Market risk takes many forms, from stocks and bonds to politics, currencies and social fracturing.

Below, we pause to look at, and give context to, just about every key theme impacting our financial past, present and future.

Stock Markets

Markets continue to postpone reality (and mean-reversion) under the moral hazard that the Fed will forever save them.

After a year of headline-making tightening and rate hikes in a 2022 of double-digit losses in stocks, the Fed’s balance sheet in 2023 is effectively right back from whence it started thanks to historical bailouts of bank depositors from Silicon Valley to New York.

In short, investors and markets in 2023 are once again bullish on more addictive and miraculous “Fed support.”

Meanwhile, and despite re-defining the very definition of a recession, the U.S. (with record-high S&P to GDP ratios) is heading straight for an official one, which means a typical peak-to-trough stock fall of at least 50% according to historical averages– and hence an S&P aiming for a minimum of 3000 in the months ahead.

Most investors and their traditional portfolios, however, are completely unprepared for what is hiding in plain sight, namely the mother of all recessions.

Don’t want to believe such painful thoughts? Well, look at the obvious and the facts…

Recession Signs Flashing

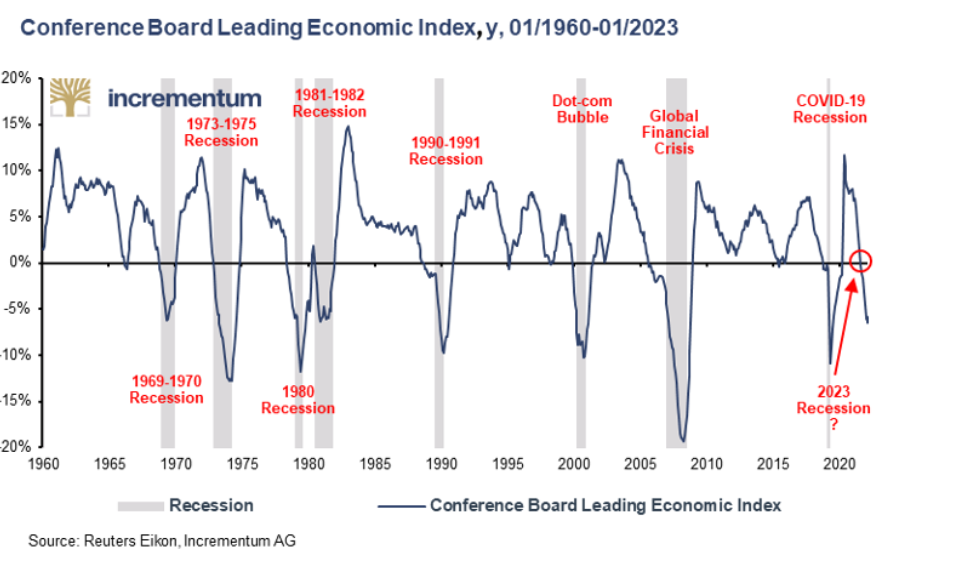

The Conference Board of Leading Indicators (which considers rate spreads, money supply data, unemployment claims etc.) has correctly predicted every recession in the last 50 years once its signals begin sliding southward into negative numbers. And those numbers are indeed sliding…

The Conference Board of Leading Indicators (which considers rate spreads, money supply data, unemployment claims etc.) has correctly predicted every recession in the last 50 years once its signals begin sliding southward into negative numbers. And those numbers are indeed sliding…

If history, common sense and basic math still matter, the issue of a recession is now effectively obvious.

Powell, of course, won’t reverse course and move from a rate pause and subsequent rate cut until investors are already drowning in capital losses and sinking portfolios.

He still thinks recessions, even “softish” ones, can be managed like a light-switch, but the recession off our bow will be dark, very dark, given the macro backdrop of unprecedented debt levels, and declining UST and USD hegemony/faith.

De-Dollarization

As warned from the very outset of the Putin sanctions, freezing a sovereign’s FX reserves of USTs would result in the rest of the world distrusting (and hence dumping) a weaponized US dollar and IOU.

For years, nations from the BRICS corners have been sitting on piles of USTs which not only offered negative real returns, but can now, it seems, be frozen at the political will of DC.

Such weaponized uses of a world reserve currency have consequences, and though the USD (which is 60% of global currencies and 40% of global debt settlements) is very far from losing its “world reserve” status, its trust, respect and use as a payment system is already making an historical shift.

In short, the once mighty USD and UST is losing friends and interest.

Oil, moreover, won’t save the USD, as the petrodollar is no longer a foregone conclusion as OPEC in general and Saudi Arabia in particular look East rather than West for future currency settlements in oil.

This slow but steady trend away from USDs and USTs means the only buyers for Uncle Sam’s essential IOUs will be the Fed as opposed to natural market demand.

In the long run, this will be inflationary.

This will result in mouse-click money like never seen prior in order to keep bonds afloat and hence yields and interest rates from spiking too high to sustain a nation facing greater than $95T in unpayable public, corporate and household debts—not to mention the $100T+ in unfunded liabilities not otherwise making headlines or public balance sheets.

If that’s not scary (as well as objective) enough, imagine when US pension funds, endowments and universities realize what the BRICS have already realized, namely that US sovereign bonds just aren’t what they used to be?

The dumping of USTs within, as well as outside, the US will just put more pressure on the inflationary money printers in DC, which even the inevitable, though temporary dis-inflationary forces ahead, won’t be able to quelle the subsequent tidal wave of inflationary broad money supply expansion.

See how deflation and inflation cycle together?

In short: Stagflation is the most likely outcome to follow the looming deflationary/recessionary forces gathering all around us.

Gold, of course, is rising in the interim, because, well…gold loves chaos and chaos is now the norm.

Gold

As stated many times, the gold price is all about positive or negative real rates. When real rates are negative, gold surges; when positive, gold falls.

That is, when CPI Inflation surpasses the 10Y UST yield, the level of negative rates at the 3% range means bond holders lose the moment they purchase them, which is why even a non-yielding ounce of gold makes more sense than a negative yielding IOU.

Of course, gold suffers when rates are positive rather than negative.

In reality, however, such a scenario is now all but a fantasy, as the only thing which would make rates sustainably positive again would be if Congress balances the budget, the US debt crisis is resolved, and over $100T in entitlements (pensions, social security, Medicare etc.) are suddenly solvent.

But again, that just isn’t gonna happen…

Ironically therefore, Gold’s best friend is drunken politics, drunken budgets and a broken Fed, all of whom have ruined the USA’s two best assets, namely the once revered UST and the USD.

Thanks to Powell’s rate hikes, the over 14T in USD dominated debt around the globe simply got too expensive to endure.

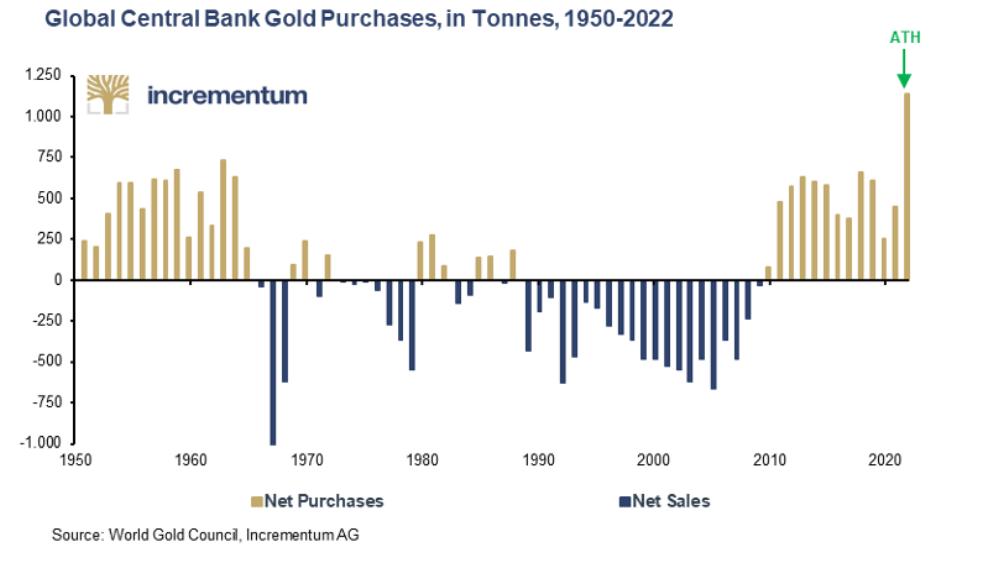

Thus, countries have been dumping USTs for liquidity as longer-term-thinking central banks out east have been making record-breaking purchases of physical gold at levels not seen since the 1960’s.

Central bank gold purchasing and gold reserves to the tune of 1100+ tonnes haven’t seen such purchase levels since 1960’s.

Gold is up 11% YTD, and that trend will continue for years, interrupted only by a recession and market implosion in which gold will be one of the only safe assets which investors and nations will have to sell in an emergency.

This could cause gold to fall for a brief window.

Thereafter, however, gold will race to levels never before seen.

Sadly, however, gold rises when just about everything else is fracturing, so it’s never a smug celebration to watch this metal get the last laugh.

Social Fracturing & Political Breakdown/Control

As warned many times, every debt crisis throughout history is followed by inflation, currency destruction and hence a social fracturing followed by extreme political desperation, change and control.

Just look at history…

Inflation in China? Chairman Mao followed. Inflation in France? Napoleon followed. Inflation in Tsarist Russia? Bolshevism followed. Inflation in Italy? Mussolini followed. In Spain? Enter Franco. Inflation in Weimar? Next comes Hitler.

You see the pattern…

In the US, we’ve seen inflation because the M2 supply skyrocketed by $14T despite a meager $500B reduction last year. M3 money supply is up 500% since 2008.

But rather than draw simple and obvious connections between inflation and US monetary and fiscal sins, DC will distract us with headlines which blame what was once “transitory” inflation on Putin, COVID and global warming.

Meanwhile the nation distracts itself with a weaponized DOJ and a “woke” climate of social justice warriors who, much like the Salem Witch Trials or the McCarthyism of old, are marked by a tolerance message which is based ironically and entirely on intolerance.

As already warned, the rise of CBDC is just another evidentiary example of nations tilting toward more control as per the patterns above.

Inflation/Deflation

Despite all the pundit squawking and endless debates, the inflation/deflation question is simply a matter of the expansion/contraction in monetary units.

But yes, supply chain disruptions and OPEC contracting supply in anticipation for demand contraction in a recession are all inflationary tailwinds.

But the real cause of inflation is money supply expansion which will become inevitable once the dis-inflationary pains of the looming recession are “solved” with trillions more in mouse-clicked dollars thereafter.

See the doom-loop? See the stagflationary end-game?

If not, let’s remind ourselves of the most important indicator in modern markets: The Bond Market

The Bond Market is the Thing & More Inflationary QE is Inevitable

We’ve warned for years that the “bond market is the thing.”

It’s very simple, really.

The Fed, for example, knows that US sovereign bonds can’t be allowed to fall too far in demand and hence price.

If allowed to so fall, bond yields and hence interest rates would spike, which in the backdrop of historical debt levels would spell complete national disaster.

Already, public debt in the USA is fatally too high.

Uncle Sam’s True Interest expense for his IOU’s is already $640B; next year the tab will be nearly $740B. And with a DC budget that requires nearly 3X spending than actual money in the tiller, the need for more instant (and inflationary) money creation will be obvious in the years ahead.

In short: the trend toward (and need for) more QE/synthetic demand is not a matter of debate but a matter of national survival; the US will kill the currency, as the last bubble to pop is always a currency bubble.

Why so certain?

Easy: Debt levels tell us so.

DEBT

US Debt is up by $9.5T in just the last 3 years, and the Q3 debt ceiling will be pierced yet again as the Biden Budget effectively extrapolates out to another $19T in deficit spending by 2030.

But how on earth will this debt be resolved?

There are only three options: 1) default 2) inflate away the debt via currency debasement or 3) a global re-structuring/chapter 11, aka the “great reset” in which the culprits (i.e., guilty central bankers and election-seeking politicos) will blame its debt and inflation sins, again, on a virus, Putin and/or global warning…

Prepared?

Given that default is political suicide, the likely road ahead will be one of more instant and inflationary money creation/liquidity in the wake of a deflationary and cruel recession followed by more stagflation, headline credit events and increased political control masquerading as needed “emergency measures.”

Signals Matter can’t prevent or solve all the political, social and cultural changes and challenges ahead, but we can, at least, prepare your portfolios for the volatility and market risk which impact your wealth and hence security.

Again, the world may be going a bit mad these days, but our portfolios remain sane.

Signals Matter Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Our Portfolio Solutions are generally geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here. For three ways to engage with us, please click: 3 Ways to Engage.

If CBDC becomes the law of the and with no cash in circulation what happens to the price of gold and how would one sell it for the currency since sales and sales for items and even prices could be controlled by the federal government?

Thanks, –

How much to hold and what to hold in one’s portfolio, given all you say seems to be a good question.

Yes, PM will be a big key for sure. However, what form does cash and near cash equivalents now hold and into the foreseeable future?

Paper instruments (another kind of questionable fiat trash) found in MMA, ST Bond Funds of varies types, and even bank CDs? Should it increasingly be 10-15-20% PM with the balance being pure paper fiat cash laying around – even as it continues to wilt and earns negative real yields and waits for CBCD to be the new CB scared solution?

Your Thoughts?

Richie B