There are a number of forces at work creating extensive U.S. Dollar demand, which, as we discuss below, buys the U.S. markets crucial time as well as market power as U.S. Dollar strength increases for now.

24 shares

In this critically important report, we look deeper into how the U.S. Dollar demand partially helps markets rise despite flat-lining GDP and record-breaking deficits.

We examine this in simple speech while also answering questions about currencies, inflation, debt levels, and even the counter-intuitive case of gold rising alongside a rising U.S. dollar.

Bullish Views in a Bearish Backdrop – One More Reason for the Final Melt-Up: A Currency “War”

There’s no escaping the fact that within Signals Matter, our views on the long-term direction of the U.S. economy and markets are decidedly and historically downward.

Toward that end, we’ve written extensively about the key triggers for a market meltdown, as well as the myriad layers of what has been factually proven to be disinformation (i.e. myths) that the financial media, Wall Street, and D.C. have handed investors for years.

These open lies, which help push markets up, cover everything from myths about profits and earnings to equally egregious lies about unemployment and inflation. In short, the Fed has a long nose.

But know this: The Fed may be lying, but as most investors and traders know, one still doesn’t “fight the Fed.”

If the Fed hands us a fat pitch (e.g. an interest rate “pause” that stimulates stock buy-back support), we have to take a swing, even if we don’t like the pitcher.

The tragic reality today is that the Fed is the number-one force behind markets. But the equally important truth is that the U.S. dollar (which the Fed controls) is the most important trade currency in the world.

Why?

As discussed in our piece Three Reasons Not to Go Down with the Fed, this is because the Fed controls the supply of U.S. dollars.

This is critical because the U.S. dollar comprises 60% of the global currency reserves, 80% of the global banking-payment system (SWIFT), and effectively 100% of the global oil exchange via petrol dollar deals struck in the 1970’s with Saudi Arabia, our “democratic” (?) ally –the only country in the world named after the family that rules it.

And as we will see quite clearly below, despite its declining purchasing power, the extraordinary and relative power of the U.S. dollar (despite printing/”diluting” trillions of them since 2008) in the global monetary system is a key reason why U.S. markets can go up before they come crashing down.

The U.S. Dollar Will Rise Dramatically in Relative Strength – and Keep U.S. Markets Up for One Final, Record-Breaking Top

Ironically, the U.S. markets can climb not because things in the world are going so well, but because of the opposite reason. That is, because things are so bad everywhere else in the world, the U.S. markets can roar upwards as other less developed markets (and currencies) struggle based entirely about U.S. Dollar demand.

This U.S. Dollar demand, imposed via dollar-based banking and oil regulations, essentially boils down to the U.S. (and its dollar) being the best horse in the global glue factory, a point we’ve made in our bullish piece on Why War Is Ironically Good for U.S. Markets, as well as in the Seven Tailwinds for a Melt-Up.

In this Signals Matter Report, we drill down specifically on U.S. Dollar demand and how the U.S. dollar will rise – along with gold – in the oddest blow-off top in market history.

Specifically, and despite some minor pullbacks here and there, the U.S. dollar is about to strengthen in 2019 to some record-breaking new highs in the next 12-24 months simply because the U.S. dollar has become the number-one global trade currency. Again–it all boils down to forced U.S. dollar demand.

Why?

The Simple Power of Debt Coupled with the Forces of Basic Supply and Demand

The answer comes down to the trillions and trillions in U.S. dollar-denominated debt around the world (and within the U.S.) all colliding with the forces of supply and demand.

Greater than $1.5 trillion is required each year just to pay the interest in U.S. dollars on this massive debt storm. This, all by itself is a powerful source of U.S. Dollar demand and hence U.S. Dollar strength.

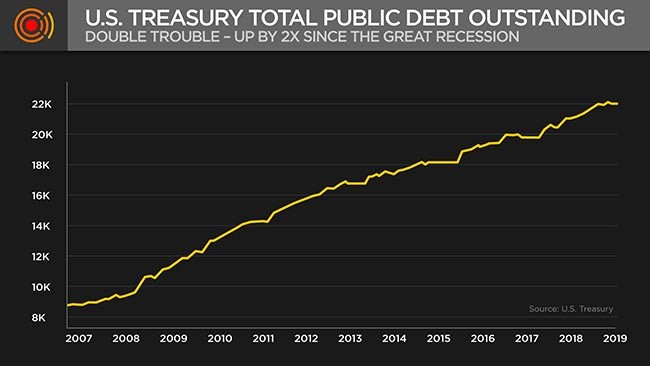

We’ve already seen the sickening levels of over $22 trillion in U.S. government debt, up double from the Great Recession of 2008.

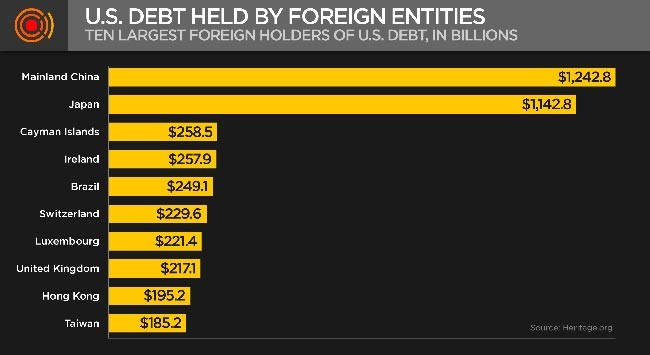

But outside our borders, there is another $4.2 trillion-plus in foreign entities and governments that owe the U.S. money in dollars, not local currencies. Again: This creates massive U.S. Dollar demand.

In order to pay all this debt, there’s going to be an increasing U.S. Dollar demand , and as all high-school economics students know, the more the demand, the higher the price of any widget.

In the case of U.S. Dollar demand, that demand is about to skyrocket, and with it the relative strength of an otherwise diluted U.S. dollar. This means the price of already grossly overvalued U.S. stocks can also rise with the dollar.

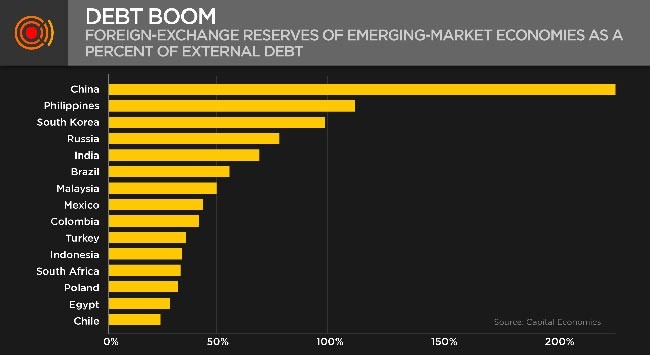

This tragic debt reality is especially apparent in the emerging markets, which have all been saddled with years of toxic loans from U.S. lenders that they can’t repay in U.S. Dollars unless they dramatically crush their local currencies via inflationary policies in order to buy more Greenbacks.

Take Argentina, for example; it’s in debt up to its ears and crushing its currency via inflationary death traps to pay back dollar-denominated debts. In 2000, one Argentinean peso could buy one U.S. dollar. Today, that same peso can only buy two U.S. pennies. Yep: two pennies.

But the sad fact is that the U.S. Fed has exported U.S. inflation (via sickening money-printing “solutions”) to the emerging markets for years, and now those countries are broke and devaluing their local currencies to pay back U.S. dollar-denominated debt. The interest rates in Argentina alone are now 60%…

Similarly, high-school economics students also know that as the supply of any given widget declines, the price of that widget rises. Since 2017, the Fed has been openly “tightening” its balance sheet, meaning it’s no longer the “liquidity provider of first choice” for U.S. dollars. Add to this, the choked amount of derivative-trapped U.S. Dollars in the Euro Dollar system (a topic we’ll address separately) and we see even tighter supplies of dollars, thereby pushing up its price.

This “tightening” of dollar supply is scheduled to continue into the fall of 2019 and will thus add to pushing the U.S. dollar – as well as asset prices, namely stocks – UP.

That said, given how desperate the Fed is to keep interest rates compressed, we can expect the Fed to print more money this year (as soon as the markets have a hiccup) and hence end this tightening policy (and begin easing) any day now, which will take some of the pressure off the rising dollar.

The Rest of the World Is Rotting First – and Fleeing to U.S. Markets

Argentina in particular, and Latin America in general, is by no means the only region of the world rotting from within and desperately seeking U.S. dollars to repay record-breaking debts.

Europe

As someone who knows the European Union quite well, let me bluntly say that the European Union is facing a blender of astronomical political, regulatory, and financial woes.

Italy is effectively bankrupt, and Spain and Portugal are close behind. Even Germany is a small breath away from a recession, and Brexit is already proof of the first signs of a disintegrating EU at worst, or a broke EU at best.

Investors and institutions in Europe see this writing on the wall and are thus sending their currencies into the relative “safety” of U.S. markets, which means there is an epic conversion of euros into dollars taking place today, which will only increase as conditions (and debt) worsen in Europe.

This currency flow will further push up “demand” for U.S. dollars and hence the price and strength of our greenback – along with U.S. stocks.

In short, the “currency crisis” in emerging markets is already spreading to European markets.

Asia

The same is true in Asia. Going forward, even economic basket cases like Japan and China will have no choice but to buy more U.S. dollar-denominated swaps and stocks.

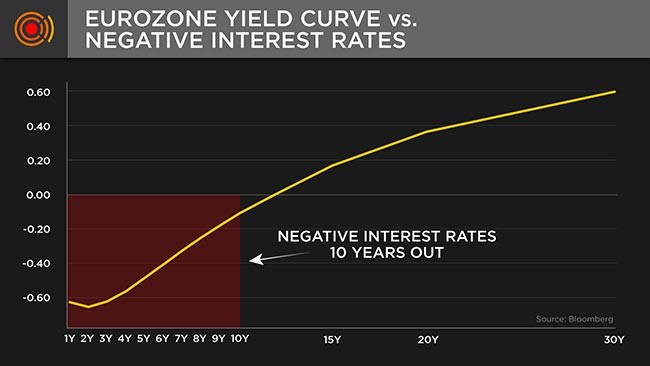

The spreads between European and Asian bond yields with those in the U.S. is also pathetic. Yields on government bonds in Asia and Europe, for example, are in the fricking negative…

Source: BloombergSource: Bloomberg

Foreign investors seeking any semblance of yield simply have no choice but to send their currencies into U.S. markets and hence add more upward pressure on the dollar for the next 12-24 months.

Other Sources of U.S. Dollar Demand

Needless to say, debt ceilings are a thing of the past in the U.S. The U.S. survives today not by producing income but by issuing more debt – over $1.2 trillion in government bonds/IOUs every year – and this is not about to change anytime soon.

All of the bonds issued by the U.S. Treasury have to be bought in U.S. dollars. This translates to even more dollar demand to come.

In addition, the Trump tax cut meant trillions of overseas monies from U.S. and even foreign entities/banks repatriating money back into U.S. markets and hence U.S. dollars.

Such flows into the U.S. further increase the dollar’s strength. In fact, half of the banking reserves at the U.S. Fed are from foreign banks.

A Stronger Dollar Is like an Ebola Virus – Spreading Chaos to Global Markets

A “strong” dollar may sound sexy, but in fact, it leads to a very bad ending. First, a strong dollar crushes U.S. exports, as U.S. goods increasingly become more expensive and thus less competitive internationally.

Secondly, as U.S. Dollar demand rises and the U.S. dollar increases in strength, all those other countries, from Turkey and Argentina to India or Italy, go deeper into recession by trying to repay debts in increasingly unpayable and scarce dollars.

The Ironic Short-Term Boom for U.S. Markets in a World of Chaos

All this global strife, ironically, can send U.S. markets rising in the next 12-24 months for the simple reason that our already pathetically over-indebted, distorted, and dishonest markets are ironically still considered a “safe haven” by the rest of the world.

Again: We’re the best horse in the global glue factory. The only caveat to this bullish track would be a heightening trade war with China, which could cripple U.S. markets if allowed to get out of control.

Debunking the Counterarguments for a Stronger Dollar

Some argue that all this terrifying global debt – and hence dollar demand – will just end as countries, banks, and companies simply begin to default en masse, i.e. as they rub their hands and walk away from their debt obligations.

Fine. This epic and deflationary debt “reset” may happen. But if it does, once the debt disappears, the electronic dollars behind that debt also vanish – straight to “money heaven.”

If the dollars disappear alongside defaulting loans writ large, then the supply of dollars goes down – and hence the value of dollars just continues to rise.

See the vicious circle? There’s just no way of avoiding the debt-induced disasters facing global markets and hence the increasingly dangerous overvaluation of the world’s reserve currency: the U.S. dollar.

Others say a U.S. recession (which is inevitable) can weaken the dollar. Nope. In fact, if already-weak U.S. consumers go even deeper into Main Street despair, there will be even fewer U.S. buyers for global goods, and hence more pain globally for foreign sellers.

The consequent pain overseas will lead to more desperate efforts to convert foreign currencies into dollars to stay alive. This means more U.S. Dollar demand.

Then there’s the argument that more money printing from the Fed (i.e. QE) or even MMT will weaken the value of the dollar.

This is plausible, but equally plausible is that the level of further QE measures by the Fed will be lower in the future for the simple reason that the U.S. is already getting enough “indirect QE” from foreign inflows.

That is, with the other central banks of the world printing over $15 trillion of their local currency in post-2008 QE policies, much of that foreign QE (printed money) will eventually flow into the U.S. as converted U.S. dollars anyway.

In short, the U.S. will get a lot of its “QE” from the rest of an already QE- and debt-soaked world.

(If we get even crazier and adopt MMT, well then all bets are off, as the U.S. will effectively become one big, government-lead, stock buy-back scheme – as far from capitalism as Stalin was from democracy…)

Finally, there’s the fear of the inverted yield curve – i.e. the scenario in which the Fed raises rates on the short end that are higher than rates on the curve’s longer-dated bonds. This is a real problem and a classic harbinger of recession down the road.

But here’s the rub, folks: It typically takes about 18-24 months between the time a yield curve inverts and when a recession is made official. Furthermore, an inverted yield curve typically re-verts to a rising yield curve before the “Uh-Oh” moment hits–sometime in 2020 or 2021.

During that interim period, we are likely to see massive speculation in the stock market – and thus new highs – just before the markets go into a recession.

Why?

Well think about it. Banks, for example, love a steep yield curve and hate an inverted yield curve.

Banks like to borrow at cheaper, short-term rates and then lend at higher, long-term interest rates. They make money on the “spread” between lower short-term rates and higher long-term rates.

But an inverted yield curve totally ruins that party formula for the banks, as short-term rates are higher than long-term rates!

Speculators (i.e. stock buyers), however, love an inverted curve because it allows them to borrow for the long term at low rates and use that money to invest in the short term – i.e. during the melt-up, which we are seeing now.

Such low-rate borrowing during flattening or inverted yield curves is a massive tailwind for the kind of crazy speculation and stock buy-backs that can and will send U.S. markets much higher in the next 12-24 months.

Low rates are simply the key fuel behind a melt-up.

And then there’s the bond market…

During this “speculation craze” to come, bond holders, who have seen a 40-year bond market bull, could see the first hints of a rising-rate bond sell-off. As bonds go down in price or popularity, there could easily be more flows into stocks as this massively overvalued bond bubble finally starts to let out air.

What Should Investors Do?

OK, so we’ve seen how the U.S. dollar is the biggest trade currency in the global markets due to unusual and un-natural U.S. Dollar demand. We’ve seen why the U.S. dollar is going to strengthen in 2019 and why that creates trouble everywhere else in the world.

We’ve further seen how trouble in the rest of the world means more money pouring into the U.S. as a “safe haven” – and thus a short but massive final rise in the U.S. markets (failing, of course, a total trade war with China).

Our reports on the Melt-Up leading to a Melt-Down tells you all you need to know on how to gauge, track, and trade this coming cycle. We provide the signals, the vehicles, and the strategies to navigate this tragic but final bull cycle leading into a bearish fall and/or Japan-like stagnation.

Gold?

In the interim, we also see a solid opportunity in the gold and precious metals space – even in a rising-dollar scenario driven by U.S. Dollar demand. Sound crazy? Nope. Readers have been asking a lot about this.

Traditionally, most investors have been told that gold and the U.S. dollar move in opposite directions, that gold goes down as the U.S. dollar goes up.

Furthermore, and for many years, even the best gold experts in the field have been calling for $5,000/ounce gold due to all the hyperinflation that the Fed’s massive money-printing policies created from 2008-2014.

But that hyperinflation never happened, and gold has yet to break out to record highs.

What gives? Were the experts stupid?

No, they weren’t stupid, they were just wrong – and there’s a big difference between “wrong” and “stupid.”

In all fairness to the gold experts, no one has ever seen a Fed “experiment” like we have seen since 2008. It was normal to assume that quintupling (yes, quintupling) the U.S. money supply would lead to a devaluation of the U.S. dollar, massive inflation, and thus a spike in gold.

But as we’ve learned since 2008, the hyperinflation did not completely hit the all-powerful U.S. dollar; inflation went instead into the central banks, then into private banks, and finally into the grossly inflated stock market.

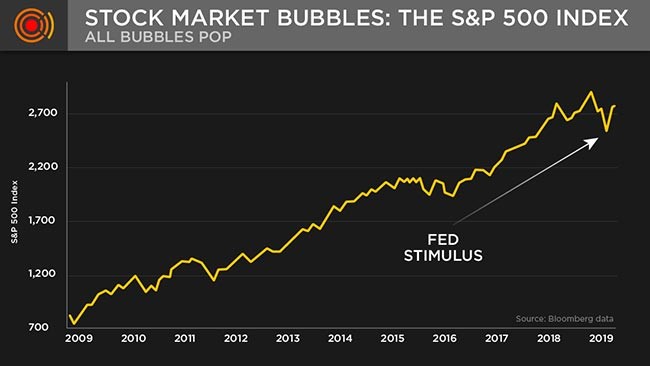

In short, if you want to know where U.S. inflation went, in went into our inflated stock market – which looks like this…

Does That Mean You Were a Sucker If You Bought Gold?

Not if you bought gold for the right reason – namely as patient insurance rather than as a greedy speculation.

Gold is history’s number-one insurance hedge against dying currencies and is a wise part of any portfolio. This was true 5,000 years ago and is just as true today.

By now you may be scratching your head. After all, I’ve just argued that the dollar is getting stronger – so who needs gold as a currency hedge in the U.S.?

But keep this in mind: The dollar may be strong, but what about the yuan? The yen? The euro? The peso?

You see, the rest of the world’s currencies (from Cyprus to Venezuela, Argentina to Turkey) are dying at the U.S. dollar’s feet, and those parts of the world sure as heck need gold. Thus, the price rise in gold relative to other fiat currencies has been significant.

The gold market is in fact a very small market per capita, which means if the world (as opposed to just the U.S.) increases its gold holdings by even 1% or 2%, the price of gold could double.

And as we’ve discussed above, the rest of the world sure as heck needs to be thinking about gold – and will be increasingly buying this precious metal as their currencies head toward the basement of history while the U.S. dollar makes its last great and totally distorted rise before it, too, falls.

In this way, then, gold will eventually rise alongside a rising dollar. Those who own gold will see massive returns.

Seem crazy? Well, if you’ve read even half of our free reports at Signals Matter, you’ll know by now that “crazy” is precisely what our post-2008 markets have become, thanks entirely to the centralized engineering of the markets from our equally crazy central bankers.

But if you really want to know what crazy can look like, just consider the newest drug to hit the debt-addicted central planners in D.C.: Modern Monetary Theory, or MMT, which we discussed at length in our latest report.

In the interim, be careful out there, and stay informed.