The Gold Market

Below we look at blunt reality, market elites and a common-sense case for the gold market .

Blunt Is Good

The years do teach things the days don’t always notice. The more I navigate among this great, round planet and its various heroes and weasels, from surfing line ups to trading floors, hedge fund luncheons, and stocks pitches to polo pitches (or the odd crowds that follow them), I find less to admire on the surface and more to reflect upon inside.

In short: fluff just bothers me.

And so, I find something refreshingly clean in those who navigate and speak bluntly, honestly and simply rather than with a clever (dumb?) silence or a “fancy twist.”

From the earliest classrooms to little league coaches, I have found that whether learning about Nietzsche, Adam Smith or the correct way to hold a curve ball, the best mentors always, well: cut through the crap.

In today’s markets, however, there’s an unusual priority given to…well…. crap…and thus mountains of it to cut through…

Like many of you, I see (and have seen) so much sell-side, MSM and bobble-head “spin” that it’s hard to find any clear path to candor that doesn’t otherwise sound like, or get castigated as, gloom and doom whining or bearish trite.

But those market veterans who speak bluntly aren’t whining, and the fact the macro economic conditions today (unprecedented debt levels, profligate spending and dishonest hope-selling) are so blatantly poor is not “whining” … It’s just being blunt.

But being blunt often feels so out of vogue. In everything from classrooms, newsrooms and bedrooms, some people just aren’t comfortable being direct; yet straight talk helps us walk away from dead ends, and that, although scary, is also liberating.

And as far as the dead end to which the current economy is heading, I like to speak bluntly.

Trusting the “Elites”?

The first layer of “crap” to consider is the current trend in overly admiring (or relying upon) our so-called “elites” and fiscal leadership—especially regarding those “book-touring” geniuses who steer our economy at the Fed.

Perhaps it’s worth reminding ourselves that PhD’s from Ivy League Schools with posts at big banks, central banks and/or Presidential Cabinets may make for great ambitions and resumes, but I have found that ambition and wisdom rarely share the same pillows in places like DC and Wall Street.

In markets, as in combat, fancy resumes mean far less to me than grass-roots experience, of which folks like Bernanke, Greenspan and Yellen have none—other than as theoretical model makers…

I am thinking of a great quote by La Rouchefoucauld, who noted as far back as 1650 that high offices and great talent rarely overlap…

As for the track record of our “elites,” let us remind ourselves that the very same Federal Reserve that “saved America” by printing trillions circa 2008 and onward, was led by the very same Chairman who described the sub-prime mortgage crisis as “contained” in 2007, just months before sub-prime securities blew markets to shreds in 08.

As for the nearly uncountable numbers of MBA-backed analysts who took home 7-figure salaries and “broker-advised” my trades in 2000 and 2008, they were nearly unanimous in giving me “buy” recommendations just days before the dot.com and sub-prime bubbles burst in 2001 and 2008.

I also recall several Wall Street analysts who upgraded Enron literally just minutes before it went bankrupt.

But dumb never dies…There’s much more.

Remember David Lereah, the Chief Economist for the National Association of Realtors? His book, “Why the Real Estate Boom Will Not Bust” came out in 2006, just a year before that boom, well busted…

How about Abby Joseph Cohen, Goldman Sachs chief investment strategist? She reported the S&P would hit 1675 by year-end in 2008? It actually ended below 900…

Or where would we be without the brilliant guidance of truth-sayers like AIG’s Joseph Cassano? This genius ran AIG’s entire financial products division and couldn’t imagine AIG “losing one dollar” from its CDS exposure on all those sub-prime mortgages.

Days after this bold guidance, AIG was bankrupted by its CDS exposure… You and I (and our taxes) then bailed out AIG…

And as for my fancy Harvard, I can’t say enough about the President of that esteemed university while I wandered its infamous green lawns…

The “great” Larry Summers, who put his pen to deregulating the very derivatives market that later crushed America (and the Harvard endowment in 08), was the same “genius” who signed the repeal of Glass Steagall, which made banks into hedge funds and once rational markets into speculative casinos.

Thanks Larry.

In fact, Larry Summers is so special he deserves his own separate read—so check this blog out if you have a minute…

My point? Please don’t just trust labels, positions and resumes. From chief economists at the Fed, Goldman, or AIG to your favorite TV bubble-head or Academic post-hopper, their “truth” is often little more than “sales talk” and job hustling.

Common Sense Is Better

Better approach: Trust your gut, your common sense and those who speak from (and to) both.

And as to common sense, just take a gander here, here and here and ask yourselves this: what kind of stock market only goes up?

Normal stock markets, if you’re old enough to remember them, go up and down.

Since 08, we’ve seen such massive distortions in price discovery and supply and demand due to markets entirely engineered by central banking and governing that there is nothing real about today’s so-called free market economy.

Sound crazy? Just look at this picture of the S&P since the Fed “stimulus” began a decade ago:

Does that look normal? Or does it look, well…crazy? Unreasonable perhaps?

You see ladies and gentlemen, that’s what happens when a central bank and a central government decide market direction by enjoying short cycle boom at the expense of long term pain ahead. The tape goes up and to the right based on “stimulus” (i.e. debt) rather than productivity and value.

Prior market BS detectors and reason-restorers like the CAPE Indicator or GAAP accounting and PE multiples are now ignored like missing lifeboats on the Titanic.

Meanwhile the spin coming out of the god-awful main stream financial media just keeps reheating the same pabulum about dividends and earnings—all of which are based on debt roll-overs, stock buy-backs, bond bubbles, bogus accounting and central bank “stimulus” (which will soon be coming to an end at a prime broker near you).

I mean what good are dividends and earnings the moment we hit a global financial crisis? I doubt you’ll be giving much thought to dividends when there’s no bid for your ask and no one picking up your calls at your current RIA’s home office while markets tank.

Meanwhile, the bulls and the bull $#!@ coming out of Wall Street and the Fed try to tell us that printing $4T in fiat currencies since 08 while pushing debt-ceilings beyond any hope of repayment will not impact your portfolio, currency or well-being.

Do you really believe there’s no “cost” or consequence to printing trillions and trillions od dollars out thin air in the US (and across the world)?

But the ironies do abound, for the very government and central bank (a privately-owned monster independent of the government it “serves”) are actually quite aware of the poison Trojan Horse (money printing and interest rate manipulation) they created…

And as a result have been storing up large swaths of their own antidote.

Want to guess what that is?

Gold. And Lots of It

In fact, the central banks and governments of the US (and of the EU and China in particular) are bracing for economic collapse in case their so-called “money printing experiment” fails… In short: they are hoarding gold.

And given our debt levels, bogus employment figures, stalled GDP and historically outsized securities bubble, failure is right before our eyes as well as right around the corner.

Am I gold bug? Do I have a secret kick-back arrangement between SignalsMatter and gold dealers?

Nope.

I just know that in a world awash in fiat currencies, bond bubbles and central banks running out of gunpowder, this yellow metal is infinitely safer than so-called “sovereign wealth” (i.e. “debt’) and totally corrupted currencies, to which even Bitcoin is more appealing (wrongly or rightly) to many.

Don’t believe me yet? Can’t blame you. After all, Bernanke himself promised the world that the Fed could increase its balance sheet (i.e. print money out of thin air) by 5X “at no cost” to the economy.

But take a look at the historical “strength” (i.e. purchasing power) of the poor US Dollar. Still think printing trillions out of thin air comes at no cost? By the way, this graph is compliments of the Fed…

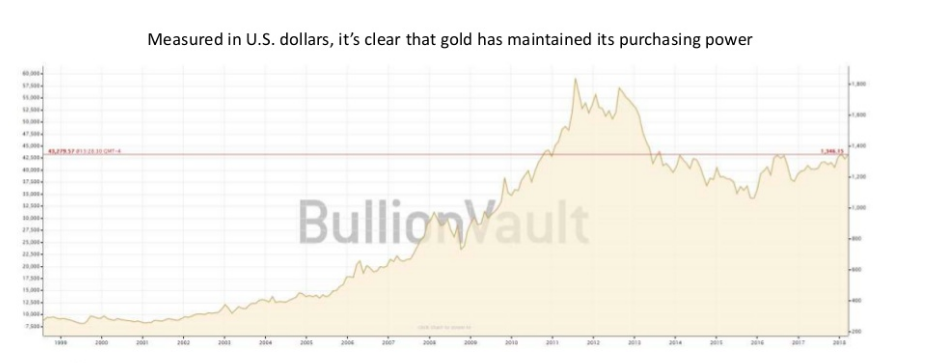

Now take a look at the purchasing power of gold during the same period (as measured in dollars):

So, which asset would you want in a crunch? Common sense is such a calming guide. At least for me.

Nor am I alone. The majority of the hedge fund managers I invest with, allocate to or hit those silly polo balls with, well…they own gold, lots of it. So too does your government.

Just saying…

So, if you, like me, are losing faith in the most hated bull market on record, you can consider a number of options:

A) you could follow our trading signals, and when and if we catch the volatility moves, you could short this bubble and make a fortune (markets do fall faster than they rise, and this market is gonna fall someday…)

…or B) you could buy some gold (not too much, but the Swiss model of 10 to 20 percent of your portfolio will seem brilliant the day this fantasy market turns toward reality rather than fiction).

Anyway…Hope this foray into elite-bashing, common sense and gold-plugging raises an eyebrow.

As always, be careful out there…

1 thought on “The Gold Market : Common Sense for a Senseless Market?”

Comments are closed.