Signals Matters News Letter: The Signals THAT Matter

Investing with a plan and process is absolutely critical as markets become increasingly volatile. Broadly, the core and timeless principles behind the infrastructure of Signals Matter Portfolio Construction are carefully discussed here and here.

As for WHAT’S HAPPENING NOW…

Toppy Markets

Let’s face it, folks: The markets are toppy right now. Yet no one’s officially calling a recession or suggesting what to do if one appears. This is where signals really matter.

For the technicians among us, US Treasury data is exhibiting severe compression of yield spreads, a signal that has preceded each of the last four US recessions. Elliot Wave counts across major equity indexes signal a weekly 5-count, generally associated with market tops (all charted and available to Subscribers at Signals Matter).

Bloomberg’s Macro Strategist, Simon White, wrote this week, “Hedge-fund strategies across the board are positively exposed to US stocks, a rare occurrence. At the same time, flows into equities are stretched, positioning is very long, and almost every sector is highly overweight stocks, presenting an increased underlying risk of a non-trivial selloff.”

Overweight stocks? So are we! Is this crazy, given the signals above?

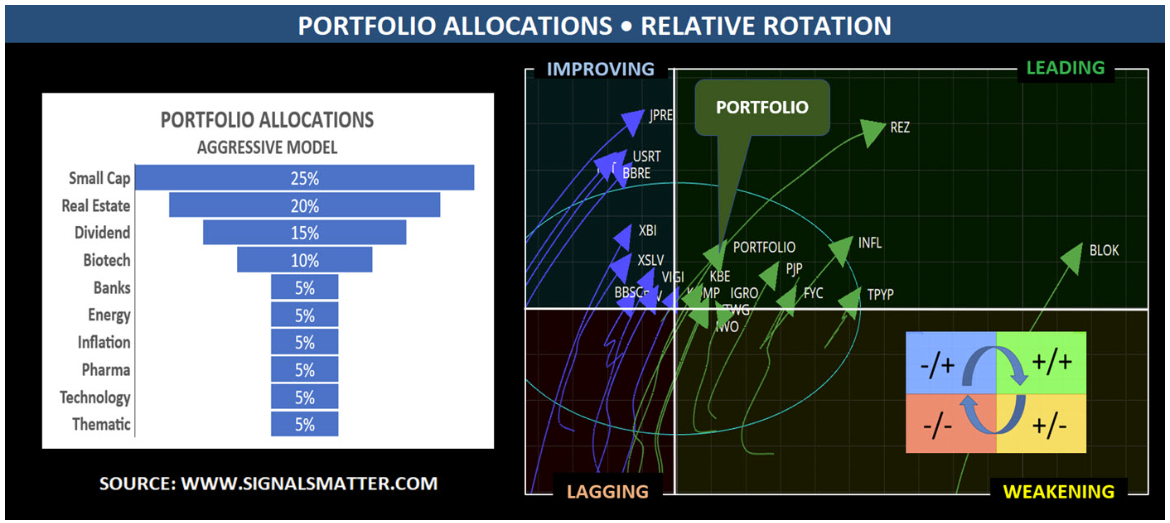

When a particular sector is booming, we too are prone to overweight what’s working. Rather than diversifying away, we recognize concentrations for what they evidence—namely, extreme demand, strong relative strength, and leading sector rotation.

What’s not to like?

But what about the risks of a blow-off top?

Storm Tracker

That’s when we turn to Storm Tracker. Folks ask us, “When will the markets turn, and what should I do?”

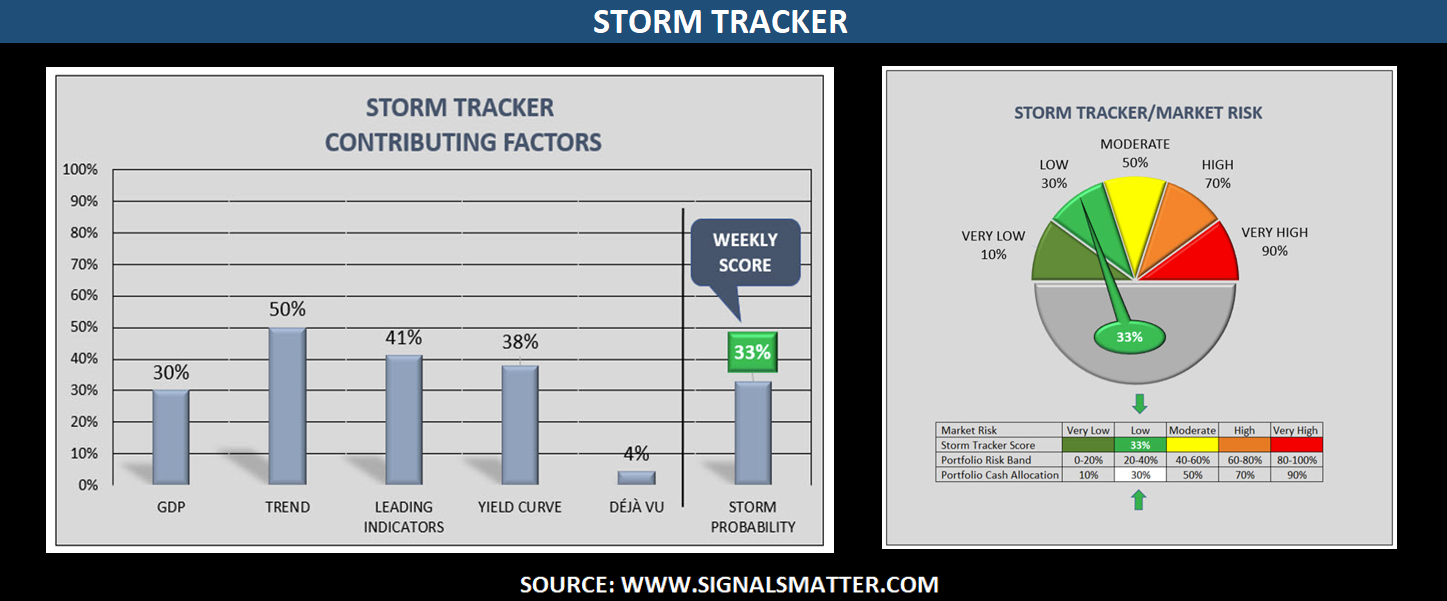

We turn to our signals – all 172, including economic forecasts, GDP, yield curve inversions, trends (daily, weekly, and monthly) across financial conditions, global equities, bonds, currencies, and commodities; 30 leading indicators; and a few proprietary signals.

Currently, Storm Tracker is scoring at 33%, taking all of these indicators into account and weighting them properly. That means, for us, there is a 33% chance of stormy weather near-term, low by our count, at least for now.

When will the markets turn? When Storm Tracker rotates to the Moderate Zone (yellow). When will a recession begin? When Storm Tracker rotates to the high zone (orange).

Storm Tracker is published weekly at Signals Matter, providing proactive advice on when and how to raise cash. Preparation is key in navigating potential market downturns as they occur, not after they occur.

How We Hedge

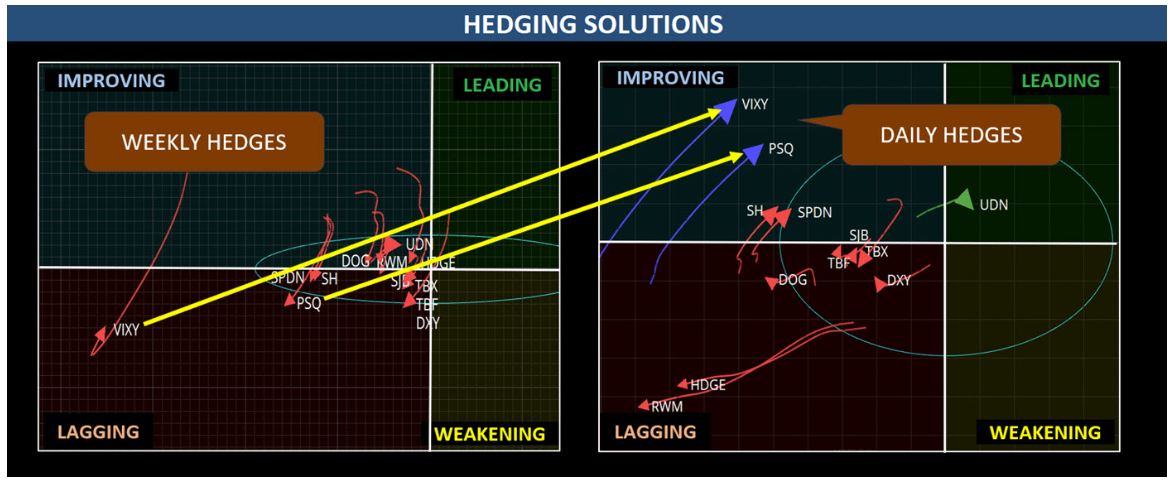

As Storm Tracker advances, we turn to inverse exchange traded Funds (ETFs). Inverse ETFs are designed to profit from a decline in the value of an underlying benchmark. They achieve their goal by deploying various financial derivatives that allow the ETF to move in the opposite direction of the underlying index or asset, profiting when the market or index declines.

Inverse ETFs come in various flavors highlighted below (stocks, bonds, commodities, volatility, and more). As these can be leveraged, be sure to discuss the associated risks with your investment advisor.

From a rotational perspective, inverse ETFs rotate just like typical stocks and long-type ETFs. As recessions near, inverse stock ETFs rotate like any other ETF, gaining favor. Weekly (lefthand chart below), ETF hedges aren’t looking very strong. Daily though, two ETFs (in blue) are showing signs of life daily, namely VIXY and PSQ.

VIXY – ProShares VIX Short-Term Futures ETF – is an ETF that corresponds to the performance of the S&P VIX Short-Term Index before fees and expenses. When market volatility increases, VIXY generally follows quickly.

PSQ – ProShares Short QQQ ETF – is an ETF that corresponds to the inverse (opposite) of the daily performance of the NASDAQ-100 Index.

Why are these ETFs rising?

Because of growing market uncertainty with the Nasdaq, especially the Magnificent 7, under pressure. In many ways, the broader equity indexes are dangerously and narrowly lead by a few tech names, making the overall indexes little more than “tech ETFs.” This lack of breadth in the stock markets is extremely concerning.

Bottom Line

Markets are toppy. Stock mania has led almost all major domestic and overseas sectors to be highly overweight equities. Making things worse, hedge funds are almost unanimously crowded into long equity exposure, for that’s where the action is. Nearly all equity sectors are overweight in equities.

And yes, so are we. But we have something most traditional investors lack: A plan and a process. Come join us at Signals Matter or Book a Meeting with us, and we’ll discuss.

Trading requires constant attention to daily signals and direction changes, many of which are divorced from the larger macro-economic realities which most refuse to understand. That said, one has to always keep on eye of the broader direction of markets, economies and currents in which specific allocations are made at the trading level.

Even More

Signals Matter Market Reports reflect the company’s long-term macro views and are posted free of charge at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Portfolio Solutions are geared to shorter timeframes and may differ from our longer-term perspectives. Our actively managed Portfolios are available to Subscribers who Join Here and to Accredited Investors who directly invest in Signals Matter Partners, LP. For further information, click Direct Invest or Book a Meeting with us.