Gold, stocks, the USD and markets in general are flipping and flopping like a dying fish on the dock. What is happening, what can we expect and how can we prepare?

Let’s dig in.

As risk assets witness their worst annual start in history, more investors are turning to real assets in general and precious metals in particular to address increasingly obvious inflation concerns as well as currency alarms.

In this openly disconcerting and volatile macro environment, gold, universally mis-understood, will re-emerge not only as true store of value against weakening global currencies, but also as an exceptional value investment.

The Great Inflation Disaster

As recently as 2021, many prominent Fed officials stuck to their now fully-discredited argument that rising inflation concerns were only “transitory.” The FOMC’s Lael Brainard famously announced that she anticipated a “deceleration” in inflation by year-end, 2021.

Since then, Year-over-Year producer price inflation has risen to 20%, and CPI inflation has passed the 8% marker. As usual, so much for trusting the “experts.”

Furthermore, when considering the same CPI metrics previously used to measure inflation by the Bureau of Labor Statistics in the 1980’s, current inflation would now be more accurately reported at least 17%, which is how we all actually feel it rather than how the bogus inflation metrics measure it.

In short: Inflation is and was more than “transitory,” as we warned so many times ahead of the Fed. In fact, inflation is now a growing and present danger.

What is more, and despite public statements to the contrary throughout 2021, the 2022 Fed is (and was) more than aware of this inflationary threat.

A Cornered & Double-Speaking Fed

Into 2022, other Fed officials, including Neel Kashkari, began openly calling for aggressive Fed rate hikes to combat the growing inflation threat, which he and other FOMC talking heads first blamed on COVID and then later blamed on Putin.

But that’s not the full reality…

Needless to say, when: 1) a central bank balance sheet goes from less than 1 trillion (circa 2008) to more than $8.9 trillion as of this writing, or 2) when the M1money supply skyrockets by over 450%, the inflation problem, which is defined by an expansion in the broad money supply, finds its real blame (and culprits) in central banks, not politicized viruses or a financially weaponized war in the Ukraine.

Regardless of the Fed’s characteristic efforts to shirk responsibility or lay the blame elsewhere, their “solution” to the current inflation problem is as comical as it is tragic.

They have literally placed themselves, and the global economy, in a corner of their own making.

From Chest Puffing to Bluffing

That is, the only viable tool for “combating” inflation is to raise interest rates. Recently, Brainard even made a public, chest-puffing homage to the days of Paul Volcker and his infamous 1980 rate hikes to fight the inflation which Nixon unleashed by closing the gold window in 1971—an historical move which removed the precious metal “chaperone” from the USD’s drunken expansion ever since.

What Fed officials like Brainard fail to mention, however, is that when Volcker rose rates to as high as 20% in 1980, US Public debt was $900 billion. Today, that debt tally has risen to over $30 trillion.

There is absolutely NO WAY that Uncle Sam could afford any meaningful rate hike today akin to the Volcker era.

So, what can the Fed do to fight inflation aside from blaming others or making fantasy “homages” to the bygone days of Volcker?

The answer is simple: They can bluff.

Stated otherwise, the Fed can make public and actual overtures to increase the Fed Funds Rate by 50 or 25 basis points here and there to “combat” inflation.

In reality, however, the Fed is seeking rather than fighting inflation.

Really?

Yes. And here’s why.

The Lesser (Easier) of Two Evils

First the Fed corner alluded to above boils down to this: 1) if they raise rates too high, then neither Uncle Sam nor the vast majority of debt-soaked enterprises on the S&P can stomach the interest-expense pain, and thus markets will crash; 2) if they don’t raise rates, then inflation runs wilder, Main Street gets clobbered by an invisible inflationary tax and the USD’s inherent purchasing power weakens even further.

When faced between such bad choices, the Fed will always and ultimately bend toward the markets and politics and not the Main Streets.

In other words, the Fed will help Uncle Sam do what every debt-soaked nation or regime from Ancient Rome or 18th century France to 1990’s Yugoslavia to 2022 America has always done: Inflate away its debt.

By this, we mean the US central bank, as well as central banks in Japan, the EU and elsewhere, will make sure that no matter how high they take up interest rates, the inflation rate will always be higher.

In short, the Fed and other corned central banks will simply pursue a deliberate policy of negative real rates (i.e., inflation outpacing interest rates) while publicly pretending to “fight inflation.”

This magic trick of allowing future inflated (i.e., debased) currencies (take the Yen as a recent example) to pay for yesterday’s debts is of course disastrous for the citizens over which these private central banks are (and have been) taking ever more political and financial control.

Public Flexing, Private Scheming

Currently, for example, the Fed has been “flexing” publicly by announcing less money printing and bond buying (i.e., “tapering”) to allow rates to rise and hence allegedly “fight” inflation.

US Treasuries, feeling a tad bit less support from the Fed, have consequently fallen in price and hence their yields have risen.

But what the Fed isn’t publicly reminding investors is that even as the yield on the US 10Y Treasury rises to near 3%, that yield/rate is still well below the current Year-over-Year inflation rate of 8.26%.

When adjusted for inflation, the real rate of even a rising UST rate is still NEGATIVE to the tune of -5%.

So, there you have it: A bi-polar world of central bankers “fighting inflation” in the headlines but seeking inflation in their private sessions.

Risk Assets Reeling in the Face of Rising Rates: What Can the Fed Do?

Meanwhile the risk asset markets (stocks and bonds) have been tanking throughout Q2 of 2022 because they are terrified of a tightening rather than easing Fed.

Why?

Because, as bond yields and interest rates rise, their debt expenses become fatal. We’ve been saying this for years.

But the Fed favors markets and political survival over real economies, and knows that that the bulk of Uncle Sam’s otherwise dwindling income from stagnating GDP growth comes from tax receipts rather than actual productivity.

In short: The Fed knows all too well that if markets tank, tax receipts tank as well. This scares the Fed.

Furthermore, the interest expense on entitlement and other US debt obligations are currently greater than 120% of US tax receipts, which means Uncle Sam can’t afford a tanking market and even less incoming tax revenue from capital gains taxes.

That is why we foresee an inevitable (as well as classic) Fed “pivot” from its current tough-guy taper stance to even more money printing by 2023.

That is, the markets will flip and flop like a fish on the dock into a taper, and then the markets will fall dramatically, as they did in late 2018 when Powell took rates too high for the S&P to endure.

By 2019, unlimited QE was back in play to placate a market tantrum.

We expect a similar move from hawk to dove in the near future.

For now, this market has not found its bottom yet. Not even close.

The Gold Question: Headwinds & Tailwinds

Needless to say, more money printing will not only be inflationary (what the Fed secretly needs), but it will also weaken faith in the increasingly debased USD, which ultimately acts as a massive tailwind for gold.

As of this writing, of course, gold has seen prices fall rather than rise. This is neither a surprise nor a concern to informed gold investors, and if anything, simply allows for better buying opportunities.

As for gold’s price suppression into 2022, there are simple headwinds and explanations.

First, there is the omni-present and open price-fixing employed daily by a handful of bullion banks in the OTC market. Here, a small group of BIS minion banks are placing a permanent short on the gold price via levered forward contracts.

Nations are terrified of rising gold because it embarrasses their sovereign fiat currencies. They use the OTC markets to commit legalized price fraud.

Secondly, the US Treasury Department under former Fed-Chair-turned-politico, Janet Yellen, is openly pursuing a failed policy to make the USD appear relatively stronger in a rising rate environment. As the USD’s relative (rather than inherent) power rises, gold always takes a temporary hit.

Thirdly, as risk assets take a beating in the public markets, gold often follows markets downward for a short period, but in a far more anti-fragile manner.

Ultimately, however, as central banks like the Fed are forced to pivot toward more fiat money creation to artificially prop their otherwise zombie-fied bond markets, global currencies in general, and the world reserve currency in particular, will continue to weaken.

Golden Value for a Store of Value

That is when and how gold emerges in its historical role as wealth insurance for openly dying currencies.

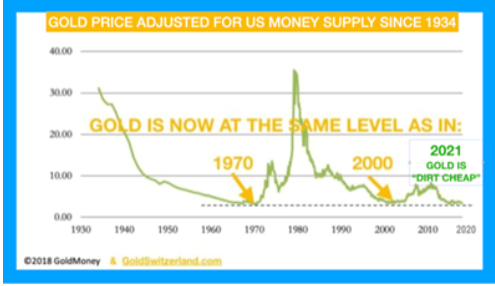

Today, as grossly over-valued bonds and stocks (including tech stocks like BTC…) are falling due to years and years of extreme over-valuation, gold, when measured against the broad money supply, is as cheap today in the 1800-range as it was in 1971 at the $35 range.

In short, for investors looking for real value as well as a store of value, gold is a sober and obvious first choice.

Be Prepared

Meanwhile, risk asset markets are no place today for the unprepared, the passively managed or the Fed-trusting.

Now, more than ever, investors need true diversification outside of correlated and grossly over-valued stocks and bonds. Now more than ever, investors need experienced guidance not Wall Street spin or Fed promises.

That’s why created SignalsMatter.com.

Signals Matter’s Blogs & Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly by Signing Up Here. Signals Matter’s Portfolio Solutions Made Simple are geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here.

Excellent commentary of the situation faced by the Fed and seeing through their cards so to speak. They will eventually fold as they always do for the reasons you cite above.