Below, we look at intelligent portfolios in a not-so-intelligent Fed backdrop of fragile and volatile market suffering.

More importantly, we offer time-stamped proof (rather than timely verbosity) that this crisis was avoidable and still is if one is equipped with intelligent portfolios.

Here’s the Problem – It’s Official – We’re in a Recession

The Coronavirus has been the spark that ignited the global debt gas-can and hence ushered the global recession in which we now find ourselves.

At Signals Matter, we have been anticipating this inevitable moment for quite some time, openly warning of, and offering intelligent portfolios and solutions for, precisely such an event, as evidenced in a special report published a year ago this month.

By April of 2019, we nevertheless reminded readers of an interim and temporary melt-up for most of 2019, followed in tow by the meltdown we are currently fighting, and even warned readers to anticipate record (and mind blowing) money printing measures by the Fed in another (pre-crisis) special report here.

Throughout this arc from the sublime to the ridiculous, we’ve been signaling intelligent portfolios for our subscribers, capturing bear and bull opportunities as the markets (rather than media bobbleheads) indicated.

Now, and almost on que, the Fed has acted with predictable desperation, as seen by the mind-blowing and destructive emergency measures taken last week, none of which will work for the long-term, as debt is no real solution for a global debt crisis hiding behind an equally global health crisis.

Throughout this building and perfect debt storm, intelligent portfolios have stayed safe and dry while others have been getting soaked with losses.

With a global economy made unduly and fragile as we have painstakingly described in our new Amazon best seller Rigged to Fail, the timing for COVID-19 could not have been worse, but such unpredictable black swans were something we also anticipated with date-stamped clarity here, as intelligent portfolios are always prepared for –and hence expect—the unexpected.

Such sequences and intelligent portfolios require no psychic skills or market-timing bravado, simply market experience, all of which we share with YOU each week.

As for the current crisis, US and global markets, unlike intelligent portfolios, are not adequately prepared for the market storm ahead.

A 20% decline in equities generally defines a bear market, so that’s where we are now.

Here’s What’s Happening Now

-The S&P 500 Index tumbled 34% from February 19 to March 23, recovering 13% through last Friday, on the tailwind of, you guessed it: More central bank steroids.

-There is little support beneath the surface to expect a 2008-like rebound. Once the current steroids wear off, we can expect an L-shaped rather than V-shaped recovery, as I openly described at length here some months back.

-Fitch cut Britain’s credit rating, in light of the volume of cash their Treasury is tossing at the Coronavirus pandemic, on ominous sign and poised to become even more so if Fitch or Standard and Poor similarly ding the U.S., as we too are all about issuing more debt/Treasuries now.

-Oil storage tanks are near overflowing as commerce shuts down and demand tumbles worldwide. Brent crude, already tanking in price pre-virus, closed below $25 last week. Energy stocks haven’t been this week since the Great Depression, according to Bank of America’s chief investment strategist.

-Bloomberg Economics has declared that the recession has already begun, based upon frequently-reported data across the global economic.

Here’s what’s going on.

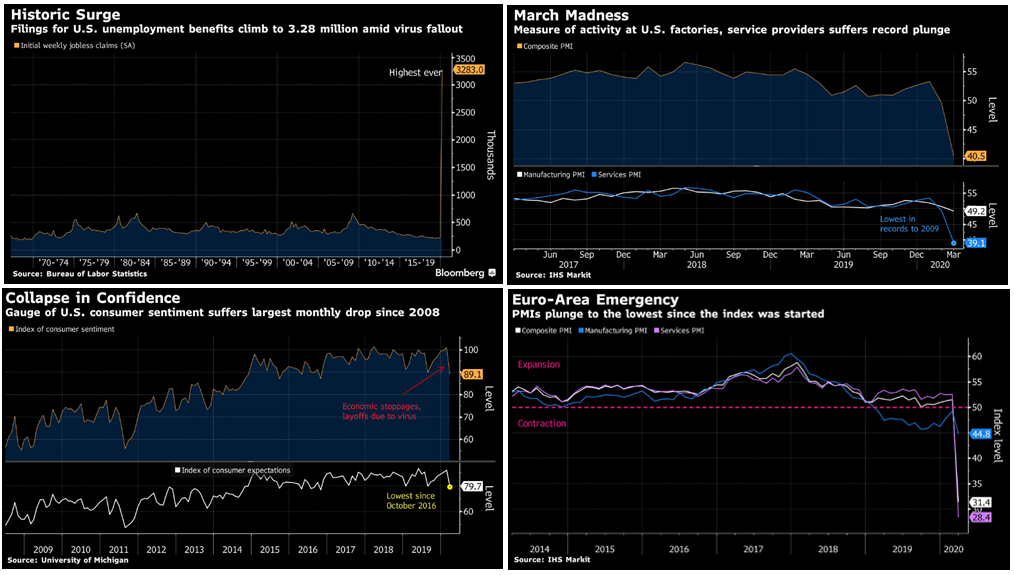

-Unemployment is soaring.

-Consumer confidence is collapsing.

-Metals prices are collapsing.

-Public transportation usage is down 50-90% globally.

-Open Table reports that restaurant bookings have collapsed to basically zero.

-News stories using the term “recession” is fast approaching the 2008 peak.

-External financing for emerging market countries has dried up.

-Goldman Sachs reports that Latin American economies are heading to their worst contraction since WWII and my personal conversations with friends in these zip codes have been alarming in their confirmation.

-Italy can expect a 60-70% decline in monthly GDP.

In such an objectively risky setting, intelligent portfolios can’t simply rely on the Fed “having your back.” Conditions are simply too factually fragile and risky to assume a miracle touchdown pass from the Eccles Building.

A few confirming charts on how quickly and deeply this has all occurred. Again, our economy, and Fed-bloated securities markets, unlike our intelligent portfolios, were ill-prepared for this.

Hence the quicker and greater the fall. No surprise at all here.

The outlook for growth in Europe is horrible, with first-half GDP now estimated to be negative across Europe’s biggest economies, ranging from negative 3.8% for Germany to negative 10% for the U.K.

In France, where I’ve lived part-time since 9-11, the country is effectively shut down, but France, as I’ve written, is no stranger to debt-soaked markets colliding with an “Uh-Oh” moment…

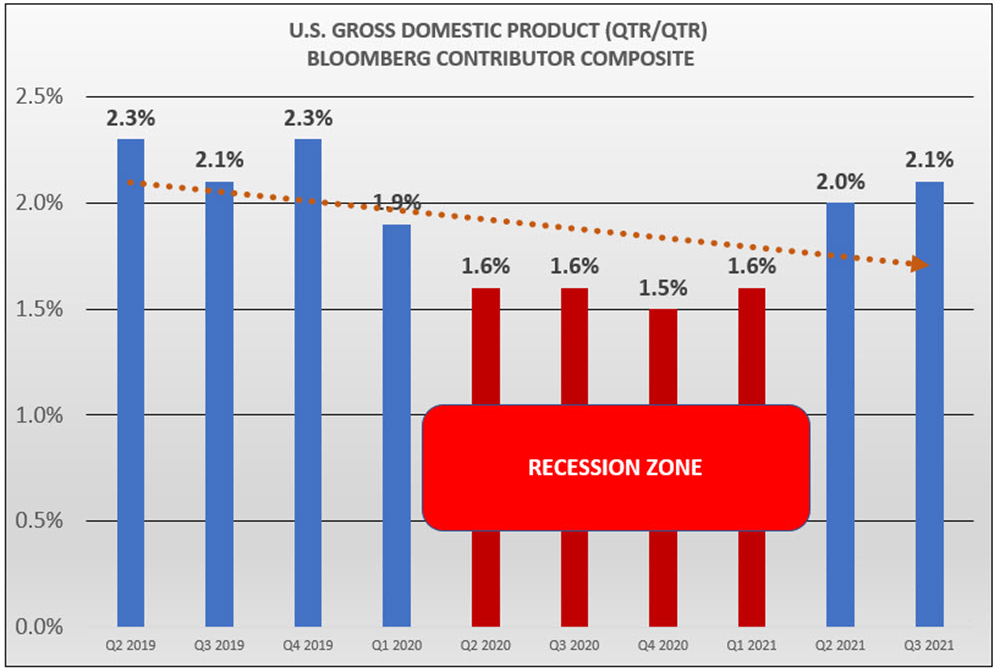

Here in the U.S., Bloomberg contributors are forecasting that GDP will tumble to 1.5-1.6% in the four quarters beginning in Q2 2020, which starts on Wednesday next week.

GDP data lags. We could easily expect that when the data is officially in, GDP here in the U.S. will go negative during at least two of the months highlighted below.

Intelligent portfolios don’t wait for post-pain confirmations, they react beforehand.

Signals Matter Subscriber Content. Please click here to sign up: Subscribe Now.

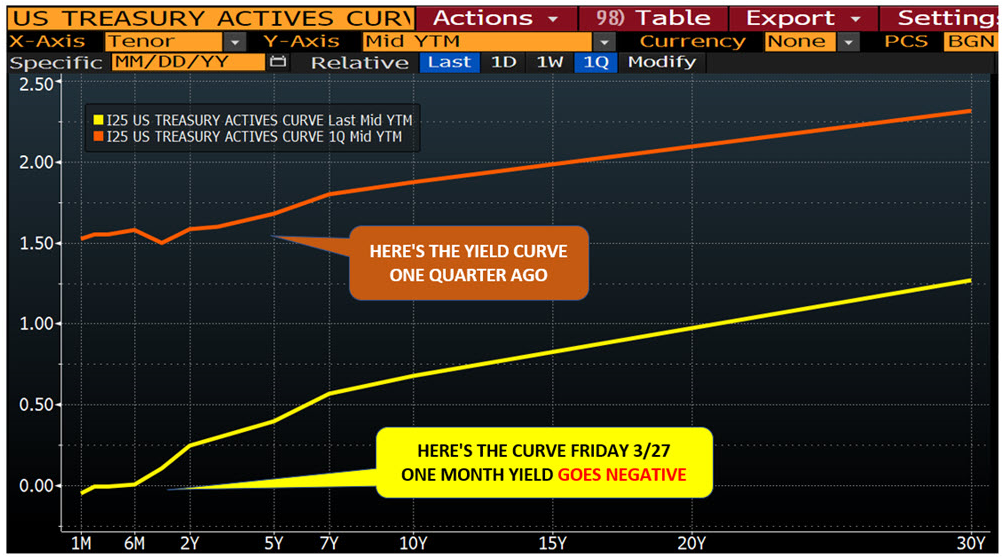

Central Banks across the globe have cut already basement-level interest rates to offset the impact of the Coronavirus. These interest rates, whether real (inflation-adjusted) or nominal, are all in (or approaching) negative-rate territory…

…with the U.S. now sadly joining Europe and Japan in negative interest rate territory…

Signals Matter Subscriber Content. Please click here to sign up: Subscribe Now.

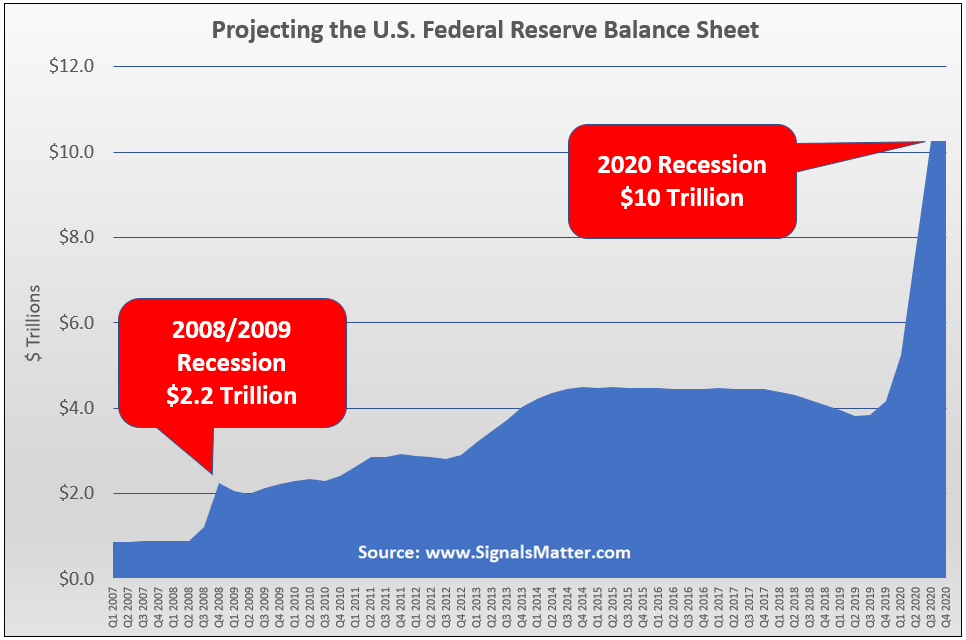

To save us, the headless chickens at the U.S. Federal Reserve are planning to more than double their current $4.7 trillion balance sheet to levels as high as $9 to $10 trillion in order to help the U.S. economy survive the Coronavirus shutdown, a 10x expansion since the start of the 2008 recession, discussed in painful detail in Friday’s Market Report, Fed Fraud: Highway to the Danger Zone.

Signals Matter Subscriber Content. Please click here to sign up: Subscribe Now.

Such dramatic money-printing measures are death-knells to currencies, already in a race to the bottom as global central banks track the Fed’s desperation by engaging in similar printing to keep FX markets aligned (and tanking)…

The Australian dollar, for example, has tanked compared to the Greenback, an inevitable scenario which we laid out in equally “predictable” (i.e. common sense) detail over the summer, here.

Here’s the Solution – All-Weather Intelligent Portfolios

The 2020 Recession has just started to roil investment portfolios. The fundamentals are bad; the technicals are worse. Intelligent portfolios will fare well, traditional portfolios will not.

Portfolio management will be challenging and short-term trading very difficult for those less-skilled amidst markets that are out-of-whack.

Therefore, there’s a choice YOU have to make and that is whether to invest in/trade the macro or position yourself more tactically for now. At this stage, we favor the latter for the same equally predictable and common-sense reasons we saw this coming.

Now it’s time to make equally common-sense decisions with YOUR portfolios. We created Signals Matter to help you with precisely that—your portfolio, i.e. intelligent portfolios for not-so-intelligent times.

Trading the macro can pay off handsomely, even create generational wealth, but not until a clear bottom has been put in. We’re not there yet. Not even close.

For now, we favor getting tactical, deploying rigorous risk management and diversifying tools that will keep our Subscribers safe in any market environment, which is what we aim to do with Your Portfolio Suggestions at www.SignalsMater.com.

Nod to the Coronavirus, we are in a new volatility and correlation regime, where volatility is driving much higher correlations among securities than is normal.

Rather than act as off-setting “hedges,” for example, bonds are tanking with (rather than protecting against) tanking stocks.

Thus, the traditional 60/40 stock/bond pie-chart portfolios of the past are getting slaughtered, again, as we warned they would well ahead of this crisis in striking detail here.

Smart Portfolio Management—Intelligent Portfolios

Market stress levels are elevated. It takes a specific skill set to be successful, to resist emotional reacting, even if markets temporarily “recover” here and there with Lance Armstrong effect from more Fed steroids.

But as with Lance, we know how that strategy ultimately ends…

And as always in times like these, risk management is the common denominator. Jack Schwager, legendary author of The Little Book of Market Wizards (and a Market Wizard by his own right) rightly said that “you can’t win the game if you can’t stay in the game”.

Risk management, cash management, and smart portfolio management are keys to success in markets like these. Our intelligent portfolios have passed the test of time, as confirmed here.

Based upon decades of allocating to hedge funds, to running hedge funds, to picking managers for hedge funds and to trading, your guides (Matt and Tom) have been around the block.

We get what’s going on now (because we’ve been there), why it is happening (run, don’t walk to Rigged to Fail on Amazon.com), and how to build an All-Weather Portfolio around it. Let us show you the way.

Key Elements to an All-Weather Portfolio

Here at www.SignalsMatter.com, we deploy four key elements to building our All-Weather Portfolios, namely active management, absolute return benchmarking, selective portfolio metrics and security selection.

In our next report, we’ll dive a bit deeper into each of these approaches in greater detail so that those of you just becoming aware of our service can see the science and art behind the adjectives and math of our more general and public reports.

As Tom always says: “Trust but verify.”

We build this trust by offering layers of verification.

Thus, stay tuned for Wednesday’s report on how and why our intelligent portfolios are working despite a market and economy that is suffering.

In the interim, continue to stay safe by staying informed, which means hitting (and reading) the links above and following our recent responses to readers questions in the last report on Friday.

There’s a lot going on right now, and we are racing (and typing) like mad to keep YOU current.

Best, Matt and Tom

Hi Matt and Tom,

Huge fan of the website and your book. I am currently a senior in college looking to put some money into savings for my future but am not sure how to handle these dangerous times. After reading your warning signs for quite some time I am concerned about the potential risks that the stock market brings given the fed’s carelessness and propensity to print more money. As I try to position myself more tactically moving forward would you advise someone in my position (experience limited to what I have learned in school) to take money out of equities and hold cash or look to get into assets such as gold and real estate that should provide some protection if/when we see the hyperinflation that you are expecting.

Hi Avery, I’ll tell you what I tell my own college-aged son and recently college-graduated daughter (who works at Goldman Sachs but follows my advice 🙂 Namely: WAIT FOR A BOTTOM AND THEN GO LONG AND LONG AND LONG. At your age, you can afford to wait for a market bottom and then have an AMAZING generational opportunity to truly acquire financial assets at discounts rather than premiums; at that point, you can even “set and forget” and enjoy the compounding effect that natural markets were and are designed to generate over time. If you read my report on “Traditional Investing,” I’m actually not against MPT (Modern Portfolio Theory) in general–I just don’t believe it works: a) when the Fed has distorted natural price discovery and B) when markets are at tops. This latter warning is particularly true for older investors, who don’t have the time or luxury to sit out a 10-20 year “recovery” in the next market crash. YOU, however, have the luxury to ride tops and even bite a stick through bottoms, but why bother–justget out of risk’s way now and wait for the bottoms–they’re coming. As for gold, I tell my daughter to buy little bits that she can afford and ignore the price, or even massive declines, as by the time she’s my age, she’ll be smiling. Gold is a long term play, not a short-term trade–as I see it. I recommend silver for the younger crowd, as its affordable and, again, by the time your my age, the returns will be massive, in MY OPINION. Real estate too is wonderful, but I feel if you’re patient, you can get real estate far cheaper tomorrow than today, especially if you have the funds and don’t need leverage–which is admittedly hard at your age unless you have other family wealth or income. Glad you are taking these markets–and opportunities seriously at early stage, and glass as well you are learning how to track macro issues (central banks, bond yields, debt indicators etc.) The sooner this all crystalizes in your mind, the less intimidated you’ll be down the road and the more opportunistic and confident you will be.