Feeling Crazy?

Today’s broken markets consist of “healthy” commercial banks, a delusional central bank, a disruptive US President, a fractured GOP, a stock market bubble and a bond market teetering on the edge of collapse lead by sub-prime car loans and a looming debt ceiling crisis.

Sound crazy to you?

It sounds crazy to me.

There’s just so much noise, so much fog out there. Squawking pundits, smug experts, euphoric bulls and scary bears are competing daily for a slot on TV and a corner of your mind.

A Lighthouse Amidst the Market Pundit Fog

Wouldn’t it be nice to just have a simple lighthouse to cut through the fog and give us some guidance? You know: A great big beam of common sense?

For me, the most obvious lighthouse is right in front of us—and it’s the S&P:

Looks pretty clear to me that this stock market is in a bit of a bubble, no? I’ve written elsewhere how we got here (Market Reality Check), and it all begins and ends with the Federal Reserve and its post-08 twin steroids of 1) a 5X increase in the money supply (i.e. “QE 1-3”) and 2) over 110 months of free (or almost free) money (“ZIRP”).

A few mouse clicks at the Eccles building resulted in trillions of dollars being created out of thin air and then funneled directly to the TBTF banks (i.e. the “08 bailout”) whose balance sheets were contaminated by sub-prime mortgage loans. And “abracadabra” the 08 Crisis was over and the post-08 “Economic Recovery” (i.e. bull market) began.

Healthy Financials?

It’s no wonder then that the financials (i.e. “banks”) are such “healthy banks” today and leading the bull market’s confidence. Financials are reportedly “flush” with cash reserves and poised to withstand another recession. But you’d be “healthy” too if I hacked into your checking account and added six 0’s to your ending balance.

If that sounds like a fantasy, think again, because that artificial recovery is Quantitative Easing in a nutshell.

The Fed is So Proud of Itself Too

Ben Bernanke (now on a book tour) and later, Janet Yellen, are quite proud of themselves. They have become capitalism’s superheroes. And those two steroids they prescribed seem to have “saved America.” When recently asked if the U.S. would ever see another market crisis, Yellen’s response was loaded with comforting (fairytale) confidence (and hubris):

“You know probably that would be going too far, but I do think we’re much safer and I hope that it [another financial crisis] will not be in our lifetimes and I don’t believe it will be.”

Whoa. Not in our lifetimes? Really? Really? So now the Federal Reserve has not only become the magic wand behind the post-08 “never-a-bad-day” bond and stock market recovery, but also super-re-insurers against market corrections– a kind of permanent rich uncle for a lifetime without market tears…

But if something sounds too good to be true, well, you know…

Has Delusion Taken Over the Eccles Building?

For a sitting Federal Reserve Chairman/woman to effectively declare deficits without tears (ours is $20T) and capitalism without crisis, one would have to wonder if the Fed has literally forgotten Econ 101 (as well as History 101) and become fully delusional?

After all, Capitalism without a correction is kind of like Christianity without Hell: It’s the prospect of the later which keeps the former on good behavior. Yellen, however, is basically telling the market there’s no such thing as fire and brimstone.

These are comforting thoughts, right? And hasn’t the Fed historically been a great source of comforting thoughts? Remember Ben Bernanke, just hours before the markets went straight to well… Hell in 08? His precise words on the eve of the sub-prime crisis were these:

“The sub-prime crisis is contained.”

Thanks for the comforting words Ben… And thanks as well for getting rid of the market Devils. But we all can guess what happens whenever the arm-waving preachers take away the fear of a purgatory…The flock’s behavior starts to deteriorate.

The same is true of a central bank that takes away fear of market forces: investor/herd behavior starts to deteriorate…

The all-time low VIX levels confirm that fear has left these markets. Meanwhile, the yield curve and S&P bubble (take another gaze at the graph above) further confirm that investors are acting like there’s no chaperone at the dance.

I’ve written elsewhere about the full extent of this crazy market behavior. (Signal This: Crazy Markets). The irony comes down to this: in taking away any fear of a market Hell, Yellen is actually setting the stage for devilish behavior and a helluva a bonfire ahead…

Enter the President of the United States

No fear, for if Yellen can’t save our markets, certainly President Trump can, right? After all, this all-time high market is expecting (and already pricing in) big things from The Donald and his GOP: massive tax cuts, a dramatically swift repeal and replace of Obamacare, a conservative budget along with “huge” infrastructure spending, wall-building and military expansion.

But none of this is even close to happening…

Whatever your politics, it’s fairly clear that Trump is a refreshing “disrupter” of the DC status quo, but this alone does not mean that he or the increasingly splintered GOP can lead America out of the fiscal, monetary and economic corner it (and the Fed) has pushed itself into.

In short, Trump may not have a solution. As for leadership, anyone who spends as much time as Trump does obsessing on his image, avenging slights and tweeting for attention would have a hard time leading anything, including an economy… Aside from making even devout Republicans question his mental stability, the following (and most recent) Trump tweets (whining) have nothing to do with economic guidance:

“So they caught Fake News CNN cold, but what about NBC, CBS & ABC? What about the failing @nytimes & @washingtonpost? They are all Fake News!”

“The failing @nytimes writes false story after false story about me. They don’t even call to verify the facts of a story. A Fake News Joke!”

Sadly, our Commander in Chief often seems more concerned about a playground cat-fight with the media than serving as a mature leader with more important things to do. Twitter wars and attacks on the IQ, looks and moods of female TV personalities and tweets aimed at Mika Brzezinski are drawing bipartisan disgust and prompting fellow Republicans to beg him to “Please. Trump, Stop Tweeting!”

Now I’m no fan of media witch hunts or fake news, and in all fairness to Trump, he has been subject to a lopsided media blitz since his campaign began. But whether he deserves it or not, or whether the media has lost its bearings (they did so long ago, in my opinion), this President needs to get off the tweet box and take a look at the S&P graph above…

Facts, not Tweets

As important, Trump and his financial team of bailed-out, ex-Goldman Sachs-ers should consider a few hard facts, such as the fact that despite a raging Wall Street, America is broke. We are seeing the unraveling of state and local government, which is drowning under $3T of conventional debt and $5.5T of unfunded pensions and other employee benefit programs.

And regardless of whatever “health care” miracle, modification or stall the fractured GOP can come up with, total Medicaid spending will nevertheless rage from $4T to at least double that in the next decade—be it under Obamacare or the still failing Senate plan.

What’s equally worrisome is the increasingly clear indications that the repeal and replace disaster-to-date has watered down any hitherto faith we had of a “working GOP majority” in Congress.

This, along with Trump’s increasingly questionable sanity and ongoing media obsession, has everyone—Red and Blue—a bit worried. The Democrats, of course, are no help to Trump, but the Republicans are increasingly looking like a broken jar of glued factions in no position to tackle the massive problems facing our economy or the soon-to-burst market bubbles of which Trump is currently so proud (yet called out as “fat and ugly” during his campaign).

Or stated more simply: it’s a mess out there.

Back to the Credit Markets

But turning (thank God) from politics back to our surreal markets, let’s consider a few more facts and tragic comedies being played out in real time.

Remember that sub-prime housing crisis the Fed “solved” in 08? At least we’ve moved forward, right? You know, thanks to Fed Guidance and Ivy League/PhD wisdom, we erased that ol embarrassing sub-prime stain in the free market handbook and moved bravely and wisely ahead, lesson learned, hands wiped and chin up into a wiser, less indebted tomorrow.

If only this were true. The tragic comedy of today’s market is this: we’re right back into another sub-prime crisis. Only this time it’s not houses, but the other half of the American Consumer Dream—our CARS—which are driving our economy and bond market deeper into popping territory.

A Primer in Market Bubbles: It All Comes Down to Debt, Lots and Lots of It

When desperate central banks increase the size of the money supply and offer it nearly for free (i.e. at all-time low rates), this creates a temporary euphoria (now 8 years old and counting) that is supposed to stimulate economic growth.

What we got instead was just a debt soaked America and a stalling economy…

Why did this happen?

Because the trillions of dollars magically created by the Fed went into Wall Street, not Main Street. The money took the form of financial engineering (i.e. stock buybacks, M&A deals and leveraged recapitalizations) rather than actual investments in productivity and manufacturing.

And as this grotesque misallocation was taking place on Wall Street, American households, students and workers have essentially been forced into a debt serfdom to the tune of over $15T in collective IOU’s to student loan servicers, mortgage brokers and car lenders.

Stepping back for a little perspective, the collective debt levels of the American business sector chimed in at $8.5T just before the 08-bubble crashed. Today, the corporate and noncorporate business sector debt stands at a staggering $13T, hardly any of which was pumped back into Main Street America.

Our Poor Bond Market: Sub-Prime Car Loans, Junk Bonds and Retail Credits

The horrific boom in borrowing for survival in the private sector as well as the greed-based LBO’s and stock buy-backs in the corporate sector has no doubt left its impact on the bond market in general and junk bonds in particular.

Junk loans and bonds outstanding have nearly doubled from their pre-crisis peak in 2008. And this boom is not held on bank balance sheets, but by mutual funds and other mark-to-market entities, which will tank the moment borrowers and investors no longer feel, well, “euphoric” …

And if you’re looking for one of the many canaries in the bond market coal mine, just look at all the new subprime auto lenders (and syndicated bonds) which have sprouted up since 2008. The moment this bubble pops, the sell-off will look 08-familiar (more below).

The retail sector, another bond “canary” of which I’ve written at length, has been its own poster boy of massive borrowings and credit expansion to fund stock buybacks and LBOs. This sector has more to fear than just AMZN, and like the car loan sector, will eventually have to confront massive excess capacity (and the Amazon Blitzkrieg), all of which is anticipated to lead to 30,000 retail store closures between 2016-2018.

Case Study: The Auto Sector Driving America into Peak Debt

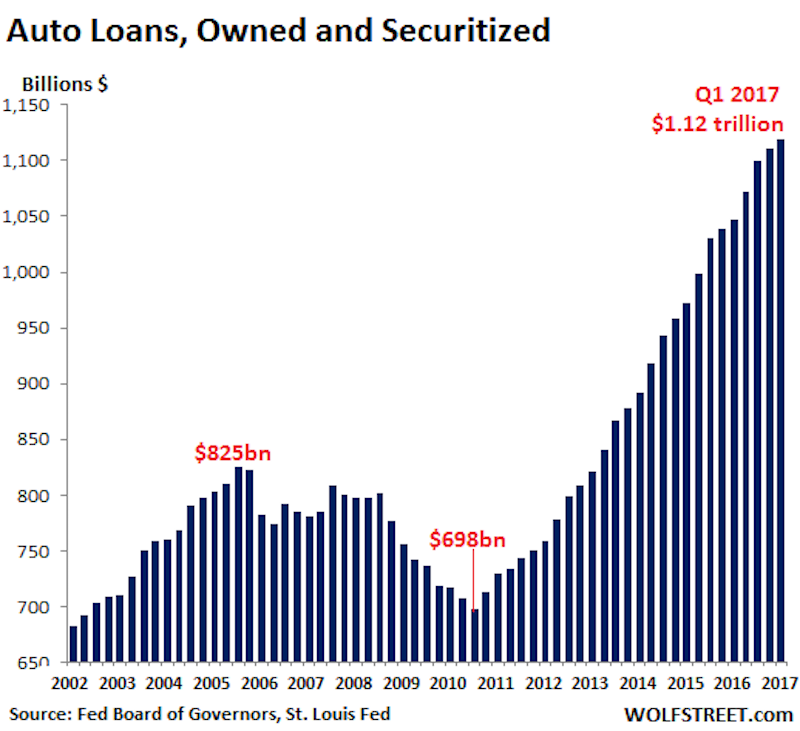

The auto-sector is facing a minimum of $1T in outstanding debt. Why? Because today anyone with a pulse can get a car loan—just like those strippers or unemployed waiters getting sub-prime home loans in 06.

GM, for example, put a record-breaking $4000 of cash incentives on its dashboards in June, just over 10% of its average $35,000 per vehicle sales price. Despite such carrots, GM felt the stick of a 5% year-to-year sales decline and a 46% rise in inventories.

Ugh.

The news is no better for Fiat/Chrysler, Ford or Hyundai, whose sales were down by 19% Y/Y…

What the heck is happening to the auto-sector?

As you might guess by now, it all comes down to easy money in particular and the Fed in general. Once the Fed compressed rates to the zero bound in the wake of 08, bond market yields tanked and thus the market needed a new asset class to produce better yields.

Enter the suckers market…I mean the sub-prime auto market…

While real production in most sectors of the US economy shriveled in the post-08 “recovery,” the auto sector saw a 130% gain from the early 2010 bottom. Meanwhile, the index for consumer goods excluding autos remains below its 2007 levels.

Stated more simply: Today’s auto bubble is yesterday’s housing bubble.

Behind all bubbles, easy money lenders are lurking with a canary-eating-grin in the corner. And here’s how the scam works in the auto world: the average car price for June was $31,000, up 75% form the June average from 1997. Unfortunately, the median household income for that same period is up only 52% (from $37K to $56K). The obvious gap between buyer income and car sale price is paid for by DEBT. Lots and lots of easy debt.

Today’s cars are financed at 98% of the average purchase price! Lenders look to the car value as collateral, not the borrower’s profile. And to induce more suckers (buyers), the lenders have extended the loan period to 70 months, precisely the kind of shady lending practices we saw in the housing bubble hey-day…

Today, there are a staggering 108 million outstanding car loans, a record level. The dollar amount behind these loans exceeds $1 trillion and are by any matrix (or Ponzi scheme) well into the unsustainable level.

So, if you’re looking for a bond sector to short or avoid, just look at the bubbles forming over your nearby auto dealer.

By the way, do you still think the bond market is a “safe-haven”?