After over a decade of rising markets, many are starting to think that recessions no longer exist.

27 shares

As we head full-bore into 2020, below we tackle a question posed by many bemused bears and fervent bulls alike, namely: Has the Fed’s money printer outlawed recessions?

That is, can we artificially print our way past the lessons of market history, the forces of natural price cycles or the otherwise painful consequences of debt by simply counterfeiting our way into a new market scenario where every economic nail can be solved by one of two Fed “hammers,” i.e.-(1) the power to print money and (2) the power to repress interest rates?

The answer is…

Too Good to be True?

This may seem too good to be true, not to mention just plain absurd, but as our readers by now understand, such fantasy and absurdity is literally the “new abnormal” which so defines the post-08 Twilight Zone markets in which we now find ourselves almost free of fearing recessions.

In fact, our full report on Modern Monetary Theory revealed that many politico’s in DC now believe that deficits, history and the laws of natural market forces don’t matter, so long as we print more dollars to purchase our own bonds to support their price and thus keep rates low and recessions extinct.

Nor is history without examples of well-dressed leaders and educated economists promising similar miracles and markets without recessions. The French National Assembly launched a similar campaign of money-printing nirvana in the 1790’s.

Net result? It was a helluva good time, for a while. Of course, it ended with most of these folks marching into a guillotine…

This Time Is Different?

But many now believe “this time is different.” Recessions don’t matter now.

With the U.S. dollar as the world’s reserve currency, some argue we have carte blanche to do whatever we want with our money printers, as we effectively export our inflation, causing other nations, pegged to our FX rigging, to simply print more themselves just to keep up.

This orgy of global money printing has resulted in so much artificial bond buying that we are now seeing bond prices pushed so artificially high that upwards of $15 trillion in sovereign bonds currently provide negative yields, an epic distortion never contemplated in business school text books nor seen in the entire history of capital markets, going back to the bronze age…

At the same time that interest rates are falling below zero around the world, politicians are giving more and more clout to magical solutions like Modern Monetary Theory (MMT), especially around this coming election year when it’s important to dish out fantasy and promises to keep voters, left or right, loyal to whatever is being peddled from the blue and red soap-boxes.

QE for Main Street?

Furthermore, there is more talk today of the politically sensitive issue of bailing out Wall Street, as post-08 voters are increasingly less inclined to allow another such handout, and are instead asking that whatever QE we see in the future should be directed to Main Street rather than Wall Street.

The political left likes this, and is promising more printed money to solve everything from free healthcare care to student loan relief.

Whatever your views on such policies, they boil down to the same old thing we’ve now become accustomed to for years upon years: solving a debt problem with more debt.

Can we just print away without causing massive recessions? Can the U.S. print trillions more dollars, or force rates below zero without dire economic consequences in this effort to keep economic (or stock market) expansion going at any cost? Natural market forces (or even healthy corrections) be damned?

Uncharted Waters

Well, we are now in uncharted waters, as no major modern nation has ever pushed the debt envelope this far, both nationally and globally.

The world has never seen so many nations printing so much money ($21 trillion) and incurring so much debt ($250 trillion) all at the same time, yet with no GDP growth to show for it.

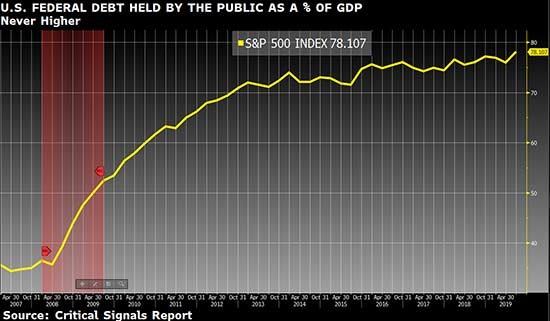

In the U.S. alone, federal debt held by the public as a percent of GDP has never been higher. We’ve just been printing away since 2008 and there’s more money printing to come.

More Printing to Come

What we can assert is this: More money printing will happen. We will see more and more desperate measures as the markets rise higher toward their inevitable “U h-oh” moment as the experts tell us not to fear recessions.

By example, we could easily see the Fed place a cap on interest rates or force pension funds to buy US Treasuries. We will definitely see more outright money printing and some form of Main-Street-supportive “MMT.”

The Only Question Is This: Will It Work?

Since the disaster of 2008, we’ve tried everything-the TARP bailout, QE 1-4, Operation Twist, the recent Repo band aide and a trillion-dollar autumn “rescue” of our Treasury and banking sectors, and yet none of this has put a dent into our country’s massive debt pile or declining growth numbers.

In short, more debt doesn’t and hasn’t solved a debt problem or prevented recessions from arising, though at least the stock market has and continues to reach new highs despite every traditional market indicator screaming recessionary risk.

Do Traditional Risk Indicators Even Matter in the New Abnormal of Fed Support?

Which raises some real concerns and other questions, namely: Do the old, time-tested market signals for recessions even matter anymore?

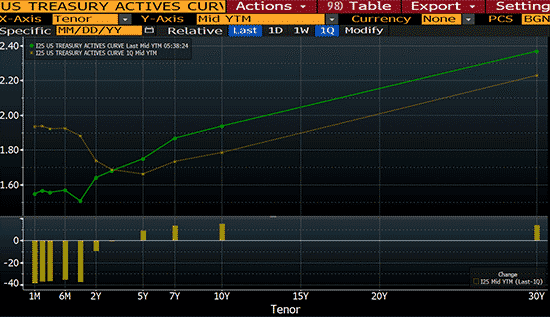

Inverted yield curves followed by sudden steepening, as we saw recently, have been 85% accurate in predicting recessions. It’s a time-tested set-up.

Furthermore, whenever the NY Fed’s Recessions Indicator has passed 30, recessions have ensued – 100% percent of the time. And yet no recession has come, unless of course we’re already in one as indeed, that infallible NY Fed signal has just peaked, as it did in 2008.

Good Times Create Blind Times

Such risk-defying market highs in the face of time-tested warning bells have led many to believe the Fed has indeed outlawed recessions and that markets can only go up. They are starting to truly believe that the old indicators don’t matter, that it’s different this time.

If this were the case, then how could or should anyone manage risk let alone a portfolio anymore? In the past, for example, when warning bells like the one’s we’re hearing today rang out, smart investors would seek safety in cash or bonds.

But today, with yields stapled to the basement of time and currency purchasing power diluted by money printing gone wild, where else can investors safely turn other than more pumped-up, Fed-driven stock markets?

Today, more and more investors are “all-in,” with no cash hedges.

This means more and more folks are being seduced to go deeper and longer into an already grotesquely over-valued stock market because they actually feel safest at the most dangerous top (and time) in the history of U.S. securities markets, because, hey, “The Fed won’t’ fail us.”

This is a very dangerous assumption. Now, the masses are buying the tops, not waiting for a bottom that seems to never come.

The Useless Quest to be “Right” Rather than Smart

In the meantime, bears and bulls are fighting it out in an ongoing war to be proven right, when the facts suggest that so much focus on who’s right or who’s wrong in the prediction game is absolutely the wrong thing to be doing.

Why?

Because the preponderance of the evidence supports factoring in a recession as a very real possibility despite the fact that absurd policies by the Fed and the growing popularity of MMT can indeed act to postpone such realities for months or even years to come.

To do nothing but chase these tops with every dollar you can spare would be the height of folly, just as it would be going fully to cash and hiding in the woods as the Fed front-runs the entire securities market.

What to Do? What Not to Do?

As we fast forward into 2020, uncertainty and risk surround us at every turn, which is why we stopped worrying about being labeled bears or bulls and just continue to watch these rigged markets for bullish and bearish signals and allocate accordingly.

In the end, of course, we see an awful day of reckoning coming for the U.S. markets and our children’s’ generation, which will be faced with paying the price of our current financial sins.

As a father, I find that just sickening.

But for now, with the Fed going guns-blazing to support the markets and with the rest of the world seeking ironic safety in our relatively stronger (yet inherently broken) bond, stock and currency markets, there will be more foul winds to support this equally foul melt-up going forward.

At some turning-point, however, and one whose trigger-date we can only track rather than predict, the Main Street which the Fed has totally ignored, will begin to rot from the bottom up. Recessions come in many flavors.

Rotting from the Bottom Up

We’re already seeing evidence of this open rot in cities like Los Angeles, Seattle, San Francisco, Baltimore etc., where pedestrians and drivers have to zig-zag down the street to avoid homeless Americans strung out on opioids and beyond much hope in tomorrow in increasingly growing tent cities.

But even putting such dramatic experiences aside, the raw numbers speak with equal clarity, as the U.S. middle class shrinks in size at the same time U.S. private debt levels break new records.

Bailing Out Main Street?

If MMT is used to bail out Main Street, any number of scenarios can play out, depending upon when this ramps up.

If new money pours in during the next recessions here and aborad, it’s likely that nervous Americans will use such “support” to save and de-leverage rather than spend, as this was the fear-based pattern seen in 2008.

Consumer savings during a recession is a bad scenario for markets, as demand, and hence prices tank.

However, should the politicos try to assist Main Street before a recession, nervous investors will spend more, which means all that printed money would actually go into the economy rather than the stock market.

This scenario would lead to higher inflation, and hence higher rates, thus sending the markets down. Another bad scenario.

Keep your eye on this tipping point for recessions – the 10-Year U.S. Treasury rate. According to global fund manager responses to a recent by survey by Bank of America, yields can rise to about 2.71% before causing a spike in volatility and a sell-off in risk assets.

At the same time that such bad-case scenarios play out, we are likely to see continued “rot from the bottom up” play out too as companies eventually begin cutting jobs and the whole human side of a recession, now hidden behind rising equity markets while leaving out the majority of Americans, becomes undeniable.

In France and other parts of Europe, I’ve seen this rot and frustration already begin to play out, from protests in Germany to the yellow vests blocking toll booths and striking en mass in France.

Eventually, similar popular unrest will rise in the U.S.

As I’ve argued elsewhere, the next market crash could begin on the hitherto ignored Main Street rather than the grotesquely supported, post-08 Wall Street.

Nothing Solved, Just Postponed

Regardless of the so-called “recovery” (which was nothing more than the creation of the largest securities bubble in U.S. history), the crisis of 2008 was never solved, but merely can-kicked down the road.

Piling more debt onto an existing debt problem is never a solution, merely a delusion that buys short-term fun and long-term pain.

And here’s the danger that follows: The higher the climb, the harder the fall and coming recessions.

For now, and perhaps for many desperate months or even years to come, QE has proved that many otherwise honest and smart bears are wrong, as Fed-supported markets defy all traditional warning signs, from yield curves to data like price-to-book, price-to-sales and price-to-earnings.

Today, a dangerous complacency level has thus become the norm, and even the most experienced hedge fund managers I know have effectively given up trying to short this market from the moment the Fed began printing money in 2009.

The Biggest Short

At some point, of course, the Fed’s magic support will stop working and markets will fall on good news, which means the biggest short in the history of our markets will be signaled. Then, the sell-off in recessions will be fast and furious.

This is something the Fed and other Wall Street bulls already know, which is why they have pursued extraordinary measures and policies to desperately (and for now, effectively) stave off even the most natural market corrections and recessions which were once such critical components of keeping markets honest by allowing them to drop when valuations got too out of hand.

Those days are gone now, and with them, the basic tenants of classic capitalism which has now been replaced, ironically, by “Wall Street socialism“-namely a central bank that injects trillions to support an otherwise debt-sickened stock and bond market rather than the real economy.

As we recently revealed, the Fed just added another half trillion in new repo funds on top of the $60 billion per month in QE ushered in October to support short-term Treasury markets.

Just imagine the boost such amounts could have otherwise provided for the U.S. if we had allocated those funds toward better infrastructure programs, public schools, veteran hospitals, senior benefits or even inner-city drug counseling?

Instead, unbelievable amounts of printed dollars continue to pour daily from the Eccles Building into an already unconscionably-high stock market, as if the stock market alone was the key indicator of a healthy economy, which most of us know it is not.

So, Can the Fed Outlaw Recessions?

Which brings us back to the original question: Has the Fed outlawed recessions?

The answer, as we see it, is clear: Of course not.

Instead, the Fed has been successful in delaying rather than outlawing the nest recession.

This is a delay that can continue for many months, possibly even years to come. And while it may seem like good news, the longer and farther the can-kicking, the more seismic the recession that follows.

Stop Predicting, Start Listening to the Markets

We cannot predict the day, month or year when this moment of profound reckoning will come.

Instead, we can only listen carefully to what the market tells us and then filter those signals through the complex indicators which we reduce into a simple Storm Tracker, and soon, detailed portfolio solutions for our subscribers that work in all market conditions.

Uncertainty and risk surround us, despite the melt-up we are enjoying (and called this fall).

Rather than ignore both the risks and opportunities that we track with bewildered awe, we manage both the artificial upside and historical downside by riding an ever-changing “clutch” through careful cash allocations and smart portfolio allocating, which allows us to capture upside yet prepare for the eventual fall.

Enjoy the Ride, Yet Manage the Risk

So, enjoy the current melt-up and Fed steroids, but in 2020, remain forever informed, forever vigilant and forever patient, for eventually the “big short” will come to these rigged-to-fail markets, the biggest of our careers.

And that, folks, is where the real fortunes are made, and where most of the uninformed lose everything these distorted markets handed them during the complacency phase.

Stick with us. Stick to our cash hedges. We’ll keep you informed, and hence safe, in this historical period of absolute crazy.

Sincerely,

Matt and Tom

Comments

10 responses to “Has the Federal Reserve Outlawed Recessions?”

- Edouard d’Orangesays:

What are your thoughts on the Political Calculations’ Recession Odds Reckoning Tool, based on a recession forecasting method developed by Jonathan Wright? Most recently, odds have dropped to about 5% from a peak on 09 Sep 2019 of 11.3%.

- Tom O’Connorsays:

The clarity of all the explanations, especially the connection between money printing, bond prices and interest rates is far better than anything I have ever received from paid subscriptions.

- Terry Wildesays:

Yes it does seem Trump has the Fed in the palm of his hand but for how much longer are foreign government’s going to be prepared to have the amounts of money that before much longer will be needed to stave off there own financial difficulties.This then will start the sell off of treasuries that will in turn start to cause the sell off in equities and I wouldn’t want to be on the wrong side of this event.I don’t think the Chinese government has any loyalty as far as holding on to US treasuries so time will tell.

- John Gorskisays:

Everything you say just makes sense to me. It’s to bad 2 plus 2 don’t equal 4 anymore.

- Z.says:

Great article !! But remember the ‘extreme’ and lasting power of the FED and the power of what TRUMP has done and will do when he is reelected. If the socialists were to get power, get into just cash and gold and not much else.

L.Z.

- Larry F Silbaughsays:

Matt/Tom,

Your statement about the possibility of the economy already being in a recession raises an interesting question. I studied economics at three different schools right up to the doctoral level and most of the academics I encountered were of the Keynesian ilk, usually passionately so.

Now as I recall, unless Keynes’ own writings have been somehow re-edited, his general definition of recession/depression (academics obsessively quibble over decimal places) was any period of economic output short of that economy’s potential level of production, certainly an economic reality in the U.S. and large segments of the world for some years now. But if all the official government figures are generally true why the deafening silence on this point by his passionate academic acolytes, or, if all the official government figures are in fact – let’s be kind and just say – questionable, again why the deafening silence?

Thank you for Critical Signals Report, one of the all too few true reality windows. it is at the top of my reading list. I don’t think it possible to overestimate its value.

- Giuseppe Spatarosays:

There is so much to learn from Your weekly articles and the Monthly Charts that I study every day.Full time job.Thank You.

- LAWRENCE ARNWINE says:

Great information BACKED by Factual Data. Also, any intelligent and common sense person can research this article and track the Federal Reserve during this recession.

- says:

This article is an eye-opener!! Love the awarness!

Sincerly,

Keep it up!

- Wim Wouterssays:

I opened my Christmas ‘surprise’ little package last night, my youngest daughter brought back from New York to Belgium after a 5-month apprenticeship at the U.N. “sustainable” finance dept. In it I retrieved 7 unique replicas of the original currency during Revolutionary War paper ‘money’ . A brief history I found an interesting read :

The first settlers in Colonial America used wampum beads, beaver skins, and tobacco as means of exchange. The SHORTAGE of “hard money” (coins) severely hindered the conduct of business. The most common coin in circulation was the Spanish milled dollar; its value varied from colony to colony.

To overcome this handicap to business, the colonies began to issue PAPER currency. Many of the Colonial notes were issued in terms of shillings, because even though most transactions were in Spanish dollars, the official account of exchange was British units – pounds, shillings, and pence.

Odd denominations of the currency were often printed because of the lack of small change. To lower costs, many bills were not printed on the reverse side. Each bill was usually numbered and signed individually by hand to discourage counterfeiting

The Revolutionary War brought new money difficulties. The Continental Congress, powerless to impose taxes, was forced to PRINT MASSIVE AMOUNTS OF CURRENCY to finance the war. This flood of PAPER money caused the Continental currency to rapidly depreciate; by 1781, the paper was exchangeable for coin at a ratio of 225 tot 1 ! (225$ in paper for a 1$ coin).