In this critical report, we examine how a Apple’s stock can rise in price despite declining revenues, profits and free-cash-flow.

Specifically, we’ll be tracking the recent price moves in Apple.

Once understood, you’ll see how Apple, like the broader markets in general, is driven as much by tricks as facts.

But the laws of market forces, like Newton’s law of gravity, remind us that apples ultimately fall down rather than up. The same is true of over-hyped stocks like Apple—eventually, they have nowhere to go but down.

The Apple of the FAANG’ Eye—The Recent Rise of a Company Losing Money

Earnings for Apple came out earlier this month. Did you notice?

Its stock price surged by greater than 5% on the news and its market cap rose by over $40B in a matter of hours. Alas, the numbers for Apple must have been amazing, right?

After all, Apple seemed poised to join its FAANG partners Google and Amazon in the “One Trillion Market-Cap Club” of post-08 crazy.

But if you looked under the hood of Apple’s actual financial statements, their numbers boil down to something that is anything but “surging.”

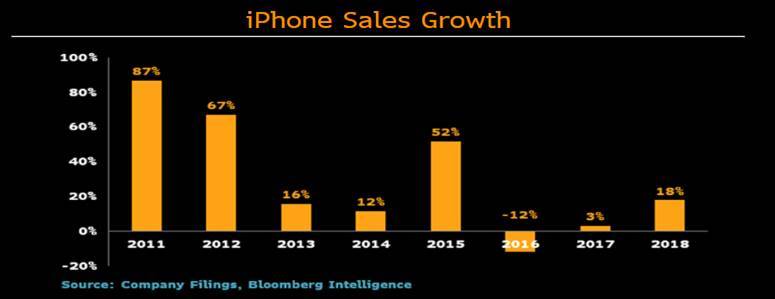

In fact, Apple’s reality over the last 12 months comes down to this: 1) Revenues are down by 5%, 2) gross profits are down by nearly 7%, 3) pre-tax profits are down by almost 15%, 4) net-income is down by over 16% ; 5) free cash flow is down by 12% and iPhone sales are down, by well…a lot.

Lipstick on a Pig

In short: What gives?

How does a stock rise when all its fundamentals are falling?

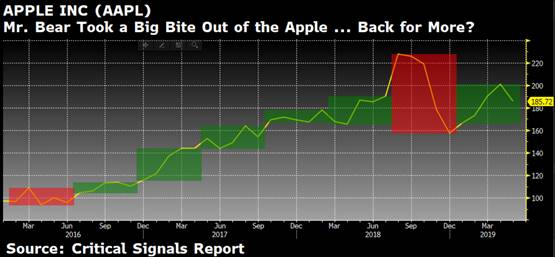

Well, recently, the markets reminded Apple that what goes up on myth, eventually falls on reality, as Apple just got spanked by Mr. Bear….

Now, Apple is trying to rebuild its image on services rather than goods, as “American” goods Made in China, like the iPhone, are not feeling so “good.”

Despite these gyrations in price, it’s worth discussing the larger questions of how Apple’s stock rose earlier in May on declining profits, as there are lessons to be learned from the tricks behind Apple.

Sadly, such disconnects between sinking balance sheets and rising market prices are nothing new.

As bluntly revealed in my free report on The Profits & Earnings Lie, Wall Street has a number of tricks up its magical sleeve to put reporting lip stick on market pigs and thus keep buyers (suckers) chasing after topping-stocks like Apple.

Of course, it may seem unfair to call Apple a “pig.”

After all, no one can deny the extraordinary and global impact of innovations like the iPhone or iPad which have made Apple a household name around the world.

Furthermore, one can’t scoff at a company that just posted $65B in income, even if that income is falling. Such data in sales, after all, are impressive.

Nevertheless, the blunt fact remains that Apple’s pre-tax income at its 2015 peak was $72B, much higher than its recent $65B print. In short, Apple’s star is no longer on the rise.

But How Can a Stock Rise on Declining Numbers?

So, we ask once again: How could the stock of a company surge upward when its financials are trending decidedly downward?

Indeed, Apple’s recent moves almost seem like a fairy tale. And thus, in order to answer this simple question, one has to consider the countless (and all-too-real) Pinocchio’s hiding behind these fairy tale markets.

Trick Number 1: “Beating Expectations”

One trick the Wall Street Pinocchio’s love, and which we’ve discussed elsewhere is the “earnings expectations” ruse.

That is, think of a teacher “puffing” you up by saying, “Hey, great news about junior’s C- in Algebra, as he beat our D+ expectations.”

Wall Street analysts and stock peddler’s use the same trick: Just before earnings announcements are due, they deliberately set earnings expectation low so that almost any company can “beat” them.

This is good for collecting (tricking) buyers…

Q1 sales for Apple, for example, were down by $3B–or 5%. That’s bad news.

Wall Street, however, had previously (and deliberately) set expectations to be worse, at negative 6%–so there you have it: “Apple beat expectations.” That’s so-called good-news, and hence Apple’s stock rose on an otherwise declining sales print.

Folks, you just can’t make this stuff up.

Trick Number 2: Market “Guidance”—i.e. Lies of Omission

Of course, salesmen with growing noses on Wall Street have other fibs in their nostrils. The next trick is to keep investors feeling all excited about market “guidance” on what Apple will do in the future while omitting context from the past

That’s how the Ken and Barbie prompt-readers on TV and their white-collar, sell-side guest speakers get investors all excited about Apple’s projected gross margins, revenue streams and other multi-billion-dollar data points.

The projected numbers are indeed impressively large.

But what the spinners don’t tell you is that all of those guided numbers are significantly down from last year’s data…

That is, Apple’s “guided” net income for June of 2019, for example, is going to be $9.6B, which appears impressive at first glance.

But what those prompt-readers won’t tell you is that last year’s net income for Apple in June was $11.5B, which means Apple has just lost 16% in profit this year while its stock surged higher for days.

Again, what gives? How could stocks rise on declining profits and falling free-cash-flows—the very heartbeat of company value and normal price discovery?

Trick Number 3: Stock Buy-Backs

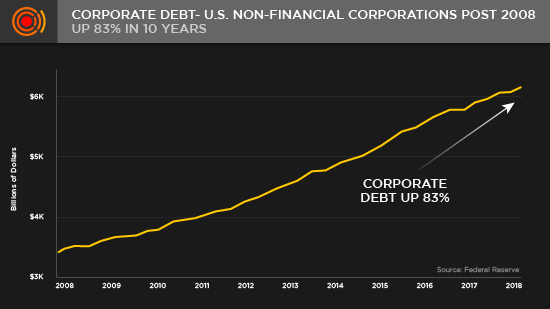

Well, as those who’ve read our 2019 Melt-Up Report already know, Wall Street pulls this magic show off buy drinking its own Kool-Aide—i.e. by buying back its own shares to push up stock prices.

Thanks 100% to a Fed that keeps rates stapled to the floor in order to “accommodate” a Wall Street binge masquerading as an “economic recovery,” fat companies like Apple are able to borrow at the cheap and then use that money to purchase and hence push-up their own stock.

As per its March Q1 report, Apple recently spent $24B on stock buy-backs, which directly explains the rise we’ve seen in its stock price since the notorious Christmas crash of 2018. Since 2015, the company has spent a total of $363B buying its own stock or paying dividends.

Due to such tricks, Apple’s share count has in fact shrunk by 16% since 2015, which gives a misleading veneer of improved “earnings per share” data, which Wall Street’s sales desks then peddle like candy to children.

A Toxic Blend of Distortions

This toxic blend of 1) Wall Street spin, 2) complicit media ignorance, 3) earnings “expectations” tricks, 4) sell-side “guidance” scams, and 5) Fed low-rate “accommodation” leading to 6) record-high stock buy-backs explains how companies that lose money can temporarily go up in price.

Pretty “tricky,” no?

What’s even more disturbing is that Apple is hardly alone in this pathetic irony of rising stock prices despite declining profits, falling sales and weakening free-class-flows.

In fact, the entire class of the FAANG stocks (Facebook, Apple, Amazon, Netflix and Google) of which Apple is a proud member, is marked by such weakening balance sheets and are years past their earnings prime, as our separate report of the Tech Risk makes mathematically clear.

To make matters even worse for “goods” sellers like Apple, the never-ending tariff war with China means its “American” iPhones (made by cheaper, underpaid labor in China) are feeling the hit to their bottom line, as well as competition from other smartphone names like Samsung.

Perhaps most disturbing of all, Apple, along with its hyped-up FAANG class, accounts for over 15% of the S&P’s total market-cap, which means the myths that have been driving Apple up are the very myths that drive the broader US market.

Unfortunately, such fairytales can suddenly turn into nightmares when a market panic sets in, as we recently saw in the last half of 2018. Fang stocks fell by greater than 30% as a group from their June highs to December lows.

Imagine, therefore, what these grossly inflated stocks (and hence the broader markets they carry) will do in a real crisis?

Short answer: fall like Newton’s apple to earth.

The Myths Still Trump Reality

For now, however, myths trump reality, and bad balance sheets and declining profits can still be glossed over using each of the above tricks.

Such tricks, in fact, are less like lipstick on these FAANG “pigs” and more like vampires whose actual teeth/fangs will suck the blood out of portfolios when conditions converge in the next Melt-Down, likely heading our way in 2020.

The recent fall we’ve seen in Apple’s stock is just the beginning gyration in much steeper rises and then falls to come.

Pausing to See the Fed Myth

For now, however, conditions are not fully set for the melt-down, as the current melt-up enjoys the complicit support of an equally dishonest Fed, which is deliberately keeping interest rates in a “pause” mode for 2019, allegedly due to the Fed’s concern about hitting a “target inflation” rate of 2%.

The Inflation “Trick”

But as my piece on The Great Con makes mathematically blunt, that target-inflation story is precisely that: a story. Worse—it’s a lie.

The Fed has hit and passed its own “targeted” 2% inflation rate years ago.

More importantly, the way the Fed measures inflation with the CPI deserves a Nobel Prize for fiction writing, because actual inflation, as my prior report on The Inflation Lie proves, is closer to 10%, not 2%.

Any of us who actually pay bills knows this already: Prices today are rising far faster than 2% a year…

But just like the sell-side in Wall Street, the Fed in DC survives on myth, not transparency.

If the Fed admitted to an actual inflation rate of 10%, no one would buy our Treasury Bonds (which yield less than 2.5%). After all, under honest inflation reporting, the returns for purchasing our debt would be negative when adjusted for inflation.

Of course, a nation and market that survives on debt, survives on bonds and an endless stream of national and corporate IOU’s.

Thus, if the Pinocchio’s at the Fed told the real truth about inflation, rates would have to rise and hence that IOU stream, and hence this market, would dry up (or melt-down) instantly.

In short: the US bond market—and broader markets in general—literally survives on Pinocchio support, i.e. deliberate lies.

Don’t Fight A (Dirty) Fed

For now, such myths pushed by both Wall Street and DC remain precariously in place. The Fed may be the dirty cop behind these rigged markets, but as I’ve said elsewhere, “don’t fight the Fed, even a dirty one.”

That’s why we are tracking the markets so carefully, for in addition to old-fashioned facts, we have to gage the market’s faith in myths—which is no easy task, but these are the very myths we are committed to both expose and exploit, as our trading signals tell us.

Stick with the Signals Matter as we walk together through the fog of rising and falling markets and its army of Pinocchio’s with the blunt signals and strategies needed to both preserve and grow wealth.

That is, even if genuine facts, fundamental transparency and blunt truth are otherwise absent in driving current price discovery, we can still track, signal and reveal the inversions and shifts that impact your financial future.

Hope this helps, and keep your eyes on stocks like Apple. Eventually, Newton’s laws of gravity will get the last say.