Signals Matters News Letter: The Signals THAT Matter

Signals Matter portfolios rotate and invest toward absolute returns rather than relative performance.

Broadly, the core and timeless principles behind the infrastructure of Signals Matter Portfolio Construction are carefully discussed here and here.

As for WHAT’S HAPPENING NOW…

Who’s Having Fun?

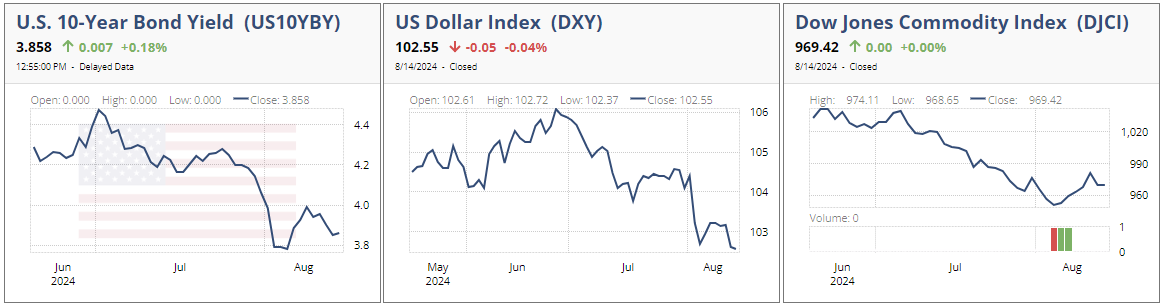

By and large, except for the gold bugs amongst you, investing in equity and other markets has not been a lot of fun lately. The Dow, S&P 500, and tech names are in a highly-correlated downturn. The US dollar is losing its relative value. Commodities are falling, along with silver.

What’s making money lately? Bonds, as yields fall, and gold, e.g., safe-haven investing.

Buckle-up. This week’s Market Report aims to keep you on the right side of the markets by using a proper benchmark, rotational tools, and a willingness to go short or to cash should risks rise.

Absolute Return Investing

For us, absolute return is our GPS for investing, as it measures how we’re doing compared to our needs, wants, and goals as opposed to just tracking an equity index. Let’s say you need a 10% return on your portfolio to make ends meet or to finance those vacation getaways. Raw investment performance matters to you, making money, full-stop. It’s not about doing better or worse than the S&P Index. It’s about not losing money. If the S&P is your benchmark and the markets are down 30%, but you’re down just 15%, that’s not good enough

The idea is to consistently make money rather than to just lose less. That requires active, not passive, investing. Absolute return doesn’t care about market trends or what other investors are up to. It’s all about your return, independent and uncorrelated with the markets.

Traditional Investing

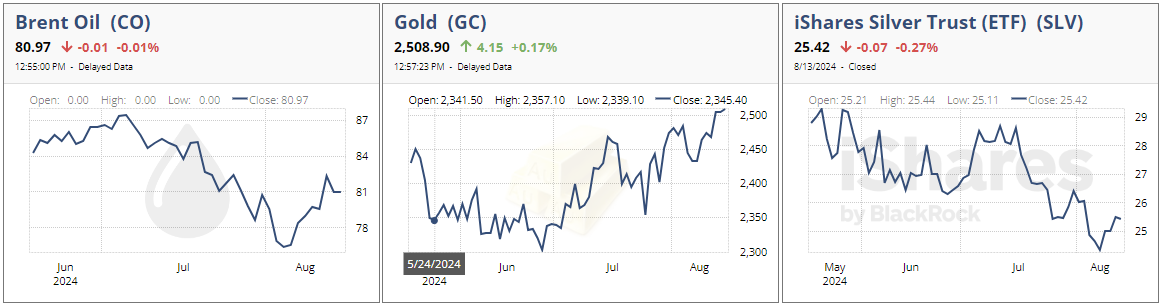

For traditional investors who invest in stocks and bonds absent a proper benchmark, the markets aren’t looking very good, according to our Relative Rotation Graph (RRG) below.

As we pen this note, stocks are weakening, and bonds are improving against a 10% absolute return benchmark, below. If you’re a traditional investor, you’re invested in both. As an absolute return investor, you would be invested in bonds only at this stage, not stock indexes that are proxies for all equities.

Relative Rotation Graphs (RRGs) are a valuable investment tool, initially developed in 2004-2005 by Julius de Kempenaer, Director of RRG Research. His work focuses on relative performance rather than directional forecasting, e.g., when to be overweight and underweight across virtually any security. Thank you, Julius!

Rotational Investing

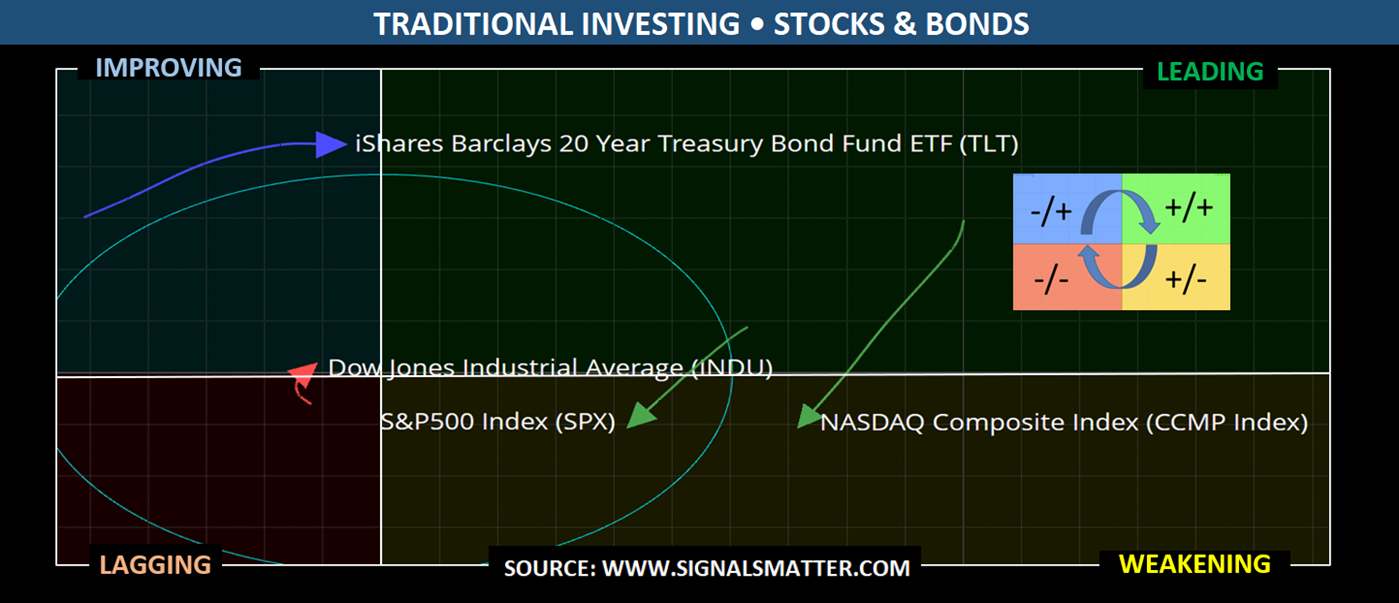

Rather than look at price charts, we prefer using rotational tools that measure performance in relative terms that target 10% absolute return.

The goal here is to keep an eye on the big picture by visualizing the rotational sequence of individual securities, including any financial instrument with a ticker and live data (e.g., stocks, exchange-traded notes funds (ETNs & ETFs), fixed-income securities, derivatives (options, futures & swaps), mutual funds, Real-estate Investment Trusts (REITs), bonds, derivatives (options, futures, and swaps), and more. You name it. RRG enables us to do just that.

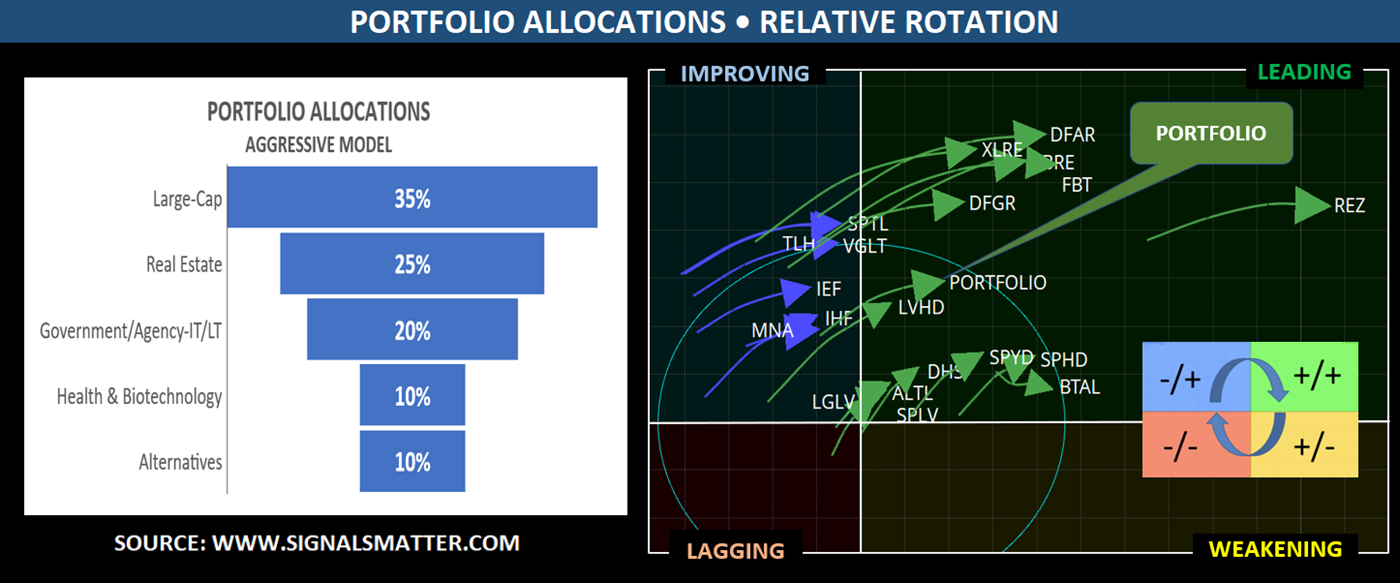

By example, our most aggressive portfolio may look like it’s traditionally invested, but it’s not. Yes, we’re into large-cap stocks, real estate, government credit, health & biology, and alternatives, but not for the long haul and not measured for performance against the S&P.

Our Portfolio Allocations are acutely-focused. It’s not just large-cap; it’s “low-volatility” large-cap. Our real-estate allocation is spread globally. Our US government allocation is exclusively intermediate and long-term. Our health/biotechnology allocation is highly concentrated in the medical arena, using living cells, cell materials, and biological processes to develop pharmaceuticals, diagnostics, and therapeutic solutions – e.g., not just heath. And our alternative allocations are market-neutral and merger-arbitrage centric.

Finally, and most importantly, our portfolio picks are always in the Improving and Leading Quadrants with required levels of relative strength and momentum.

Party-On, or Party-Over?

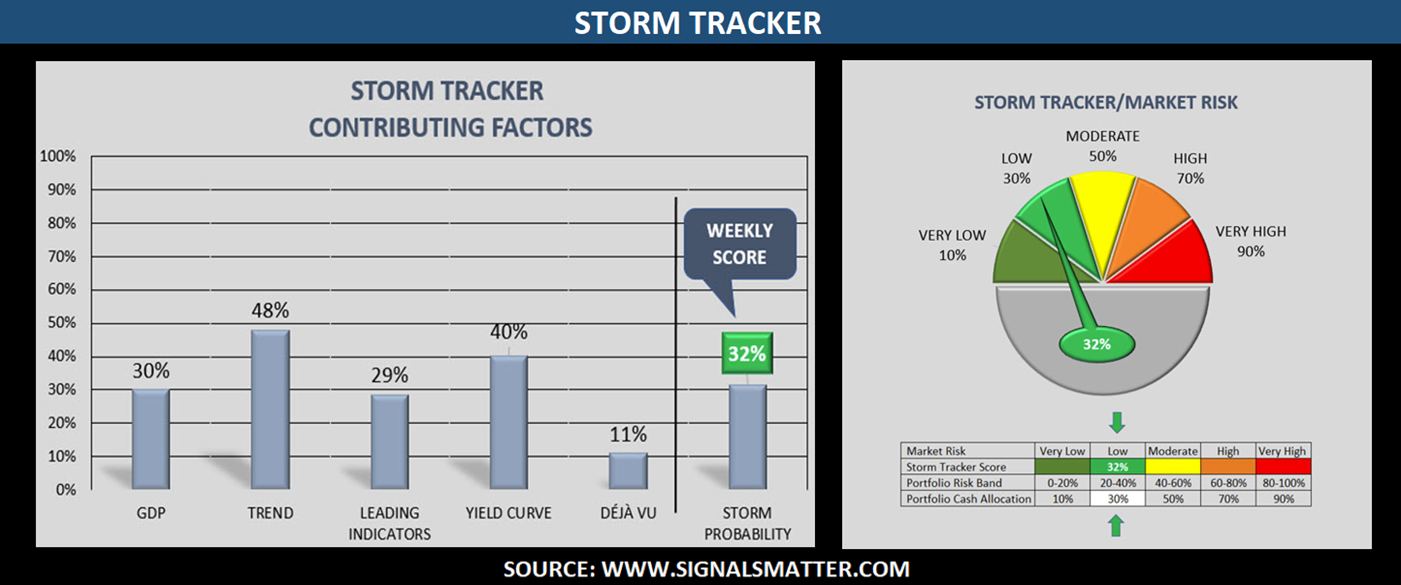

Lastly, from a macro perspective, we use our proprietary “Storm Tracker” tool to inform on just how soon that next feared recession will tumble upon us, or not, for recession probability feeds into cash allocations across our various portfolios. For now, with “Storm Tracker” in the “low” zone, let’s party on.

But should Storm Tracker head into the “moderate” or “high zone,” it could be party-over for long exposures, and party-on for the inverse or short side of the markets.

Bottom Line

We’ve covered a lot of concepts in this week’s Market Report. Here are the takeaways.

- Benchmark with absolute return, not relative return.

- Seek rotational strength.

- Be prepared to go anywhere – long, short, or cash.

Markets are toppy at the moment. Stock mania has led almost all major domestic and overseas investors to be highly overweight equities. Making things worse, hedge funds are almost unanimously crowded into long equity exposure, for that’s where the action’s been.

What to do? Do what we do: Develop a plan and a process. If you’d like to learn more about how we build portfolios and watch us trade, come join us at www.SignalsMatter.com; or invest in our hedge fund at www.SignalsMatterAdvsiors.com and let us do the driving. Questions: Book a Meeting with us. This is a crucial moment in the market. Let’s discuss.

Even More

Signals Matter Market Reports reflect the company’s long-term macro views and are posted free of charge at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Portfolio Solutions are geared to shorter timeframes and may differ from our longer-term perspectives. Our actively managed Portfolios are available to Subscribers who Join Here and to Accredited Investors who directly invest in Signals Matter Partners, LP. For further information, click Direct Invest or Book a Meeting with us.