This market secret comes from an unexpected source.

One of Harvard University’s most beloved and popular professors was not an economist, but the genius philosopher from Oakland California’s “mean streets,” the brilliant (and thus controversial) Cornel West.

Professor West literally filled Harvard’s auditoriums with hundreds of awe-struck undergrads who marveled at his ability to speak without notes on Wittgenstein, Royce, Nietzsche and William James as others might rattle off stats for the Boston Red Sox.

As a philosopher and thinker, Mr. West had taken Harvard to intellectual heights not seen since Ralph Waldo Emerson’s infamous Divinity School Address.

Professor West was, in short, a genuine inspiration to his students.

And to me in particular.

In fact, as a younger man, I was lucky enough to be chosen for one of his seminars, where just a handful of students were allowed to swap thoughts (and sometimes a bottle of wine) to talk about the “great books.”

These were perhaps the happiest days (and reading list) of my academic life.

One book that West pushed us to read was “A Treatise of Human Nature,” by David Hume.

This was some pretty heavy stuff, all about Kantian notions of reality, perception, consciousness, and other matters which you might think have little to do with your portfolio or a critical stock market secret.

Fair point.

From Philosophy to Economics—Hume’s Market Secret

But David Hume wrote another very short book (essay?) in 1752 that was less about philosophy and more about economics. It contained a profoundly simple market secret.

It was entitled “Of Public Finance,” and would later inspire Adam Smith’s infamous work, “The Wealth of Nations,” and guide the thinking of other geniuses like Voltaire, Ben Franklin and Ludwig von Mises.

Humes’ lesser known economic writing penned in 1752, and available here, looked at the problem of debt, using case studies like the Roman Empire and even far flung examples dating back to Mesopotamia to make his point (and market secret) sink in.

And what was his market secret?

Very simple: Debt destroys economies and nations.

David Hume’s Market Secret in 2020

Well, some 268 years after Hume wrote of this seminal market secret, Tom and I stuck to an identical theme when we wrote Rigged to Fail, an Amazon No#1 Ranked New Release.

Was Hume wrong? Were Tom and I wrong? Was the market secret wrong?

Well, let’s look at debt in 2020 and answer this together…

Debt in 2020—The End of “Luxurious Languor”

By the end of 2019, just moments before the Coronavirus made the headlines, the global markets in general, and the US markets in particular, were already at record levels of debt.

We thought that was a problem, and said as much here, here and here…

Why?

Because as Hume (and countless other classical economists far brighter than us) have said over an over: Whenever debt is used to enjoy a short-term “buzz,” the result is simply a long-term disaster.

The future is effectively mortgaged into pain while the present generation lives in what Hume described as a “luxurious languor.”

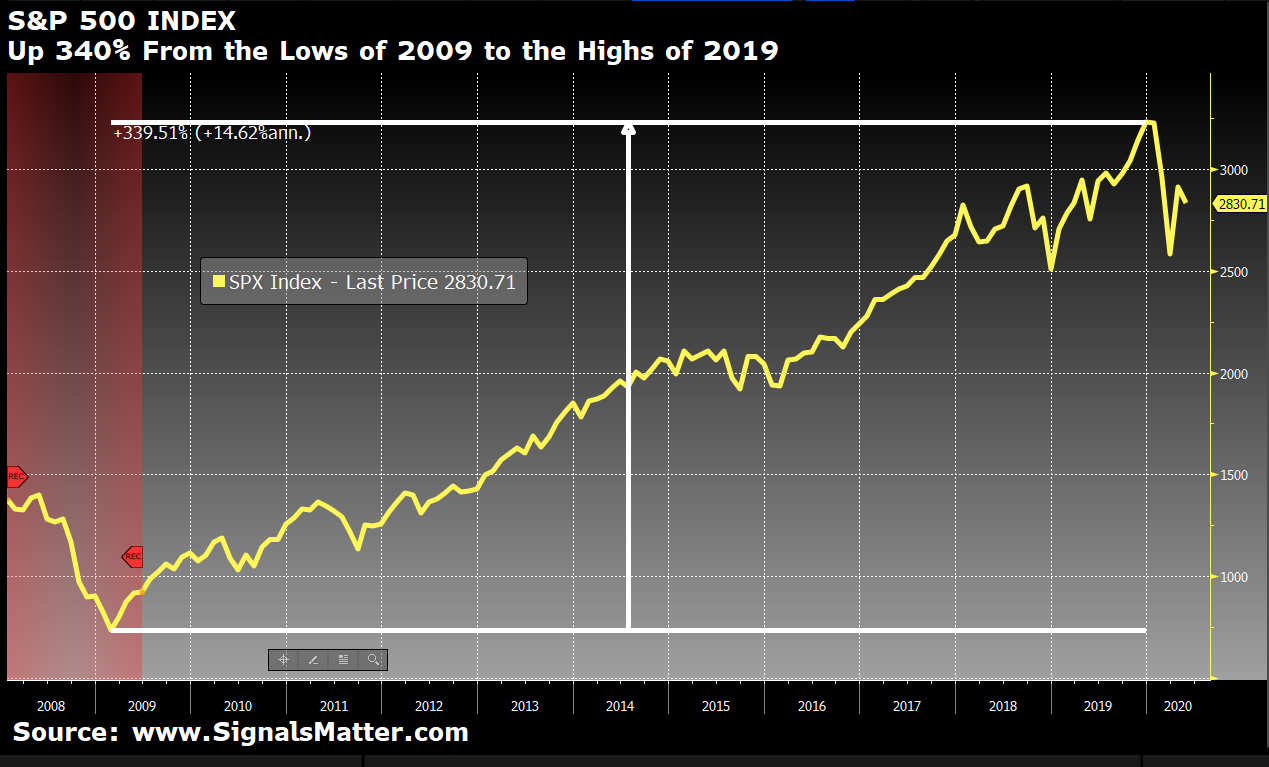

Needless to say, Wall Street in general, and the post 2008 “rigged economy” in particular, had certainly enjoyed some debt-induced “luxury” as the following, post-2008 market bonanza illustrates…

the S&P 500 Index rose by 400% from the lows of 2009 to the highs of 2019 almost exclusively on the tailwind of, you guessed it: DEBT.

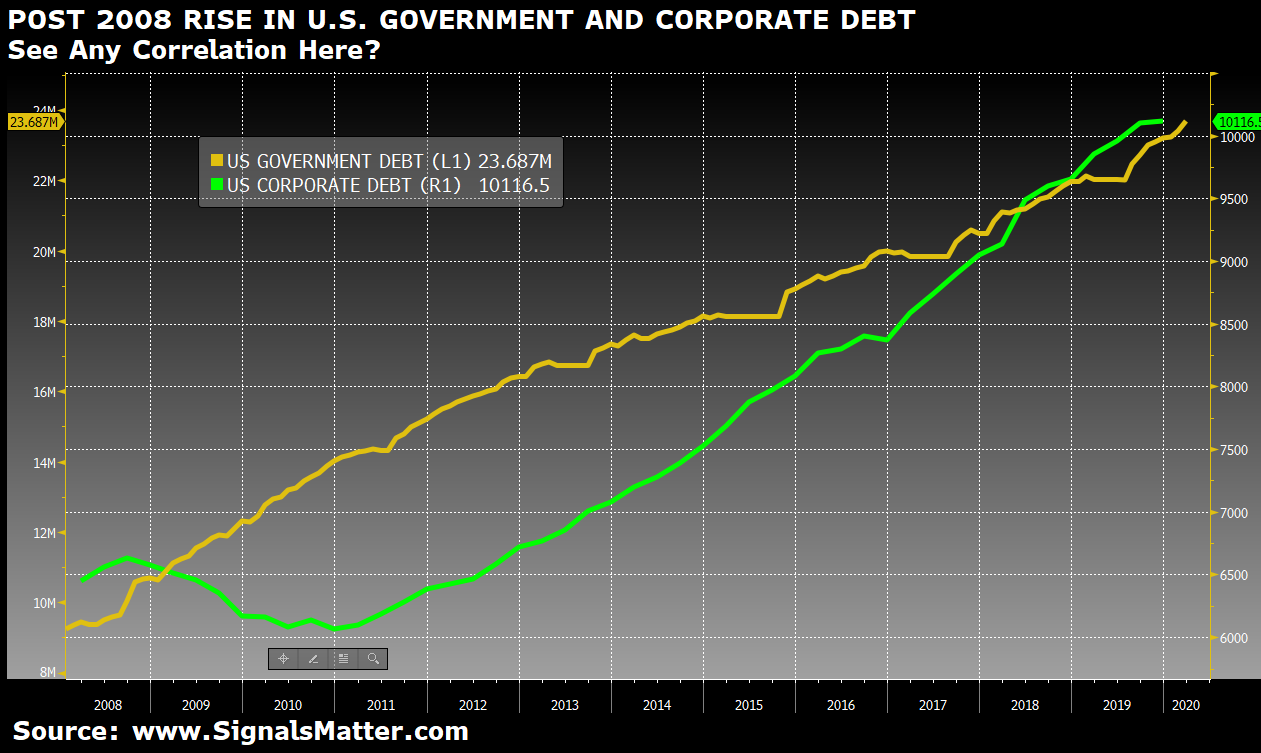

U.S. Government and Corporate Debt simply skyrocketed. See any correlation here? Most of these luxurious S&P points were paid for by corporate stock buybacks paid for by low-rate debt and plain old government borrowing.

The good folks at the big banks, or the various politico’s (red or blue) who never bothered to study economics (or the market secret) forgot to tell you that beneath the last 12+ years of “good times” and “recovery” lies market secret (and economic virus) of which Hume warned as far back as 1752…

Hume’s Market Secret: More is not More

Specifically, Hume said this of debt: “More is not more.” That is, more debt does not create long-term growth; in fact, it kills it.

To confirm this market secret, one only needs to look at the history of what happens when government debt exceeds 50% of its income, or GDP.

Once government debt hits 50% of GDP, this is bad.

And when that ratio hits 90%, the economy loses 1/3 of its growth rate.

This is not just true some of the time. It’s true all of the time, because economics, when understood, is not an art, it’s a science.

Debt, when over-extended, simply kills growth. This market secret is mathematical rather than theoretical.

Take Japan, for example.

It’s debt to GDP ratio has hit the 225% mark, and Japan’s economy has yet to see any growth worth noting since the Nikkei tanked in 1989. In fact, its economy has gotten progressively weaker.

Coming into the disaster that is the COVID recession of 2020, the US debt to GDP ratio was already at 107%.

In 2019, we added another $1 trillion to our deficit, and by the end of this horrific year of 2020, we’ll be adding at least another $4 trillion to the tab, which means our debt to GDP ratio will climb to 125% or higher.

Crisis Reality—No One to Blame?

Of course, our nation is in crisis, and there’s no argument at either a humane or even political level that emergency measures like the Family First Act, the Cares Act and the recent Payment Protection Plans (all paid for by debt) were and are needed.

But here’s the rub: As we use more debt to solve current problems, we literally and mathematically kill any hope of ever seeing growth return.

In short, Hume’s market secret tells us that the next generation will pay for our debt in ways now unimaginable.

But, hey, this was an emergency, and our government can’t be blamed, right?

Well, as Hume also reminded economists nearly three centuries ago, it actually is our fault.

Why?

Because our leaders, like the leaders of any family, were warned long ago to have what Hume described as “output gap protection,” i.e. what the rest of us would simply call a “rainy day fund.”

In fact, the US typically and traditionally kept such a rainy-day fund in place.

Eisenhower certainly did. But then everything went downhill when Nixon famously declared “I guess we’re all Keynesians now,” meaning—we all ignored the market secret and became enamored by (addicted to) debt…

Our Love Affair with Debt

Why? Because debt is fun.

It buys a lot of shopping sprees and good times, from Wall Street to the BMW dealership down the road all the way to the fiscal policies off Pennsylvania Avenue.

But Hume’s market secret would remind us that a nation that doesn’t produce and earn as much as it spends is heading one day for a real moment of “uh-oh.”

This is because debt, like a martini, makes us weaker and weaker.

Hume’s market secret warned policy makers to prepare for the “Uh-Oh” (rainy day)—which at his time included wars, natural disasters and diseases.

Once the debt to GDP ratio gets too high, every dollar of government debt gives us less pennies of economic growth.

Going into 2020, the US was getting 40 pennies of growth for every dollar of debt.

Then Came OUR Moment of Uh-Oh

With the COVID disaster (i.e. that inevitable “rainy day”), we were not prepared (i.e. already drowning in debt), and the new debt we must now take on will likely lead to 20 pennies of growth for every dollar of new debt.

Uh-oh.

Needless to say, the US is now facing a massive output gap.

Even before the COVID crisis, the volume of world trade, which typically grew at a rate of 5% per year, was only at 0.5%, levels we’ve only seen 3 times in our history.

Global debt, at >$250 trillion, had tripled in just over a decade.

In short, we had ignored the market secret and were weak even before we got sick…

Deflation, Low Yields and Declining Investment Ahead

Increasing debt levels and pinning interest rates to the zero zone to encourage more debt equally guarantee (rather than assume) deflation and low growth ahead. Period. Full stop.

The Fed literally has no choice but to keep rates at or near zero for the next 6-7 years, which means yields on longer-term bonds will remain anemic and within the 1.25-2% range for a long-time coming, as the yield curve is now mired (stuck to) the Fed-controlled over-night rates.

As deflation rises, wages will fall, borrowers will struggle and banks will too, as their game is all about borrowing near-term at low rates and lending long-term at high, but now the long-term just won’t deliver high yields.

Sorry Goldman Sachs…

What About Hyper-Inflation?

Many of you ask and wonder abut hyper-inflation.

This seems valid, given all the money printing that has been going on since 2008 in general and in the current COVID backdrop of unlimited QE in particular.

After all, when the Fed prints trillions of dollars out of thin air in a matter of weeks, inflation seems inevitable, right?

Well, that depends.

For now, the Fed (as per the Fed Reserve Act of 1913 and the revisions drafted by the Virginian, Carter Glass in the 1930’s) only has the power to provide loans; it does NOT (at least yet) have the power to spend—i.e. print money and directly allocate/spend it as it sees fit.

The current laws in place only allow the Fed to buy government debt (i.e. Treasuries and government-backed bonds), because the drafters of the Fed Reserve Act must have read some Hume back in 1913…

That is, they understood that if the Fed were given the power to print and spend, then, as Hume warned, we’d see massive inflation, rising rates and instant death—i.e. we’d become a banana republic much like the France of the 1790’s, Germany of the 1930’s, Yugoslavia post-World War 2 or something like 20th century Bolivia…

That would be very, very crazy.

Signs of Crazy?

But folks, perhaps you’ve noticed that central banks are slowly turning desperate, as our government has no “rainy day fund.”

In short, the crazy is already lurking behind the headlines.

Let’s look closer.

Just recently, for example the Bank of England made a direct loan of 500 trillion straight to the British Treasury.

They said this was only a “temporary” measure, but the power to spend has just been granted to one global central bank.

Have the Brits forgotten their Scottish Hume? His market secret? Or their French history?

The French too said their policy was only “temporary”—but years later, it led to a guillotine moment…

As for the US, perhaps you’ve also noticed how the Fed’s “power to spend,” just snuck in through the back door of the law and right past the bobble heads of the financial “media.”

By creating a clever little special-purpose entity to act as an intermediary, the Fed recently bailed out some private corporate junk bonds—which in my mind is just a form-over-substance way of desperately giving itself the power to spend.

Uh-oh.

But as Hume’s market secret warned, and history confirmed from 1793 France to 20th century Weimar, that ends very, very badly.

For now, however, the Fed is not officially “spending” and thus MMT and all its cancerous implications has been held mostly in check.

As long as such spending powers are not granted to the Fed, then the velocity of money (at 1.41 now and likely to fall to 1.31 by Q2) so critical to creating hyper-inflation can be held at bay.

Instead, we have the lesser of two evils to look forward to in the many years ahead, namely tragically low growth, continued deflation, less spending, more debt and tanking productivity.

The Solution for Our Economy?

As Hume’s market secret (as well as basic math and economic history) confirm, once a nation passes the Rubicon of too much debt to income, more borrowing and money printing will never, not ever, lead to more growth.

Instead, it just buys a stagnate, Japan-like survival mode in which we see and experience increasingly diminishing returns for our debt orgies.

The tragedy of the COVID crisis will demand and require even more debt and more aid, as that is both the humane as well as well as politically popular path to take.

But, again, politicians are not economists, for if they were, they’d admit the truth of this market secret, and the truth is we are heading for years of stagnation and less growth, which is hardly a winning campaign slogan.

The market secret which David Hume told us in 1752 boils down to this: Debt can only be solved by austerity, namely living within our means.

But as a society, stock market and country, we have been living beyond our means for over a generation, which means my children’s generation will be suffering for the excesses of their predecessors.

Living within our means would mean less spending, less demand, less growth, less savings, less bond yields, less investment, less staggering market highs and (hopefully) less faith in fantasies.

Which means if we ever see a moment when the Fed is given the open power to spend (pure fantasy solution), then don’t fall for it—not even for a second.

A Fed given the open power to spend will be the first sign and symptom of hyper-inflation to come, and that will destroy our nation, as all hyper-inflationary policies have done, from Mesopotamia to Berlin.

What We See—For Now

We don’t foresee hyper-inflation in the near-term, and hopefully our politicians won’t get so crazy that they turn to the Fed and grant it the power to spend.

Instead, we see the lesser evil of low growth stagnation ahead.

Neither Tom and I, nor our readers and subscribers, should ignore reality just because it’s unpleasant.

We are not here to dazzle you with false hope, but to inform you with respect, which means candor.

Debt-driven aid in a crisis like now is needed, but it will not return us to prior growth nor lead to a sudden V-shaped return to normal, as our nation’s debt levels are simply (and mathematically) too high now.

Instead, we must respect Hume’s market secret and thus brace for and accept reality, which means our portfolios must be equally braced and equally prepared.

Join us by subscribing here. Together, we’ll get through this with facts, candor and realism, and all the while looking to the markets for our signals, not headline noise, false hope or fear-mongering.

Again, the markets (as well as math and history) are the best guide—and we’ll help you see their signals, because in the end, signals matter.

Sincerely, Matt and Tom.

Hi Matt and Tom,

I am curious about the section on hyper-inflation where you explain how it is not a major risk right now because the Fed does not have the power to spend, they can only facilitate loans. Could you explain why the current QE and expansion of the Fed balance sheet would not increase the velocity of money and create a climate for hyper-inflation? Thanks!

Avery, apologies for the late response to what is an excellent question, namely: Where is the inflation (or even hyper-inflation) in the current backdrop of such excessive and undeniable money printing in the US and globally? Rather than try to explain my/our views here, let me address this issue straight on in a report I will post Friday, May 15th. This is a very important question/issue and I pledge to give you my best thoughts on this in the report to come.