Successful portfolios require thinking and investing well beyond the macros alone.

In today’s report, we steer away from our all-too familiar macro critiques (and Matt’s inevitable jabs at a much-deserving and increasingly cornered Fed) to remind readers how Signals Matter translates what we know (the macro) into how we produce safe investing (model portfolios).

For instance, we know that the following market forces are currently driving up market risk: spiking headline inflation; rising interest rates; tech stress.

So informed, what can realistic, risk-aware yet return-seeking investors actually do?

The answer, at least for us, is to invest accordingly and with caution, as we describe in some detail below.

Let’s dig in.

Risk #1: Headline Inflation is Spiking

In spite of forecasts that show spiking headline inflation subsiding as 2022, Omicron (hysteria?) is on the prowl and potential, policy-impacting mutations may yet come.

Indeed, it’s hard to imagine that Consumer Price Inflation (CPI, lefthand chart below) will retrace from the current 6.8% to the desired 2% Fed target anytime soon.

As for the Fed’s almost comical inflation strategies, our prior articles here and here pretty much sum up what we think of their substance, motives and (dis) honesty…

Higher interest rates simply do not have a 1:1 correlation with the supply snafus and global shortages that have helped push inflation to new highs.

Of course, inflation, ultimately is about broad money supply expansion, so if you’re looking for its real source, just ask the Fed.

Nor is the U.S. alone here. The risk of inflation is global.

By example, inflation in the Euro region (righthand chart below) has accelerated beyond record levels, defying expectations for a slowdown anytime soon and hence complicating the task for European Central Bank officials who, like our Fed officials, promote that the current spike is temporary.

Eh-hmm…

Inflation is on the rise, and interest rates with it.

Risk #2: Long Rates are Rising – Short Rates are Soon to Follow

The yield on the U.S.10-year note (lefthand chart below) extended its climb last week, reaching the highest level in nearly two years.

Rising yields, we remind, portend rising rates, which portends rising pain.

December’s employment data showed strong wage growth, prompting a step up in inflationary concerns while signaling that March is the likely starting point for the Fed’s first (market-jarring?) rate-hike.

Related, new jobs fell well short of expectations, up just 199,000 vs. an expected 450,000, although the unemployment rate declined to 3.9%, below the forecast of 4.1%.

Then again, when it comes to honest employment data, our employment thoughts are no surprise to our readers.

The tough call in all of this is whether stocks will fall once the Fed acts. The history has been increasingly less kind (righthand chart below).

Between 1995-1999, stocks rose until the Fed killed the golden goose by jacking rates to 6-7%.

In the 2005-2009 period, again, stocks fared well until they didn’t, when rates hit a punishing 5-6%.

In the 2015-2019 period, stocks again performed until rates jumped to just 2-3%.

While there is historical evidence that stocks don’t immediately rise when rates begin to rise, it’s hard to know just how fast rates will climb this time around.

Our view is that given the debt-soaked and debt-driven nature of the post-08 (and artificial) stock “recovery,” these markets won’t like a rising cost of that same debt.

Remember December of 2018, when markets puked on a 25-basis point rate hike?

And there’s this difference: the spread between stocks and rates has never been this colossal.

Too much debt (from treasury debt to corporate debt) may be more sensitive to rate hikes, faster than in previous years, should earnings begin to decline along with recently declining operating margins.

Risk #3: Technology is being Tested

The Nasdaq Composite (lefthand chart below) fell 4.53% last week,reacting to the hawkish minutes of the Federal Reserve’s December meeting that bolstered expectations of a faster pace of rate hikes, which was tough on balance-sheet challenged technology stocks.

The drop has brought the Nasdaq Composite back to the 144-day simple moving average, which has acted as a floor several times since the pandemic crash in March 2020.

The Nasdaq blew through the 50-day simple moving average on January 4, signaling that trouble may be brewing for the grossly inflated tech sector.

Hawkish signals from the Fed on reduced liquidity have hit expensively-valued technology stocks especially hard, including momentum-driven ETFs like Ark Investment Management’s flagship Innovation ETF (ARKK, righthand chart below), which has fallen some 46% from record highs in February 2021.

ARKK’s top five holdings include Tesla, Zoom Video, Teladoc Health, Roku, and Coinbase Global to give you a sense, aggregating nearly one-third of ARK’s recent holdings. Again, concentrated tech bets are getting slammed, and overall ETF risk only adds to the possible “uh-oh” ahead.

What to Do: Portfolio Modeling

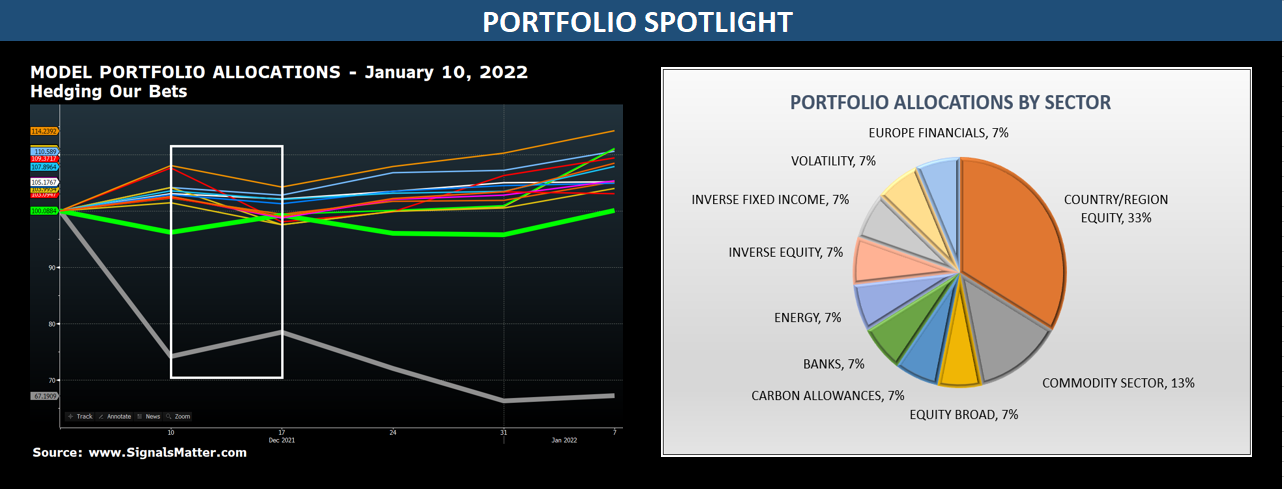

The lefthand chart below models normalized price changes across our ten Model Portfolio picks from December 1, 2021.

You’ll notice the gradual rise in most picks as we do our best to select what’s working now.

Take note of one outlier, though, the VIXY (grey in the righthand chart below). The VIXY is ProShares VIX Short-Term Futures ETF that tracks the performance of the S&P VIX Short-Term Index, which itself tracks the volatility of the S&P 500 Index.

Think of the VIXY as a sniper in the shadows, ready to pounce when volatility spikes. The PSQ too (short the Nasdaq, green) climbs as other picks decline (white box refers and recently for the PSQ, far right).

Hedging portfolios tames and diversifies portfolio volatility, enhancing higher risk-adjusted returns over the long haul.

The righthand chart below models one of the week’s Model Portfolios. Each line represents a Model Portfolio ETF. Current hedges this week include the VIXY (Volatility, at 7% of the portfolios), the PSQ (Inverse QQQ, 7%), and the TBF (Inverse Long Treasuries, 7%).

Otherwise, we are invested in dividend growth, commodities, energy, banks (as interest rates rise), carbon allowances, EAFE value, Europe beta builders, oil, India earnings, and the U.K., Canada, and Europe.

Rest assured, this is not your typical 60/40 stock/bond portfolio, now threatened as interest rates make the turn.

As for traditional portfolio construction, our warnings have been consistent, as evidenced here and here.

Is your portfolio prepared for the 2022 markets? Need a tune-up? Check us out here.

In the meantime, be well, stay safe, and stay properly diversified.

Tom & Matt