Below we look at the fascinating story and broader implications behind the Game Stop price surge.

Like so many small businesses located in hollowed strip malls and other retail centers around the country, 37-year-old Game Stop was destined to become another victim of the highly contested COVID shutdown.

Losing money by the second, the beleaguered retailer was set to close 450 stores this year.

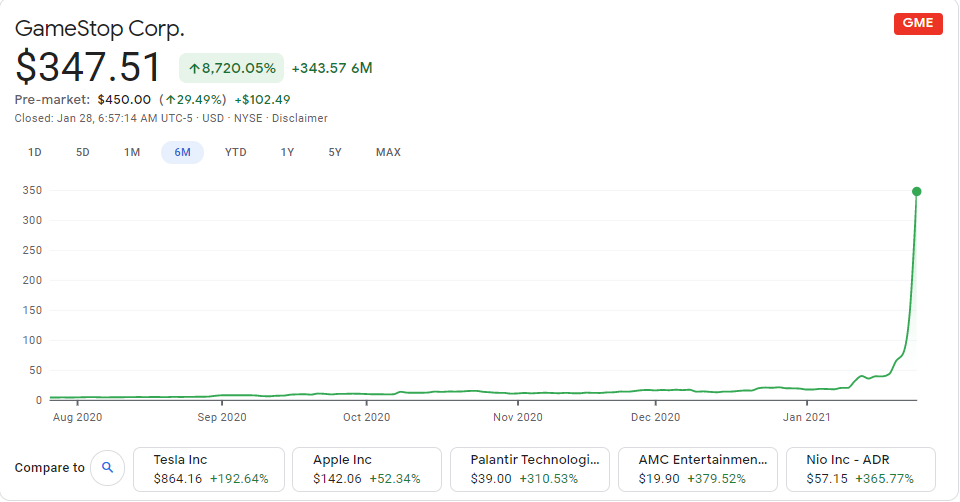

Less than a year ago, you could buy a share of GME for $3.25.

But as of Tuesday, the stock was trading at $148.

And as of this writing, it’s at $347…

What gives?

A New Kind of Pitch Fork?

The implications as well as narrative behind Game Stop’s current and insane price rally speaks volumes not only about the current status of a broken stock market, but also about the growing divide of a nation increasingly tired of the powerful ignoring (as well as exploiting) the weak.

As I’ve argued for years, the relationship within and along the Wall Street- DC corridor is a rigged game, one by which insiders and their paid-for/lobby-seduced legislatures and the compliant, post-Greenspan Fed have created a market bubble for the big boys at the expense of the retail investors.

Meanwhile, Main Street and the dying middle class have been ignored, suffering and taking the brunt of the lockdown pain (and policies) of 2020.

I’ve also argued that the debt orgy enjoyed by my generation’s policy makers will crush the generation to come.

As debt bubbles fed stock bubbles which primarily benefited the top 10% of this nation (who own more than 80% of the S&P’s market share), my children’s generation is slowing catching on to the trap set for them by the forces which preceded them.

In short, they’re pissed.

Wealth inequality is not an abstraction, but a brutal reality, and thus an increasingly angry as well as cash-strapped majority is turning its well-deserved frustration against a hitherto smug, entrenched self-serving minority—i.e. the fancy lads of Wall Street.

As I warned in plain-speak over the summer, at some point economic stresses will trigger social unrest, and not just the kind we saw recently at the Capital or last year across burning cities.

In fact, part of what is happening with the price of Game Stop is, in my mind, yet another symbol of an angry mob, only this one is armed with trading apps not pitchforks.

Put simply, Game Stop is a cult-like symbol of the little guy “sticking it” to the big boys—in this case Wall Street’s short-selling hedge funds and Amazon’s business-crushing Bezos model.

How so?

Well, it’s an interesting story…

Putting the Squeeze on the Fancy Lads

Last fall, Game Stop considered the impossible—namely it tried to compete with Devil, i.e. that anti-trust defying, small-business-swallowing monster otherwise known as Amazon.

Specifically, GME was trying to move its business model online, a big no-no to that over-valued, price-fixing, monopolistic bully on the online-retail block otherwise known as AMZN.

In fact, Game Stop’s new initiative was gaining some traction, and soon the media, as well as small investors on the Robinhood app, were seeing a chance to get a cheap stock with a chance to rise higher.

To that, I say: “Good on ya.”

But Wall Street saw it differently.

Guys like me (or at least as I once was in my 30’s) working the hedge fund desks didn’t see a great buy in Game Stop, but rather another lamb before the Amazon wolf.

In other words, Wall Street saw the perfect set up for an easy short, as clearly Game Stop would be no match for Amazon, which thanks to share-price inflation rather than cash flow, is able to slaughter any small business which enters its business sphere or lair…

Of course, with COVID and the self-inflicted gun-shot wound of a small business lockdown, Wall Street had even more reason to short (i.e., bet against) Game Stop and profit from its naturally assumed fall.

Like so many other little guys, Game Stop was on death’s door—and thus Wall Street’s fanciest and most practical asked the obvious question: Why not make a buck while Game Stop is gasping its last breath?

This would explain why there was over 71M shares ($4.6B) worth of Game Stop shorts (i.e. positions betting against Game Stop) coming into this week.

Game Stop was a sitting duck for the short-sellers.

Easy money.

Unless, of course the stock went up, rather than down.

In that case short-sellers get crushed, not rich. It’s called a “short squeeze” and it hurts.

The Squeeze is On

Well, by Monday, the “squeeze” was on, as GME rose by 145% in a matter of hours, taking its yearly gains to over 300%. By Tuesday, the rally continued.

Again: What gives?

Why the skyrocketing surge?

Was there a technology breakthrough? An earnings revision? A dramatic merger in the works?

Nope.

Crowd Pumping Game Stock

Instead, an informed mob of social-media linked, Reddit-savvy and small-time investors got together and decided to do what the big boys on Wall Street have exclusively been doing for years—namely pump a stock.

Only this time the joke was on the big boys, not the little guys of the retail universe, whom the Fancy Lads like to call “suckers.”

A wave of small investor buy-orders rushed across the exchange (which had to temporally halt trading) in a concerted effort to send GME to record highs, thereby front-running themselves while saving Game Stop from a fatal Wall Street short-position and another Amazonian slaughter.

In my mind, part of what we are witnessing this week is a civil war (or war of attrition) between a socially-linked and large class of small investors against a small and exclusive circle of Wall Street short-sellers, like Citron Research or Melvin Capital.

In essence, a band of small retail investors—who are typically the one’s the Wall Street short-sellers crush, turned the table and squeezed the fancy lads while simultaneously trying to save a small business chain.

Looking Beyond the Little Guys

Frankly, I like to see the underdogs win, and I’ll admit I got a kick out of this recent turn of events.

But before I enjoy this shameless moment of Schadenfreude at the expense of those poor little short sellers at Citron or Melvin, we need to look at other implications behind the Game Stop hurray-story.

Although it’s always nice to root for the little guys, one has to step back and ask the larger question, namely:

Has the Stock Market Truly Lost Its Mind?

Beyond the David & Goliath moment symbolized by Game Stop’s defiant surge lies the larger issue, and danger, of a market now totally off its rocker—i.e. intoxicated.

Whatever one thinks of GME, there’s nothing on its balance sheet justifying the share price highs it hit this week.

But as I recently wrote of Tesla, such insanity is nothing new in a US stock market which the Fed has taken from a Danger Zone to an all-out Fantasy Zone of just grotesque over-valuation.

The fundamentals, as I’ve said many times, have left the building, and this market, long ago—as our recent valuation report made objectively rather than just spasmodically clear.

As Tom and I sit before our screens and track the volatility as well as rising swells of names like Bitcoin, Tesla and now Game Stop, the narratives as well as cash-flows behind them make almost no sense against the lessons we learned in school or in the markets we’ve traded for years.

This is in many ways humbling, exciting and, well, alarming—as the foregoing narratives suggest a market that is getting further and further from the plow of basic reality, and thus basic safety.

Such moves, headlines and tensions suggest a real moment of uh-oh ahead.

As usual, we will continue to build actively managed, all-weather portfolios free of the unicorn, headline and frothy-top risks now in vogue, thereby keeping our subscribers in the safety zone rather than Twilight Zone.

Have a great weekend!

Matt & Tom