Below, we look at four deliberately ignored reasons why extreme liquidity is drowning paper money.

Reason 1: The Taper Debate May Not be a Debate at All

Here, we look past the taper headlines and ask a simple question: Would a Fed “tapering” of QE really matter?

As we’ve written elsewhere, the Great Taper Debate is less of a debate than it is a pundit circus, forever fueling now classic yet complimentary debates on inflation vs. deflation, gold vs. the dollar or the Fed vs. simple honesty.

Of course, such topics, including the great “taper,” are all critical issues worthy of opposing views and somber discussions.

The world needs open, transparent and respectful (as opposed to tyrannical) debate, now more than ever.

If the Fed, for example, were to taper money printing, it’s logical to assume (and argue) that this would mean falling bonds, rising rates, deflationary forces, a stronger dollar and massive headwinds for risk assets like stocks and real estate.

But for many who are not otherwise deeply ensconced into the weeds of Wall Street (i.e., normal, smart and conscientious investors), what they may not know is this: The Fed has other tricks up its liquidity sleeve than just “QE.”

Stated otherwise, the taper fears as well as taper debate may not be as central to the central bank debate as one might think.

Why?

Hidden Liquidity Tricks and More Central Bank Fire Hoses

Because hidden within the backwash of the deliberately murky and mysterious (i.e., toxic) love affair between Wall Street and the Fed, lies unmarked little islands of hidden liquidity powers known as the Standard Repo Facility (SRF).

Specifically, we’re referring to the Reverse Repo Program (RRP) for domestic use and the FIMA swap lines (for foreign creditors) which allows the Fed to keep dumping liquidity into the system even during a QE “taper.”

The RRP program, for example, allows the Fed to help commercial banks avoid (i.e., cheat on) those otherwise laudable Basel 3 rules, thereby giving our seemingly immortal banks the hidden power to circumvent Basel 3’s reserve requirements.

Without diving too deep into this intentionally complex arena, RRP programs technically reduce liquidity, but the program’s fine print effectively allows increasingly less “liquid” commercial banks to sidestep Basel 3, which means they are not forced to become “less liquid” in actual practice—just more dangerous.

As we warned months ago, as debt conditions worsen, so too does transparency and truth; far more importantly, centralized control over (and support for) an otherwise grossly distorted banking system (and risk asset bubble) continues to rise behind the headlines.

In short, if investors are wondering why or how markets can and could climb despite “taper” headlines, the answer is hidden in plain yet deliberately complex sight. After all, distortion loves to hide behind complexity.

Like inflation, the real truth behind Basel 3 and the taper-debate is hidden behind deliberate obfuscation and mis-reporting—what normal folks call, well…lies.

This means, taper or no taper, the dollar liquidity will keep pumping within the fantasy islands of the RRP archipelago and hence the liquidity needed to help “inflate away” otherwise unconscionable and mathematically growth-killing sovereign debt will and can continue.

Such liquidity trends, of course, just mean the further debasement of fiat/paper money.

Reason 2: The IMF Signals More Liquidity

But if you think the Fed is the only monetary body growing more desperate and hence liquidity-clever by the day, let’s not forget those Wunderkinder at the IMF nor Forest Gump’s reminder that when it comes to dumping more money onto an already unsustainable debt pile, “stupid is as stupid does.”

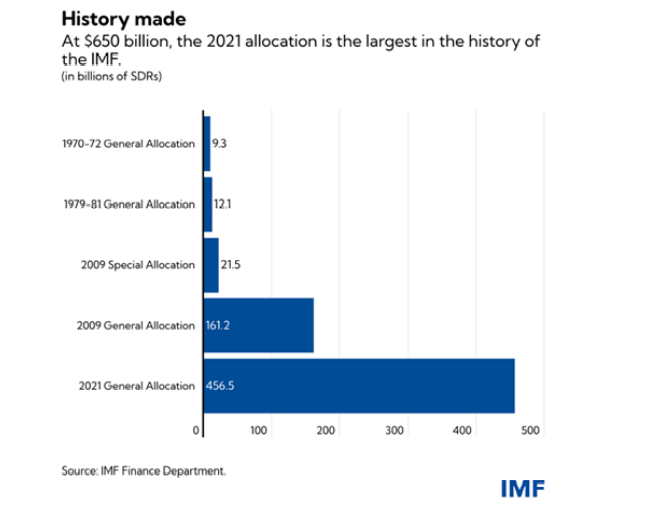

Just one month ago, the IMF’s board of governors approved an allocation (its first since 2009) of Special Drawing Rights (SDR) to the tune of $650B (456B in SDR) in order to stimulate, you guessed it, more global liquidity.

And as the graph below confirms, this latest allocation is an historical doozy, even for the IMF.

Aside from confirming desperation, the foregoing SDR allocation facts have a direct implication on that “barbarous relic” otherwise known as gold, which has been consolidating above last year’s breakout.

That is, whenever SDRs are issued (and they just issued a lot of them), that basket of global money (USD, JPY, EUR, CNY, GBP and JPY) tends to go on a shopping spree for gold.

Of course, that’s just another tailwind for precious metals, but the CNY (i.e., Chinese) component of those SDR’s won’t be the only demand-driven tailwind for gold.

As Brazil’s gold reserves skyrocketed by 100% in recent months, it’s worth noting who has been buying the bulk of those precious rather than “barbaric” metals.

Here’s a hint, the buyers are Brazil’s biggest trading partner—i.e., China.

But the plot thickens.

China is buying gold (as well as soybeans, steel, corn and oil) from Brazil for a reason

Like Russia, the Chinese can buy and sell those Brazilian products in CNY yet settle prices in gold which floats in price (as well as back into Brazil’s gold-thirsty central bank) based on each currency, thereby slowly but surely ignoring that increasingly discredited and distrusted world reserve currency known as the U.S. dollar.

Reason 3: The World Reserve Currency—Not So Exceptional

But as for such declining trust, political gaslighting and dollar-debasing trends, we can thank our so-called “experts” rather than the Chinese or Russians, who are calmly playing financial chess while Powell, Lagarde and others struggle comically to master checkers.

As DoubleLine’s Jeffrey Gundlach observed just last week, the U.S. is running its economy “like we’re not interested in maintaining global reserve currency status.”

Like the recent retreat from Afghanistan, U.S. monetary policy (and its dollar) is looking ever more embarrassing to the world at large.

We’re not suggesting that the U.S. Dollar’s “status” will change tomorrow, but we do believe strongly that owning real assets in general and precious metals in particular is simply commonsense realism in the backdrop of increasing currency fantasy spewing out of D.C.

Reason 4: Simple Math and the “Not-So-Crazy” of Rising Inflation & Deeper Negative Rates

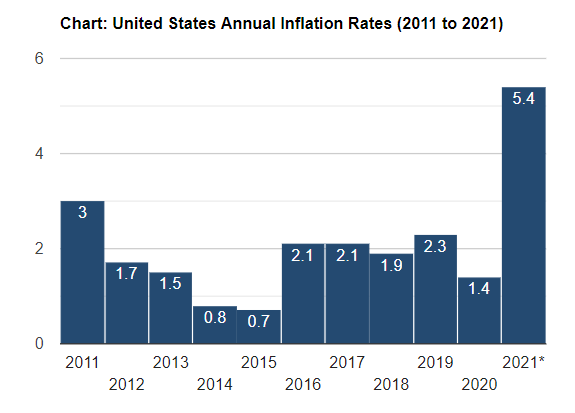

A core aspect of that realism comes down to inflation now surging past “transitory” and morphing into just plain dangerous.

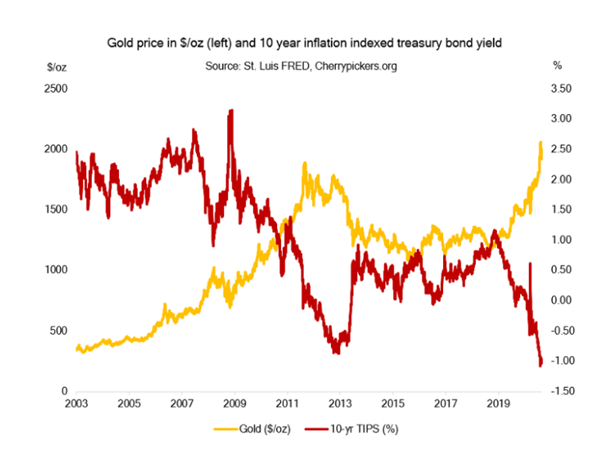

As repeated so many times, negative real rates (i.e., inflation outpacing sovereign bond yields) have extraordinary implications for rising gold price and declining dollar purchasing power, regardless of the dollar’s relative strength against other currencies.

Last week, for example, we made a case for negative rates going as far down as -15%, which would require some pretty ghastly (but we feel deliberately engineered yet publicly denied) inflation ahead.

Toward that end, we reminded readers of prior moments in US debt history when rates fell that deep below zero as inflation rose to the sky—all deliberately allowed to get Uncle Sam out of a debt hole as he sucker-punches the public.

In case that -15% prognosis still seems “crazy” today, keep in mind that the official CPI measure of inflation itself, as reported out of DC, is simply another open CPI lie from the Bureau of Labor Statistics.

Deep down, we all know this.

Nevertheless, and if fantasy is officially accepted as a form of financial policy, the current inflation expectations (based upon the Fed’s 10-Year Breakeven Inflation Rate) of 2.3%, offset against the current 10YT yield of 1.3%, places real rates today at “just” negative 1% as of this writing.

As embarrassing as even negative 1% real rates may be, that’s hardly -15%, correct?

Reason to relax?

Not so fast.

Mathematical Reality vs. Policy Fantasy

The inflationary dangers become clearer once we dig deeper and factor in mathematical honesty rather than policy fantasy.

Even using the current year-over-year (July) CPI rate of 5.4% inflation against the 10YT yield, we arrive at a negative real rate figure of -4.1%.

Ugh.

But it gets worse.

That is, if we were to apply the Chapwood Index which accurately measures inflation by the more honest scale used by the U.S. in the 1970’s (i.e., before the inflationary CPI scale was conveniently “tweaked”), actual inflation today is closer to what it feels like—namely 12%.

This means that when pitted against current 10YT yields, real rates today are negative to the tune of -10.7% right now. This very moment.

Which brings us back to the -15% figure we feel is coming.

Again, does it really seem that “crazy” to expect negative 15% rates in the next 4 years, 5 years, or 10 years when real, yet intentionally misreported rates, are already closer to negative 11% right now?

Hmmm.

Gold

If gold shines brightest as real rates go deeper and faster into the negative, it’s our conviction, based upon honest math and genuine rather than doctored inflation figures or Fed-speak, that gold’s golden era has yet to even begin.

Whether more fiat money comes from: a 1) keyboard at a central bank; 2) the twisted fine print of the Reverse Repo Program; 3) the unprecedented fiscal deficits of mentally-mediocre policy makers seeking re-lection on COVID “concern”-signaling and tyrannical shutdowns, or 4) from the IMF’s SDR pool, the simple fact is that inflation follows the money supply, and today’s expanding money supply is literally off the charts.

The Fed, for now, can pretend to hide this liquidity-driven inflation behind double-speak or creative math, but eventually all truths (including inflation facts) float to the surface as real rates, like the paper money currency you own today, sink closer to the ocean floor.

But as every treasure hunter already knows, paper rots at such depths but gold never does—even after countless years of countless failed attempts by bankrupt regimes (from Rome to Yugoslavia) to pretend paper has value once the trust it has died.

But as Voltaire quipped, eventually all paper money reverts to intrinsic value: zero.

Volatility Ahead…

Meanwhile as markets reached higher highs and then saw sudden falls, the volatility we’ve been warning about is returning with a vengeance, and we remind one and all to seek portfolio solutions like ours to help you weather the crazy before us now and heading our way tomorrow.

With all the world’s money printing going on and the race to the bottom moving at light speed, what would one do if he woke up one day and discovered the he was suddenly living in a time period where his life savings was worth absolutely nothing?

His buddies who had millions stashed under their mattresses reported that they couldn’t pay rent with their dollars because it was all worthless and a fire hazard and told to vacate the property and dollars were not acceptable.

As a USA citizen I must be able to spend USD because it is legal tender for all debts private and public, right?

But if it becomes absolutely worthless and nobody will take it what will I do?

Fair and yet disturbing question. For many, the logical answer is crypto, but for most, the answer has always been the same from Rome in 180 AD to current Swiss millionaires–at least 20% of liquid worth in physical gold–not as a speculation, but as tragically needed currency insurance.

Thank Guys. I read yesterday that at the treasury auction 70% of them were sold . Who the heck would buy them.

Thanks James

other than the Fed, a lot of pension and sovereign wealth funds are effectively obligated to own this paper, which trickles in via various conduits. Pretty sad…