets (which are at record highs) are totally disconnected from economic reality (which is on its knees).

Other signs of this are hiding in plain sight. Totally rigged names in the Big Tech Sector (like Apple and Google) seem to only go up. Such concentrated movements in select names are bad market indicators.

Remember Cisco, Yahoo, and Microsoft in the dot.com era? They each dropped by more than 60% when that bubble popped.

But the hard numbers are screaming economic slowdown. As Main Street continues to struggle against the backdrop of nervous market highs, U.S. companies are falling like Pickett’s Charge all around us.

The trucking industry, for example, is tanking (never a good indicator) as names like LME, Timmerman, Falcon, and New England Motor Freight shut their doors as Fed intervention sends markets in a melt-up toward newer highs.

Retailers like Charming Charlie (261 stores), and Fred’s (129 stores) are leading the way to a record-breaking year of store closings set to hit 12,000 by year-end as Amazon’s antitrust-defying economic retail Armageddon pockets its executives’ immoral fortunes.

And if you still think such facts defy the “data dependent” comforts of our so-called low unemployment miracle, just take a quick look at the real math behind the unemployment lie, itself just another sign of Fed intervention.

Even New York’s iconic Barney’s is staring down the barrel of Chapter 11. Things in Europe and Asia are even worse, as populist tensions and national debt levels push markets and central banks toward an inevitable (which doesn’t mean imminent) breaking point.

Such signs are ominous, as all recessions follow slow-drip patterns of a domino of failures in smaller markets, which eventually impact larger markets. Prior to the 2008 crisis, for example, we saw Iceland tank, then Ireland, then Bear Sterns, Northern Rock, and at last Lehman Brothers. But with Fed intervention hitting the crazy-button, who knows if such fundamentals even matter anymore?

Today, we are seeing a similar domino pattern. Venezuela has all but vanished, Deutsche Bank is effectively a shadow of its former self, and “outlier” countries like Australia are teetering on the edge while others like Portugal and Spain are stepping over it.

And no, folks, this is not gloom & doom selling; these are just blunt, macro-economic facts. We have no interest in scaring you; our sole aim is to prepare you. And with Fed intervention now the new “abnormal,” uncertainty and risk are hard to address–all we can do is track signals, not make predictions from here.

The Number 13: A Whole New Kind of Normalized Crazy

And if there is one magic number that brings this all to an undeniable forefront it is this: $13+ trillion in negative-yielding bonds across the globe. Soon this number will reach $15 or more trillion before the year ends, and which case central banks will tweek rates yet again.

That’s $13,000,000,000,000 – 13 million millions of negative-returning bonds.

But what does this number mean?

First, a negative-yielding bond essentially means you are paying to lose money. In Europe, where I’m typing from today, even junk bonds are turning negative.

Junk bonds, by the way, are supposed to give high-yield returns for their insane default risk – upwards of 20% in the past. Today, they are flat to negative.

This is, well, nuts. A negative-yielding bond isn’t even a bond, for by definition, it offers no fixed income payments and guarantees a loss if held to maturity.

Frankly, financial education in the bond market has very few textbooks (none in fact) for this kind of crazy, as no one ever thought it would happen.

But today, with folks in neckties and fancy diplomas (and supportive headlines) at the ECB cranking rates below zero and Japan buying 40% of its own ETFs to artificially support bond prices into a negative-yielding Twilight Zone, such crazy is the “new abnormal.”

How did we get this comfortably dumb? Simple: Central banks, in their fantasy effort to outlaw recessions, have distorted price discovery to herd-accepted heights of stupidity by using printed money to purchase the bonds that the natural markets didn’t otherwise want. That’s Fed intervention: Fun for so long, and then a nightmare in seconds.

This artificial (and ultimately unsustainable) support pumped up bond pricing and hence killed bond yields (which move inversely to price).

With yields (and hence rates) this low, otherwise dead companies (zombies) can borrow cheap to stay alive as an entire class of suckers buys these absurdly insecure securities. That too is Fed intervention.

This, then, is the new abnormal – central banks running uphill on roller skates, desperately trying to prevent a recession of their own design by using adjectives rather than truths to keep an artificial market afloat.

When forced to choose between the wise (but reputation killing) path of letting bad bonds die (and free markets naturally tank/correct) or the stupid yet politically expedient path of postponing the pain by cranking rates to the floor, Fed intervention and similar moves by other central banks will naturally choose the stupid path of killing free markets and the bond market – which are essentially already dead.

And the U.S. Fed is no less stupid. In fact, we strongly trust the stupidity of the Fed’s Ph.Ds. and thus strongly believe rates will continue to march toward zero as Fed intervention continues to march toward murdering the last vestiges of free-market capitalism.

Yesterday’s Fed intervention rate cut was just the beginning. More will come – postponing (yet not preventing) the looming recession ahead, which our Storm Tracker is tracking for you.

Is your money prepared?

The only question today is whether Powell’s words can buy enough time to keep our Frankenstein market alive into the next election cycle. WE expect a melt-up well into 2020.

In the near-term, we’ll keep sending you signals to trade the Fed-speak as our markets attempt to stave off the inevitable tipping point of central bank design.

Yesterday’s Price Action

In a recent report, for example, we shared this thought with you…

“If the Fed reduces interest rates this Wednesday and the markets noticeably falls rather than rises, we may be nearing that tipping point.”

Well, the Fed dropped rates and the market did not salute. That tipping point is getting pointier, but not fatal (yet) as markets will certainly continue to gyrate up and down with increasing volatility and increasing Fed B.S. That said, we expect some real volatility in repo and bond markets this autumn.

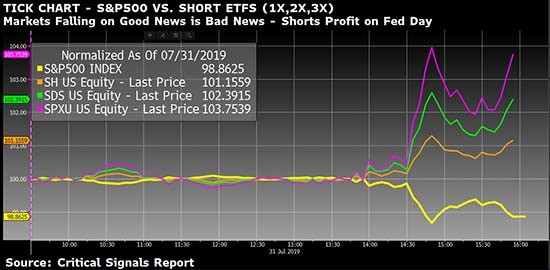

As to Monday’s trade recommendation, we suggested shorting the S&P 500 by buying ETFs that short the major indexes. Well, here’s what happened yesterday…

All of our suggested trades were up. ProShares Short S&P 500 (1x) ETF (SH) was up 1.15% on the day. ProShares UltraShort S&P 500 (2x) ETF (SDS) was up 2.32%, and ProShares UltraPro Short S&P 500 (3x) (SPXU) was up 3.67%.

… And all within at least a half hour of prior warning after the 2:00 p.m. Fed announcement!

But, folks, those were just finger-bite trades, and are subject to all kinds of whipsawing in the coming weeks as the Fed rolls out more myth peddling and Fed intervention to come.

The bigger play (and main course meal) is in the long-term strategy of seeing through the nonsense, buying at bottoms (rather than tops), and making a killing when the recession we are tracking daily gives you the opportunity to make the real returns.

Stick with us. We’re here to help.

Comments

10 responses to “How the Fed is Playing You”

- jack kimurasays:

August 1, 2019

How accurate can you get? Is there still a possible melt up?

- jason normansays:

August 1, 2019

Ty 4 ur nsight!

- Guy Starzsays:

August 1, 2019

Thanks

- Mike Palazzinisays:

August 1, 2019

Thank you Mr. Piepenburg.

- Richard Phillipssays:

August 1, 2019

I read every report, and love the information.

- Judith Demarro says:

August 2, 2019

Since we have this great confluence of 5G, Block chain, the new super duper electric battery, AI, Io, electric self driving vehicles, and the Republican Party in the cat bird seat I thought we had enough stimulus to keep our economy moving. You seem to be saying we are all going to hell in a hand basket. Are you saying we are headed for recession? If we are i believe the socialist will win, the Democrats will take back the White House and there will be no hope for a booming economy, Wall Street, the middle class or capitalism. Please tell me I am wrong.

- S Dennis Barbersays:

August 2, 2019

Thank you… you are making the picture crystal clear.

- Minhsays:

August 2, 2019

Thanks Matt.

Should I buy the LEAP of SH and other inverse ETFs?

Minh

- Bobsays:

August 2, 2019

Just st a question,, why do etfs instead of weaker companies,, seems to me that they would respond quicker to quick sell-off that etfs. Always been. A back side of the table or house side dice shooter.

- Edouard D’Orangesays:

August 2, 2019

Since I can agree with a lot of what you’re writing and believe that most equities are risky investments, what about a portfolio composed of mutual funds (with low volatility) which hold short term treasuries (notes & bills) and investment grade securities? This is what I mostly have transitioned my small portfolio into holding.